3 Minutes

Nvidia's Meteoric Rise in Market Value

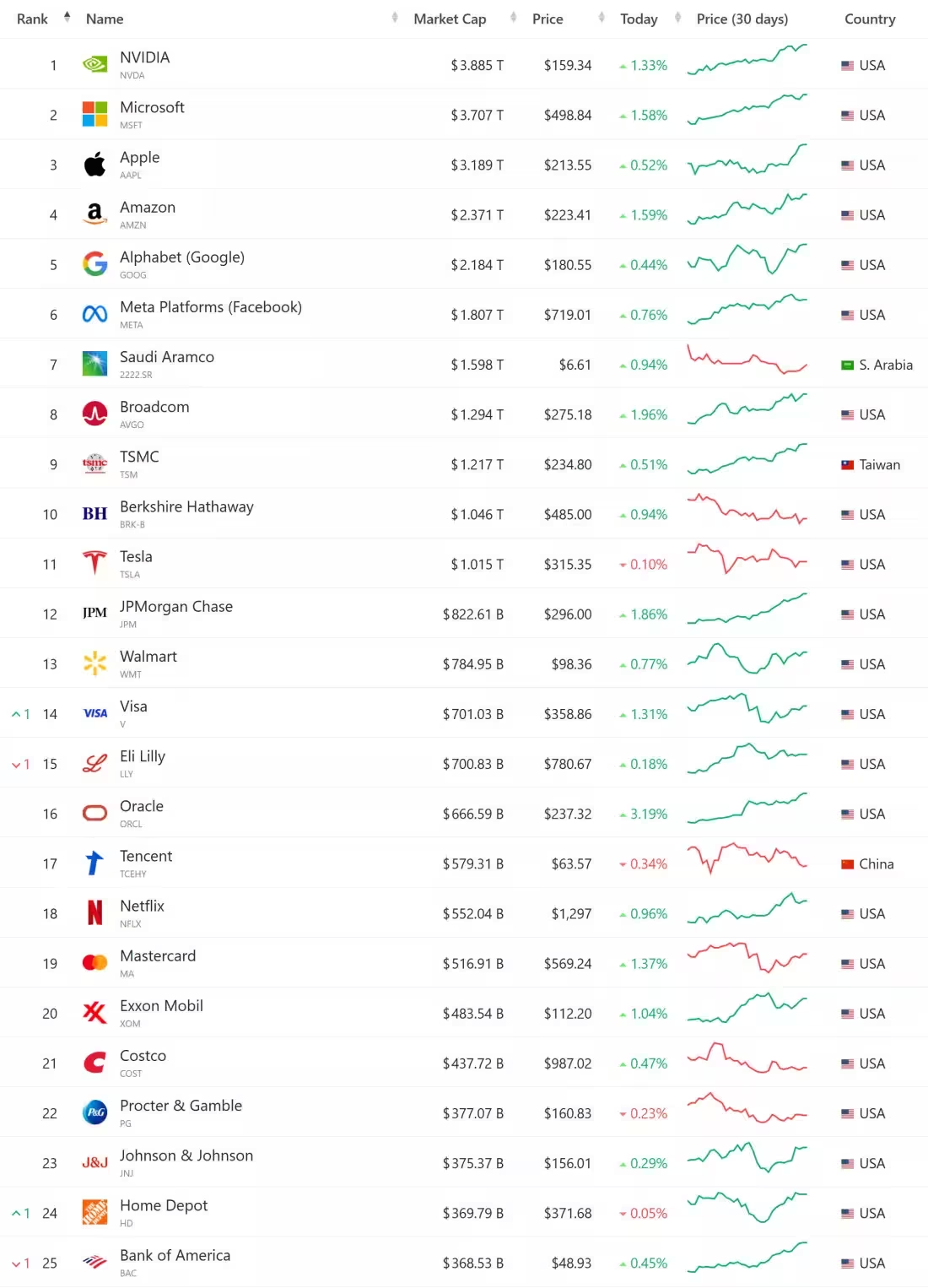

Nvidia, the global leader in artificial intelligence hardware and graphics chipsets, is on the cusp of a historic milestone. In recent trading sessions, Nvidia's market capitalization soared to $3.92 trillion, briefly outpacing tech giant Apple and setting an unprecedented benchmark in the technology sector. This remarkable surge is primarily fueled by the relentless demand for Nvidia's cutting-edge AI chips, which have become essential components in powering the next generation of artificial intelligence models and cloud infrastructures.

The Driving Force: AI Chip Demand & Strategic Partnerships

The current wave of enthusiasm on Wall Street reflects growing optimism about the future of artificial intelligence. Nvidia's advanced GPUs and specialized hardware are now foundational to training and operating large-scale AI models. Leading tech companies—including Microsoft, Amazon, Meta, Alphabet, and Tesla—are all expanding their AI capabilities, relying heavily on Nvidia hardware to gain a competitive edge.

Revenue Growth and Financial Performance

Four years ago, Nvidia was primarily recognized for its graphics processing units (GPUs) used in gaming, with a market value of $500 billion. Today, its valuation has nearly octupled, a testament to its successful pivot toward AI-centric technologies. In the latest fiscal quarter, Nvidia reported revenue of $44.1 billion—up 69% year-over-year—with $39.1 billion of that stemming from its data center business. As Nvidia moves towards its fiscal year 2026, analysts expect annual revenue to reach a staggering $170 billion, further cementing its industry dominance.

Comparison and Market Influence

According to LSEG data, Nvidia's current market valuation now exceeds the combined market capitalizations of all publicly-traded companies in Canada and Mexico, and even surpasses that of the entire UK stock market. For a brief moment, Nvidia overtook Apple's previous all-time high of $3.915 trillion at the end of 2024, showcasing the seismic shift in where value is being created within the global technology industry.

Product Innovation: Blackwell Ultra GPUs

At the heart of this momentum is Nvidia’s relentless innovation. The recent introduction of the Blackwell Ultra graphics processors is expected to further propel the company’s growth trajectory. These GPUs offer enhanced computational power, optimized efficiency, and unmatched scalability for AI workloads, making them indispensable tools for enterprise-scale AI deployments and supercomputing.

Advantages, Use Cases, and Market Relevance

Nvidia’s GPUs are renowned for their performance, flexibility, and ecosystem support, enabling breakthroughs in generative AI, deep learning, autonomous vehicles, and scientific research. Organizations worldwide are leveraging Nvidia-powered data centers to accelerate discovery, optimize workflows, and unlock new revenue streams in AI-driven industries.

Challenges and Outlook

Despite facing hurdles such as export restrictions to China and intensifying competition in custom AI chip design, Nvidia’s culture of innovation positions it well for future growth. Industry analysts anticipate that, with continued product leadership and expanding demand, Nvidia will soon surpass the $4 trillion valuation mark.

Conclusion

Nvidia’s extraordinary journey from a gaming GPU manufacturer to an AI powerhouse underscores the transformative impact of artificial intelligence on the global tech industry. As data-driven innovation accelerates, Nvidia stands at the epicenter, shaping the future of technology, driving market optimism, and setting new records in valuation and influence.

Source: itresan

Comments