3 Minutes

Japanese Investment Giant Metaplanet Prepares Record Fundraising via Bitcoin-Backed Shares

Metaplanet, a prominent investment firm based in Japan, has unveiled plans to dramatically increase its Bitcoin holdings by initiating an unprecedented fundraising strategy. The company has filed a shelf registration to raise up to 555 billion yen (approximately $3.5 billion USD) through the issuance of two distinct classes of BTC-backed shares over the next two years. This aggressive capital-raising effort is central to its strategic goal of amassing at least 210,000 BTC by the end of 2027.

Innovative Dual-Class Share Structure Backed by Bitcoin

In its recent corporate filing, Metaplanet detailed its intent to issue a significant number of authorized shares, with a focus on preferred shares rather than common stock. Typically, preferred shares do not carry standard voting rights in shareholder meetings, and in many cases, their voting power is further restricted. According to Metaplanet, the introduction of preferred shares allows the firm to raise capital efficiently while minimizing the dilution impact on existing common shareholders.

The company explained, "Preferred shares offer corporate investors a powerful tool for optimizing capital structure and ensuring greater flexibility in financial strategy." Additionally, in liquidation scenarios, holders of preferred shares are prioritized over common shareholders when remaining assets are distributed.

Notably, Metaplanet’s preferred shares will be uniquely backed by Bitcoin, reflecting the company’s decisive move toward digital asset integration. By choosing this structure, Metaplanet aims to diversify its financing options and enhance the flexibility of its capital policies.

Details of the BTC-Backed Share Offering

The fundraising plan features two distinct classes of perpetual preferred shares: Class A "Non-Convertible" and Class B "Convertible". Each class will represent up to 277.5 billion yen in value, and the shelf registration provides Metaplanet with the ability to issue these shares at any point up to August 2027. This approach grants the company outstanding flexibility to respond to market conditions as it works toward its ambitious Bitcoin holdings objective.

Metaplanet Sets Ambitious 2027 Bitcoin Accumulation Goal

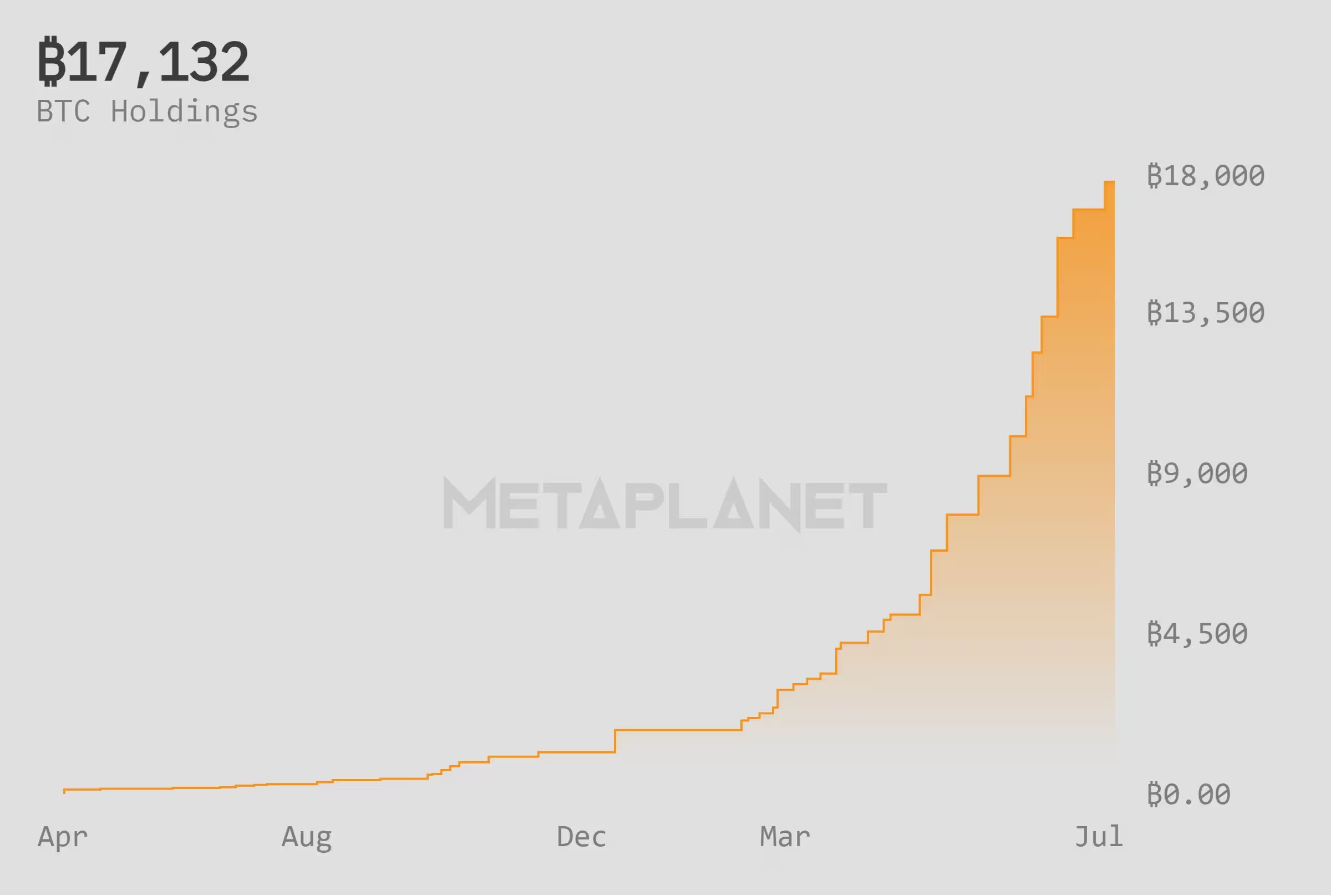

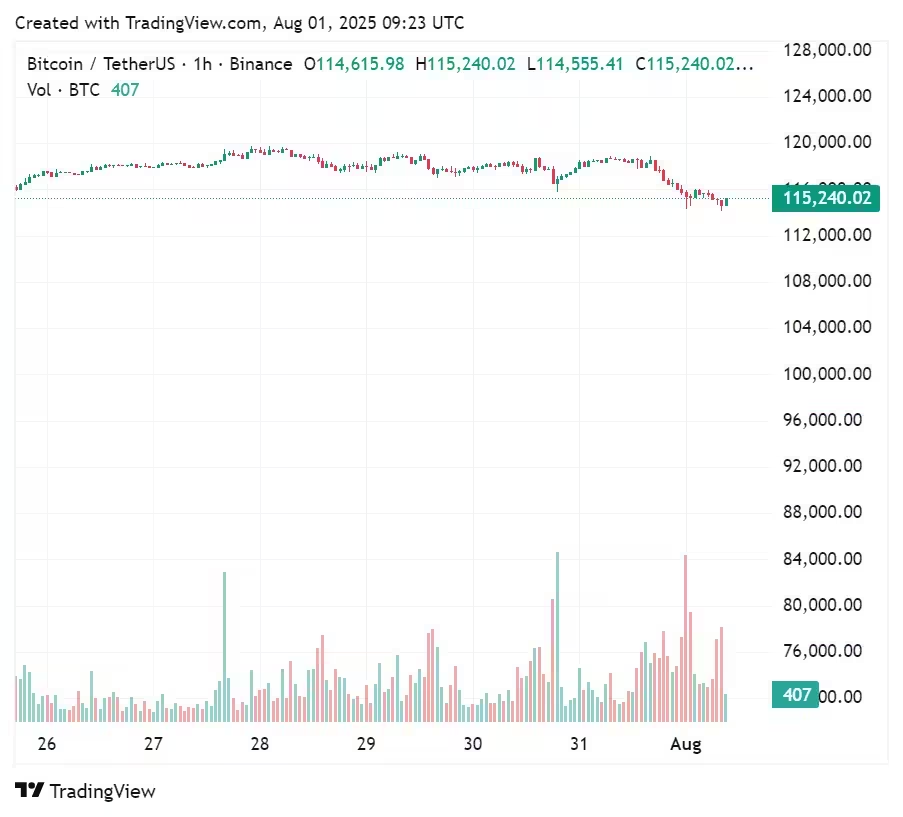

Metaplanet has rapidly established itself as a major institutional player within the Bitcoin treasury space. As of the latest data, the company holds 17,132 BTC, with an average acquisition price of $114,964 per coin. Impressively, the firm has achieved a year-to-date BTC yield of 449.7% according to official disclosures.

In June, Metaplanet significantly raised its 2026 annual Bitcoin acquisition target, jumping from 21,000 BTC to 100,000 BTC—a nearly fivefold increase. This revised target aligns with the firm’s ultimate objective to hold 210,000 BTC by the end of 2027, which would equate to roughly 1% of Bitcoin’s total global supply.

Strategic Shift: From Common to Preferred Shares Issuance

Until recently, Metaplanet’s Bitcoin accumulation strategy predominantly relied on issuing common shares. However, company statements reveal an evolving approach, exploring additional financing avenues such as preferred shares to support its long-term Bitcoin goals. The issuance of these preferred shares remains subject to shareholder approval at the upcoming Annual General Meeting.

By pursuing bold capital strategies and leveraging BTC-backed financial instruments, Metaplanet is positioning itself at the forefront of institutional Bitcoin investment and demonstrating a pioneering approach to blockchain-based capital markets.

Source: crypto

Comments