2 Minutes

Bitcoin's Path to $200,000: Insights from On-Chain and Technical Data

The cryptocurrency market is once again abuzz as Bitcoin (BTC) reaches new all-time highs in 2025. However, on-chain metrics and technical analysis suggest that the world’s most valuable digital asset may still have significant room for further growth, with the $200,000 milestone well within reach.

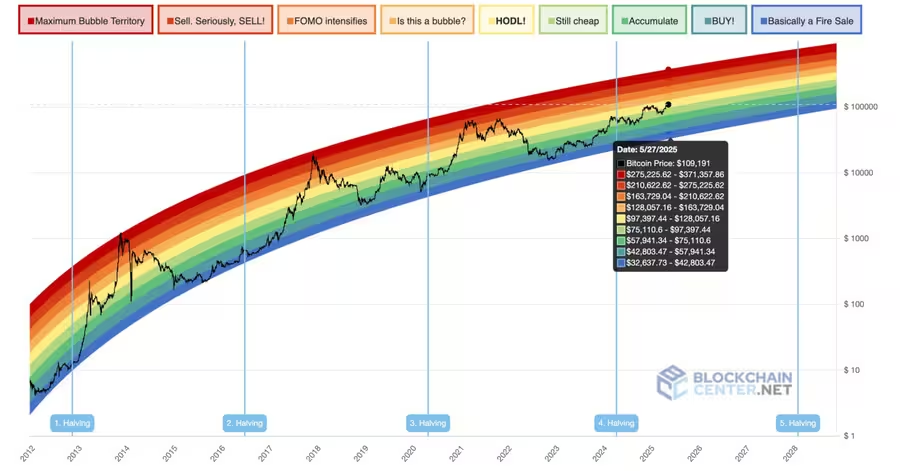

1. Rainbow Chart Highlights Mid-Cycle Bitcoin Potential

Among the analytical tools used by experts, the Bitcoin Rainbow Chart stands out. Leveraging the logarithmic growth curve, this model maps out potential long-term price movements for BTC. Current readings show that Bitcoin remains only halfway through its growth phase, signaling there’s ample opportunity for further price appreciation before the bull cycle tops out.

2. Relative Strength Index Leaves More Room for Upside

Technical analysts often turn to the Relative Strength Index (RSI) to gauge whether an asset is overbought or oversold. With Bitcoin’s RSI currently sitting at 71—far below historic peaks near 90—market momentum still favors the bulls. This technical indicator implies there’s still space for the current uptrend to continue, supporting projections of higher price targets.

3. Long-Term Bitcoin Holders Accumulate Despite Price Corrections

Long-term investors are capitalizing on price dips below $111,000 to increase their Bitcoin holdings. The realized value metric for this cohort recently surpassed $28 billion, a strong indication that seasoned holders are steadily accumulating during market pullbacks. Analysts interpret this behavior as a sign of unwavering confidence in Bitcoin’s long-term potential, differentiating them from short-term traders who were compelled to sell during recent corrections.

4. Investor Sentiment and Trading Trends Still Favor Growth

Market behavior data reveals that retail trading volume for Bitcoin remains below the annual average, as reported by CryptoQuant. This suggests that the market has yet to enter a FOMO-driven frenzy typically observed near market tops. As a result, the current environment reflects healthy, sustainable growth potential for BTC.

In summary, a combination of technical signals, investor behavior, and robust on-chain data collectively indicate that Bitcoin has not yet reached its cyclical peak. The much-anticipated $200,000 price target is increasingly being discussed by market analysts as the next major milestone for the leading cryptocurrency. Still, investors should remain mindful of short-term volatility and broader macroeconomic forces influencing the digital asset landscape.

Comments