8 Minutes

At the Foreign Investors Annual Summit 2025, held at the Radisson Blu Hotel in Vilnius, Chris Knight, Managing Director of FT Locations — part of the Financial Times Group — delivered a compelling keynote presentation on global foreign direct investment (FDI) trends and Lithuania’s growing role as a regional investment hub.

In his 20-minute speech, Knight outlined six key global trends shaping the future of FDI, analyzed sector-specific dynamics, and highlighted Lithuania’s strategic advantages — from skilled talent and digital innovation to energy resilience and geopolitical alignment.

The Global Context: Six Mega Trends Shaping FDI

Chris Knight began his keynote by framing the current state of global investment as one of complexity and uncertainty, yet full of opportunity for agile economies like Lithuania. He identified six fundamental trends driving FDI decisions worldwide:

Geopolitical Shifts

Rising tensions between major economies — notably the U.S. and China — have redirected investment flows toward emerging markets such as Vietnam and Mexico. These “winners” benefit from their proximity and access to key markets, while global investors reassess exposure to geopolitical risks.New Industrial Policies and Incentives

Governments are using subsidy-driven policies to attract investments. Examples include the U.S. CHIPS Act and Inflation Reduction Act, designed to foster both domestic and foreign projects in technology, clean energy, and manufacturing.Energy Price Volatility

Conflicts in Ukraine and the Middle East have intensified fluctuations in energy costs. Knight noted that “for manufacturing firms, volatility in energy prices is the last thing you want,” underscoring how energy stability has become a critical factor in location decisions.Stricter Investment Screening

Across advanced economies — especially the UK — scrutiny of FDI in sensitive sectors such as cybersecurity and intellectual property has increased sharply, adding complexity for international investors.Digital Transformation

Rapid expansion in AI, FinTech, EdTech, MedTech, and Cybersecurity is reshaping the investment landscape. These sectors now account for some of the fastest-growing FDI project categories globally.Market Confusion and Decision Delays

According to FT Locations’ data, global FDI projects fell by 4% last year to 17,604, as investors paused amid uncertainty. However, Knight forecasted renewed growth over the next few years as markets stabilize.

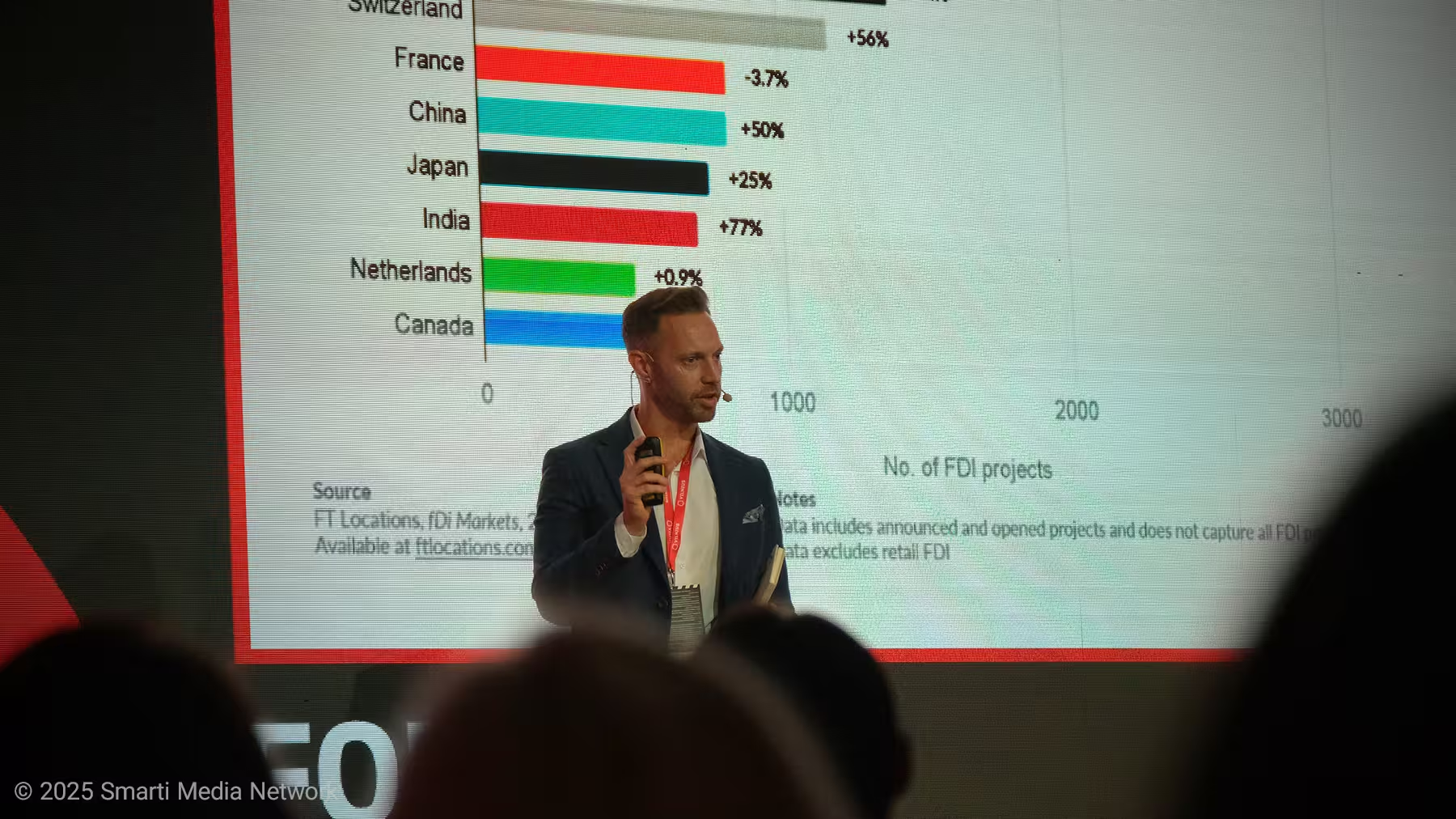

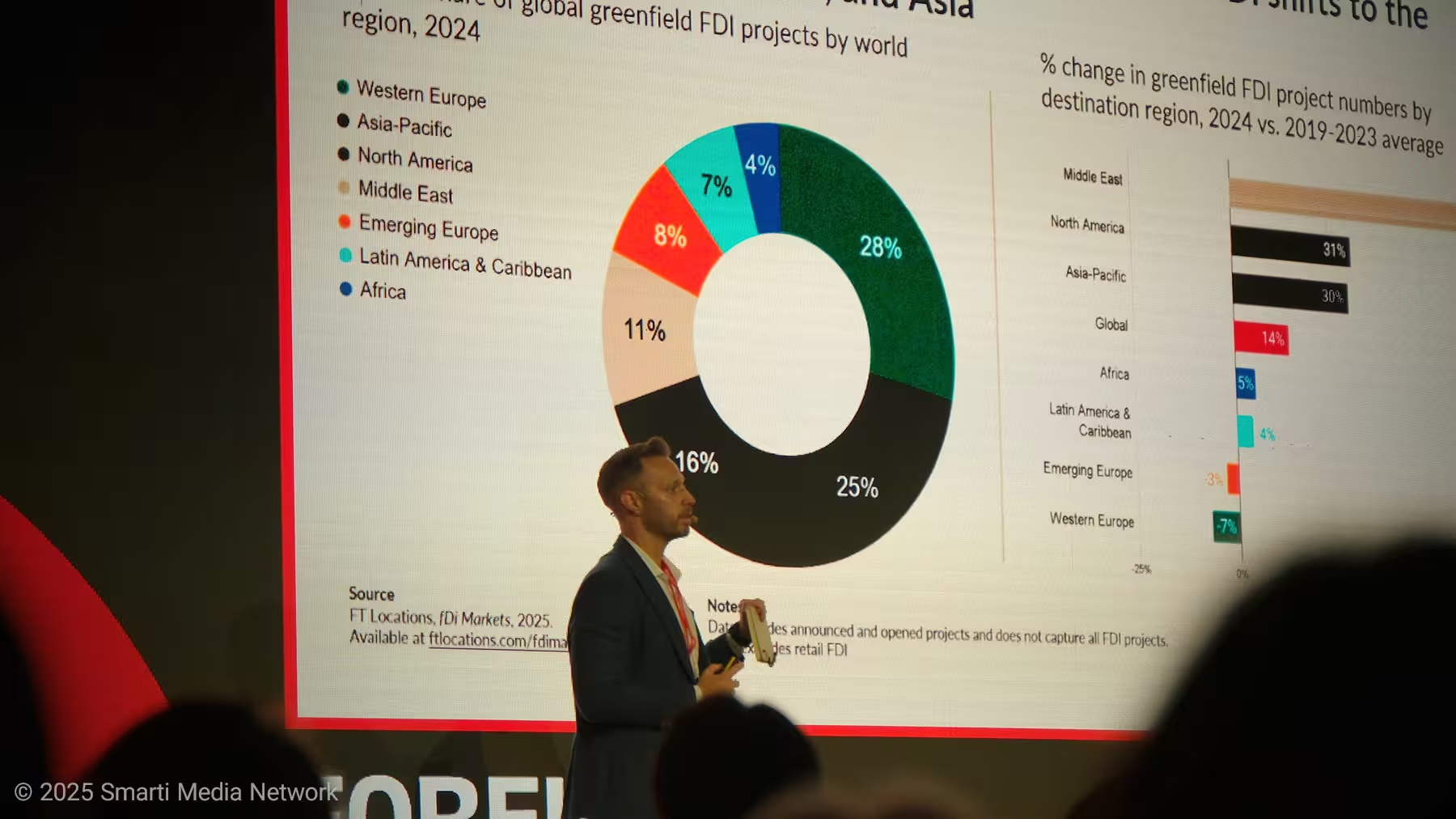

Shifting Regional Dynamics

Based on FT Locations’ analytics, Europe remains the leading destination for FDI, attracting 36% of global projects, followed by Asia and North America. Yet the Middle East has emerged as a major growth region, posting a 70% year-on-year increase, fueled by diversification strategies in the UAE and Saudi Arabia.

In contrast, Western and Emerging Europe have seen slight declines in market share, reflecting investor caution over costs and economic headwinds.

When viewed by sector, the global FDI composition is evolving:

Services lead with 55% of projects (up 8%)

Manufacturing accounts for 16% (down 3%)

ICT & Infrastructure projects have surged by nearly 30%

Knight emphasized that AI-driven growth is fueling unprecedented demand for data centers and digital infrastructure, calling it a “key driver” for the coming decade.

Sectoral Shifts: Where the Capital Goes

In terms of capital expenditure (CAPEX):

Renewable energy tops the list at $271 billion in 2024, despite a $100 billion year-on-year decline.

Communications and semiconductors follow as major capital-intensive sectors.

Military technologies represent the fastest-growing segment, expanding by 450% over the past 18 months — with actual figures likely higher due to confidential defense deals.

AI projects alone accounted for $200 billion and 450+ new projects in just the first half of 2024.

“These data points clearly show,” Knight remarked, “that the future of FDI is already here — and it’s digital, green, and secure.”

Spotlight on Lithuania: A Rising Star in Emerging Europe

Transitioning from global trends to regional specifics, Knight identified four key trends positioning Lithuania as an FDI overachiever:

Friendshoring & Reshoring

As companies reconfigure supply chains due to geopolitical disruptions, Lithuania’s strategic location, EU membership, and political alignment make it an attractive destination.Green Transition & Energy Resilience

With Europe accelerating investment in clean tech and renewables, Knight predicted that Baltic states — especially Lithuania — will benefit from policy shifts and sustainability mandates.National Security & NATO Alignment

Lithuania’s commitment to defense spending (approaching 5% of GDP) is driving investor interest in defense and dual-use technologies — a sector often overlooked in FDI discussions but now poised for significant growth.Digitalization & Technology Strength

The country’s growing ecosystem in AI, cybersecurity, and data centers aligns perfectly with global investment priorities.

What Attracts Investors to Lithuania

FT Locations’ Investor Motives survey highlights the top three reasons companies choose Lithuania:

Skilled Workforce – “Talent, talent, talent,” Knight emphasized, “that’s what truly matters now.”

Stable Regulations and Predictable Governance

Technology and Innovation Capacity

In Knight’s view, human capital now outweighs physical assets:

“It used to be about buildings; today it’s about the people who work inside them.”

Lithuania’s Performance in the Baltics

When adjusted for population size, Lithuania ranks second in the Baltic region for FDI projects per 100,000 residents.

Moreover, three Lithuanian cities — Vilnius (24%), Kaunas (8%), and Klaipėda (4%) — together capture 36% of all Baltic FDI projects.

This concentration, Knight argued, underscores Lithuania’s urban innovation hubs and balanced regional development.

Competitive Advantage Analysis: Key Growth Sectors

FT Locations’ RCA (Revealed Comparative Advantage) model shows Lithuania excelling in several high-growth industries:

FinTech – By far the strongest performer

AI and EdTech – Large emerging sectors

MedTech and Life Sciences – High synergy potential

Military Tech and Clean Energy – Fast-rising strategic sectors

Knight noted that data-driven validation of these sectors gives Lithuania a powerful narrative when pitching to international investors:

“It’s not just about saying Lithuania is great — the data confirms it.”

Reduced Exposure to U.S. Dependency

A notable takeaway was Lithuania’s low dependency on U.S. investment and exports, especially compared to countries like Ireland, where 55% of manufacturing projects originate from the U.S.

Knight showcased Lithuania’s diversified exposure, calling it a strategic de-risking advantage amid global tariff shifts and protectionist trends.

Key Takeaways and Closing Remarks

Knight concluded with three decisive messages:

Lithuania is overachieving in FDI — outperforming expectations relative to its size and population.

Talent is Lithuania’s greatest asset, attracting global companies seeking skilled professionals.

Strategic diversification through friendshoring, digital innovation, and energy security positions Lithuania as a resilient and future-ready investment hub.

“Lithuania not only aligns with the fastest-growing global sectors,” Knight said, “but its data-backed strengths make it a top-tier choice for forward-looking investors.”

The keynote concluded with applause from delegates, affirming Lithuania’s growing reputation in the global investment community.

Leave a Comment