73 Minutes

Vilnius, Lithuania — The Foreign Investors Annual Summit 2025, hosted by the American Chamber of Commerce in Lithuania (AmCham) and held at the Radisson Blu Hotel in Vilnius, brought together government officials, international investors, business leaders, and policy experts for an intensive day of debate and reflection on Lithuania’s investment climate and future competitiveness.

From 9:00 AM to 2:00 PM, the summit explored Lithuania’s economic positioning in a rapidly changing world — where geopolitical tensions, technological disruption, and evolving global capital flows are reshaping investment strategies.

The event served as a unique platform for dialogue between policymakers and business, reflecting AmCham’s mission to foster a predictable and collaborative environment for foreign direct investment (FDI).

Opening Addresses: National Vision and Global Context

The day began with opening remarks from Lithuania’s Minister of Defence and the Mayor of Vilnius, who set the tone by highlighting the country’s security-driven economic agenda and its role as a rising European innovation hub. Although the full transcripts of their speeches are not available in this report, their messages underscored Lithuania’s strategic location, resilience, and commitment to investor confidence amidst regional challenges.

Following the opening remarks, the first featured keynote came from Chris Knight, Managing Director of FT Locations — part of the Financial Times Group.

In his address, Knight delivered a comprehensive overview of global foreign direct investment (FDI) trends and assessed Lithuania’s emerging position as a regional investment hub.

During his 20-minute presentation, he outlined six key global shifts influencing the flow of FDI, explored sector-specific opportunities, and highlighted Lithuania’s strategic strengths — including its skilled workforce, digital innovation ecosystem, energy resilience, and geopolitical alignment with Western markets.

The Global Context: Six Mega Trends Shaping FDI

Chris Knight began his keynote by framing the current state of global investment as one of complexity and uncertainty, yet full of opportunity for agile economies like Lithuania. He identified six fundamental trends driving FDI decisions worldwide:

Geopolitical Shifts

Rising tensions between major economies — notably the U.S. and China — have redirected investment flows toward emerging markets such as Vietnam and Mexico. These “winners” benefit from their proximity and access to key markets, while global investors reassess exposure to geopolitical risks.New Industrial Policies and Incentives

Governments are using subsidy-driven policies to attract investments. Examples include the U.S. CHIPS Act and Inflation Reduction Act, designed to foster both domestic and foreign projects in technology, clean energy, and manufacturing.Energy Price Volatility

Conflicts in Ukraine and the Middle East have intensified fluctuations in energy costs. Knight noted that “for manufacturing firms, volatility in energy prices is the last thing you want,” underscoring how energy stability has become a critical factor in location decisions.Stricter Investment Screening

Across advanced economies — especially the UK — scrutiny of FDI in sensitive sectors such as cybersecurity and intellectual property has increased sharply, adding complexity for international investors.Digital Transformation

Rapid expansion in AI, FinTech, EdTech, MedTech, and Cybersecurity is reshaping the investment landscape. These sectors now account for some of the fastest-growing FDI project categories globally.Market Confusion and Decision Delays

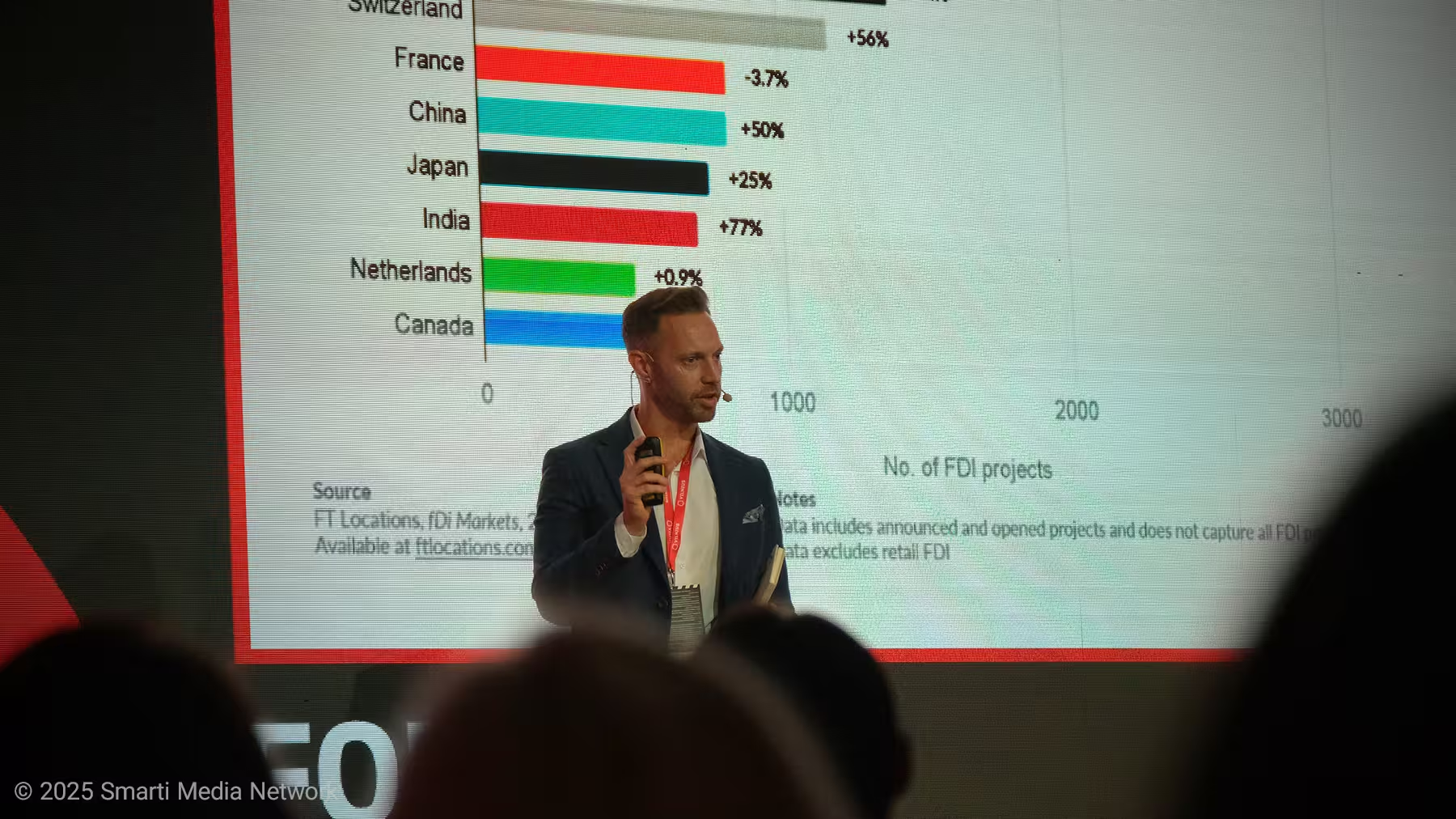

According to FT Locations’ data, global FDI projects fell by 4% last year to 17,604, as investors paused amid uncertainty. However, Knight forecasted renewed growth over the next few years as markets stabilize.

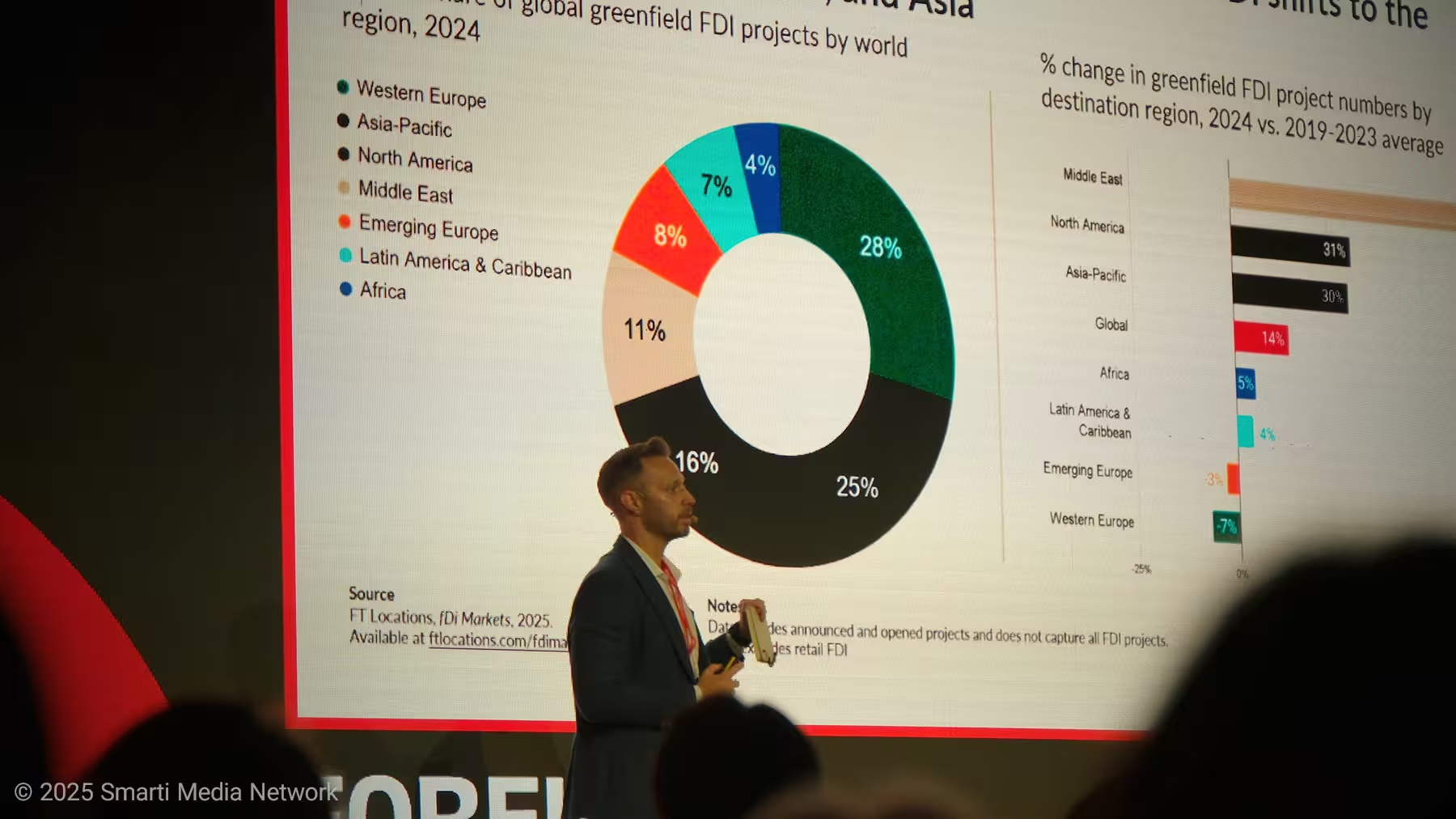

Shifting Regional Dynamics

Based on FT Locations’ analytics, Europe remains the leading destination for FDI, attracting 36% of global projects, followed by Asia and North America. Yet the Middle East has emerged as a major growth region, posting a 70% year-on-year increase, fueled by diversification strategies in the UAE and Saudi Arabia.

In contrast, Western and Emerging Europe have seen slight declines in market share, reflecting investor caution over costs and economic headwinds.

When viewed by sector, the global FDI composition is evolving:

Services lead with 55% of projects (up 8%)

Manufacturing accounts for 16% (down 3%)

ICT & Infrastructure projects have surged by nearly 30%

Knight emphasized that AI-driven growth is fueling unprecedented demand for data centers and digital infrastructure, calling it a “key driver” for the coming decade.

Sectoral Shifts: Where the Capital Goes

In terms of capital expenditure (CAPEX):

Renewable energy tops the list at $271 billion in 2024, despite a $100 billion year-on-year decline.

Communications and semiconductors follow as major capital-intensive sectors.

Military technologies represent the fastest-growing segment, expanding by 450% over the past 18 months — with actual figures likely higher due to confidential defense deals.

AI projects alone accounted for $200 billion and 450+ new projects in just the first half of 2024.

“These data points clearly show,” Knight remarked, “that the future of FDI is already here — and it’s digital, green, and secure.”

Spotlight on Lithuania: A Rising Star in Emerging Europe

Transitioning from global trends to regional specifics, Knight identified four key trends positioning Lithuania as an FDI overachiever:

Friendshoring & Reshoring

As companies reconfigure supply chains due to geopolitical disruptions, Lithuania’s strategic location, EU membership, and political alignment make it an attractive destination.Green Transition & Energy Resilience

With Europe accelerating investment in clean tech and renewables, Knight predicted that Baltic states — especially Lithuania — will benefit from policy shifts and sustainability mandates.National Security & NATO Alignment

Lithuania’s commitment to defense spending (approaching 5% of GDP) is driving investor interest in defense and dual-use technologies — a sector often overlooked in FDI discussions but now poised for significant growth.Digitalization & Technology Strength

The country’s growing ecosystem in AI, cybersecurity, and data centers aligns perfectly with global investment priorities.

What Attracts Investors to Lithuania

FT Locations’ Investor Motives survey highlights the top three reasons companies choose Lithuania:

Skilled Workforce – “Talent, talent, talent,” Knight emphasized, “that’s what truly matters now.”

Stable Regulations and Predictable Governance

Technology and Innovation Capacity

In Knight’s view, human capital now outweighs physical assets:

“It used to be about buildings; today it’s about the people who work inside them.”

Lithuania’s Performance in the Baltics

When adjusted for population size, Lithuania ranks second in the Baltic region for FDI projects per 100,000 residents.

Moreover, three Lithuanian cities — Vilnius (24%), Kaunas (8%), and Klaipėda (4%) — together capture 36% of all Baltic FDI projects.

This concentration, Knight argued, underscores Lithuania’s urban innovation hubs and balanced regional development.

Competitive Advantage Analysis: Key Growth Sectors

FT Locations’ RCA (Revealed Comparative Advantage) model shows Lithuania excelling in several high-growth industries:

FinTech – By far the strongest performer

AI and EdTech – Large emerging sectors

MedTech and Life Sciences – High synergy potential

Military Tech and Clean Energy – Fast-rising strategic sectors

Knight noted that data-driven validation of these sectors gives Lithuania a powerful narrative when pitching to international investors:

“It’s not just about saying Lithuania is great — the data confirms it.”

Reduced Exposure to U.S. Dependency

A notable takeaway was Lithuania’s low dependency on U.S. investment and exports, especially compared to countries like Ireland, where 55% of manufacturing projects originate from the U.S.

Knight showcased Lithuania’s diversified exposure, calling it a strategic de-risking advantage amid global tariff shifts and protectionist trends.

Key Takeaways and Closing Remarks

Knight concluded with three decisive messages:

Lithuania is overachieving in FDI — outperforming expectations relative to its size and population.

Talent is Lithuania’s greatest asset, attracting global companies seeking skilled professionals.

Strategic diversification through friendshoring, digital innovation, and energy security positions Lithuania as a resilient and future-ready investment hub.

“Lithuania not only aligns with the fastest-growing global sectors,” Knight said, “but its data-backed strengths make it a top-tier choice for forward-looking investors.”

Following Chris Knight’s data-driven keynote on global FDI trends, the spotlight shifted to Lithuania’s newly appointed Minister of Economy and Innovation, Edvinas Grikšas, who spoke on his first full day in office.

In a lively fireside chat moderated by Ludvika Stepienė, Senior Policy Manager for the Baltics, Minister Grikšas shared his strategic vision for Lithuania’s economic future — emphasizing balanced regional growth, a startup-style government, and digitally empowered public services aimed at fostering innovation and investor confidence.

Mixing humor with clear priorities, Grikšas described Lithuania’s investment journey as transitioning from a “Green Corridor” to an “Investment Runway” — a platform ready for takeoff toward higher value-added growth, innovation, and global competitiveness.

From “Green Corridor” to “Runway Economy”

Asked to unpack his metaphor of a “runway,” Grikšas reflected on Lithuania’s evolution over recent years:

“We started with the Green Corridor and the Investment Highway. Now it’s time for the Runway. The next government might talk about investment teleportation,” he joked.

Behind the humor lies a strong record:

Over 20 large-scale FDI projects

More than €1.6 billion in investment

Around 5,000 new high-quality jobs

He stressed that Lithuania is no longer a low-cost destination, but a country advancing toward Industry 5.0, where innovation, skilled talent, and sustainable value creation take center stage.

“FDI today means better working conditions, global best practices, and opportunities for people to evolve. We must now focus not just on how much investment we attract, but how widely it is distributed across the country.”

A Vision for Regional Inclusion

Grikšas, originally from the southern city of Biržai, underscored the need to reduce regional disparities between Vilnius and other areas:

“By 2030, at least 30% of all foreign investment should go to Lithuania’s regions. True development means no part of the country is left behind.”

To achieve this, the ministry plans to:

Establish a Regional Economic Council with multiple ministries (Economy, Environment, Transport)

Launch Regional Specialization 2.0, encouraging each area to build its own economic niche

Transform industrial parks and “Sketching the Regions” hubs into innovation incubators

Strengthen cooperation with municipalities to accelerate approvals and infrastructure support

“The goal is a collaborative ecosystem — government, local authorities, and businesses working hand in hand.”

Life Sciences: Still a Living Priority

When asked why life sciences appeared less prominently in the new government’s program, Grikšas reassured the audience that the 5% GDP target by 2030 remains intact:

“Biotech is still a top priority in our Smart Specialization Strategy. We’re currently at 2.2% of GDP, but we’re scaling up.”

He announced three major initiatives:

BioCity Vilnius – a private-sector anchor project for biotech growth

Data Pilot 2.0 – a joint program with the Ministry of Health using data for innovative medical solutions

Biotech Sandbox in Kaunas – an upcoming accelerator for biotech startups and SMEs

“These initiatives show that life sciences are alive and thriving in Lithuania’s innovation agenda.”

Startup Thinking in Government

One of Grikšas’s most striking messages was his call for a startup mindset in public administration:

“The government must think like a startup — agile, fast, and solution-oriented.”

He outlined plans to:

Digitize workflows within the Ministry of Economy and Innovation

Merge innovation policy units for greater synergy

Expand GoTech Challenges, encouraging tech-driven public sector problem-solving

Introduce scale-up programs for best practices across institutions

The centerpiece is the creation of a One-Stop Digital Window — a unified AI-powered system allowing businesses to submit documentation once, with the government responsible for renewals and follow-ups.

Target:

35% reduction in administrative burden

2x improvement in public sector efficiency by 2027

“Permits shouldn’t take years. With AI and digitalization, we can make Lithuania’s government as efficient as its entrepreneurs.”

Positioning Lithuania in the European Innovation Landscape

Looking beyond national borders, Grikšas stressed that Lithuania must evolve from a policy follower to a policy shaper in Europe’s innovation ecosystem:

“We must lead by example — showing how small, agile economies can integrate defense, technology, and innovation into growth.”

Upcoming plans include:

A mid-term review of the Smart Specialization Strategy

Stronger links between defense innovation and civil industries

Doubling R&D spending from 1% to 2% of GDP by 2030

Shifting public procurement toward innovative and commercial approaches

Boosting technology transfer from universities to businesses

“We have excellent research in Lithuania, but commercialization is the missing piece. We’ll learn from best practices in the US, Ireland, and Germany.”

A Human Touch: Leadership with Balance

In the final segment, Stepienė invited the minister to reflect on his personal transition from department head to minister — a change he described with humility:

“Not much has changed — same meetings, same topics, just a different level. I’m still adjusting.”

He also shared light-hearted insights into his personal life:

Sports: Karate, running (regular & extreme), basketball, gym workouts

Discipline: “Absolutely essential for success.”

Family: “Always a priority — though the next six months will be intense!”

“I changed my phone, my car, and my office — from the fifth floor to the second. That’s the main difference!” he joked.

The conversation ended on a note of optimism and humor, reflecting a leader who blends strategic clarity with approachability.

After the forward-looking discussion with Minister Edvinas Grikšas on Lithuania’s innovation-driven economic agenda, the summit turned to a more personal perspective from the business front lines.

In a candid and often humorous fireside conversation conducted in Lithuanian, Petras Narbutas — a veteran entrepreneur and founder of one of Lithuania’s best-known office-furniture brands — reflected on three decades of building in a transforming economy.

Moderated by Vilius Bernatonis, the discussion ranged from personal lessons to strategic insights on how Lithuania can stay competitive beyond cheap labor, emphasizing automation, investment in intellect (R&D, design, software), evidence-based regulation, and a long-horizon national strategy shielded from election cycles.

From the “Wild West” to World-Class: How the Ground Shifted Since 1991

Narbutas began with context: the company was registered in February 1991, when Lithuania’s business environment felt like the “Wild West.” Wages were tiny (he quipped that USD 20/month was then a “good salary”), yet the talent pool was extraordinary: over half of early manufacturing staff had university degrees—many, like him, from physics.

That combination—high motivation + high education + scarcity mindset (“hunger”)—powered the first stage of growth. But the ground has shifted:

Lithuanians aren’t “inherently superior”; the early edge was situational—education quality, some healthy habits, traditions, history.

Hunger has eased: after a historic sprint, people expect a comfortable European standard of living. That’s a success, but it removes the old fuel.

The cost advantage is gone: labor is no longer cheap; productivity is where Lithuania still lags—because for years, firms could win with skilled hands rather than expensive automated lines.

“We own great standalone machines—but not full automated lines. That was rational when labor was affordable. Now it’s changed. Either we cross the bridge to lines and intelligence—or we’ll be overtaken.”

Competing After the Cost Advantage: Automation and Intellect

Narbutas split the investment agenda in two:

Hard Automation — moving from isolated equipment to integrated production lines, even if the capex goes to line-makers “likely in Western Europe.”

Intellectual Investment — design, engineering, software, data, R&D, where the savings and differentiation can be greater than in metal.

“We didn’t invest in intellect because it simply wasn’t there—now we must. Our edge can’t be national or geographic anymore; it must be firm-specific.”

What Really Explains Success? (Hint: It’s Not “Secrets”)

A reporter once pressed him: “Why are you so successful—what’s the one reason?” He listed 17 competitive advantages in 2017, then realized competitors already knew those advantages.

“The secret isn’t what advantages you have—it’s why you have them and others don’t. Knowing the checklist is easy. Building the capabilities is the hard part.”

Labor Shortages Are Real—So Make Migration Policy Logical

For the first time, he said, the company cannot produce as much as it can sell because there aren’t enough workers. He criticized the stalemate over labor migration:

The public fear is that firms “just want cheap labor.”

Yet some rules would force higher pay for foreign hires than locals—“illogical” if the aim is to fill gaps, not undercut wages.

“If we all agree the population is aging and workers are scarce, then design a logical migration policy—who and under what conditions—so companies can plan.”

Evidence Over Aesthetics: Regulate with Data, Not Round Numbers

Narbutas challenged policy by ‘nice round numbers’—from overtime multipliers to talk of a four-day week—asking whether these claims rest on serious research or political aesthetics.

“If we want to be competitive, decisions must be evidence-based—grounded in research and impact analysis, not just opinion.”

Crisis Driving: The Mario Andretti Principle

He likened entrepreneurship to racing on the edge:

“If you drive too comfortably, you’ll be overtaken. If you’re at the limit, you risk sliding off in a sudden curve.”

In 2008–09 they did slide—but survived. “Luck played its part,” he admitted. “Had we not made it through, we wouldn’t be where we are now.”

The lesson: controlled risk is inherent to growth—complacency kills champions.

On Government: Praise for the Past, a Prescription for the Future

Having seen every Lithuanian government over 35 years, Narbutas refused to dunk on politics:

“We became champions in 20 years of the EU—so governments and business together did something right.”

But for the future, he wants strategy above parties:

A non-partisan institution to craft a 20–30-year national strategy (vision → strategy → execution), beyond election horizons.

A bold cultural target: make politics a prestigious profession—then it becomes realistic to make teaching prestigious next.

Why Lithuania Can Still Win (and What Could Trip It)

Why it can win:

A track record of building from scarcity to quality.

A culture that can choose to pivot from hands to minds + machines.

An economy ready to deploy automation lines and intellectual capital together.

What could trip it:

Labor shortages without pragmatic migration.

Regulation by aesthetics, not evidence.

Under-investment in automation/R&D, leaving productivity behind rising wages.

Complacency after two decades of catching up.

“We used to be the hungry ones. Now we must become the smart, automated ones. That’s the only way to stay champions.”

A Note on Investment and Outlook

On stage, Bernatonis referenced a major €170 million factory investment decision tied to Lithuania—framed as a vote of confidence in the country’s future. Narbutas kept optimism grounded: optimists can be ‘under-informed’ if they don’t see the bottlenecks. The economy needs talent inflow, productivity leapfrogging, and policy clarity to translate capex into durable competitiveness.

Following the individual keynotes and fireside conversations, the summit shifted into its first group dialogue — a high-energy panel on “Investing in Defense and Technologies”.

Bringing together practitioners from frontline defense tech, digital transformation, data platforms, and site selection, the discussion offered a multi-angle view of how Lithuania can turn its geopolitical urgency into sustainable, high-value growth.

Moderated by Bob Hess (Vice Chairman, Global Strategy, Newmark), the fifty-minute session unfolded as a fast-paced, crowd-engaging exchange, where speakers compared lessons from war-adjacent theaters, NATO programs, EU procurement realities, and the hard arithmetic of capital projects — mapping a pragmatic roadmap for investors and policymakers alike.

A room primed for urgency—and opportunity

The moderator set the tone with a brisk tour of the landscape: an $800-billion aerospace and defense industry growing mid-single digits; a broader tech layer sprinting at 30% annually; and a NATO region moving to materially higher defense outlays. “It’s a VUCA world—volatile, uncertain, complex, ambiguous,” Hess said. “But precisely because of that, defense and technology sit at the intersection of growth and national resilience. The fundamentals still matter—space, talent, speed, and a workable regulatory regime—yet the differentiator is now data-rich decision-making.”

That framing proved prescient. Every voice on stage returned, in one way or another, to speed (cycles from idea to field), to talent (how to attract, integrate, and protect it), to procurement (how to move from rigid purchase orders to co-creation), and to AI (what it can do now, what it must not yet do, and how it multiplies scarce resources).

The defense-startup lens: procurement as the critical path

From the first response, Dr. Sigutė Stankevičiūtė—Baltics & Poland Manager at Mach Industries—put the spotlight squarely on procurement. After a career in government, she joined Mach only three months ago, recruited at a conference in Ukraine. The company’s portfolio includes vertical-takeoff missiles, high-altitude balloons, glide munitions, and counter-UAV solutions—a product mix that screams speed and iteration rather than decade-long acquisition cycles.

“Startups live or die by access to procurement,” she said. “If you are a prime, the door is open; if you are a startup proposing a novel concept, you first have to make it legible to doctrine, then to budgets. That can take five years. Few young companies survive five years without a contract.”

Her point was not a complaint; it was a design brief. While still in government, she helped stand up ITIS—an innovation-promotion pathway that maps unmet military needs to pilots, funding, and finally to procurement. The emphasis is systemic: give SMEs and startups predictable entry, an evidence-based pipeline, and a way to convert prototypes into programs. That, she argued, is why Mach is actively evaluating investment in Lithuania: not only because defense spending is rising, but because the process architecture is beginning to acknowledge how innovation actually happens.

And her personal why? “I joined to defend my country,” she said plainly. “Military capability wins wars; technology wins them faster. Lithuania’s defense industry is still small. That’s an opportunity.”

Digital government meets defense: interoperability, resilience, and the unglamorous backbone

Then came the operator’s view from Andrius Šimėnas of Nortal Lithuania. Nortal—born in a basement in Tartu—helped define what “e-government” means in the Baltics and beyond. Translating that muscle into defense, he said, means resisting the cinematic stereotype of missiles and pilots and embracing something more complex: defense as a mini-state.

“A modern military is logistics, finance, HR, soldier health records, inventory systems—hundreds to thousands of IT systems,” Šimėnas noted. “The battlefield glamour sits on top of interoperability, data movement, security, and resilient architectures. If 2,000 systems exist and 100 go down, how do we keep operating?”

This is where Nortal sees its lane. The firm audits system landscapes, defines replacement cadences, and designs fault-tolerant architectures so that breaches are contained and operations continue. It is patient work, sometimes “mundane,” he admitted, but in a domain where minutes matter, the back office is the mission. The point resonated with investors in the room: digital plumbing is investable—it is repeatable, exportable, and it compounds.

From games to war games: Hadean and the new command-and-control

The panel’s provocateur was Mimi Keshani, Co-founder & COO of Hadean. The London-based company (≈70 people, with a DC footprint) started in gaming; today it builds mission-lifecycle decision support and hyper-realistic war-gaming environments. In early 2022, working with NATO, Hadean built city-scale evacuation models of Estonia—a leap that exemplifies how creative engines from adjacent fields can now drive defense.

Keshani was frank about the historical challenge: “A year ago I’d have told you we needed to become a US company to scale. The procurement gravity was there.” But the geopolitics have shifted. “Europe had a wake-up call. The NATO-first posture is real, and we now see Central Europe as our main growth vector.” She credited Invest Lithuania for clarity and responsiveness, and called for partners to help Hadean build in the region.

Her diagnosis mirrored Stankevičiūtė’s: startups need two things above all—talent and contracts. The demand signal must be faster, clearer, and closer to end users. “Often the person writing requirements is not the person who will use the system. By the time the solution is built, the world has moved on.”

What AI should—and should not—do (yet)

AI threaded the conversation, but carefully. The panel agreed: AI is not a monolith. Classical machine learning and computer vision already run production workloads at scale—battle damage assessment from satellite imagery, anomaly detection, logistics optimizations—delivering deterministic, repeatable outcomes in bounded contexts. Generative AI, by contrast, is a force multiplier for human analysts and planners; it does more with less, but still requires human verification.

Šimėnas offered a decisive rule-of-thumb: “If cost of failure is high, you constrain AI to the sub-tasks where stochastic outputs are acceptable—or you don’t use it yet. If cost of failure is low, AI is the best tool in the stack.”

That distinction dovetailed with the data-platform perspective from Rimantas Žylius (now with Palantir Technologies and formerly Lithuania’s economy minister). In both military and civil spheres, he said, threat velocity is rising while decision velocity stays flat. “We need to react in days and minutes, not quarters. Software—and especially AI-assisted software—closes that gap.”

Žylius pointed to NATO’s adoption of smart targeting workflows supported by platforms like Palantir: “In the Iraq war, two thousand analysts did the targeting grind. With today’s AI-assisted tools, that workload can compress to tens. The scale difference is immense.”

Site selection and fundamentals: talent, space, speed, rules

From Wolfgang Riedel came the investor’s balancing act. Lithuania, he reminded the audience, competes in tri-continental tournaments: Europe vs. Europe, Europe vs. Asia, and Europe vs. U.S. states. Each serious project benchmarks five-and-five-and-five, minimum. “That’s how hard the funnel is.”

Riedel’s résumé spans Zeiss, semiconductor fabs, and clients that cannot be named; he mentioned TSMC to illustrate how process technology drives facility systems and thus capital intensity. His message to Lithuanian stakeholders was clear: if you want the most sophisticated parts of the AI hardware stack or dual-use advanced manufacturing, you must understand the end-to-end process requirements and be ready with sites, utilities, and speed. “Don’t forget the fundamentals,” he echoed the moderator: “space, talent, speed, regulatory predictability.”

A Baltic answer to the “border risk” question

From the audience came the predictable question: given Lithuania’s proximity to Russia, Belarus, Kaliningrad, do companies worry about investing here?

The panel’s answer was emphatically no—and more than no. Šimėnas argued proximity should be energizing, not paralyzing: it pushes teams to be fast, realistic, and targeted. Žylius added that Palantir’s presence in frontline democracies is intentional—“technology for the West to win,” as CEO Alex Karp often says. Stankevičiūtė reframed the geography as a pull factor: a smaller military with a sharper threat needs more innovative technologies—a perfect fit for defensive startups and agile investors.

Hess, fresh from a week in Vilnius this summer, took the message back to boardrooms in New York and LA: “When someone asks ‘Isn’t Lithuania dangerous?’ I say no. It is aligned, resilient, and has been dealing with this for centuries. That clarity is an asset.”

Co-creation, not cosmetic procurement reform

If there was a single policy takeaway, it was this: incremental procurement tweaks won’t deliver wartime speed. Žylius called for frameworks of co-development where government, primes, and startups iterate with users, in short loops. Stankevičiūtė’s ITIS model is a starting point: translate unmet needs into pilots, fund bridges across the “valley of death,” and only then lock into multi-year buys.

Keshani underscored why: when the requirements author is disconnected from the operator, time and relevance are lost. “By the time you deliver, the mission context has shifted,” she said. The alternative is mission-phase software that evolves with the operators, across planning, execution, and assessment—decision support as a living system.

Talent, contracts, capital: the triangle that decides outcomes

All roads led back to the triangle: talent, contracts, capital.

Talent: Lithuania’s edge is quality and motivation, sharpened by proximity to real threats. But volume still matters, and investors will ask how quickly teams can scale across secure clearances, cyber hygiene, and domain knowledge.

Contracts: Without predictable demand signals—pilots that graduate into programs—startups burn runway and leave. Programs like ITIS can schedule those signals.

Capital: Co-creation reduces technology risk, making equity and debt easier. Meanwhile, investors will keep testing the fundamentals: sites, utilities, suppliers, universities, and the policy spine.

The NATO-first shift and a European scaling thesis

Keshani captured the macro turn: “A year ago I would’ve said you can’t scale defense tech in Europe. The world changed. The NATO-first stance, a clear strategic defense review in the UK, and a whole-of-society posture across the Baltics now make Central Europe our preferred growth axis.” For a company like Hadean—working both with UK MOD (a £20m multi-service program) and US DoD—that repositioning is nontrivial. It suggests a bilingual strategy (Atlantic and European) where Lithuania functions as a testbed and hub.

Stankevičiūtė’s presence at Mach tells the same story: European talent, American product DNA, a Baltic operating context, and a procurement bridge designed in Vilnius.

What AI changes in practice: four concrete patterns

To make AI less abstract, the panel settled on four patterns that already work:

Perception at scale — battle damage assessment from satellite or drone imagery; border surveillance anomaly detection; supply chain exception spotting. These are ML/CV domains with rigorous training datasets and bounded outputs.

Human-in-the-loop decision support — Generative AI as copilot for planners and analysts (drafting CONOPs, summarizing intel stacks, red-teaming plans). Verification is mandatory; speed and breadth are the payoff.

Resilient architectures — AI helps simulate failure modes and design graceful degradation: if 5%–10% of systems fail, which services stay up, what roles re-route, and what decisions still get made?

Cyber containment — AI-assisted detection and microsurgical isolation to ensure adversaries cannot roll up an entire network from a single foothold.

What AI shouldn’t do (yet): hard deterministic effects where the cost of failure is catastrophic (e.g., autonomous kinetic targeting without bounded safeguards). The path forward is composability—identify the sub-tasks where AI is safely superior, and integrate them under strict governance.

A note on big projects: lessons from Rheinmetall and beyond

Riedel referenced the Rheinmetall investment announced for central Lithuania. No one on stage unpacked the exact siting criteria, but his point was structural: each project is sui generis. A tank plant, a radar line, a microelectronics fab, or an AI data center each stress different constraints—from power and water to workforce mix, export controls, security perimeters, and supplier radius. Policymakers must resist one-size-fits-all checklists and instead learn the stack for each vertical they court.

The scoreboard: is Lithuania on track?

Hess asked for a quick vote: Is Lithuania on the right track—digital, defense, innovation? The panel scored it a confident yes (multiple “yeses,” in fact), with candid caveats:

Don’t confuse ambition with execution. There are low-hanging fruits in digitalization that must not be ignored while chasing moonshots.

Procurement reform should aim at co-creation frameworks, not cosmetic timelines.

Keep building the talent pipeline—from universities to returning diaspora—aligned with clearances and mission skills.

Stay obsessive about the fundamentals investors expect to find on day one.

What investors heard between the lines

For investors and corporate strategy teams, three messages stood out:

Lithuania is a speed market. Proximity to threat compresses feedback cycles and political attention. This is not just risk; it is execution energy.

Defense is a systems business. The winners are those who can stitch interoperability, resilience, and human-machine teaming across dozens of workflows—not just a single shiny capability.

The commercialization bridge is being built. From ITIS-type pathways to NATO-first commitments, the region is engineering the demand side of innovation. That is where startups become suppliers and where suppliers become anchors.

Closing reflections: the Baltic method

If the session had a single thesis, it was that Lithuania’s advantage is no longer cost; it is coherence. Coherence between policy and procurement, between talent and mission, between AI’s promise and its governed use. The country’s task is to institutionalize that coherence—co-develop with operators, decide with data, site with speed, and scale with partners.

There were jokes (about James Bond and three-million airline miles), but the undertone was serious. The region’s leaders know that strategy is an everyday practice: making doctrine legible to startups, making startups legible to doctrine, and refusing to let a good idea die in the valley between pilot and program.

“Don’t forget the fundamentals,” Hess reminded the room one more time. “Space, talent, speed, regulatory predictability. Build from there—and let AI and alliances do the rest.”

After a lively discussion on defense investment and technological resilience, the summit turned to a different—but equally strategic—pillar of competitiveness: human capital.

The second panel brought together five experts to examine how education, health, and talent can be transformed into durable, long-term growth.

Moderated by Nicholette Ross (Site Selection Consultant, Global Location Strategies), the session blended perspectives from central banking, pharmaceuticals, international education, digital engineering, and location strategy.

What followed was a candid and highly practical conversation about skills development, talent procurement, health as productivity, and the policy infrastructure that can either accelerate or hinder economic momentum.

A global problem that is felt locally

Moderator Nicholette Ross set the terms right away: talent is the No. 1 filter in site selection, but the conversation can’t stop at “how many engineers exist right now.” Investors ask about pipelines, conversion, stickiness—and, increasingly, health and quality-of-life infrastructure that keeps people productive and willing to stay.

Elias van Herwaarden—who has helped more than 800 corporate projects choose locations for manufacturing, R&D, IT, and headquarters—added a dose of scouting realism. For shared services and tech, talent volume and growth are decisive. For manufacturing, the first two questions are often painfully simple: Do you already have a prepared industrial site? and How many people in the surrounding labor shed can we actually hire? “Spreadsheets matter,” he said, “but speed to start and labor depth decide outcomes.”

His sharper challenge landed later: Where are the young people in this conversation? In rooms where policymakers and executives design talent systems for the future, he argued, youth voices are under-represented. “Everywhere in the world people say ‘we don’t have enough talent.’ It’s a global diagnosis. But if you want to fix it, bring the next generation to the table. Companies that listen to the young are the ones that hire them.”

Education’s job: portability, belonging, and versatility

From the vantage point of international education, Dr. Amanda Sunderman explained why portability matters to global families who relocate for work. “A parent thinking about a new assignment is actually thinking about the three-year-old and the eighteen-year-old,” she said. International schools provide transferable curricula, delivered in English, that allow children to slot into new systems without losing momentum. At her school in Vilnius, every student also studies Lithuanian, and day-to-day learning unfolds among 20–30 nationalities. That multicultural fluency is an economic skill in its own right.

Sunderman’s second point connected education to workforce retention: belonging. “Social connections predict how long employees stay with companies,” she said. “We cultivate well-being and community for the whole family. That soft stuff shows up later as lower churn and higher engagement.”

She then described how schools are redesigning learning for volatility: “We are developing versatile learners—comfortable solo and in teams, fluent with technology, and able to distinguish information from expertise. A Google result is not a medical diagnosis. Critical reading and judgment are the future-proof skills.”

Denis Chichmaryov (EPAM) built on that and went straight to the bottleneck: time-to-skills. “Traditional education is slow; industry needs are fast,” he said. The missing bridge is tacit knowledge—the unwritten craft that lives in practitioners’ heads. His proposal: incentivize active professionals to teach, mentor, and co-design micro-curricula with universities. “Lithuania could lead by getting closer to the enthusiasts who spend late nights preparing real trainings and then go deliver them,” he argued. “Let’s stop waiting for someone to change the law. Co-create.”

Marius Skuodis offered a concrete example from the Bank of Lithuania: a quantitative economics program launched with Vilnius University, staffed in part by central-bank experts. The result? A popular, skills-targeted degree that feeds the national financial system with precisely trained talent. “This is what public–private curriculum design looks like when it works,” he said.

Health is not a perk; it’s a productivity platform

Guillaume Hugé reframed health as infrastructure. “Growing economies need healthy people,” he said. Employers can add private coverage and workplace well-being, but the decisive competitive edge comes from system-level access—general practitioners, specialists, and the ability for clinicians to prescribe the latest innovations that keep people at work. He referenced migraine during global awareness week as a cross-generational condition where modern therapies dramatically improve presenteeism. “Countries that speed access to such treatments increase workforce participation,” he said. “That shows up directly in output.”

Sunderman added a relocation-practical detail that often gets missed: in Lithuania, English-speaking medical staff lower friction for global hires. “For a multinational, knowing your people can navigate care easily matters,” she said. From the pharma side, Hugé stressed the complementary piece: research and clinical collaborations with hospitals in Vilnius and Kaunas—the kind of public–private research spine that keeps new therapies and trials close to the talent market.

Government’s new competition: people

Twice during the session the discussion pivoted to a blunt reality: governments also compete for people. Chichmaryov put it crisply: “Every business competes for users. Public services must compete for citizens. Borrow what works—human-centric design, service journeys, feedback loops—and rebuild with the person at the center.”

Several panelists praised International House Vilnius—a “one-stop” hub for foreigners managing residency and related needs—as a model worth replicating in other cities. Sunderman, who recently completed immigration formalities herself, called the experience “professional and humane—strict rules, human touch,” which signals to employers that Lithuania understands the talent on-ramp.

Skoudis added that the state’s role is to clear the runway for high-skill immigration—simple procedures, predictable timelines, and clear information. The market will do the rest: walk through central Vilnius today and you’ll hear “all kinds of languages,” he said. Compared to 15 years ago, the internationalization curve is unmistakable.

The European frame: recruit the continent, not just the country

Van Herwaarden returned to the microphone with a message many in the room nodded along to: think like Europe. “Barcelona didn’t scale because every graduate was a Spaniard with perfect Spanish,” he quipped. “It scaled because Europeans moved there to study and stayed to work. Kraków did the same. Lithuania is equally European—be a talent magnet.”

He tied that logic to internships: bring students in early, test and train them, and convert. “They don’t have to be PhDs,” he said. “Undergraduates and master’s students—normal graduates like me—become your engine if you open the door and invest.”

From knowledge to skills (and how AI changes the math)

A recurring theme—stated by multiple speakers—was the shift from knowledge storage to skills application. “Knowledge is now a service,” Skoudis said, referring to AI’s ability to serve answers on demand. What cannot be commoditized as quickly is critical thinking, adaptability, and the ability to apply insights in messy, real contexts.

Van Herwaarden issued a counter-hype reminder: “Large language models are not intelligence. They connect words; they don’t invent the dot-line between seeds of ideas.” The practical upshot: teach people to reason, to question prompts, to validate outputs, and to compose solutions—not just to retrieve them.

Chichmaryov agreed and translated it into hiring criteria: deep mastery in a home discipline and breadth across adjacent domains—multi-skill sets that can live with uncertainty and still ship. “Speed kills if you don’t have it,” he said, paraphrasing his CEO. Short learning cycles, micro-credentials, and on-the-job upskilling will dominate the next decade.

Sunderman, for her part, pointed out that schools are already aligning: project-based learning, collaborative problem-solving, and digital citizenship are standard, precisely because the future is uncertain and students must be comfortable in ambiguity.

Health access as a competitive differentiator

Returning to health, Hugé made a case for seeing access policy as industrial policy. Allow specialists to prescribe state-of-the-art treatments, reduce time-to-therapy, and you will directly boost output per worker. “The 25–55 cohort is your productivity core,” he said. “If they spend fewer days incapacitated by conditions that modern drugs can control, you’ve created a growth policy without calling it one.”

He also spoke to public–private coalitions that socialize new therapies responsibly, combining payer policy, clinical guidance, and employer programs. The goal is not just compassionate care; it’s a macro-level competitiveness play.

What Lithuania is getting right (and where to push further)

Asked whether Lithuania is on the right path, the panel’s answer was a confident yes—with work to do.

What’s working:

A skilled, multilingual workforce and a visible rise in international hires and returnees.

Early public–private experiments (Bank of Lithuania + Vilnius University; International House Vilnius; research links with Kaunas/Vilnius hospitals).

An ecosystem mindset among companies: internships, internal academies, micro-training, and co-designed curricula.

Where to push:

Speed: shorter procurement-of-people cycles (visas, recognition of qualifications), faster education-to-industry transitions, and micro-credential funding.

Incentives: reward practitioners who share tacit knowledge; co-finance industry-taught modules; expand paid internships.

Health access: upgrade pathways for modern therapies with proven productivity impacts; expand employer–insurer pilots.

Voice: seat youth at the policy table; bring students and early-career workers into FDI strategy discussions.

Practical proposals distilled from the panel

Drawing together the most implementable ideas, here’s a playbook that emerged between the lines:

Stand up a National Micro-Skills Fund

Co-fund short, stackable courses co-designed by employers and universities in AI/ML, robotics, cyber, life sciences ops, and energy transition. Make it easy for workers to stack badges into degrees.Create a “Talent Access SLA” for Lithuania

A published service-level agreement covering visa timelines, qualification recognition, residency steps, and family services (school places, healthcare onboarding). Measure it, publish it, improve it.Pay Practitioners to Teach

Launch Industry Teaching Fellowships that pay engineers, data scientists, clinicians, and product leaders to teach 1–2 courses a year across Lithuania’s universities and colleges.Scale International House

Replicate International House Vilnius in Kaunas, Klaipėda, and Šiauliai. Make it the single front door for relocation, documentation, language support, and spouse employment advice.Health as Growth: Pilot Programs

With payers, hospitals, and employers, pilot fast-track access to therapies with clear productivity gains (e.g., migraine, metabolic disease). Measure presenteeism, publish outcomes, scale what works.Internships at European Scale

Fund pan-European internship funnels to bring EU students to Lithuanian companies for summer placements with conversion bonuses for hires.Youth in the Room

Require each national talent roundtable to include students and under-35 professionals as voting members. Don’t design the future without the future present.

An honest exchange about bottlenecks

Some of the most candid moments came when speakers described the misalignment that still exists between education timelines and industry demand.

Skoudis: “We need to be flexible—modular systems that adapt to shifting needs. LNG taught us that when expertise is built, the world comes calling. Build the next wave in AI, robotics, hydrogen.”

Chichmaryov: “Soft skills for uncertainty and multi-skills are now core. People must stay deep in a craft and broaden across the system. Speed is survival.”

Van Herwaarden: “Let’s teach to think, not only to know. AI doesn’t absolve humans from judgment; it makes judgment more valuable.”

Sunderman: “Belonging is a workforce strategy. Families who feel seen and supported are families who stay.”

Hugé: “Access to modern healthcare is a competitive lever. If you want growth, keep people well and at work.”

Why this matters for investors

For corporate boards and investment committees scanning the Baltics and Central Europe, the panel’s message can be reduced to three investor-centric truths:

Lithuania is building a people-first operating system.

From immigration services to schooling to employer partnerships, the friction around arriving, settling, and growing is steadily dropping. That translates into lower ramp-up risk.The ecosystem already speaks “co-creation.”

Universities and employers are co-teaching; hospitals and companies are co-researching; the city is co-serving newcomers. Investors don’t have to build the bridge alone; they can drive across it and help widen it.Skills are compounding faster than credentials.

Lithuania’s wager—micro-skills, practitioner teaching, internships, and critical thinking—matches what high-velocity firms need. That makes time-to-productivity shorter and retention stronger.

Closing cadence: a country competing on coherence

The panel ended where it began: people. Not abstract headcount, but families, clinicians, teachers, engineers, students—the threads that, woven together, make an economy both resilient and ambitious.

Lithuania’s path is not to out-spend larger neighbors, nor to wait for a demographic miracle. It is to compete on coherence: align education with industry, align health access with productivity, align immigration with on-the-ground services, and align AI’s promise with human judgment. Do those things, and the country won’t just meet investors’ checklists; it will rewrite them.

“Think big. Think Europe. Attract and keep talent,” said Elias van Herwaarden.

“Make the government people-centric,” urged Denis Chichmaryov.

“See health as infrastructure,” pressed Guillaume Hugé.

“Teach for versatility and belonging,” argued Dr. Amanda Sunderman.

“And keep flexibility in the system,” concluded Marius Skuodis.

After the in-depth panel on education, health, and talent, the summit turned to a forward-looking dialogue on the one element technology cannot replace: human leadership.

In a candid conversation with moderator Vilius Bernatonis, Arminta Saladžienė, Vice President for Europe at Nasdaq, explored the evolving role of leadership in an era defined by artificial intelligence, geopolitical shifts, and economic transformation.

Speaking at the Foreign Investors Annual Summit 2025, hosted by the American Chamber of Commerce in Lithuania (AmCham), Saladžienė reflected on the megatrends reshaping industries and societies and discussed how Lithuania can position itself strategically amid these global currents.

Leadership as a Human Anchor in a Technological Era

When asked whether the “human touch” in leadership is becoming less important in an age dominated by AI, Saladžienė was clear:

“Leadership is human. It’s one of the few qualities that define us as people. Emotional intelligence, empathy, imagination, and the ability to connect and inspire others — these are the skills that no machine can replicate.”

She explained that as automation accelerates, the uniquely human capacities for critical thinking, creative problem-solving, and visionary leadership will become even more valuable.

“Leadership is about connecting people around a common purpose and moving in the same direction. Technology can assist us, but it can’t replace that.”

The World’s Operating Environment: Complex and Uncertain

The Nasdaq executive outlined how today’s leaders face an increasingly volatile and multi-dimensional environment. From global politics and economic shifts to technological disruptions and demographic transitions, modern leaders must navigate unprecedented complexity.

Drawing on global research presented at a recent Nasdaq leadership summit, Saladžienė highlighted five megatrends reshaping the world:

Trust Collapse – A global erosion of confidence in institutions and between individuals.

Birth Rate Decline – Aging populations and shrinking workforces across developed nations.

AI and Automation – Transforming industries and redefining the nature of work.

Job Paradox – Simultaneous skill shortages and structural unemployment.

Social Polarization & Loneliness – Fragmentation driven by misinformation and isolation.

“These trends are interconnected. When trust breaks, polarization rises. People become isolated, more susceptible to misinformation, and less confident in institutions. For leaders, this environment is extremely challenging.”

Saladžienė warned that trust — both vertical (in institutions) and horizontal (between people) — is now at historic lows in many countries.

“In the U.S., one in four citizens now expresses zero faith in at least three major institutions — government, media, business, or online platforms. Leading in a world of distrust demands integrity and a strong moral compass.”

🇱🇹 Lithuania at a Crossroads: Miracle or Middle-Income Trap?

Turning the conversation to Lithuania, moderator Vilius Bernatonis asked whether the nation’s remarkable economic transformation — often called a “Baltic miracle” — can be sustained.

Saladžienė praised Lithuania’s achievements, calling its growth story “nothing short of a miracle,” but cautioned against complacency:

“The wind that carried us yesterday may not fill our sails tomorrow.”

She noted that while Lithuania’s productivity now stands at roughly 70–80% of the EU average, recent data shows slowing growth — a classic warning sign of the middle-income trap, where a country’s traditional engines of growth lose momentum before innovation-driven growth takes over.

To avoid stagnation, she urged Lithuania to:

Double down on investment in capital, skills, and innovation

Accelerate the shift from labor-intensive to technology-driven industries

Foster a pro-business policy environment that rewards entrepreneurship and risk-taking

“We must ensure the next growth engine is ready before the current one runs out of steam. Agile, pro-business governance is more essential now than ever.”

Lithuania’s Advantages — and Its Risks

When asked to name Lithuania’s biggest strength and greatest risk, Saladžienė pointed to people as the country’s greatest asset:

“We still have the hunger — a new generation of creators building products for the world. They’re ambitious, globally minded, and deeply connected to Lithuania. That spirit is our biggest advantage.”

The biggest risk, however, lies in policy shifts that could undermine growth:

“If we overtax success or redistribute too aggressively, entrepreneurship dries up. Investment slows. The middle-income trap becomes real.”

The Future of Work: Humans and Digital Agents

Discussing AI’s impact on work, Saladžienė envisioned a near future where every professional is supported by dozens of digital agents:

“In a few years, each of us may manage 50 AI assistants helping with tasks and decisions. When that happens, we’ll earn the right to a four-day work week — because our productivity will multiply.”

This vision underscores her belief that AI should augment human capability, not replace it.

Foreign Investment as a Catalyst, Not a Competitor

Given the summit’s focus, the conversation turned to foreign direct investment (FDI). Saladžienė emphasized that FDI has been a cornerstone of Lithuania’s success and remains crucial for the next leap in productivity:

“Foreign investors bring more than capital — they bring global know-how, management standards, and networks. They put Lithuania on the map.”

She dismissed the false dichotomy between local and foreign investment:

“It’s not either/or. It’s and. Domestic and foreign capital together create exponential growth.”

Saladžienė gave the example of Nasdaq’s AI initiatives:

“Our proprietary generative AI platform trains over 600 employees in Lithuania. That knowledge flows into the local startup ecosystem, strengthening the entire economy.”

She compared FDI to thriving urban ecosystems:

“Like a street full of cafes — more neighbors mean more visitors. Foreign investors aren’t competitors; they’re catalysts.”

Capital Markets: Europe’s Untapped Potential

As Vice President of Nasdaq, Saladžienė also addressed the role of capital markets in funding growth:

“Europe has saved the most, but invested the least. €10 trillion in household savings sit mostly in deposits — 70% in banks, only 30% in markets. In the U.S., it’s the opposite.”

Lithuania alone holds €26 billion in deposits — roughly one-third of its GDP.

“We need to put even a fraction of that to work as equity. Businesses can’t grow on loans alone.”

She cited Sweden as a model:

“Only 12% of Swedish savings are in deposits; 46% of citizens hold equity. As a result, 500+ companies have raised capital through the markets — more than Germany, France, and Spain combined. Capital markets drive innovation, trust, and happiness.”

Saladžienė argued that listing more state-owned companies would democratize growth:

“When citizens can invest in national champions, they share in the success. It raises governance standards and transparency.”

Using Ignitis Group as an example, she noted how its 2020 IPO enabled billions in energy investments and modernized the company:

“It’s proof that markets serve consumers in the long run — through stronger, more innovative businesses.”

Future-Ready Leadership: A Moral Compass in a Fragmented World

In closing, Saladžienė reflected on what defines a future-ready leader:

“There’s no single model. But in a world where trust is fragile and misinformation spreads rapidly, leadership must be guided by a moral compass.”

Her message to emerging leaders:

Stay human-centric

Cultivate empathy and integrity

Embrace technology without losing sight of purpose

Lead with courage and clarity amid uncertainty

“Leadership in the AI era means blending innovation with humanity — and steering with ethics at the core.”

Following the thought-provoking conversation on leadership and global megatrends with Nasdaq’s Arminta Saladžienė, the summit moved to one of its most anticipated addresses — a policy keynote from Lithuania’s newly appointed Minister of Foreign Affairs, Kęstutis Budrys.

Speaking at the Foreign Investors Annual Summit 2025, hosted by the American Chamber of Commerce in Lithuania (AmCham Lithuania), Budrys used his first public appearance since the new government took office to outline a comprehensive, investor-oriented foreign policy agenda that integrates national security, economic resilience, and European leadership.

In a wide-ranging address followed by an on-stage conversation moderated by Vilius Bernatonis, the minister presented five strategic pillars: security, support for Ukraine, defense of international law, economic security through de-risking, and a proactive EU agenda ahead of Lithuania’s upcoming EU Council Presidency.

Executive Overview: What Investors Need to Know

Continuity without complacency. The “20th Government” will double down on what works—especially in foreign and security policy—avoiding disruptive policy lurches while accelerating implementation.

Security as a horizontal priority. Expect cross-ministerial action on hard defense and civil resilience (from robust infrastructure and military mobility to business continuity planning).

Ukraine as a strategic interest, not charity. Long-horizon commitments—from defense assistance to reconstruction—are framed as existential to European security and an open door for private-sector delivery.

International law as Lithuania’s shield. The country will continue to champion rule-based multilateralism, seeing it as the indispensable protection for smaller states and a foundation for investor certainty.

Economic security and de-risking. FDI screening in strategic sectors will continue; unfair trade practices will be challenged through EU instruments; supply chains will be diversified toward trusted partners.

EU Presidency agenda. Lithuania is already engineering a Presidency program focused on external and internal security, completing the single market, and accelerating Ukraine’s EU path.

Open door to business input. The government is asking companies for granular, evidence-based feedback on regulatory bottlenecks and market distortions to enable rapid, targeted fixes.

China policy—pragmatic channels, firm principles. Restoring normal diplomatic functionality is on the table without compromising on security screening, EU trade defense, or allied coordination.

Signature bets. The government’s “emblematic” contributions will include catalyzing defense industries (with budgetary and regulatory support) and opening a frontier for space technologies.

The Speech: Security-First, Implementation-Driven

Budrys opened with a candid disclaimer: in today’s environment, no one can predict the world with precision. What he could bring was “the answer to an awakening”—a clear articulation of how the 20th Government intends to execute foreign, security, and economic policy in ways that matter for business.

1) Security is not a silo; it’s a spine

Calling security “the horizontal priority”, Budrys described a two-track approach:

Hard security: Deepening and operationalizing alliance ties (first and foremost with the United States, alongside Germany and Poland), strengthening capabilities, and knitting allies closer through practical cooperation beyond the defense ministry.

Civil resilience: Delivering on NATO’s push to spend 1–1.5% of GDP on civilian preparedness—resilient infrastructure, military mobility, societal readiness, and crucially, continuity of business in a crisis. This crosscuts line ministries and draws the private sector into planning and exercises.

For investors, the message is straightforward: this government intends to lower the tail risk of geopolitical shocks turning into operational paralysis, by building redundancies and plans that keep factories running, networks humming, and logistics flowing.

2) Ukraine, seen through Lithuania’s vital-interest lens

Budrys framed support for Ukraine as a self-interested duty that underpins European security. Lithuania’s commitments, he stressed, stretch beyond the battlefield into reconstruction, governance support, and service delivery. He referenced the Central Project Management Agency’s deep footprint in Ukraine and its 200+ projects—from building shelters and schools to modernizing local service systems—and explicitly invited Lithuanian and European companies to help deliver them.

In practice, this is a multi-year pipeline of commercially viable projects, de-risked by public counterparties and perfectly suited to firms with experience in infrastructure, digital government, education, health, housing, and utilities.

3) International law as operating system—and risk hedge

For a small state, Budrys said, the difference between a rule-based and a power-based order is existential. Lithuania will keep defending sovereignty, territorial integrity, and lawful dispute settlement, not as rhetoric but as the realpolitik of survival. For companies, this translates into a national stance that reduces legal and regulatory unpredictability and aligns Lithuania tightly with Western governance norms.

4) Economic security, de-risking, and fair competition

Having learned the hard way in energy—where Lithuania now imports zero Russian energy—the government will pursue a similar logic in critical technologies and strategic sectors:

FDI screening will remain firm and targeted to sensitive assets;

Unfair trade practices (e.g., overcapacity-fueled dumping, covert subsidies) will be confronted through EU trade-defense tools;

Supply chains will be diversified toward trusted partner networks, blending domestic capacity where viable with allied sourcing.

Budrys flagged the spike in imports from China as a system-level warning, arguing that the response must be European: a level playing field inside the single market and resilience of critical inputs. The subtext for executives: if your competitive edge depends on fragile or politically exposed inputs, now is the time to re-engineer.

5) EU Presidency 2027: Drafting a no-nonsense agenda

Partnering in a trio with the Netherlands and Greece, Lithuania is already shaping a Presidency program with three focal points:

External security: practical EU-NATO complementarity, defense industrial policy, and funding for resilience.

Internal security: infrastructure protection, crisis logistics, and codified business-continuity standards across borders.

Completing the single market: dismantling granular frictions that balkanize demand and slow investment across sectors.

In parallel, the government wants a hands-on approach to Ukraine’s EU path: supporting the institutional reforms and administrative rewiring that must precede accession, so momentum is not lost in bureaucracy.

6) Policy made with the private sector, not for it

Budrys’s appeal to business was unambiguous: bring “hard examples”—contracts delayed by ambiguous clauses, licensing stuck in procedural loops, sub-EU-standard components displacing compliant ones—and the government will use its “wide toolkit” to fix them. This is a commitment to evidence-based regulation with line-of-sight to the shopfloor.

The Conversation: China, Time Horizons, and a “Signature” for the 20th Government

In the Q&A, moderator Vilius Bernatonis probed the policy edges—particularly on China, the pace of normalization, and what legacy Budrys expects this government to leave.

China: normalize channels, hold the line on principles

Budrys drew a careful distinction:

Diplomatic functionality: Lithuania wants to restore normal operating channels (embassy-level consular services, routine problem-solving) both ways—in Vilnius and in Beijing. This is partly about convenience (e.g., visas) and partly about reducing frictions for companies already active in China.

Policy fundamentals: Nothing changes on security screening of investment in strategic sectors, EU-level trade-defense actions, or de-risking where China’s practices create vulnerabilities.

Timeline? It takes two to normalize. Budrys wouldn’t put a calendar on Beijing’s choices. He reminded the room that other European cases have taken years, often hinging on broader geopolitical tides. The key is that Lithuania knows what it controls—standards, screening, allied coordination—and will move pragmatically within that envelope.

What will the “best government number 20” be remembered for?

Budrys’s answer highlighted three bets:

Defense industries: Already growing at ~20% year-on-year, now to be accelerated with funding windows (e.g., programs akin to ITIS/“green corridor”) and fast-lane regulation to attract anchor investors and scale up SMEs.

A proven template of turning shocks into sectors: Lithuania did it with cybersecurity (after early attacks) and with fintech (regulatory innovation + market need). Now the model will be applied to defense and dual-use tech.

Space technologies: A “small dream,” but strategically coherent—dual-use by nature, aligned with an EU portfolio friendly to space industrialization, and potent for branding Lithuania’s next frontier.

Investor Implications: From Boardroom Questions to Site-Level Decisions

1) Policy predictability

The continuity doctrine reduces country risk premia for multi-year capital deployments. Investors can underwrite not just one set of rules but their consistent enforcement.

2) Built-in resilience

Civil preparedness investment—codified at percentages of GDP—signals credible prioritization of backup power, protected logistics, alternative routes, and cross-border MOUs. This shrinks the downside tail for asset utilization and delivery performance.

3) Project pipelines in Ukraine

For EPCs, systems integrators, proptech/edtech/healthtech providers, facilities managers, and data-platform firms, EU-backed reconstruction is a multi-cycle demand driver. Lithuania’s agencies are trusted prime contractors—a gateway for firms to enter low-risk subcontracts.

4) Trade defense and compliance advantage

Firms with elevated compliance (traceability, ESG, cyber posture) will gain a relative edge as EU enforcement tightens. If your bill of materials includes opaque inputs, start re-sourcing or risk-sharing now.

5) Defense and dual-use opportunity

From sensors, autonomy, secure comms, advanced materials, power solutions to AI mission support—the government’s posture and NATO-aligned demand curve make Lithuania a logical node to manufacture, test, and certify.

6) Capital market signaling

Although this speech focused on foreign policy, there’s a clear throughline: open, rules-based markets and alignment with Nordic standards. For CFOs contemplating local bond issuance or privatization partnerships, the direction of travel remains supportive.

Sector-by-Sector: Where the Policy Touches the P&L

Manufacturing & Advanced Industry

Continuity of Operations: Expect mandated contingency planning and, in some industrial parks, shared resilience infrastructure (redundant power, hardened data links).

EU Trade Defense: Component sourcing will face more origin scrutiny; compliant firms get pricing air cover against dumped imports.

Energy & Infrastructure

Grid resilience funding and cross-border interconnectivity strengthen uptime and balancing.

Reconstruction work in Ukraine will favor consortia with Lithuanian project management roots.

Digital, Cyber, and Data

Civil resilience implies cyber baselining and incident-response interoperability across sectors.

GovTech vendors will see demand for continuity platforms, situational awareness, and secure data sharing.

Defense & Dual-Use

Procurement ecosystems will blend NATO-standard requirements with innovation pathways (pilots, sandboxes, co-dev).

Certification and export controls literacy will be a competitive moat.

Education, Health, and Human Capital

Expect targeted upskilling initiatives keyed to defense/dual-use, energy transition, and digital state capabilities.

Health investments will emphasize access and productivity impacts (e.g., therapies that reduce absenteeism).

Risk Factors and Mitigations: A Board Brief

Geopolitical Escalation

Mitigation: NATO posture, civil resilience spend, and coordinated continuity strategies reduce impact amplitude and recovery time.

Trade Retaliation / Counter-Measures

Mitigation: Anchoring in EU processes, pursuing collective remedies, and designing diversified supplier maps now.

Regulatory Overhang

Mitigation: Government’s evidence-based fix commitment; engage early with documented cases to shape rules.

EU Process Drag

Mitigation: Lithuanian Presidency workstreams are pre-wiring cross-border decision paths on security and single-market friction.

Voice of the Minister: The Lines that Frame the Strategy

While Smarti.News paraphrases for clarity and brevity, the following ideas capture Budrys’s framing:

On continuity: The 20th Government will not pivot for politics’ sake; it will scale what works.

On civil resilience: Security budgets are not just for tanks; they are for keeping businesses open when stress hits.

On Ukraine: Support is not charity; it’s self-preservation for Europe.

On multilateralism: For small states, international law is national armor.

On China: Re-functionalize diplomacy without compromising on security screening or EU trade defense.

On legacy: Turn defense industries into a growth flywheel; repeat the cyber/fintech playbook; reach for space as a dual-use frontier.

After a comprehensive foreign policy address by Minister Kęstutis Budrys, the summit turned its attention to the future of financial innovation — a domain where Lithuania has earned growing international recognition.

In a keynote speech at the Foreign Investors Annual Summit 2025, hosted by the American Chamber of Commerce in Lithuania (AmCham Lithuania), Dr. Ozan Ozerk — a Norwegian-Cypriot serial entrepreneur and founder of multiple global financial institutions including European Merchant Bank — delivered a forward-looking analysis of Europe’s evolving fintech landscape.

Combining global perspective with practical advice, Ozerk urged Lithuania’s business and policy leaders to balance innovation with regulatory discipline, stay at the forefront of open finance and digital transformation, and build trust-centered ecosystems capable of attracting sustainable investment.

A Global Perspective from a Fintech Pioneer

Dr. Ozerk, who has lived and built businesses across Norway, the US, Europe, and Asia, opened by praising Lithuania’s rise as a European fintech powerhouse. Over the past decade, Lithuania has become one of the most dynamic licensing environments in the EU, hosting a dense network of payment institutions (PIs) and electronic money institutions (EMIs) under the Bank of Lithuania’s regulatory umbrella.

“What Lithuania has achieved in the last 5–10 years is remarkable,” Ozerk said. “Opening the central bank’s infrastructure to private operators was unthinkable a decade ago — now it’s a model others are watching.”

However, he cautioned that success must not breed complacency. As technology, regulation, and global competition evolve, clarity and consistency are the new gold standards for attracting capital and talent.

Key Trends Reshaping the Financial Sector

Ozerk’s keynote focused on four transformational trends reshaping European and global finance — and the strategic actions Lithuanian businesses should take to stay competitive.

1. Instant Payments and SEPA Modernization

Europe’s SEPA Instant Credit Transfer (SCT Inst) scheme is becoming the new norm, enabling real-time euro transactions across member states. Ozerk emphasized that adopting instant payments isn’t optional — it’s a competitive necessity.

“If your clients can move money in seconds, but your system takes hours, you’re already losing the race,” he said.

Yet, he warned that speed amplifies risk. Institutions implementing instant payment rails must invest equally in:

Instant refund capabilities

Advanced transaction monitoring

Fraud detection and AML compliance

Failing to do so, he cautioned, could expose businesses to operational and reputational damage.

2. From Open Banking to Open Finance

Europe’s financial sector is shifting from open banking (data access to current accounts) toward open finance, where customers can share holistic financial data — including savings, investments, insurance, and credit profiles.

This expansion will enable:

Personalized financial products

Integrated financial dashboards

Competitive pricing and product bundling

Ozerk noted that businesses that embrace open finance early will unlock new revenue streams and customer insights, while those that ignore it will fall behind.

“Open finance is not a trend — it’s the infrastructure of the next decade.”

3. Digital Identity and Trust Infrastructure

As digital interactions expand, digital identity (eID) systems are becoming essential for KYC, onboarding, and fraud prevention.

The EU Digital Identity Wallet, set to launch across member states, will allow consumers to securely prove identity and authorize transactions online.

Ozerk urged Lithuanian businesses to integrate eID solutions early, reducing friction and cost in compliance-heavy industries like finance, travel, and e-commerce.

“Friction kills conversion. With eID, we can combine compliance with convenience.”

4. Blockchain, Crypto, and New Regulations

Addressing blockchain and digital assets, Ozerk acknowledged initial regulatory confusion in both the EU and the US, but highlighted rapid convergence.

The EU’s MiCA (Markets in Crypto-Assets) framework and the US Genius Act are paving the way for regulated crypto adoption and blockchain-based financial services.

“Ignoring blockchain is not an option. Even if you don’t offer crypto, blockchain will shape your treasury, payments, and cross-border settlements.”

He predicted a future where instant settlement networks in Europe (SEPA) and the US (FedNow) are bridged by blockchain-based rails, enabling near-instant international transactions between euro and dollar zones.

Artificial Intelligence: Promise and Perspective

Turning to AI, Ozerk urged pragmatism over hype:

“AI today is mostly advanced data aggregation and pattern recognition. It’s powerful, but not omniscient.”