3 Minutes

iPhone 16 Tops Worldwide Smartphone Sales in Early 2025

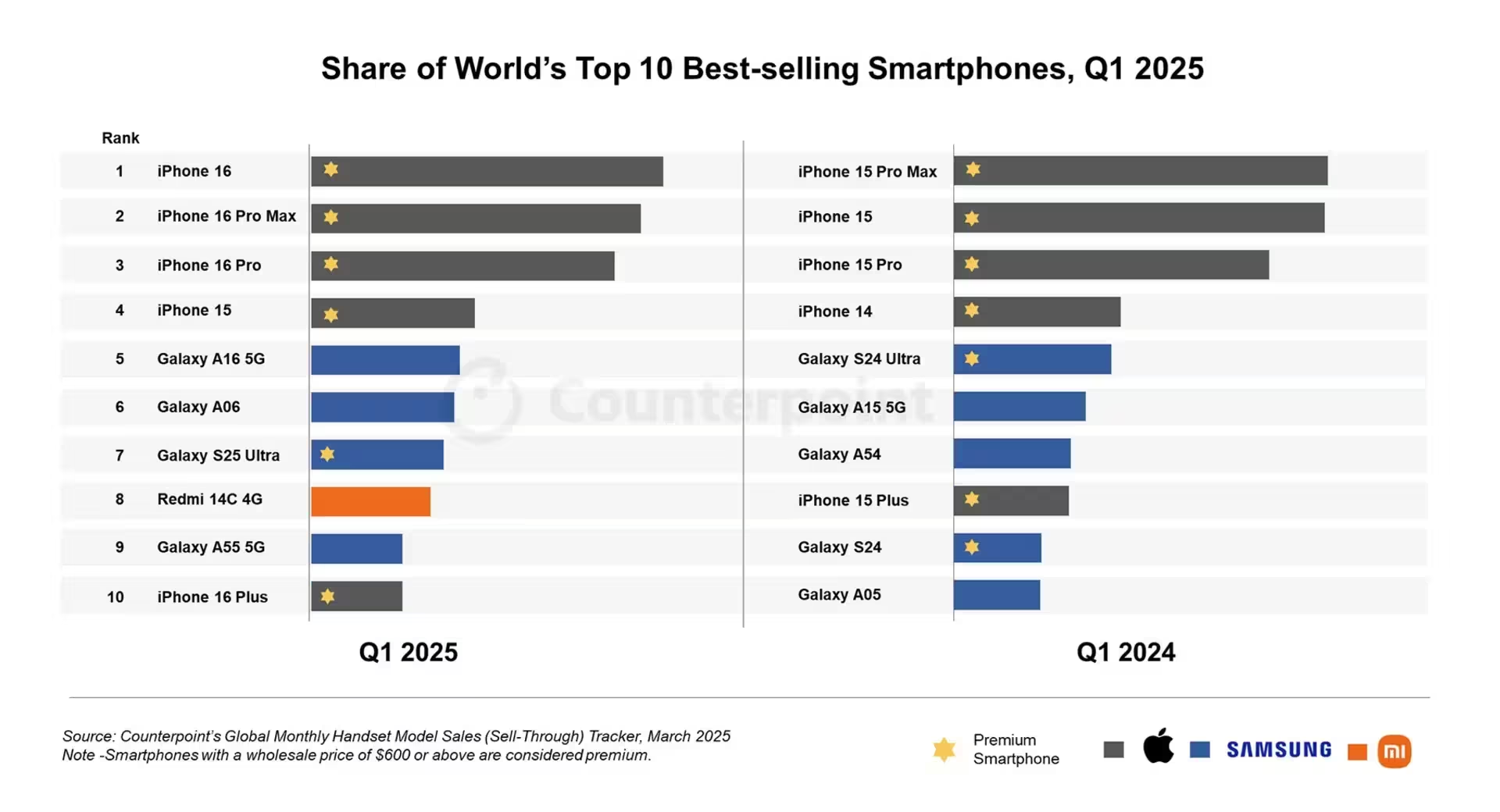

According to the latest analysis from Counterpoint Research, Apple’s iPhone 16 has become the world’s best-selling smartphone in the first quarter of 2025. This milestone marks the first time since 2022 that a base iPhone model has claimed the top spot during this period, highlighting Apple’s continued dominance in the highly competitive smartphone market.

Apple Leads the Pack With Five Models in the Top 10

Data shows Apple holds half of the coveted top 10 best-selling smartphones in Q1 2025— a trend the company has maintained for the past five years. Samsung follows closely with four models on the list, while Xiaomi remains the only other brand to break into the global top 10.

Standout Features Fuel iPhone 16 Sales

The surge in iPhone 16 shipments is attributed to its balanced blend of cutting-edge performance, attractive features, and user-centric enhancements. With improved battery life, an advanced A18 processor, and an upgraded camera system, the iPhone 16 appeals to both tech enthusiasts and everyday users. Notably, robust sales were observed in Japan, the Middle East, and African markets. Counterpoint reports that favorable economic conditions and recent changes to carrier policies in Japan have played a significant role in boosting the popularity of Apple’s flagship device.

Pro Models Maintain Momentum While Entry-Level Gains Ground

While iPhone 16’s base model led the charge, the Pro Max and Pro variants secured the second and third spots, further cementing Apple’s global influence. However, these premium versions are reportedly facing challenges in China. New government incentives targeting smartphones priced below 6,000 yuan (roughly $833) have bolstered competitors like Huawei, making the Chinese market particularly competitive for Apple’s high-end offerings.

iPhone 16e and the Rise of Value Devices

The iPhone 16e made its global debut on the sales chart, capturing the sixth position in its first full month of availability—a strong testament to consumer hunger for affordable yet capable Apple devices.

Samsung’s Performance Remains Strong

Samsung's Galaxy S25 Ultra ranked seventh in Q1 2025, a slight drop from the Galaxy S24 Ultra’s performance during the same period last year, likely due to the later release of the S25 lineup. The Galaxy A16 5G saw impressive demand in North America, Latin America, and Asia-Pacific, climbing to fifth place. Meanwhile, the ultra-budget Galaxy A06 entered the global top 10, reflecting a growing appetite for affordable smartphones priced under $100.

Global Trends: The Surge in Budget-Friendly Smartphones

Sub-$100 smartphones saw the fastest sales growth this quarter, accounting for nearly 20% of total global smartphone sales. According to Counterpoint, this remarkable increase is driven by improving conditions across supply chains and heightened demand in emerging markets.

Xiaomi Shines with Redmi 14C 4G

Outside the Apple and Samsung portfolios, Xiaomi’s Redmi 14C 4G stands out as the only other model to join the global top 10. With a staggering 43% year-over-year growth, the Redmi 14C 4G achieved notable success, especially across the Middle East, Africa, and Latin America—markets where cost-effective smartphones are highly sought after.

Outlook for the Smartphone Market

This latest sales report underscores the evolving preferences among smartphone buyers worldwide, as both feature-packed flagships and affordable entry-level devices play vital roles in shaping global sales charts. As market dynamics shift and consumer priorities evolve, Apple, Samsung, and Xiaomi are expected to remain at the forefront of technological innovation and market relevance.

Comments