10 Minutes

Introduction: Revolutionizing Crypto with Ink Blockchain

The cryptocurrency landscape is evolving at breakneck speed, redefining financial standards with constant innovation. Among the latest breakthroughs, Kraken—a globally recognized cryptocurrency exchange—has unveiled Ink, a Layer-2 blockchain designed to accelerate the convergence between Centralized Finance (CeFi) and Decentralized Finance (DeFi). More than a technical innovation, Ink signals Kraken’s strategic commitment to shaping the next generation of blockchain infrastructure and democratizing access to DeFi.

The Launch of Ink: A Strategic Move by Kraken

Unveiled at DevCon Bangkok in November 2024, Ink’s testnet launch marked Kraken’s inaugural steps into proprietary blockchain development. The subsequent mainnet release, planned for Q1 2025, cements Kraken’s intent to shape the future of Ethereum scalability and DeFi usability—making Ink a centerpiece in Kraken’s broader strategy to connect CeFi and DeFi audiences seamlessly.

Ink Blockchain: A Layer-2 Solution Supercharging Ethereum

Built as a Layer-2 blockchain on Ethereum, Ink leverages the open-source OP Stack—pioneered by Optimism and licensed under MIT—to deliver a more scalable, lower-cost, and flexible DeFi experience. Layer-2 solutions like Ink shift the transaction processing load away from Ethereum’s base layer (Layer-1) to address key bottlenecks: throughput, gas fees, and privacy. By utilizing Optimistic Rollups, Ink significantly boosts transaction speeds by assuming validity unless challenged within a preset timeframe. Only finalized records are stored on Layer-1, ensuring security while minimizing costs.

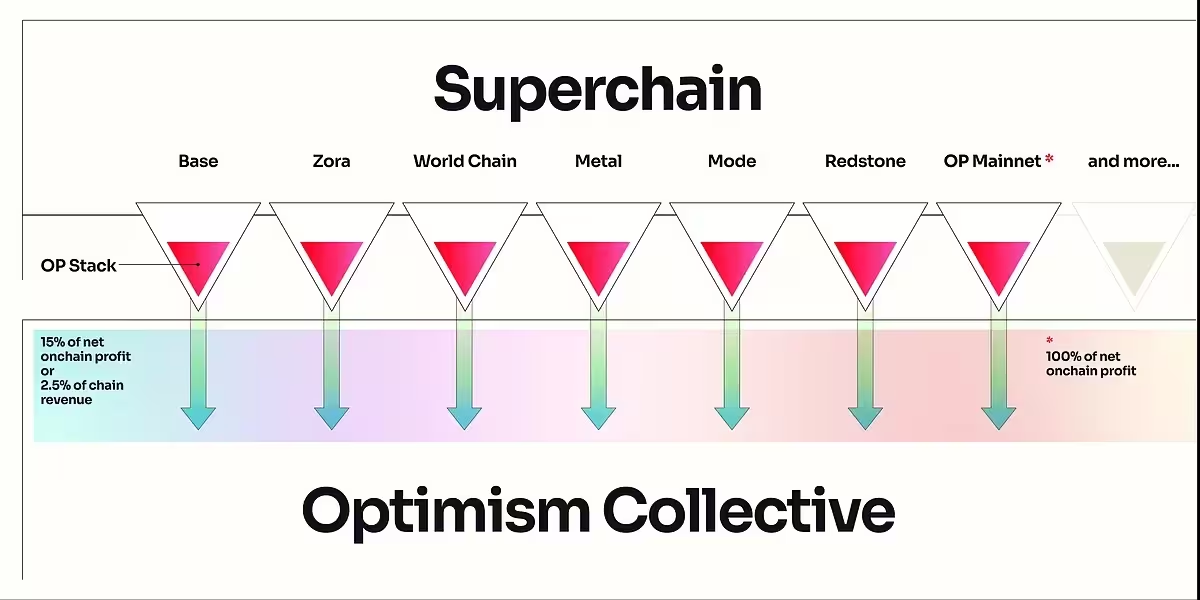

Part of the Optimism Superchain

Ink’s foundation on OP Stack aligns it seamlessly with the Optimism Superchain—a connected ecosystem of Layer-2 blockchains that share interoperability, bridging mechanisms, and a unified security and development toolkit. This synergy not only enhances Ethereum’s resilience and throughput but also promotes frictionless movement of assets and liquidity across interconnected chains within—and potentially beyond—the Superchain. By adopting these standards, Ink becomes an integral component of a scalable blockchain network that supports wide-ranging DeFi innovation.

How Ink Distinguishes Itself in the Ethereum Layer-2 Space

Recent years have seen an explosion of Layer-2 solutions aiming to solve Ethereum’s scalability challenges. Yet, Ink stands out with its unique blend of features and philosophy, positioning itself as a strategic force within the evolving DeFi ecosystem. Here are the core differentiators:

1. Bridging Centralized and Decentralized Finance

One of Ink’s most compelling value propositions is its role as a user-friendly bridge connecting the often-complex world of DeFi with the familiar, secure environment of centralized exchanges. For newcomers, interacting with decentralized applications can be intimidating and technically challenging. By harnessing Kraken’s established brand and user base, Ink seeks to make DeFi accessible and trustworthy for a much broader audience—helping to onboard millions into decentralized services and democratizing access to financial opportunities.

2. Backed by a Trusted Western Exchange

While leading Asian exchanges like Binance and OKX have developed their own blockchains, Ink is uniquely positioned as a Western-developed solution, backed by one of the world’s most reputable crypto exchanges. Having operated since 2011 and earned a sterling reputation for security and compliance, Kraken provides Ink with credibility and robust institutional backing—a key differentiator in a rapidly maturing industry.

3. Relentless Focus on User Experience and Accessibility

Ink is meticulously engineered to maximize user experience (UX) and lower the technical barriers to DeFi adoption. Smart aggregation, automation, and abstraction techniques enable seamless dApp usage—even for those without a deep understanding of blockchain internals. The ultimate goal: make interacting with DeFi as intuitive and accessible as using any modern mobile application.

4. Security and Lightning-Fast Block Times

Security remains a top priority for DeFi platforms, and Ink does not compromise. By building upon Ethereum’s time-tested security and leveraging Kraken’s decade of cybersecurity expertise, Ink offers exceptional protection. From day one, Ink delivers 1-second block times—with ambitions to cut this to sub-second in the future. Permissionless, robust fault proof mechanisms ensure resilience against attacks while keeping the network responsive and efficient.

5. More Than Just Scalability: A Comprehensive Approach

Ink elegantly blends the best of both centralized and decentralized financial systems. By reducing friction points that historically hindered cross-platform participation, Ink empowers users to move confidently between CeFi and DeFi—unlocking the full potential of both ecosystems.

Interoperability: At the Heart of Ink’s Ecosystem

Interoperability is more than a feature—it is the backbone of Ink’s role in advancing DeFi. Powered by OP Stack, Ink taps into Ethereum’s security while contributing unique liquidity and capabilities to the broader Optimism Superchain. This structure ensures that liquidity can flow fluidly between connected chains, supercharging the reach and composability of decentralized applications.

Boosting DApp Efficiency Through Seamless Asset Transfers

By automating workflows and enhancing cross-chain communication, Ink allows for smoother, cost-efficient on-chain operations. This is especially vital in the Asia-Pacific region, where adoption of blockchain interoperability is growing at an unprecedented rate, supported by robust governmental backing.

Ink’s Economic Model: Driving Long-Term Growth and Sustainability

Ink is engineered with an economic model designed for both sustainable growth and ecosystem expansion. Drawing on the successful Sequencer Revenue Model utilized by Coinbase for its Base blockchain, Kraken will act as Ink’s primary sequencer—batching and ordering transactions before submitting them to Ethereum for settlement. This structure not only generates steady income for Kraken (as evidenced by Coinbase’s $53 million in Base sequencer revenue in Q2 2024 alone) but also positions Ink for continuous innovation and development.

Launching with Broad Utility: 12+ DApps from Day One

Unlike many nascent blockchains, Ink will not launch as an empty shell. At mainnet release, over a dozen decentralized applications—spanning cutting-edge finance platforms and real-world asset (RWA) solutions—will be live, attracting liquidity and jumpstarting a vibrant ecosystem from the start.

The Ink Token (INK): Fostering Ecosystem Incentives

The Ink Foundation, the nonprofit stewarding the blockchain, has announced a fixed supply of 1 billion INK tokens. Rather than following the ordinary governance token route, INK tokens are designed to power protocol incentives and liquidity aggregation—driving capital efficiency and fostering equitable participation. The aim is to nurture a thriving, innovation-driven community where builders and users alike benefit from a shared, capital-efficient ecosystem.

Getting Started with Ink Blockchain: User and Developer Guide

Both ordinary users and blockchain developers have multiple pathways to engage with Ink and its rapidly growing ecosystem. Kraken’s goal is to make onboarding fast, transparent, and attractive for all:

1. Mint a Commemorative NFT: Early Supporter Entry

Participants can mint a commemorative NFT—designed in collaboration with Optimism—to secure a place as early adopters of the Ink ecosystem. Such NFTs could qualify holders for future airdrops should a native token distribution occur. Staying active in Ink’s official Discord and Telegram communities ensures users are informed of all early participation opportunities.

2. Engage with the Community

Active participation in Ink’s Discord and Telegram is encouraged. The channels host vibrant discussions, news updates, Q&As, and collaboration opportunities. Being involved increases awareness of new opportunities, initiatives, and provides an avenue for networking.

3. Hands-On Testing with the Ink Faucet

Ink offers a faucet supplying testnet ETH—enabling users to trial dApps and practice network interactions risk-free before the mainnet goes live. This firsthand exposure helps users become comfortable with Ink’s distinctive speed, low fees, and transaction mechanics.

4. Developers: Get the Ink Apprentice Dev Role

Ink supports ambitious builders with resources, technical guidance, and funding. To qualify for the Apprentice Dev role, developers should have deployed smart contracts on EVM-compatible chains (such as Ethereum, Optimism, Base, Arbitrum, Polygon, or BNB Chain) and maintain a GitHub account older than one year. With access to detailed documentation, mentorship, workshops, and grants, developers can design advanced composable DeFi solutions leveraging Ink’s robust infrastructure.

5. Stay Updated and Participate in Ink Events

Sign up for official Ink newsletters and participate in events like the Ink DevJam (debuted at DevCon Bangkok 2024) to connect with the team and immerse yourself in ongoing development. As with all crypto projects, always verify official links to safeguard your assets when interacting with new platforms.

Conclusion: Ink Blockchain—Pioneering the CeFi–DeFi Bridge

Ink embodies Kraken's natural evolution towards empowering users to seize financial sovereignty. Backed by a proven exchange, a keen understanding of user needs, and unwavering commitment to DeFi, Ink is set to become a cornerstone in bridging the CeFi–DeFi divide. Its strategic and technical innovations aim not just at scalability, but at making global decentralized finance truly accessible, trustworthy, and frictionless.

Frequently Asked Questions (FAQ) About Ink Blockchain

1. What is Ink, and what problem does it solve?

Ink is a Layer-2 blockchain developed by Kraken and built on Ethereum using the OP Stack from Optimism. Its main goal is to create an efficient bridge between centralized and decentralized financial ecosystems. By improving scalability, reducing gas fees, and optimizing the user experience for DeFi, Ink helps users—from crypto novices to experienced pros—transition effortlessly from CeFi services to the expanding world of DeFi.

2. How does interoperability work in the Ink ecosystem?

Interoperability is central to Ink’s architecture. As part of the Optimism Superchain, Ink enables seamless, cross-chain transfers of assets and liquidity between itself and other Layer-2 chains in the network. This provides users with access to a wide array of decentralized applications and prevents fragmentation of liquidity. For developers, it unlocks the ability to create more complex, composable DeFi protocols—boosting the overall efficiency and growth of the DeFi ecosystem.

Leave a Comment