4 Minutes

Delay in Samsung’s iPhone Image Sensor Plans

A fresh analysis from TF International Securities’ Ming-Chi Kuo suggests Samsung’s push into Apple’s camera sensor lineup will arrive later than industry whispers anticipated. Previously reported plans that had Samsung supplying 48MP and 3-stack CMOS image sensors for an upcoming iPhone generation are now expected to shift: mass production has reportedly been postponed from 2026 to 2027. The delay affects Apple’s strategy to diversify away from Sony and ease its long-standing dependency on a single camera sensor supplier.

Why this matters for Apple and Samsung

Apple has long sourced camera sensors primarily from Sony, while Samsung already supplies displays, DRAM and NAND components to the iPhone ecosystem. Introducing Samsung as a camera sensor partner could create pricing leverage, increase component resilience, and spur sensor innovation. For Samsung, adding camera image sensors (CIS) to its Apple supply portfolio represents a lucrative new revenue stream and an opportunity to scale advanced CMOS and stacked sensor technologies for high-volume smartphones.

Analyst update: the rollout will be staged

According to Kuo, Samsung won’t immediately supply flagship iPhones. Instead, Samsung-sourced ultra-wide CIS modules are expected to appear first in mid-range and low-end iPhone models, then gradually move up the lineup after further qualification and refinement. The analyst’s tweet update explicitly notes mass shipment volumes will likely be postponed until 2027.

Product features and technical expectations

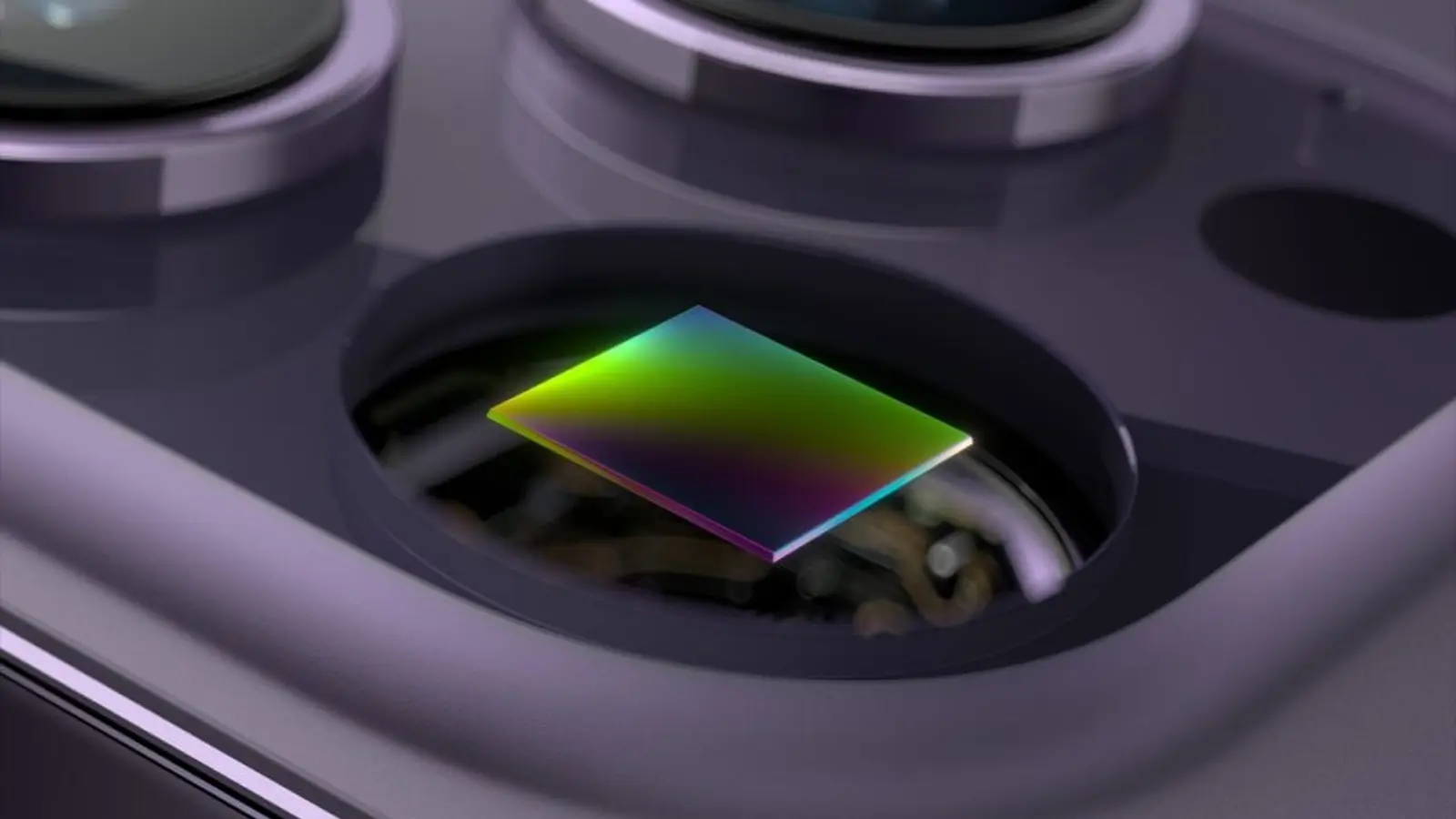

Samsung’s rumored contributions include 48MP sensors and a 3-stack CMOS design. A 3-stack (or stacked) CMOS sensor separates the photodiode, logic, and memory layers to achieve faster readout, improved dynamic range, and better noise control—features that directly benefit mobile photography and computational imaging. If Samsung refines these technologies during the staged rollout, Apple could later deploy higher-performing ultrawide and main sensors across Pro-tier devices.

How stacked CMOS compares to conventional sensors

- Stacked CMOS advantages: faster data transfer, enhanced HDR, improved low-light performance.

- Traditional backside-illuminated (BSI) sensors: simpler stack, proven reliability but limited scaling for on-chip memory and processing.

This staged adoption echoes Apple’s prior approach with internal components—introducing hardware in lower-tier models to mature the design before flagship-level deployment.

Advantages, use cases and market relevance

Advantages:

- Supply chain diversification reduces Apple’s dependency on Sony and mitigates geopolitical or capacity risks.

- Competitive pricing pressure can lower component costs and improve margins or fund additional camera R&D.

- Samsung benefits from scale and cross-pollination between its smartphone and foundry businesses.

Use cases:

- Improved ultrawide capture for mobile photography and video stabilization.

- Faster sensor readouts enabling better computational photography, multi-frame stacking, and higher-resolution video recording.

Market relevance: Delaying mass production to 2027 shifts competitive dynamics—Sony will remain the primary camera sensor supplier in the near term, but the announced timeline still signals a strategic pivot. If Samsung executes successfully, the sensor market could become more competitive, accelerating innovation for the entire smartphone segment.

Comparisons and strategic parallels

Apple’s handling of Samsung’s sensor entry resembles its rollout strategy for other in-house or newly-sourced components. For example, Apple introduced the C1 baseband in the iPhone 16e before moving to broader deployments and iterative C2 improvements in later generations. A similar iterative approach allows Apple and partners like Samsung to validate designs, optimize firmware and imaging pipelines, and scale production quality before flagship adoption.

Outlook

For now, Sony remains Apple’s exclusive camera sensor supplier for flagship models. Samsung’s delayed timetable to 2027 leaves room for refinement and quality assurance, but it keeps the door open for increased competition in camera sensors. For tech enthusiasts and industry watchers, this is a development worth following—any move that shakes up the CIS market could ripple across smartphone photography, pricing, and supplier strategies.

Source: wccftech

Leave a Comment