3 Minutes

Nvidia Surges Ahead: Market Capitalization Hits $3.46 Trillion

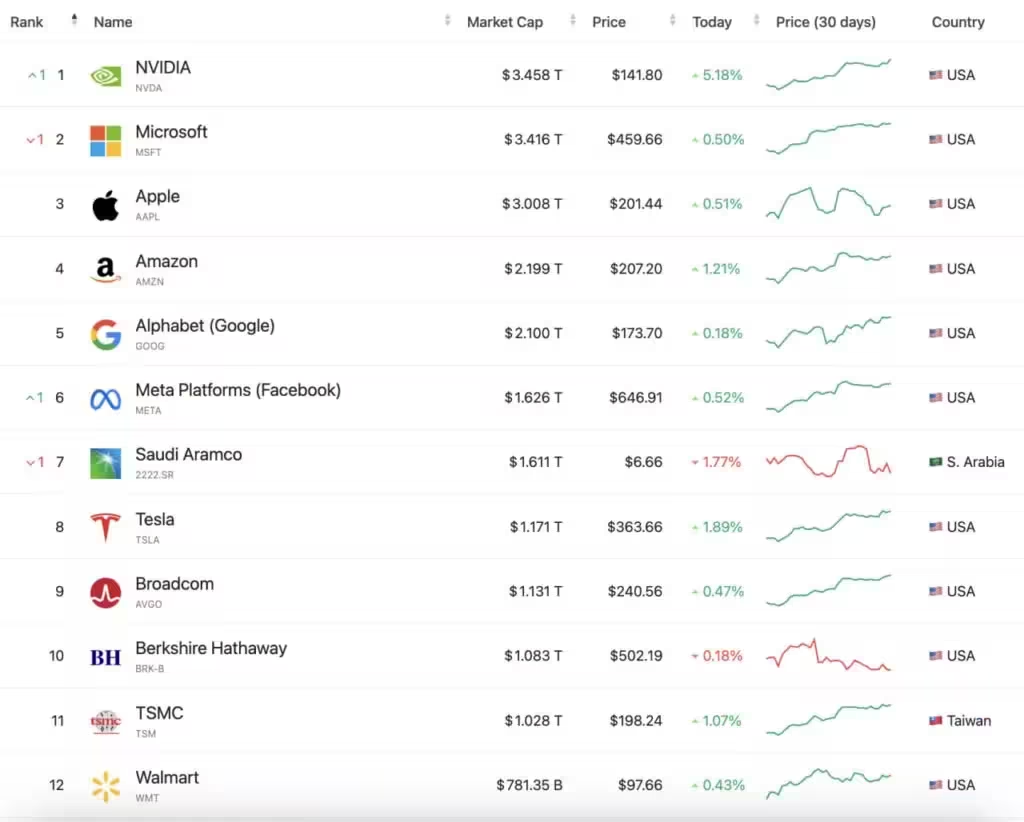

Nvidia has once again asserted its dominance in the global technology sector, overtaking both Apple and Microsoft to become the world’s most valuable company. According to its financial report for the first quarter of fiscal year 2026, Nvidia’s market capitalization has soared to a staggering $3.46 trillion, solidifying its lead over the traditional tech giants.

Record-Breaking Financial Performance

For the quarter ending April 27, 2025, Nvidia posted total revenues of $44.1 billion. This reflects a remarkable 12% growth compared to the previous quarter and an outstanding 69% increase year-over-year. These impressive figures underscore the company’s rapid growth, driven primarily by its leadership in artificial intelligence (AI), data center hardware, and cutting-edge graphics technology.

Data Center Division and AI Drive Explosive Growth

Nvidia’s data center segment, which has been the backbone of its AI infrastructure offerings, delivered a record-breaking $39.1 billion in revenue. AI demands from cloud computing providers, enterprises, and research institutions fueled a 10% quarter-over-quarter and 73% year-over-year increase. As global industries and governments recognize AI as a foundational technology—on par with electricity and the internet—Nvidia’s role at the forefront of this digital revolution is more prominent than ever.

Gaming Division Exceeds Expectations

The company’s gaming division also surpassed market forecasts, posting $3.8 billion in revenue. This translates to a robust 48% sequential and 42% annual growth. With the highly anticipated release of the Nintendo Switch 2—leveraging Nvidia’s advanced graphics processors—set for June 5, the upward momentum in gaming is expected to continue.

CEO Jensen Huang Highlights Nvidia’s Industry Impact

Commenting on the results, Nvidia CEO Jensen Huang emphasized the global shift towards AI-driven infrastructure, noting that nations are now treating AI as an essential resource for future innovation. Huang expressed pride in his company’s instrumental contributions to this broader technological transformation.

Facing Regulatory Challenges, Yet Maintaining Momentum

Looking ahead, Nvidia predicts second-quarter revenues near $45 billion. However, new US export regulations on high-performance H20 AI products to China have introduced significant challenges. These requirements forced Nvidia to secure costly licenses, incurring a $4.5 billion expense in the last quarter and compressing its non-GAAP gross margin from 71.3% to 61%. Without these regulatory headwinds, earnings per share (EPS) would have reached $0.96 instead of $0.81.

Shareholder Benefits and Market Response

Nvidia announced a quarterly cash dividend of $0.01 per share for shareholders of record as of July 11. Following its latest earnings call, Nvidia’s stock price jumped approximately 4% in early trading, signaling continued investor confidence amid rapid technology market evolution.

Innovation, Competitive Differentiation, and Market Outlook

Nvidia’s ongoing advancements in AI, GPU technology, and data center solutions not only set it apart from competitors like Apple and Microsoft, but also underpin a vast ecosystem of partners and emerging applications—from autonomous vehicles to enterprise machine learning. With surging demand across sectors and a relentless pace of innovation, Nvidia remains a critical engine driving the future of global technology and digital transformation.

.avif)

Comments