2 Minutes

China's Smartphone Market Remains Stable with Slight Growth

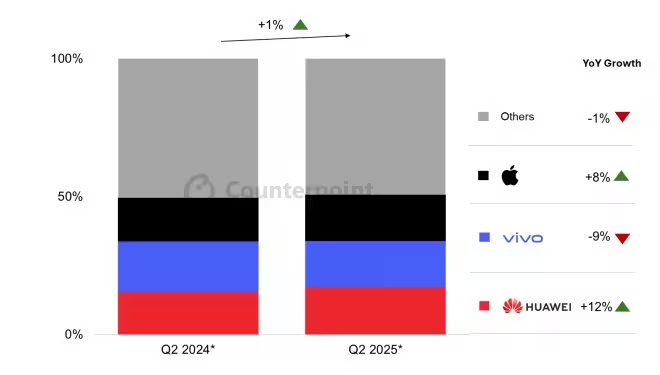

In the second quarter of 2024, the Chinese smartphone market demonstrated remarkable resilience, recording a modest 1% year-on-year increase in total smartphone shipments, according to the latest Counterpoint Research analysis. Despite the subdued overall expansion, leading tech giants Huawei and Apple have stood out with robust shipment growth, maintaining their dominance in one of the world’s most significant mobile markets.

Huawei Leads Q2 Surge Thanks to 618 Festival and Subsidy Program

Huawei experienced an impressive 12% year-over-year increase in smartphone shipments for Q2. This surge is largely attributed to surging consumer demand during China’s widely anticipated 618 shopping festival, as well as the national government’s ambitious subsidy program. The subsidy initiative covers a variety of digital products, including smartphones, tablets, smart bands, and smartwatches priced under CNY 6,000 (approximately $820), providing buyers with up to CNY 500 ($68) in one-time savings. However, there is growing speculation that these incentives might be reduced later this year, which could impact future shipment figures.

Apple’s iPhone 16 Series Gains Momentum

Competitive Discounts Boost Shipments

Apple remains the only other brand in China’s top five lineup expected to post positive shipment growth in Q2, with a strong 8% rise. The release of the iPhone 16 series—coupled with timely promotional discounts ahead of the 618 shopping spree—significantly fueled consumer interest and sales, helping Apple solidify its competitive edge in the premium segment.

Comparative Analysis and Market Impact

Compared to other smartphone brands in China, Huawei and Apple’s innovation-driven strategies and customer-centric promotions have distinguished them from competitors, many of whom faced stagnant or declining shipment numbers. Huawei’s rapid growth underscores the advantages of government-backed programs and festive demand, while Apple leverages its brand loyalty through feature-rich devices and strategic pricing.

Use Cases and Consumer Appeal

Both firms excel in delivering high-performance devices tailored to Chinese consumers’ preferences, including advanced cameras, AI-powered features, and seamless ecosystem integration. The ongoing popularity of 5G-enabled smartphones is also a significant driver for both brands, catering to users seeking speedy connectivity and future-proofed investments.

Source: gsmarena

Comments