3 Minutes

Global Cryptocurrency Adoption Soars According to Gemini Exchange Report

The latest "Global State of Crypto 2025" report released by leading cryptocurrency exchange Gemini highlights a substantial rise in cryptocurrency ownership worldwide. The report, published after a turbulent start to the digital asset markets in 2025, reveals strong signs of continued growth and rising adoption not only for Bitcoin but across a wide spectrum of cryptocurrencies.

Key Drivers Behind the Rise in Crypto Holdings

Gemini's analysis identifies recent policy shifts—particularly in the United States—as primary catalysts for this upward trend. Following the inauguration of the Trump administration in January 2025, a strategic Bitcoin reserve was established, and crypto-friendly leaders were appointed to key positions within the U.S. Securities and Exchange Commission (SEC). These decisions have increased public trust in digital assets, helping foster a more supportive environment for investment. Meanwhile, the U.S. Congress is working to put in place new regulations that aim to clarify the legal status of stablecoins and set comprehensive rules for digital assets.

Although past studies suggested only around 4% of the global population held Bitcoin—with the United States making up roughly 14% of that number—recent data demonstrates broader and more rapid adoption rates across multiple countries.

Europe and Asia Lead in Crypto Ownership Growth

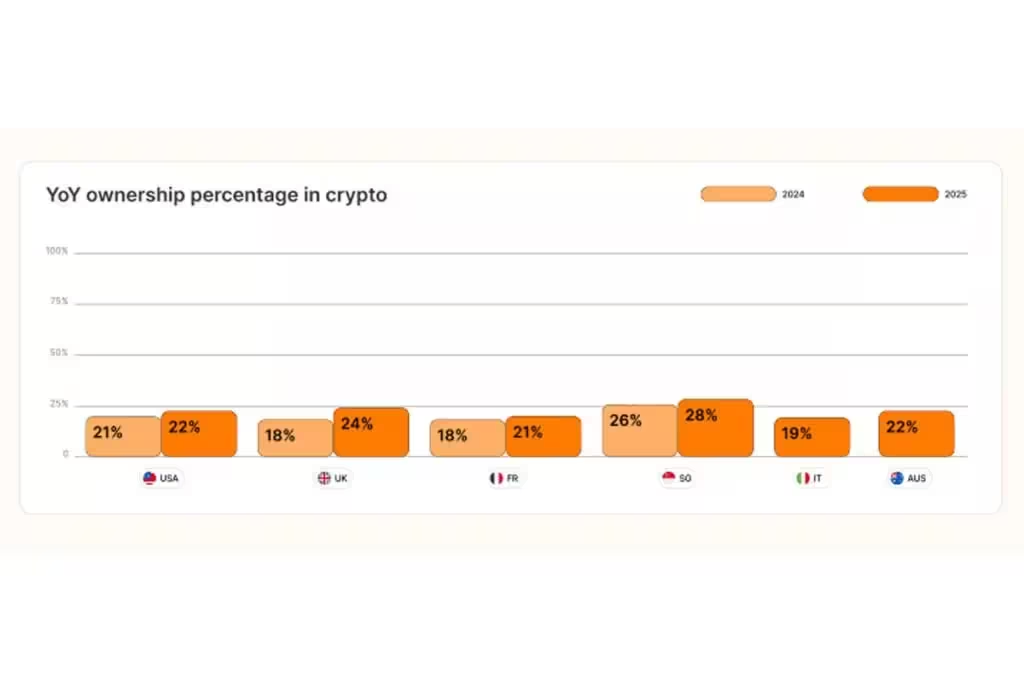

2025 marks Europe as a frontrunner in cryptocurrency adoption. In the United Kingdom, ownership jumped from 18% to an impressive 24% within a year, marking one of the steepest annual increases globally. France has also witnessed a rise, reaching 21% from last year's 18%. Notably, Singapore remains at the forefront with 28% of respondents holding cryptocurrencies. The United States (22%), Italy, and Australia are also experiencing robust growth in the digital currency sector.

Marshall Beard, CEO of Gemini, noted: "With newly implemented pro-crypto policies, the U.S. is reinforcing its position as a leader in Web3 and blockchain technology. This forward-thinking approach is fueling sharp expansion of the crypto industry both domestically and worldwide."

Public Trust in Bitcoin Bolstered by U.S. Policy Shifts

The report underscores a growing sense of confidence in cryptocurrencies due to government actions. In the U.S., nearly 23% of non-crypto owners say the creation of a strategic Bitcoin reserve by the Trump administration has positively influenced their trust in digital assets. This growing sentiment is echoed in the UK (21%) and Singapore (19%) as well.

ETFs and Inflation Protection Drive Crypto Investments

Cryptocurrency exchange-traded funds (ETFs) have rapidly gained traction since their launch in early 2024. In the U.S., 39% of crypto investors participate in these vehicles, helping propel Bitcoin prices and boosting mainstream adoption. Despite easing inflationary pressures in recent years, 39% of American investors view cryptocurrencies as effective protection against inflation—up from 32% a year ago.

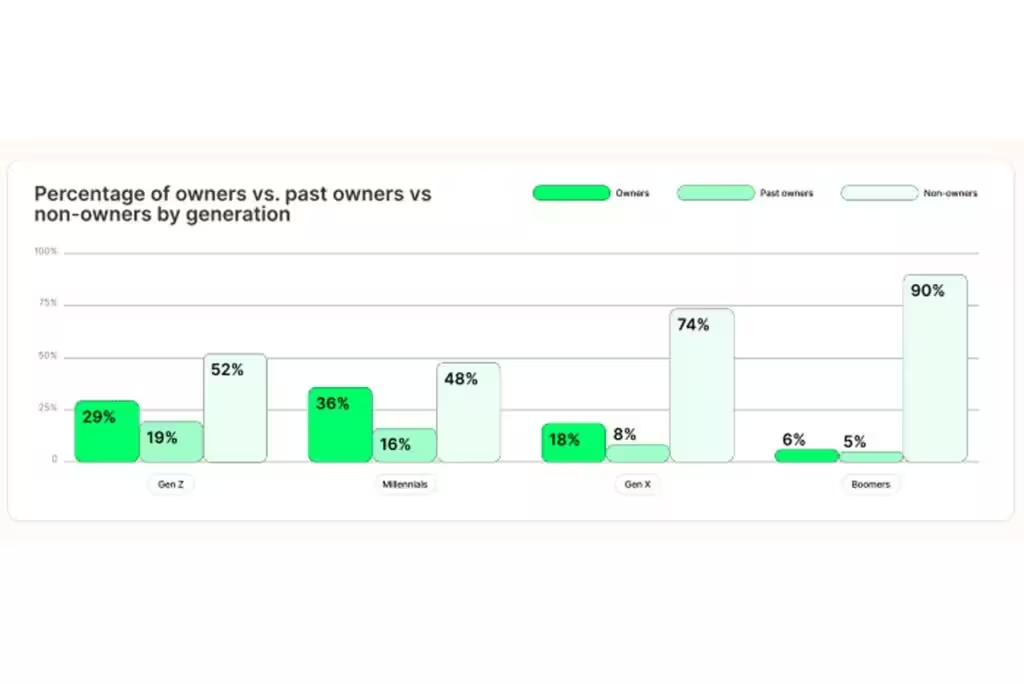

Younger Generations Power the Crypto Revolution

Crypto adoption among millennials and Gen Z is outpacing other age groups globally. More than half of millennials (52%) and nearly half of Gen Z respondents (48%) report owning digital assets, significantly surpassing the global average of 35%. The gender gap in cryptocurrency investment is also narrowing, with more women entering the blockchain and crypto markets across different regions.

As the world continues to embrace blockchain technology and digital currencies, reports like Gemini's emphasize a promising outlook for the cryptocurrency ecosystem into 2025 and beyond.

Comments