3 Minutes

Market Overview: Bitcoin and Ethereum Facing Crucial Levels

Both Bitcoin (BTC) and Ethereum (ETH) have recently experienced significant upward momentum, attracting global investor attention. As of April 25, 2025 (6 Ordibehesht 1404), both cryptocurrencies are now displaying signs of consolidation and reduced momentum in their 4-hour charts. This analysis explores their current technical outlook, important support and resistance levels, and what these mean for traders navigating the volatile crypto market.

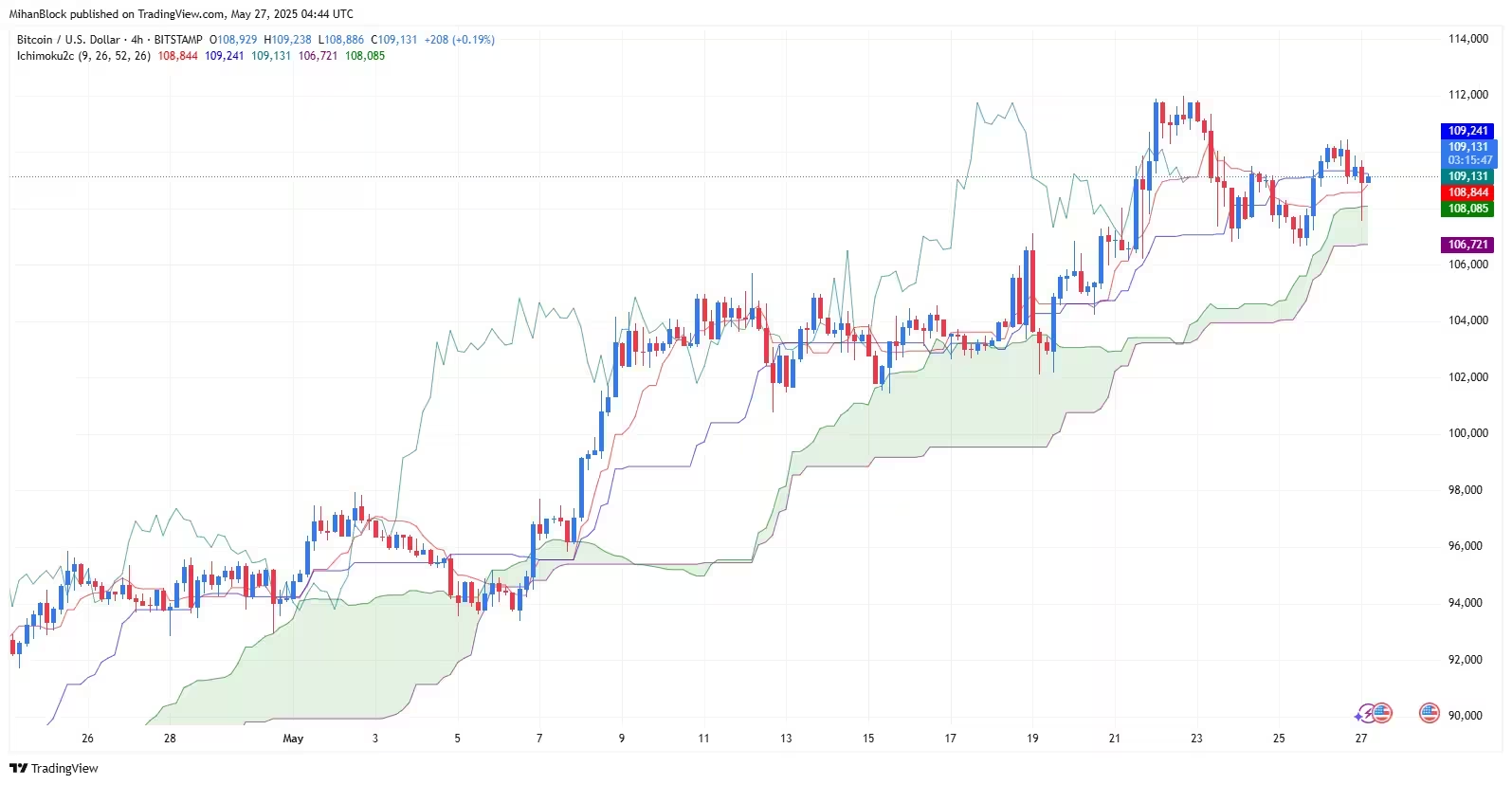

Bitcoin (BTC): Sustaining the Uptrend or Entering a Correction?

At present, Bitcoin is trading around $109,130, maintaining a position above the Ichimoku Cloud on the 4-hour timeframe. This technical indicator generally supports a bullish market structure. However, the Kijun-sen (red) is closely aligned with the price, suggesting weakening buying pressure. Similarly, the Tenkan-sen (blue) moving nearly parallel to the price reflects market hesitation and possible consolidation.

The Ichimoku Cloud remains green and ascending, but its leading edge has started to flatten, hinting at decreased bullish momentum. The Chikou Span (lagging green line) is still above historical prices, signaling that the broader bullish trend remains intact for now. Key support lies near $108,080; breaching this may push BTC toward the next major support at $106,700. For bulls, clearing the $109,240 resistance convincingly is essential to reignite the upward trend. Until then, BTC is likely to remain in a sideways consolidation phase, testing the commitment of both buyers and sellers.

Ethereum (ETH): At the Brink of Major Movement

Ethereum is currently fluctuating near $2,561, perched atop the upper boundary of the Ichimoku Cloud. The Tenkan-sen (red) rests directly on current price levels, with the Kijun-sen (blue) slightly above, underscoring the prevailing indecision and accumulation phase in the market.

The Kumol Cloud is relatively flat, suggesting a slowdown in bullish momentum. Furthermore, the Chikou Span is interacting with the price line, indicating hesitation and uncertainty about the continuation of the uptrend. The primary support aligns with the base of the cloud at $2,540; a breach could see ETH revisiting $2,508. To confirm a renewed bullish move, Ethereum must decisively surpass $2,599 resistance. Until then, range trading or mild corrections are probable.

Outlook: Risks and Opportunities for Crypto Investors

With both BTC and ETH consolidating near vital support and resistance zones, market participants should brace for potential volatility. The flattening Ichimoku indicators point to a cooling of momentum after the recent rallies. However, as long as prices stay above their respective Kumo Clouds, the prevailing bias remains cautiously optimistic.

For global crypto investors, these technical scenarios emphasize the importance of monitoring key price levels and momentum shifts. A clear breakout above resistance could signal the start of another bullish leg, while weakness below support might trigger corrective moves. Staying informed and agile remains crucial in navigating the dynamic world of cryptocurrencies and blockchain assets.

Comments