4 Minutes

Cake Wallet Expands Assets with Decentralized dEURO Stablecoin

On Tuesday, popular crypto wallet platform Cake Wallet announced the integration of the decentralized euro-pegged stablecoin dEURO, significantly broadening the range of euro-based digital assets available to its worldwide users.

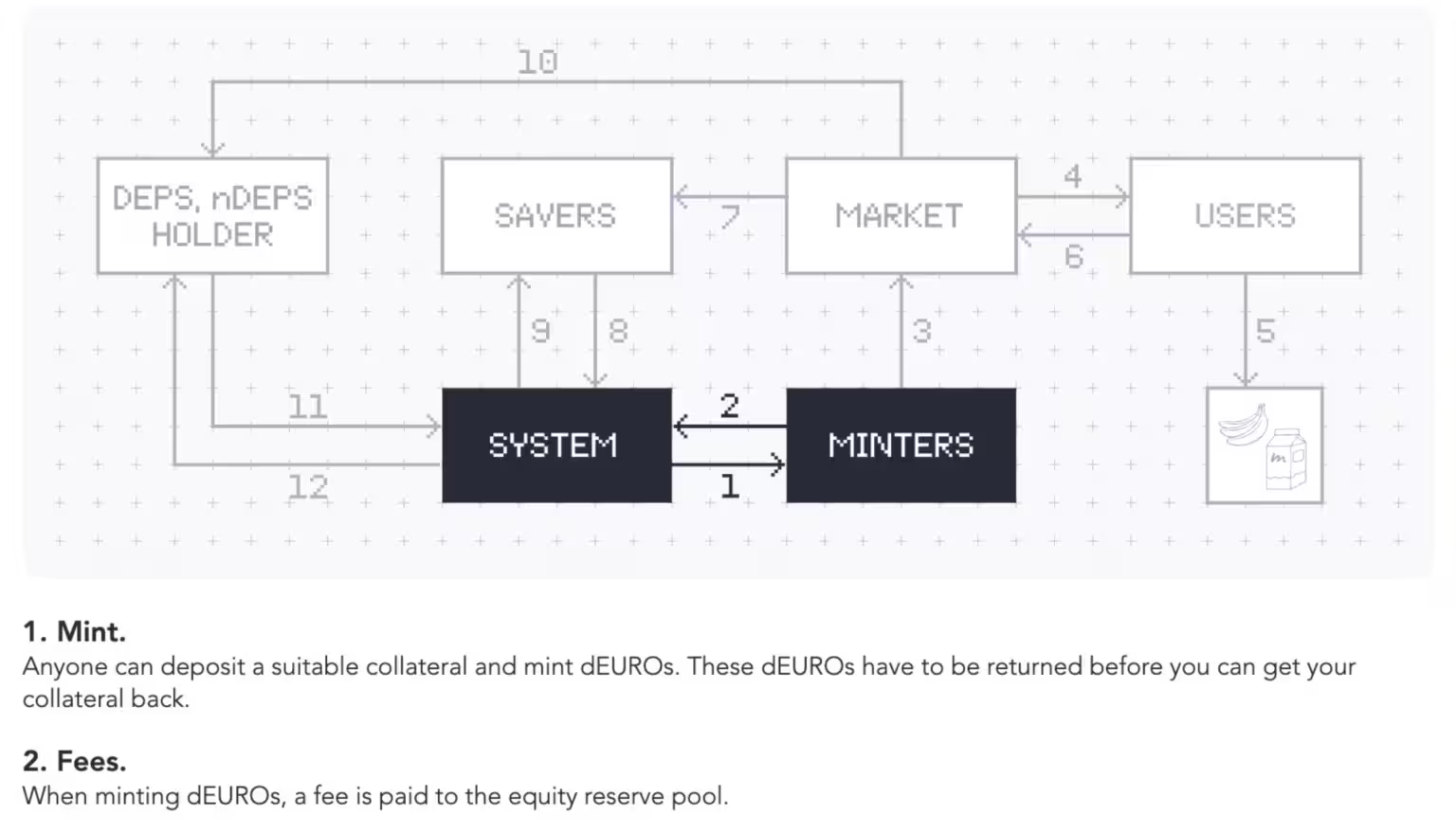

As reported by Mihan Blockchain, dEURO's innovative architecture relies on overcollateralization with leading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Monero (XMR). This means that, to mint new dEURO tokens, users are required to lock up corresponding amounts of other digital currencies as collateral.

dEURO in Cake Wallet: Bringing Decentralized Euro to Users

The dEURO development team explains that this dual-collateral mechanism helps protect the stablecoin's price against euro depreciation. If the value of a user's collateral dips below required thresholds compared to their minted dEURO, those assets are automatically liquidated to preserve system stability.

Cake Wallet further reveals a major incentive for adoption: Users can earn up to 10% annual yield on the cryptocurrencies backing their dEURO, without having to relinquish ownership. A dEURO spokesperson stated that this yield comes from protocol fees collected from token minters, which are then pooled in a reserve fund to help maintain dEURO's price peg.

This structure not only encourages more users to mint dEURO but also enhances asset liquidity by enabling them to access euro-backed tokens without selling their core cryptocurrencies.

Decentralized and Algorithmic Stablecoins: Innovation Meets Risk in Crypto

Decentralized and algorithmic stablecoins, like dEURO and the well-known DAI, are seen as groundbreaking financial innovations. Their transparent, on-chain mechanisms reflect the early cypherpunk spirit of the crypto community. However, experts continue to caution about the inherent risks, given the industry’s history of dramatic collapses.

The Downfall of Algorithmic Stablecoins: Lessons from Terra-LUNA and UST

The most infamous collapse to date is arguably the Terra-LUNA ecosystem crash in May 2022. The UST stablecoin, based on an algorithmic model utilizing "mint and burn" mechanics, required users to burn nearly $1 worth of LUNA to create $1 of UST. This arbitrage-driven model theoretically kept UST at its intended $1 peg, as traders profited from any price differences between UST and LUNA.

A significant portion of demand for UST, however, was fueled by the Anchor Protocol, a DeFi lending platform offering yields as high as 20% for depositing UST. Massive withdrawals from Anchor set off a domino effect, sending UST's price tumbling to $0.67 in May 2022 and eventually collapsing to just $0.01.

UST notably lacked any collateral backing. By contrast, stablecoins like DAI and now dEURO employ overcollateralization, requiring users to deposit excess digital assets to mint stablecoins. While this system offers a layer of protection, it is not a fail-safe against de-pegging or market shocks.

Collateralization Is Not a Cure-All for Stablecoin Volatility

Even overcollateralized and fiat-backed stablecoins have not been completely immune to market stress. DAI, the flagship decentralized stablecoin from MakerDAO (now known as Sky), temporarily lost its dollar peg in March 2023 when USDC, a major collateral asset, briefly lost its own backing.

Similarly, fiat-collateralized stablecoins, backed by U.S. government bonds or bank deposits, have experienced short-term price deviations during times of financial instability.

The Future of Euro-Backed Stablecoins and DeFi Innovation

With Cake Wallet’s addition of dEURO, crypto users gain greater access to euro-based stable digital assets, along with attractive passive income opportunities. However, while protocols like dEURO seek to address past failures with robust collateral strategies, users must remain aware of the risks and complexities inherent in the rapidly evolving decentralized finance (DeFi) ecosystem.

For anyone interested in blockchain, decentralized finance, and stablecoin technologies, staying informed about developments like those at Cake Wallet is essential to making educated investment and usage decisions in the crypto space.

Source: mihanblockchain

Comments