4 Minutes

Arthur Hayes Offloads Crypto Holdings During Market Turmoil

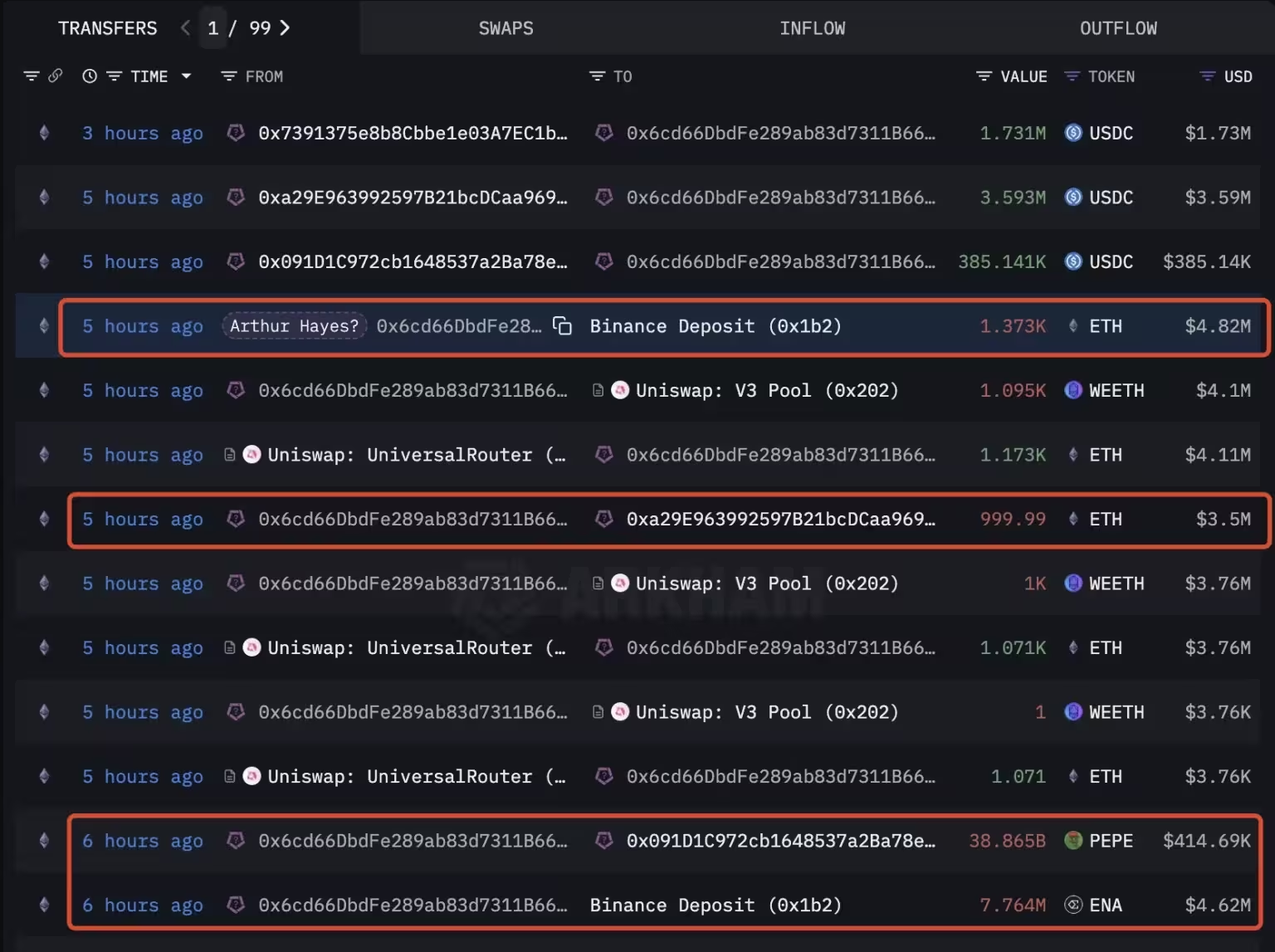

Arthur Hayes, co-founder of the renowned cryptocurrency exchange BitMEX, has made waves across the blockchain community by liquidating over $13.35 million in digital assets as the crypto market experienced intense volatility. The unexpected sale involved significant amounts of Ethereum (ETH), Pepe (PEPE), and Ethena (ENA) tokens, catching the attention of investors and analysts alike.

Details of the Sudden Sell-Off

According to on-chain analytics from Lookonchain, Hayes decided to sell approximately 2,373 ETH, worth about $8.32 million, alongside 7.76 million ENA tokens valued at $4.62 million. Additionally, he sold around 38.86 billion PEPE tokens, equating to roughly $414,700. This substantial liquidation coincided with a sharp 24-hour price drop for Bitcoin, which at one point tumbled to $112,731.

Julio Moreno, Head of Research at CryptoQuant, highlighted that Bitcoin is currently entering its third significant profit-taking wave in the ongoing bull cycle. Historically, such phases signal a period of market correction before the next upward trend, a dynamic closely watched by both retail and institutional crypto traders.

Strategic Shift: From Optimism to Caution?

Hayes' recent maneuvers are particularly striking given his previous bullish outlook on the altcoin season. Not long ago, he encouraged traders not to shy away from policy changes, such as potential Trump-era tariffs, and confidently predicted soaring prices for cryptocurrencies like Ethereum—forecasting its potential rise toward $10,000 fueled by institutional demand and treasury policies.

However, the sizeable sale suggests a tactical pivot toward a more cautious approach. This comes amidst the largest daily outflow in months from US spot Bitcoin ETFs. These exchange-traded funds saw a collective outflow of around $812 million, with Fidelity's FBTC leading the exodus at $331 million alone. Ethereum ETFs also witnessed notable net outflows, reflecting mounting investor skepticism amid global macroeconomic uncertainty.

Adding to the bearish sentiment are new tariffs announced by the US administration targeting goods from over 60 countries, set to take effect on August 7. Analysts, including those at the Federal Reserve, warn this could stoke inflation, prompting further risk aversion in the digital assets space.

Profit-Taking or Long-Term Bearish Turn?

The contrast between Hayes' recent actions and his previously optimistic forecasts for ETH and altcoins has left many observers puzzled. As a prolific altcoin supporter, Hayes has consistently advocated for the massive potential of decentralized finance and emerging blockchain projects. The current sell-off, however, is seen more as a prudent risk management move rather than an outright pivot to bearishness.

Indeed, just weeks ago, Hayes was accumulating ENA tokens at lower price points, signaling his continued interest in high-risk, high-reward blockchain projects. His willingness to offload large positions during a turbulent market could be a tactical play—reducing exposure in the short term with the intention to re-enter when conditions stabilize.

This strategy aligns with Hayes’ previous patterns of buying undervalued assets and temporarily exiting positions that face short-term headwinds. For now, it appears the BitMEX co-founder is taking a defensive stance, reducing his ETH and PEPE holdings while patiently waiting for new opportunities as the crypto market cycles through its current phase.

What Does This Mean for Crypto Investors?

For established traders and newcomers alike, Hayes’ actions serve both as a cautionary signal and a lesson in strategic portfolio management. Managing risk amid high volatility is crucial in cryptocurrency markets, and even industry veterans adapt their strategies in response to regulatory changes, ETF flows, and global economic developments.

As the debate continues over whether we are witnessing mere profit-taking or a deeper bearish shift, crypto investors are reminded of the value in staying alert, employing robust risk management, and maintaining a long-term perspective on digital asset growth.

Source: coingape

Comments