3 Minutes

OpenAI Distances Itself from Robinhood’s Tokenized Equity Offerings

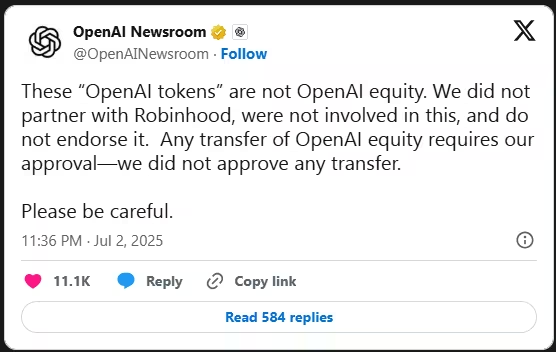

Recently, OpenAI, the renowned artificial intelligence research organization, has moved to distance itself from the launch of so-called "OpenAI stock tokens" promoted by the crypto trading giant Robinhood. In a formal statement published on X (formerly Twitter) by the OpenAI Newsroom, the company made it clear that it neither participated in, nor endorsed, Robinhood’s latest venture into tokenizing private equity—highlighting growing concerns around unauthorized crypto equity products.

All image placements, captions, and formats remain unchanged.

OpenAI Issues Warning over Misleading Equity Tokens

OpenAI strongly emphasized that any stock tokens referencing the company and sold via Robinhood’s platform are not official or valid representations of OpenAI’s equity. The organization’s response came in the wake of Robinhood CEO Vlad Tenev’s announcement at a major event in Cannes, where he revealed that eligible European users could claim tokenized shares linked to private firms such as OpenAI and SpaceX.

Robinhood’s New Crypto Asset Launch Attracts Attention

Labelled as "stock tokens," Robinhood offered a promotional incentive—€5 in OpenAI and SpaceX stock tokens—for qualifying EU-based users who register to trade these digital assets by July 7. Tenev reported that users could claim their tokens a week after installing the Robinhood app, with $1 million in OpenAI tokens already allocated for subsequent distribution.

Clarification: Tokens Are Not Actual Equity

Following OpenAI’s disavowal, Tenev clarified on X that the stock tokens are not direct shares or legal ownership stakes. Instead, these blockchain-based tokens are meant to provide retail investors with exposure to the price performance of private companies such as OpenAI and SpaceX, without conferring actual shareholder rights. He directed users to Robinhood’s Terms for details, underscoring that these tokens serve as a means for crypto traders to access and speculate on private assets within the evolving digital asset ecosystem.

Robinhood Expands Its Cryptocurrency Services

Robinhood continues to broaden its suite of crypto-related offerings beyond traditional stock trading. Alongside the debut of tokenized equities, the firm has rolled out perpetuals trading, allowing users to take leveraged positions on cryptocurrencies, as well as staking services, which let participants lock their digital assets to help secure blockchain networks and earn token rewards. Additionally, Robinhood recently announced a Layer 2 blockchain built on Arbitrum, further strengthening its position in the blockchain and cryptocurrency ecosystem.

Regulatory and Investor Cautions

The rapid emergence of tokenized stocks and similar crypto instruments raises questions about regulatory oversight and investor protection. OpenAI’s warning serves as a reminder to the global crypto community to verify the legitimacy of digital assets, especially those purporting to represent equity in high-profile companies. As blockchain technology continues to disrupt traditional finance, clear communication and regulatory compliance remain essential for maintaining market trust.

Source: crypto

Comments