3 Minutes

The electric vehicle (EV) market in China is witnessing a dramatic shift, with BYD and Xiaomi rapidly becoming the brands of choice for Chinese consumers—leaving Tesla trailing amid a decline in popularity. Once hailed as the leader in electric mobility, Tesla now faces stiff competition and evolving consumer expectations in both China and global markets.

Tesla’s Waning Market Share in China and Beyond

Recent sales data reveals that just 14% of Chinese EV buyers now view Tesla as their preferred brand—a notable drop from the impressive 30% it enjoyed in 2020. This decline isn’t confined to China; worldwide, Tesla’s reputation as the top EV brand has fallen from 22% to 18%. In the United States, Tesla's share also slid from 38% to 29%, while in Europe, the brand’s 15% market share has been eclipsed by German luxury giants Audi and BMW. Experts cite a range of region-specific factors behind Tesla’s fall, from pricing and feature competitiveness in the US to CEO Elon Musk's political interventions impacting perceptions in Europe.

BYD and Xiaomi: Redefining EV Value and Expectations

Chinese automakers BYD and Xiaomi have rapidly capitalized on the market’s shifting dynamics. In April alone, Xiaomi’s SU7 sedan achieved standout success by selling 26,223 units, even surpassing Tesla Model 3 sales for the month. The new Xiaomi YU7 is poised to fuel a highly competitive race with the Tesla Model Y, offering fresh choices for tech-focused consumers.

BYD, meanwhile, has secured its dominance by outselling Tesla in both the Chinese and European markets. In April, BYD overtook Tesla for the first time in Europe, solidifying its leadership in China. In a sharp contrast, Tesla’s sales in China plunged by 60% from March to April (covering the traditional Chinese calendar months), dropping to just 28,731 units.

Competitive Advantages: Price, Features, and Design

Chinese electric vehicles, led by BYD and Xiaomi, offer compelling advantages in both price and features. Many of their models deliver specifications and technology on par with—if not superior to—those of Tesla, often at a significantly lower cost. This value proposition is rapidly reshaping consumer expectations and forcing Tesla to rethink its approach to features, performance, and pricing.

Performance and Market Positioning: The Numbers Speak

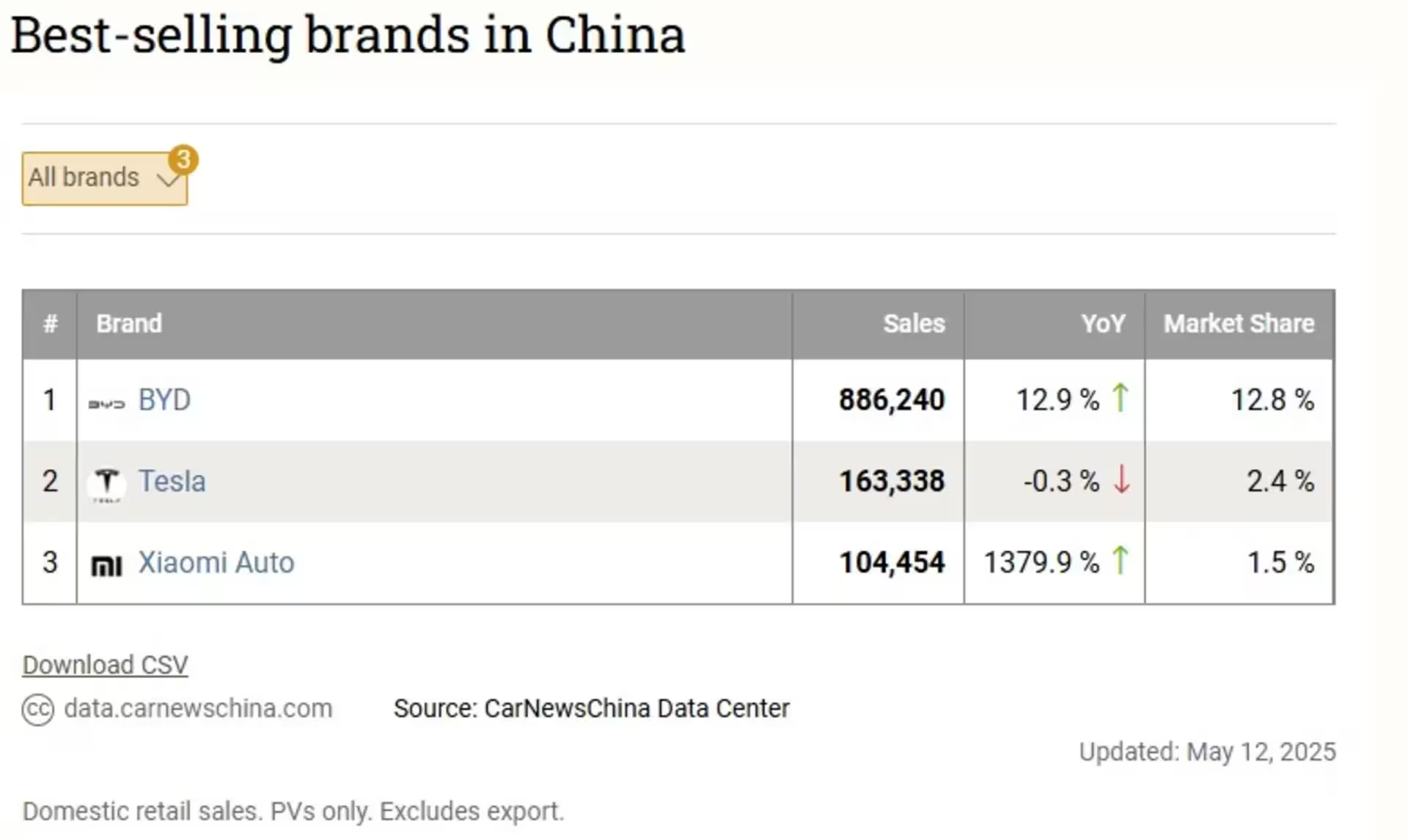

The first four months of 2025 further highlight this shift. Tesla sold 163,338 vehicles in China, marking a modest 0.3% decrease year-over-year. In the same period, BYD posted a robust 12.9% increase, selling 886,240 units. Xiaomi, a newer entrant in the automotive sector, reported extraordinary growth—delivering 104,454 EVs since starting shipments in April 2024, an astonishing 1,379.9% year-over-year rise, as it only commenced deliveries last year.

Conclusion: Future Prospects and Industry Implications

With the surge in popularity of homegrown Chinese brands like BYD and Xiaomi, the EV market in China is undergoing a rapid evolution. Tesla, once synonymous with innovation and electric luxury, now faces the imperative to adapt—enhancing its vehicle features and reconsidering pricing strategies to stay relevant in the world’s largest and most dynamic EV market.

Comments