31 Minutes

The most anticipated segment of Startup Fair 2025 saved its drama for last: the Pitch Battle Finals, where 12 finalists raced through 3-minute pitches and 2-minute Q&As on the main stage an hour of compressed ambition to cap the event. The stakes were tangible. Beyond visibility, the winner would secure a new “Future Proof Brand & IT” strategic package to safeguard and scale its brand, €3,000 in Talent Hub recruitment credits, and headline attraction an investment offer of up to €3 million (negotiable) from a coalition of regional and global backers: CoInvest Capital, Baltic Sandbox Ventures, Scale Wolf, Plug and Play Ventures, NLE Capital, the Lithuanian Business Angel Network (LITBAN), and the Latvian Business Angel Network (LATBAN).

Overseeing the finale was a compact, operator-heavy jury: Victorija (CoInvest Capital), Andrius (Baltic Sandbox Ventures), Egidijus (Scale Wolf), Anastasija (Plug and Play Ventures), Daiva (NLE Capital), Roberta (LITBAN), and Emils (LATBAN). The ground rules were simple and unforgiving three minutes to pitch, two to defend, no spillovers with the MC rallying the audience to play “Team Startup”: loud on the highs, sharp on the substance, and relentless on the clock.

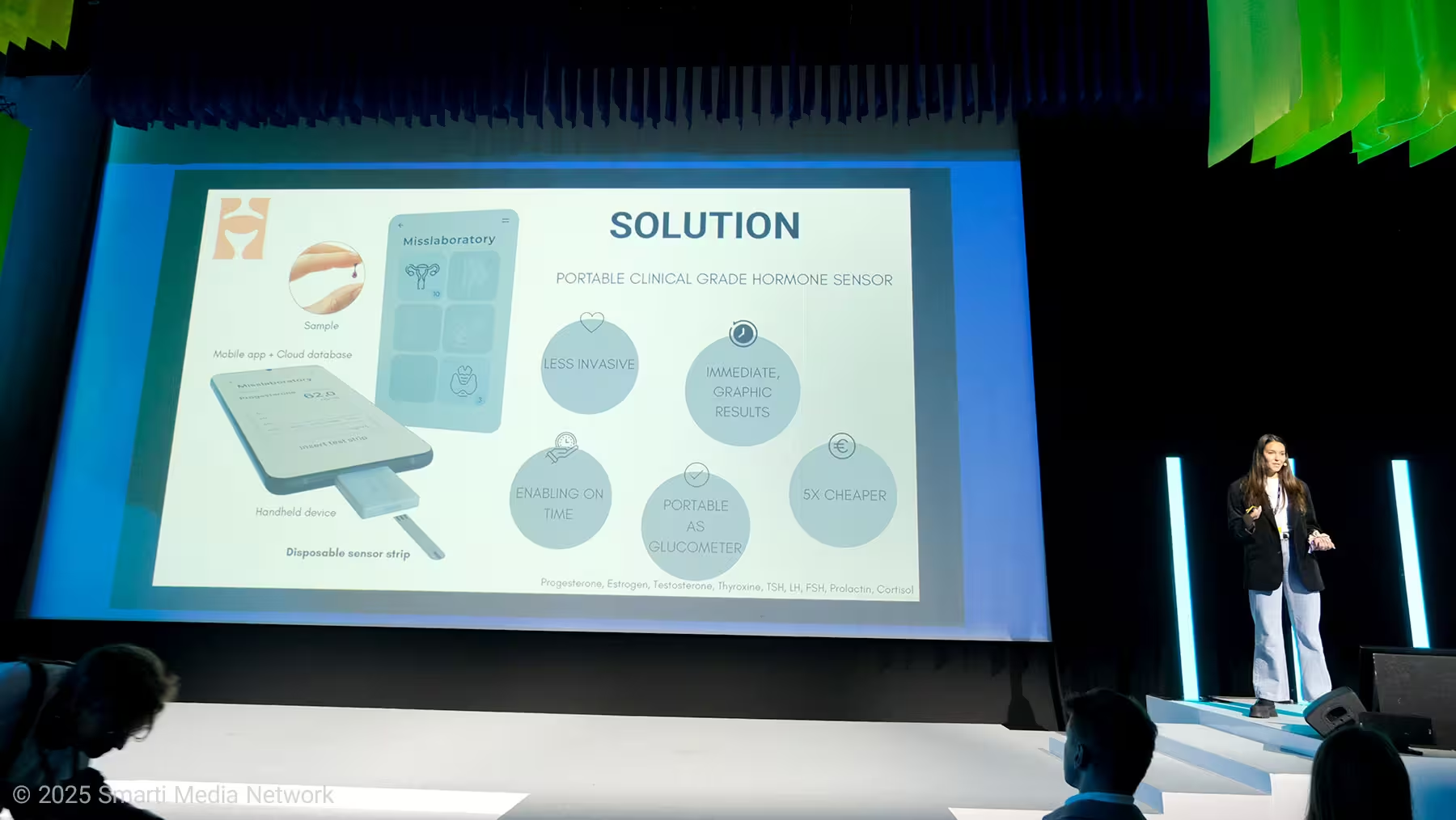

1) Miss Laboratory, Clinical-grade hormone tracking, from lab bench to living room

Problem

We count steps, sleep, heart rate yet hormones, the master regulators, remain trapped in slow, episodic lab workflows. A single blood draw per month can’t capture the dynamics of a menstrual cycle or guide precise, adaptive dosing in therapies like HRT.

Solution & product

Miss Laboratory is miniaturizing lab-grade immunoassay performance into a portable reader + single-use sensor strips. With a finger-prick of blood, users get immediate readings; results stream to an app and cloud portal for clinicians. The system is designed to measure multiple hormones via different strips to reflect how hormones actually act in concert.

Why it matters

Clinic-level accuracy + home convenience

~5× cheaper than current blood tests

Structured, longitudinal hormone data at scale (finally)

Business model

Consumables (sensor strips)

Hardware (sale/lease of the handheld reader)

SaaS (app subscription)

This combination underpins recurring revenue as usage scales.

Market

Women’s reproductive health is a fast-growing market, projected to reach $39B by 2032.

Traction & team

90% of surveyed potential users said “yes” to the concept

Patent draft pending

Lead investor committed: BSV (Baltic Sandbox Ventures) has committed €260K toward a €500K round

Team: Elvina (15 years in business leadership & ops) and Kotryna (surgeon, scientific lead) with clinical, science, and engineering contributors

Jury Q&A (highlights)

Who pays? Initially women already in HRT (clear willingness to pay to optimize dosing).

Unit pricing? €8 per strip (target).

Distribution? Hybrid: directly in accessible markets; distributor partnerships for tough markets (e.g., Japan).

Takeaway: Compelling clinical logic + a razor/razor-blade model; smart to start where pain (and willingness to pay) is highest.

2) Fivrec — Lithium-ion battery recycling from intake to black mass (and onward to refining)

Note: The on-stage introduction said “Fivrec,” and the founder introduced himself as CEO of Fivrec.

Twin crisis

Surging demand for critical metals (Li, Ni, Co, etc.)

E-waste is the fastest-growing waste stream globally

Approach

Fivrec attacks both by recycling Li-ion batteries end-to-end:

Digital client portal to unlock and manage feedstock

Proprietary pre-treatment to produce black mass

Refining (next step) to return metals to the supply chain

Revenue stack

Gate fees (collection)

Toll recycling

Sale of recovered materials

Second-life battery resale

Future: battery intelligence features to enhance value per unit.

Traction

Launched commercial operations this year

23 B2B clients already (several notable names shown on their slide)

On track for €1M revenue this year

Team of 12 with decades in metal recycling & commodity trading; advisors from academia & industry

Fundraising

€1.8M equity round, de-risked via non-dilutive grants

Funds earmarked for EU co-financing and a metals refining pilot; 18-month runway

Jury Q&A

CapEx intensity? First phase (black mass) financed; this round builds the refining pilot. Larger CapEx will follow once the pilot de-risks.

Competition? High, but first-mover advantage in region + heavy switching costs in recycling supply chains.

Geography? Focus on Nordics, Baltics, and Eastern Europe.

Takeaway: Sensible phasing (cash-flowing pre-treatment, then pilot refining); portal + ops stack can lock in upstream.

3) BioHifas, Protein from mycelium grown on industrial side streams

Context

Livestock drives ~15% of global GHGs. The world needs abundant, affordable, nutritious alternative proteins that scale.

Technology & flow

BioHifas cultures mycelium on industrial side streams (e.g., brewer’s spent grain), turning cheap, ubiquitous waste into high-quality protein. The three-stage process:

Food-grade preparation of the side stream

Mycelial fermentation

Raw material stabilization

A pilot module is designed to produce ~1 ton/week in ~5 days with an ROI ~4 years.

Applications

Meat analogues

Pet food ingredients

Two public tastings completed; positive feedback reported.

Market

Alt protein projected $290B by 2035; current B2B addressable market already €3B+ in Europe and €2B+ in North America.

Business model

Dual revenue: sell the technology + sell the output.

Pricing

Target €7/kg for the fermented raw ingredient priced into the “high-quality plant protein” band.

Stage & team

Lab scale today, ~40–50 kg/month output

Designing a 1-ton/week pilot

Team: Thomas (CEO; long-standing plant-based advocate) + two scientists (Pauline, PhD in fermentation & food tech; Simas, PhD candidate in mushroom cultivation on side streams). Advisors cover commercialization and industrial engineering.

Jury Q&A

“Four years?” That’s the payback for a modular unit, not time in development.

Customers? Two kinds: feedstock owners (e.g., breweries) and food manufacturers who want to incorporate the ingredient. Names cited included several breweries.

Takeaway: Elegant circularity story with co-location next to feedstock; modular payback credible if they hit yields and cost targets.

4) .lumen — “Glasses for the blind” guided by pedestrian-autonomy AI

The company styles its name .lumen (dot-lumen).

Premise

Mobility aids for the blind are still essentially the white cane and the guide dog. Guide dogs are amazing but scarce and costly. Only ~28,000 serve 300+ million visually impaired people worldwide.

Product

.lumen glasses replicate the core mobility features of a guide dog. Instead of a dog gently pulling your hand, the glasses “pull your head” using patented haptic feedback guided by onboard pedestrian-autonomy AI that detects and avoids obstacles.

Tech

Own AI models and own datasets

No internet, no remapping required

The same core tech could extend into humanoid robots, legged robots, outdoor AR

Go-to-market

B2B2C / B2G via blind associations and assistive technology dealers. Average price ~€8,000. Reimbursement (full or partial) exists in many markets; the goal is zero out-of-pocket for end users where possible.

Traction

Pre-registrations jumped from ~980 to 1,052 between morning and this pitch

Manufacturing: small batches in Romania now; contract manufacturing in Italy for mass scale

Recognition: opened NVIDIA GTC last year; part of the EIC Accelerator portfolio

Team

Cornel Amariei (founder/CEO; ex-innovation lead in automotive)

Dr. Marian Pădure (testing lead; legally blind)

Dr. Oana Blaga (US academic, returned to join .lumen)

~50 engineers & scientists

Jury Q&A

Raising? Closed a round in December; now focused on entering markets.

Competitors? The guide dog is the true benchmark. Other devices merely signal obstacles (like parking sensors). .lumen “drives” it chooses safe routes.

Reimbursement frictions? CE-marked consumer version is shipping; medical certification timelines vary by country, but the product is built as a medical device.

Takeaway: A standout blend of deep empathy + deep tech. Crisp narrative (don’t “beep,” lead). Big category unlock if reimbursements align.

5) TILTSUN — End-to-end robotic deployment for utility-scale solar

The MC alternated between “TILTSUN” and “Tilson.” The team introduced themselves as Tilson; the original startup list used TILTSUN. We retain TILTSUN (noting the on-stage pronunciation).

Problem

Utility-scale PV farms are still assembled manually fragmented tasks, crews, and QA.

Solution

A single-pass robot that:

Places the mounting structure

Installs modules

Lays wiring

Streamlines QA

Two patents filed (structure + robot).

Impact

Cuts CAPEX and timelines, improves LCOE, reduces land and crew intensity, builds an O&M beachhead.

Market

Global utility PV build-out ~2.4 TW by 2030 (the founder illustrated this as “two Lithuanians of land” covered in PV). Installation TAM cited €7.2B; €1B revenue ambition in five years.

Model

Robot-as-a-Service (pay-per-output or annual lease) plus O&M (25-year annuity, including cleaning via third-party robots under TILTSUN’s service wrap).

Traction

Two projects secured (~€700K)

€2.35M hot pipeline for 2026

Prototype lab- and field-tested; final robot design complete

Shortlisted/appointed to Catalyst Master City x BP Ventures joint accelerator

Loan €1.3M from ILTA; €0.5M founder commitment; raising €1.5M for GTM

Jury Q&A

Carport/rooftop installs? Focus is utility-scale ground mount (elevated ~20 cm), not canopies.

Operations (cleaning)? Included under O&M; cleaning done by third-party robots within TILTSUN’s service scope.

Takeaway: The “do-it-all” pass (structure→modules→wiring→QA) is the differentiation; RaaS + O&M gives both upfront and annuity lines.

6) PowerUp Energy Technologies, Quiet, low-heat hydrogen-hybrid generators

Macro

Outdated grids + mass electrification = blackout risk. Resilience requires on-site power that is clean, quiet, telemetrable.

Product

Electric generators that hybridize Li-ion batteries and hydrogen fuel cells with a software control layer (ML for maintenance, H₂ levels, etc.) and long-range IoT for remote operations. Portfolio from 400 W to 100 kW even EV fast charging.

Markets & proof

Telecom, security/defense, healthcare

Defense loves low noise/low heat footprints critical in theaters like Ukraine (infrared/aural signatures get you targeted). A commander quote: “First time ever I could sleep next to a generator.”

Sales motion

VARs & distributors 23 agreements signed. Lean ops: they develop, sell, market; manufacturing is outsourced (partners take working capital).

Edge

Developed with the European Space Agency; the same tech is being adapted for cargo ships landing on the dark side of the Moon and rovers.

Team & raise

Experienced, execution-ready team; raising €7M purely to scale sales. Lead investor in place, seeking one follower for €1.5M.

Jury Q&A

Explosivity? Live-fire tests at ranges with defense forces. Safer than batteries alone and far safer than diesel.

Lithuania ties? Hiring underway; defense projects with Lithuania mentioned (confidential).

Takeaway: A classic “software-enabled hardware” line with credible dual-use and distribution leverage already inked.

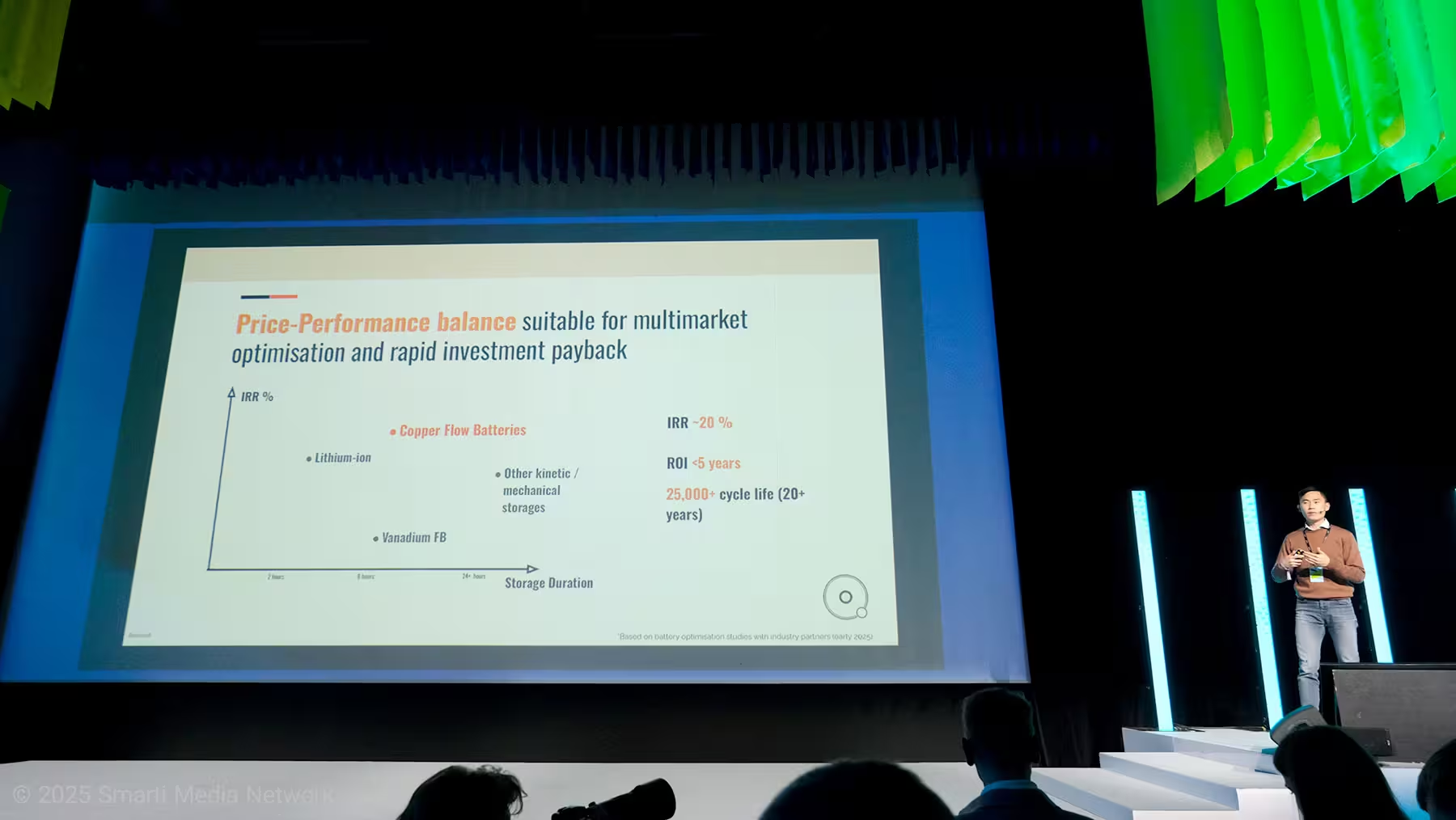

7) Halide Energy Copper flow batteries for long-duration storage

Claim

Lithium is suboptimal for long-duration, stationary storage. Copper flow batteries can be 30% cheaper at the battery/system level while offering sustainability and modularity.

Customers

Solar/wind developers, IPPs

Energy-intensive industries (data centers, pulp & paper, etc.)

Grid balancing providers in the Nordic/Baltic markets

Moat

They claim to be the only team commercializing copper flow batteries because they own the patents on chemistry, manufacturing, and operation.

Origins

Years of R&D + co-development with energy stakeholders. Spun out as a manufacturer/integrator in Finland.

Manufacturing

Low-CapEx equipment and simplified processes allow commercial-scale capacity with high revenue potential.

Go-to-market

B2B partnerships starting from co-developed pilots, rolling into conditional offtakes and commercial deployments from 2027.

Pipeline & raise

Healthy pilot funnel; closing the last €300K of the round to build the first small-scale production line and a 100–300 kW grid-connected pilot. Co-financing expected from European grants.

Jury Q&A

Lithuania linkage? Lead investor BSV; technology transfer process ongoing.

Takeaway: If their cost/IRR positioning holds, copper flow sits neatly between lithium and other flow chemistries; pilots will be the truth serum.

8) Traxlo AWS for physical work: task-based gig labor for retail & warehousing

Thesis

The task-based gig economy maps perfectly onto commerce: repeatable tasks at scale + chronic staffing gaps.

Product

Traxlo app exposes local tasks (store merchandising, picking, warehouse ops, etc.) on a map. Pay is per task (not per hour), driving ~30% efficiency gains at the switch. Training/upskilling is inside the app; a LLM-powered fulfillment back-end runs ops almost automatically.

Traction

4 countries live, UK entry this year

30,000 gig workers, 350,000 tasks completed

€10M in potential upsells under negotiation

10× growth targeted next year

Rapid e-grocery task adoption (JOKR/Takeaway/Bolt Food/Wolt were cited), 3 pilots in Romania in 3 weeks; new warehouse vertical opened

Last 7 days: new collab with Deliveroo (UK), Stuart (Poland), warm intro to Walmart, new self-service task ordering record

Worker supply (secret sauce)

A unique, high-quality pool: women aged 30–55. CAC tests in London/Milton Keynes comparable to Warsaw via TikTok/IG/FB geo-targeting.

Business model

20% commission on every completed task (managed two-sided marketplace).

Funding

€1M convertible to enter the UK and pilot with Tesco (pre-Series A); €2M R&D loan in progress.

Jury Q&A

Robots when? 10-year horizon; robot companies already asked to use Traxlo’s deep, labeled task datasets to train models.

Competition? Legacy temp agencies + “hourly shift” apps. Traxlo’s edge: task-based model and deep grocery specialization (biggest employment category in Europe).

Takeaway: Tight category focus + task pricing + data flywheel is a credible wedge into a massive labor market.

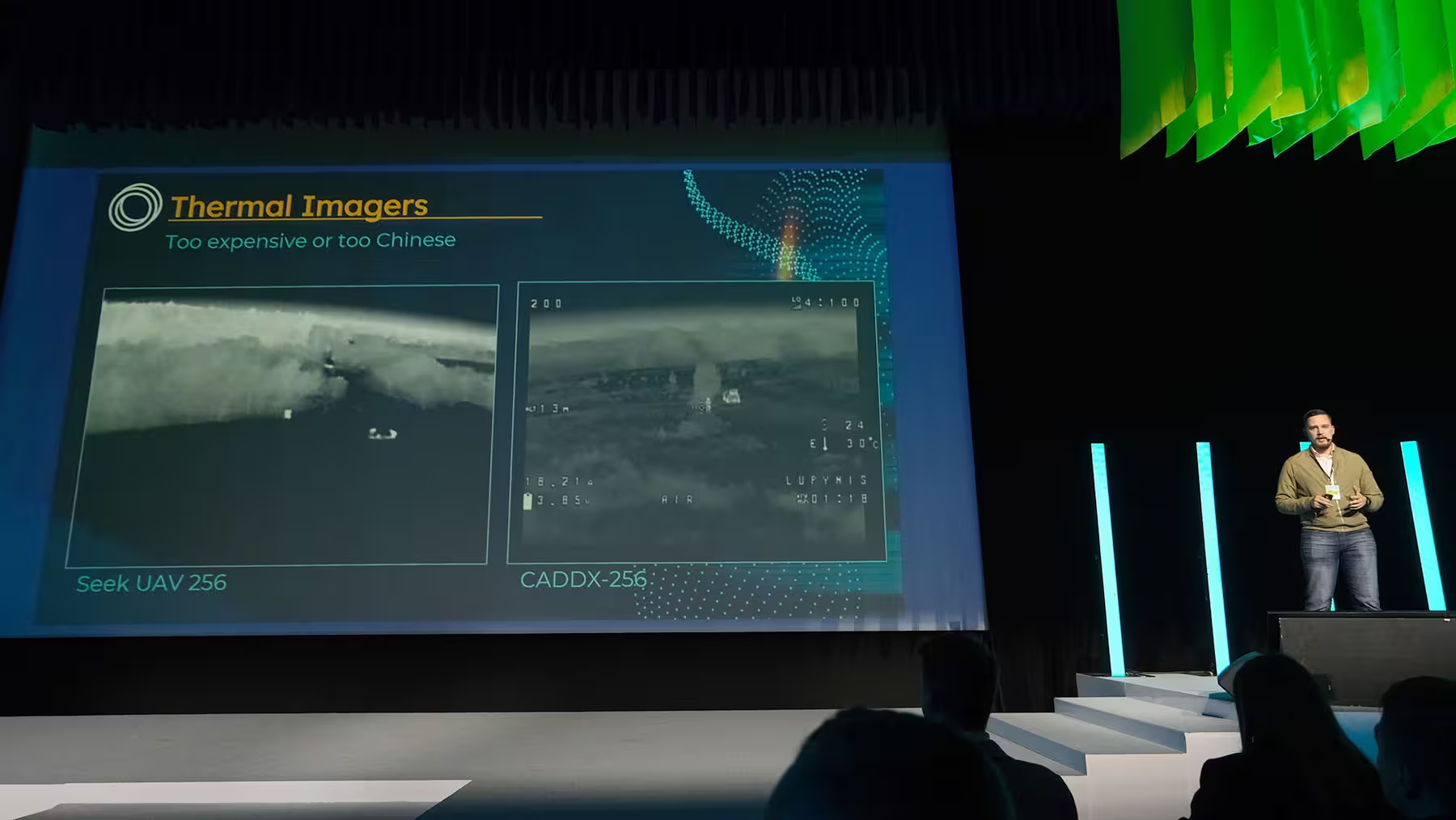

9) Luna Robotics Night-vision FPV cameras for the modern battlefield

Battlefield reality

Ukraine will produce ~5M FPV drones this year. Off-the-shelf FPV cameras are blind at night exactly when troop rotations, logistics and MEDEVACs run. Thermal cameras are too expensive or China-dependent.

Product

LunaCam: color by day, enhanced night vision by night, with active IR illumination that reflects off clothing, glass and metal helping pilots avoid anti-drone nets. Additional onboard compute enables object recognition, edge detection, etc.

Supply chain & team

All electronics manufactured in Lithuania

Software + hardware in-house

Team has national service backgrounds; building what they “wished they’d had” a decade ago.

Traction

Field-tested on the front

Selling to several NATO countries

Pre-seed round recently closed; next seed planned for next year

Business model

B2B: sell directly to local drone OEMs in each European country; they sell complete systems to their governments (B2G standards).

Jury moment

A member of the jury (already an investor) literally pitched the company to the room, underlining confidence in follow-on rounds.

Takeaway: A crisp, single-pain point product with sovereign supply chain and immediate utility the kind of dual-use hardware Europe is hungry for.

10) Boomio.ai Branded games with minutes of attention, not seconds

Marketing’s attention problem

Most ads hold attention for 2–5 seconds. That’s expensive and shallow.

Boomio’s answer

Playable, brand-tailored games that drive real engagement:

Avg. time per game: ~8.5 minutes

Reward redemption up to 5× higher

Up to 10× reach vs. standard content

Case studies

Shopping mall campaign: 10× more in-store traffic via reward mechanics

Coca-Cola & a major ice-cream producer in Latin America: 10× bigger audience

New: collaboration with AWS on an AI tool to generate games in seconds; self-service product is next

Numbers & motion

Tripling revenue this year to ~€400K

Live in 8 countries

ARPC ~€3K/month (recurring; long-term contracts)

Moving upmarket to mid/large customers; self-serve will unlock SMB scale

Competition & moat

Yes, competitors exist. Boomio competes on production quality and deep customization (where generic AI gen falls short today). Virality of the games feeds inbound; outbound continues in parallel.

Funding

€1M raise to reach €225K MRR next year.

Jury Q&A

Pricing/competition? Outlined above.

Acquisition? Combo of outbound and inbound via game virality.

Threat from generic AI? Their bet with AWS is precisely to crack specificity and polish, not just “toy” generation.

UX? Strong focus on social mechanics (teams, families, friends), referrals, and network effects inside the game.

Takeaway: “EPM Emotion Per Minute,” as the MC joked Boomio’s currency is time and action, not impression counts.

11) Boldr The distributed residential power plant

Vision

Boldr is building the largest residential power plant by connecting and orchestrating home energy devices with the grid.

Product

A home energy platform that connects EVs, home batteries, HVAC, and solar, optimizing bills and critically participating in grid programs to shift load off peak. Grid operators pay for this capacity.

Go-to-market (today)

Started with HVAC (the largest untapped load-shift potential in the US). EV and battery integrations roll out over 12–18 months.

Traction

Launched on this stage 3 years ago; team partly based in Kaunas

15,000 customers

Major OEM partnership with Daikin

Manufacturer rep network across US & Canada

Grid partnerships in place

~$3.5M revenue expected this year

Several EBITDA-positive months; aiming to stay profitable while reinvesting

Revenue model

Hardware sales (custom IoT/thermostats/sensors) via contractors (the most repeatable channel discovered)

Subscription for contractors launches in February

Grid revenues: e.g., $83/kW/year in California, $207/kW/year in New York for verified peak shifting

Competition

Every segment has players (EV-led, battery-led, pure software, etc.). Boldr’s differentiator: start where the biggest flexible load is (HVAC), lower CAC through contractor networks, and proprietary datasets from thousands of homes feeding their algorithms.

Jury Q&A

Profitability? Several months EBITDA-positive; target to maintain while growing.

Revenue mix? 100% hardware today (channel fit), SaaS + grid ramping next.

Takeaway: Picked the right wedge (HVAC), nailed channel fit, and is now turning data & utility revenue into durable advantage.

12) DNAMIC Archival data storage in DNA

Why now

Silicon-based storage is hitting physical limits. At current growth rates, the world will pave cities with data centers electricity, water, and floor space run out first. 60% of all data is archival (read once or never). There’s a better medium.

Thesis

Use DNA as a dense, durable, energy- and water-free archival medium. In a small vial, you can theoretically store all of Europe’s data for millennia.

System

Encode any digital file into DNA sequences

Synthesize the physical DNA and encapsulate it

Store at room temperature; retrieve and decode on demand

The device aims to be archive-standard compliant, no deep-tech expertise required, and modular for future upgrades.

Market entry

Start with EU government & private archives (they already mandate archival formats like A/Doc). DNA can become the next archival format.

Costs

Today’s commercial DNA data storage is ~€10,000 per MB. DNAMIC has brought its internal cost down 10× already and targets €1 per TB a staggering multi-order reduction.

Business model

Initially “solution as a service” for archives; later full device production.

Traction & IP

€5M European funding (the only Lithuanian team to secure this instrument)

Stored the Lithuanian national anthem and other works as proofs

Patents in place

Pilots starting with Lithuanian and Swiss archives

Team & raise

Bertas (7 years in the domain)

Florian (engineering)

Simonas (DNA specialist)

Basma (pan-European archival network)

€20M seed to reach TRL-7, expand IP, and run early market pilots

Jury Q&A

Who pays? Archives initially; critically, they hold regulatory power to define archival standards pushing downstream compliance from businesses.

Revenue math? Driven by the delta between falling DNA cost and pricing per TB of archival services. €1B revenue target by 2033 (assuming format adoption).

Corporate linkage? DNAMIC is being spun out of Genomica; the project’s technologies/IP are being consolidated into the new company.

Takeaway: It’s audacious, but the format-setter in archival often wins the decade. If they crack the cost curve, this moves from moonshot to inevitability.

Stagecraft, delivery, and the “in-between” moments

QR codes are back (Miss Laboratory used one smartly). They bridge the stage and CRM.

The MC repeatedly coached “under-inform to over-excite.” Leave one slide off to engineer the Q&A, then pull up appendices for surgical answers.

The Lithuanian wave and catwalks kept the room alert. When founders are back-to-back for an hour, every extra joule matters.

Several teams nailed memorable “one-liners”:

.lumen: “Others beep at obstacles. We drive.”

Traxlo: “Think AWS for physical labor.”

DNAMIC: “By 2050 you’ll have a data center next door unless we put it in DNA.”

A rare thing happened with Luna Robotics: a juror (already invested) pitched the company to the audience. That’s not just endorsement it’s a credibility loan.

What happens next?

After DNAMIC closed the twelfth pitch, the MC invited one last roar from the crowd and ran a quick audience cheer-meter, TILTSUN drew loud support, but applause meters don’t wire funds. The jury stepped offstage to deliberate. A short interlude with last year’s finalists followed, and then, the winners.

We’ll cover that announcement, scoring logic, judges’ rationale, and the final investment offers in the next piece. This article ends deliberately open-ended so we can stitch the two halves, the on-stage battle and the off-stage decision, into a single definitive report on the 2025 Startup Fair Pitch Battle.

The Announcement and Awards

As the jury returned to the stage, the crowd at Vilnius Tech Park fell silent. The energy that had powered an hour of fast pitching and tough questions now condensed into one expectant pause. Host Matt Smith stepped forward, microphone in hand, smiling. “All right, friends,” he said. “Time to see who takes the spotlight home.”

Before unveiling the headline results, the ceremony began with the special prizes recognitions meant to support early founders with tools, not only capital.

The first came from Sorainen, one of the region’s leading law firms, offering legal services worth three thousand euros. The firm’s representative explained that their mission was to help promising companies avoid early legal pitfalls and scale safely. The chosen startup was Traxlo. A Plug and Play Ventures representative walked up to accept on behalf of Traxlo’s CEO, who was at that very moment on a business call in the United Kingdom. The audience laughed, applauded, and cheered them on.

The next prize was offered by Fondia Lithuania, another legal advisory firm providing three thousand euros in professional support. Their award went to MissLaboratory, the team that had opened the pitching session earlier that day. The founder returned to the stage smiling, joined by the event’s mascot unicorn for a photo.

The third recognition came from Triniti Jurex and Ogilvy, who together introduced a new joint package called “Future-Proof: Brand and IP.” Their spokesperson explained that branding and intellectual property protection go hand in hand, especially for startups building sustainable products. Their chosen recipient was .lumen, the company known for its navigation glasses designed for the visually impaired. The hall erupted in applause as the founders joined the presenters on stage.

The final special award was given by TalentHub, a recruitment platform offering three thousand euros in hiring credit. Their team explained that scaling companies need more than capital they need people. Their chosen startup, once again, was Traxlo. The crowd laughed as the company’s name echoed through the hall for the second time that evening. “Traxlo’s having quite a night,” Matt Smith remarked with a grin.

With the smaller prizes presented, the room shifted to the centerpiece of the event: the investment invitations.

Investment Negotiations and Main Winners

For the first time in the history of Startup Fair, the event introduced a joint investment model where several funds and angel networks would invite selected startups to direct negotiations. The maximum total investment pool exceeded seventeen million euros, and the stage lights turned to a focused, cinematic glow as the investors returned to the front.

They stood in a single line: Viktorija from CoInvest Capital, Andrius from Baltic Sandbox Ventures, Povilas from Plug and Play Ventures, Daiva from Aneli Capital, Roberta from LITBAN (Lithuanian Business Angel Network), and Emils from LATBAN (Latvian Business Angel Network).

Andrius stepped forward first. “Let’s begin simply,” he said. “We would like to invite Fivrec to investment negotiations.” The announcement was met with loud applause. Fivrec, known for its lithium-ion battery recycling technology, thanked the investors and noted how recognition like this helped drive environmental innovation forward.

The second invitation went to BOLDR, the team developing residential energy management systems and virtual power plant technology. One of the investors noted how energy efficiency had become the defining theme of European innovation. The BOLDR founders shook hands, smiling modestly under the lights.

Next came DNAMIC, whose DNA-based data storage approach had fascinated both the jury and the audience. “There is significant interest from investors to go deeper,” one panelist said. “Due diligence starts soon.” Their founder Lambertas took the mic, half joking, half moved: “We said we were raising twenty million euros looks like half of that is already covered tonight.”

The fourth startup invited was Traxlo, returning again to the stage to enthusiastic applause. Roberta from LITBAN explained that their technology for automating logistics processes represented exactly the type of innovation angel investors were seeking. A representative from Plug and Play accepted once again on behalf of the founders, noting how strong mutual trust had grown between them.

Then came Boomio.ai, the gamified marketing platform helping brands retain and engage users. Anastasia from Plug and Play highlighted the importance of creativity in customer retention and said Boomio’s product addressed that challenge directly. Ruta from Unicorns Lithuania accepted on behalf of the founder, who was home with his children that evening. The audience responded with warm applause.

The sixth invitation was for PowerUP Energy Technologies, a company producing hybrid hydrogen fuel cell generators. As the founder hurried down the aisle toward the stage, the host laughed, “He’s running he knows what’s at stake.” Out of breath, the founder smiled and said, “My boat was waiting outside, but this was worth staying for.” The crowd cheered and investors nodded approvingly.

The final invitation went to Luna Robotics UAB, a startup building advanced robotic and night-vision systems. The founder looked genuinely surprised as he took the stage and said, “It’s a shock, but thank you. We’ll keep building.” The audience rose to their feet in applause, and the full lineup of winning founders gathered together at center stage.

The Closing Moment

When the cheering settled, Matt Smith turned to the investors and audience. “That’s a total investment pool of 17.3 million euros,” he said. “You saw it happen here today. This is what Startup Fair stands for connecting talent, capital, and bold ideas.”

The photographers rushed forward for a final group photo: the seven winning startups, six investor networks, and the organizers of Startup Lithuania standing shoulder to shoulder. Confetti filled the air. The unicorn mascot jumped once more onto the stage, waving the event flag as music played.

Matt raised the microphone for one final thank you. “On behalf of Startup Lithuania, the Innovation Agency, and the Ministry of Economy and Innovation of the Republic of Lithuania, thank you for making this not just a competition, but a celebration of what Europe’s startup community can achieve together.”

He paused for a moment, scanning the faces of founders, investors, and volunteers. “This wasn’t just another year,” he said. “It was the biggest and most inspiring Startup Fair ever held in Lithuania.”

|  |  |

|  |  |

Comments

DaNix

Pretty flashy evening, some pitches felt overhyped. Luna and PowerUP had real grit tho. juror pitching a portfolio co onstage was... eyebrow raising

Tomas

I worked on utility PV installs once — a one-pass robot would be a lifesaver. if TILTSUN nails reliability, weeks shaved off projects IRL. hope they scale fast

labcore

DNAMIC saying €1 per TB? is that even realistic with current synthesis costs? curious what tricks they used to cut 10x, sounds optimistic...

v8rider

Boldr and TILTSUN look solid, makes sense tbh. hardware + services = sticky revenue. ops risk though, but doable.

atomwave

wow didn't expect DNAMIC and .lumen to steal the night. confetti + real tech hype — if their cost curves hold, this could change everything. big if tho

.webp)

Leave a Comment