7 Minutes

Deal Drama in Hollywood: Ellison Eyes an Iconic Studio

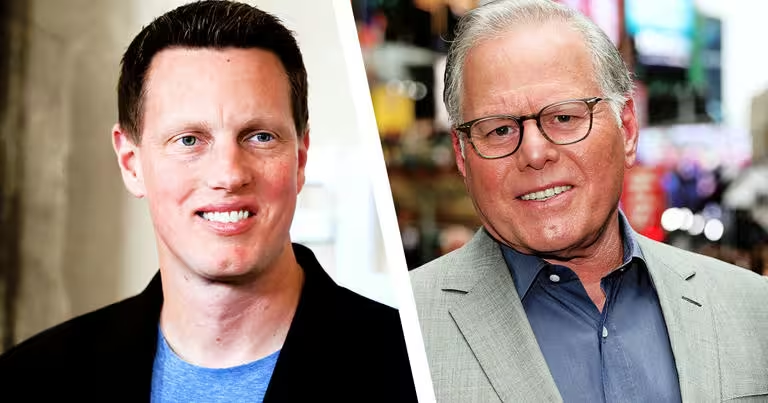

A new chapter may be forming in the long-running saga of studio consolidation. David Ellison, backed by advisors with heavy Hollywood and private equity experience, is reportedly positioning a bid for Warner Bros. Discovery that could reshape the media landscape. With Michael De Luca and Pam Abdy recently re-signed as co-chairs of Warner Bros Motion Pictures, the studio's most prized creative leadership is now firmly on the roster, making Warner Bros an even more tempting target for any buyer who values box office clout and franchise stewardship.

The timing is telling. Warner Bros Motion Pictures has contributed to a global box office haul that approaches billions this year, and studios know well that talent and leadership are as valuable as IP on the balance sheet. Re-upping De Luca and Abdy has been described by insiders as akin to finding a Warhol tucked away after buying a house: a lucrative surprise that sharply increases a property’s value.

What Ellison Would Inherit — and Avoid

Sources say no formal offer has yet been delivered by the Ellison-led group to Warner Bros Discovery, but informal conversations and quiet due diligence have begun. The Ellisons, mindful of Skydance’s bruising and protracted $8 billion deal for Paramount, seem eager to prevent surprises and heavy integration headaches. That signals a preference for a clean acquisition with clear financials and manageable legacy obligations.

One thorny issue is David Zaslav’s role post-transaction. According to studio insiders, there is little appetite on the Ellison side for keeping Zaslav in an operational leadership position. A modest post-sale arrangement such as a board seat or strategic advisory role has been floated, but it appears unlikely Zaslav would remain a major player in the new corporate structure. The Ellisons, and particularly Larry Ellison as an influential tech investor, seem to want a reset rather than a merger of leadership styles.

Why the Studio's Split Matters

Warner Bros Discovery is in the midst of structural change, with streaming and linear distribution increasingly disentangling. For a buyer, that split presents both opportunity and risk. Buying the entire company before a formal breakup could be cheaper, if an acquirer is willing to assume the cable and linear networks along with intellectual property and production assets. But regulators and strategic fit matter: Comcast would face regulatory scrutiny, while Apple or Amazon would need to weigh the complexities of cable carriage and legacy wholesale agreements.

Analysts also doubt Netflix would step in. The streamer has repeatedly signaled no interest in wrestling with linear networks and complex distribution arrangements. If Netflix wants Warner content, licensing remains an easier path than owning a tangled legacy business.

Industry Comparisons and Context

Hollywood has seen similar tectonic moves in recent years. The Disney acquisition of Fox reshaped franchise ownership and streaming strategy; AT&T’s purchase of Time Warner and subsequent corporate reshuffles provided a cautionary tale about telecoms and studios mixing cultures. Skydance’s drawn-out Paramount acquisition offers a direct comparison in scale and messy politics. Ellison's camp appears keen to avoid those friction points: they want the control and IP without an eight-year theatre of corporate warfare.

This bid must also be viewed through a geopolitical and technological lens. Investors and strategists are increasingly factoring in AI investment, content globalization, and the political implications of media ownership. TD Cowen's recent analysis suggested the rationale for a PSKY-style bid might be as much geopolitical as commercial. In other words, standard valuation models are only part of the picture.

Creative Leadership Is the Crown Jewel

For any studio purchaser the creative team matters. Michael De Luca and Pam Abdy have become key assets, overseeing a slate that can generate tentpole revenue, critical prestige, and awards-season momentum. Studios with strong leadership are better positioned to navigate franchise extensions, international distribution, and the evolving streaming window.

"Leadership matters more than ever when IP is king," says Anna Kovacs, film critic and festival programmer. "Buyers are not just acquiring content libraries; they are buying the talent and relationships that turn ideas into hits. De Luca and Abdy are the kinds of executives who can keep franchises moving and filmmakers engaged." — Anna Kovacs, film critic

Market Reaction and Risk

The market has already reacted to shadow whispers. Warner Bros Discovery shares jumped on takeover rumors, a familiar pattern when a potential acquirer emerges. Yet insiders warn the rally could be volatile; if a bid fails to materialize, shares could retrace significantly. The net debt on WBD's books and its market capitalization complicate any headline valuation, leading some analysts to estimate acquisition prices far above current market caps.

Potential bidders are limited by regulatory and strategic fit. Sony could make a play but might need partners, Apple and Amazon would wrestle with legacy cable entanglements, and Comcast would draw antitrust scrutiny. The Ellisons’ combination of private capital and corporate backing from advisors positions them uniquely, especially with the Ellison family keen on a decisive, controlled acquisition.

What This Means for Film and TV Fans

For audiences, the practical effect could be subtle or seismic depending on how the new owner treats creative output. A buyer committed to theatrical windows, festival runs, and auteur-driven cinema could ensure continuity for films that thrive on prestige, while an owner focused on streaming might accelerate content into digital-first release strategies. Either way, the value of franchises and the global box office will guide decisions.

Fans should also watch the fate of HBO and legacy cable channels. If a split between the studio and streamer proceeds, licensing negotiations and distribution deals could reshape where and how big titles are released.

In the end, this is a classic Hollywood story: power, money, and movies intersecting with personal ambition and corporate strategy. Whether the Ellisons make a formal offer, and whether Warner Bros Discovery accepts, remains to be seen. But with top creative leaders locked in place and a complex asset on the block, the next act promises to be must-see business.

Concluding note: keep an eye on upcoming public appearances. David Ellison is scheduled to speak on a Hollywood stage in the coming days, right before De Luca and Abdy. In Tinseltown, timing is never accidental, and sometimes a panel is just a stage for the next big headline.

Source: deadline

Leave a Comment