5 Minutes

Bitmain Sets a New Benchmark With the Launch of Antminer S23

Bitmain, the world’s leading manufacturer of cryptocurrency mining hardware, has introduced its latest Bitcoin mining rig—the Antminer S23—during the prestigious Global Digital Mining Summit held in Las Vegas this week. Touted as the most powerful and energy-efficient Bitcoin miner to date, the S23 is expected to redefine performance benchmarks in the crypto mining sector.

The Antminer S23 will come in three distinct variants, each designed to cater to the evolving demands of the global Bitcoin mining community, with significant improvements in hash rate and efficiency over its predecessors.

Comprehensive Overview of the Antminer S23 Series

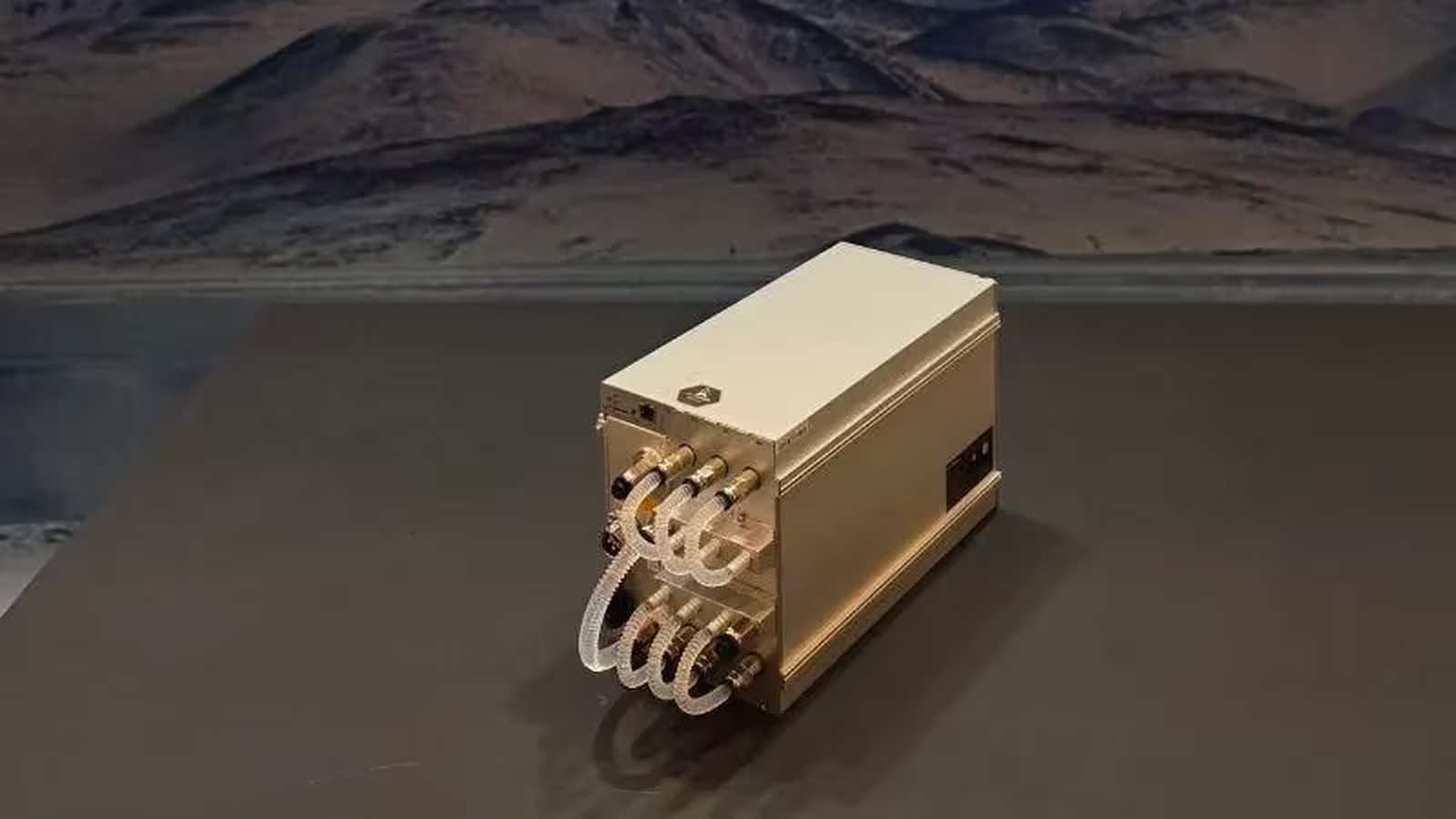

According to Bitmain, the Antminer S23 will be available in three specialized models, each featuring advanced cooling technologies tailored to maximize performance:

- Air-Cooled Version: Delivers a robust computing power of 318 TH/s (terahashes per second) with an exceptional energy efficiency of 11W/TH.

- Hydro-Cooled Version: Achieves an impressive 580 TH/s with an industry-first energy efficiency rating of just 9.5W/TH, making it the first Bitcoin miner to break the sub-10W/TH barrier.

- Immersion Cooling Version: Offers a flexible hash rate between 368 TH/s and 442 TH/s, also maintaining an efficiency of 11W/TH.

To put these numbers in perspective, the air-cooled S23 consumes a total of about 3,498 watts at 318 TH/s and 11W/TH. Compared to the earlier Antminer S21, launched in September 2023, the S23 boasts a staggering 69% increase in hash rate and a 41% improvement in energy efficiency, cementing its position as the gold standard in Bitcoin mining hardware.

New Purchase Options and Market Timing

Following the Bitcoin halving event in April 2024—where block rewards dropped from 6.25 BTC to 3.125 BTC—miners have seen profit margins squeezed across the board. In response, and to encourage ongoing investment, Bitmain has introduced an installment purchase plan for the Antminer S23, making it more accessible to miners facing declining block rewards. The S23 series is set for commercial release in the first quarter of 2026, giving miners ample time to prepare for integration.

IMAGE (Keep placement and caption as in the original)

Bitmain Faces New Obstacles Amid US Tariffs

Despite launching a cutting-edge, high-performance miner, Bitmain is confronting significant challenges due to increased import tariffs on mining equipment in the United States. Following new regulations introduced by the Trump administration, imports of ASIC mining rigs from major manufacturing hubs such as Malaysia, Thailand, and Indonesia now face a 10% tariff. If current exemptions expire and full tariffs are reinstated, these costs could rise to as much as 24% or even 36%, severely impacting the profitability of mining operations in the US.

In light of these challenges, Irene Gao, Bitmain’s Senior Vice President, has stated that the company is actively working to mitigate supply-chain risks and reduce its dependence on foreign manufacturing. As part of this initiative, Bitmain launched a new production line in the United States in December 2024, marking the company’s first step towards domestic manufacturing.

Nonetheless, some key processes remain offshore. The cutting-edge ASIC chips used in the Antminer series are manufactured by TSMC in Taiwan, with final assembly occurring primarily in Malaysia. As a result, even with partial US production, the need to import critical components will continue to influence final product costs.

IMAGE (Keep placement and caption as in the original)

Miners Under Pressure: Navigating Halving and Trade Tariffs

While Bitcoin recently soared past the $100,000 milestone, these price gains have not fully offset the financial strain on miners caused by the 2024 halving event and the consequent reduction in block rewards. The added weight of increased import tariffs has only intensified the pressure on mining companies, driving up the already high costs of acquiring new, high-performance mining equipment.

Although a US court has recently ruled the Trump-era tariffs as unlawful, the case remains unresolved, and the government continues to pursue further legal action. Until a final verdict is reached, the tariffs remain in effect, creating a climate of ongoing uncertainty for the American crypto mining sector.

As a result, US-based miners now find themselves at a crossroads, grappling with three major challenges: steep declines in mining revenue following the halving, surging equipment costs due to tariffs, and legal uncertainty about the ongoing future of these tariffs. All these factors are making Bitcoin mining in the United States increasingly risky, even during a period of record-breaking Bitcoin prices.

IMAGE (Keep placement and caption as in the original)

Final Thoughts: The Future of Crypto Mining in a Shifting Landscape

The introduction of the Antminer S23 marks a new era for cryptocurrency mining hardware, offering unprecedented levels of efficiency and power that will appeal to both institutional and individual miners. However, the rapidly evolving regulatory and economic environment, especially in the United States, means that careful planning and adaptability will be essential for the continued growth and profitability of Bitcoin mining. Crypto miners, investors, and hardware manufacturers alike must navigate these complex challenges to build a resilient future in the blockchain ecosystem.

Comments