3 Minutes

Uniswap’s Ongoing Price Struggle in the Crypto Market

The cryptocurrency market has seen significant turbulence in recent months, and Uniswap (UNI) has not been spared. After peaking in May, the UNI token has plummeted by over 20% from its highest point, marking a clear entrance into bear market territory. On July 5, Uniswap was trading around $6.95, a stark contrast to its November 2023 high of $20. This sharp decline has reduced its market capitalization to approximately $4.8 billion—down from a peak of more than $10 billion last year.

Broader Altcoin Sell-Off Intensifies UNI’s Decline

UNI’s downward trajectory mirrors a wider trend across the altcoin space. Excluding Bitcoin (BTC), Ethereum (ETH), and stablecoins, the overall market cap for cryptocurrencies has tumbled nearly 30% this year. During this downturn, investor sentiment has shifted, prompting a substantial sell-off of altcoins, including Uniswap.

Rising Competition in the Decentralized Exchange Arena

A core reason for UNI’s price weakness lies in mounting competition within the decentralized exchange (DEX) sector. Uniswap’s 30-day trading volume recently reached $80 billion—far less than PancakeSwap’s $160 billion during the same timeframe. Hyperliquid, another emerging DEX, recorded an even higher volume of $220 billion, edging ahead of Uniswap and intensifying the battle for market share. Major protocols like Raydium and Aerodrome Finance have also gained traction, further diluting Uniswap’s dominance in the DEX ecosystem.

On-Chain Signals Point to Investor Caution

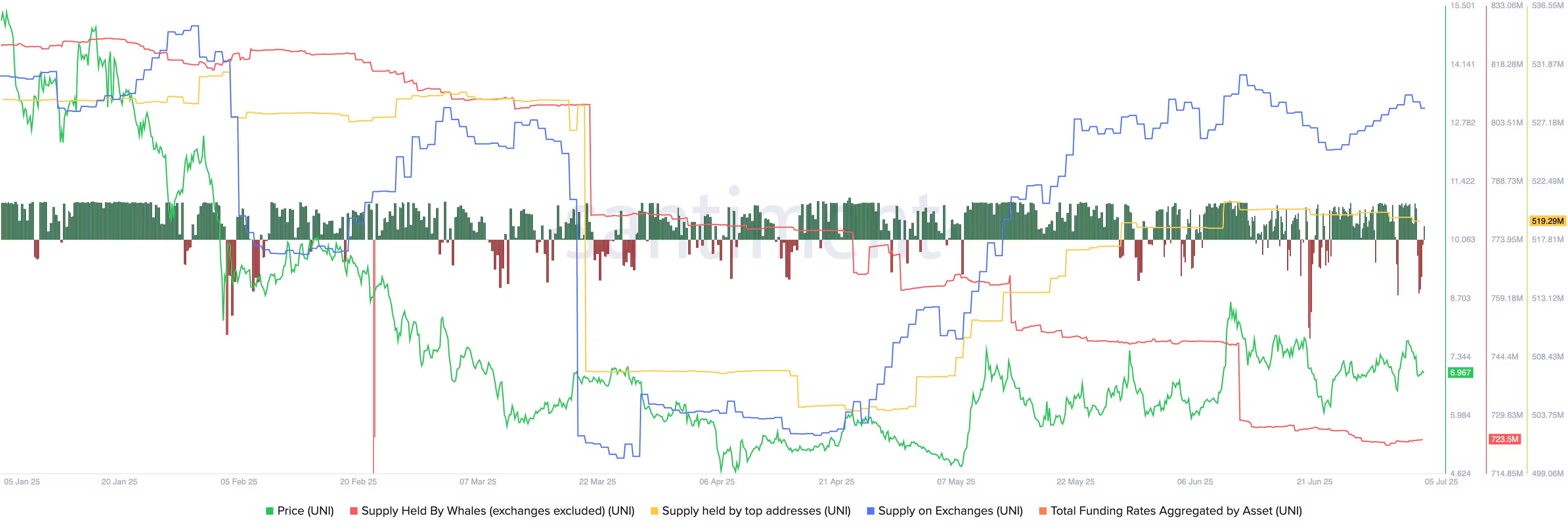

Blockchain data reveals a growing supply of UNI tokens on cryptocurrency exchanges, now totaling 84.6 million—rising from a yearly low of 69 million coins. This increase signals ongoing selling pressure as holders offload their UNI positions. Additionally, large-scale holders (known as whales) have reduced their holdings from 824 million coins in January to 723 million, signaling little confidence in a near-term price recovery. UNI’s funding rate has also swung negative, suggesting that futures traders expect the token’s price to continue sliding.

Technical Analysis: Bearish Patterns Dominate UNI’s Outlook

Price charts underscore the severity of Uniswap’s correction. The daily timeframe shows UNI plunging from November 2023 highs near $20, finding temporary support near $6.98 after rebounding slightly from this year’s low of $4.70. The token has now formed a bearish flag—a technical pattern typically indicating potential for further downside. Should Uniswap break below nearby support levels, traders will be watching the $4.70 mark as a critical floor. Conversely, a move above the strong resistance at $8.60, last seen in May, could shift momentum more positively but remains challenging in the prevailing bearish environment.

The Path Forward for Uniswap and DeFi Tokens

With heightened competition, persistent on-chain selling, and unfavorable technical patterns, Uniswap’s near-term outlook remains cautious. However, market conditions can change rapidly in the cryptocurrency landscape. Investors and DeFi enthusiasts should monitor trading volumes, whale activity, and overall crypto market sentiment for signals of a potential UNI recovery or further downside.

Source: crypto

Comments