8 Minutes

Trump's Possible Ouster of the Federal Reserve Chair: A Pivotal Moment for Crypto

The prospect of Donald Trump removing Jerome Powell from his position as the Chairman of the U.S. Federal Reserve could trigger the most drastic change in the American central banking system’s 110-year history. This potential shakeup not only impacts the $30 trillion in U.S. government assets but also has far-reaching implications for global financial markets and the ever-expanding world of digital currencies.

Why the Independence of the Federal Reserve Matters

Political Pressure on Interest Rates

Recent months have seen a familiar pattern unfold. Whenever Trump's economic policies appear to harm the U.S. economy, he has publicly pressured Jerome Powell to cut the central bank’s interest rates. Powell, however, has firmly rejected such interventions, emphasizing the necessity to maintain the Fed's independence. Lower interest rates inject liquidity into the market and stimulate economic activity—but experts caution that such measures must be based on sound economic principles, not political motivations.

The Consequences of Losing Market Trust

If markets lose faith in the Fed’s independence, selling U.S. Treasuries becomes a challenge. The direct result: rising borrowing costs for the American government. Given the staggering $30 trillion national debt, a loss of confidence could quickly escalate into a crisis with global repercussions. For cryptocurrency investors, such instability often triggers shifts in market behavior and asset allocation.

Crypto Markets Respond to Political Uncertainty

Bitcoin's Shifting Correlation with Traditional Markets

Historically, Bitcoin’s price movement has closely mirrored that of the Nasdaq. Yet, since the onset of U.S.-China trade tensions, a new dynamic has emerged: while stock market indices remain subdued, Bitcoin (BTC) has started to gain momentum. This shift suggests cryptocurrencies may finally be carving their own path, independent of traditional assets—a core vision laid out in Bitcoin’s original whitepaper.

Safe Haven Capital Flows into Digital Assets

In times of crisis, investors previously turned to U.S. Treasuries. Now, with 10-year Treasury yields nearing 5% amid uncertainty, the landscape is changing. Should political controls over the Fed intensify, a large-scale rush of capital into cryptocurrencies is plausible—potentially driving the next bull run and further legitimizing crypto as a safe haven asset.

Legal Hurdles: Can the Fed Chair Be Removed?

The Federal Reserve Act and Supreme Court Rulings

Since 1913, the Federal Reserve Act has stipulated that its chair serves a 14-year term, removable only for valid legal cause. This restriction was reaffirmed by the Supreme Court’s 1935 Humphrey’s Executor case, preserving central bank autonomy. However, a shift in the Supreme Court's composition could bring these laws under scrutiny, potentially granting presidents—even beyond Trump—unprecedented power to influence, or even control, the nation's monetary policy.

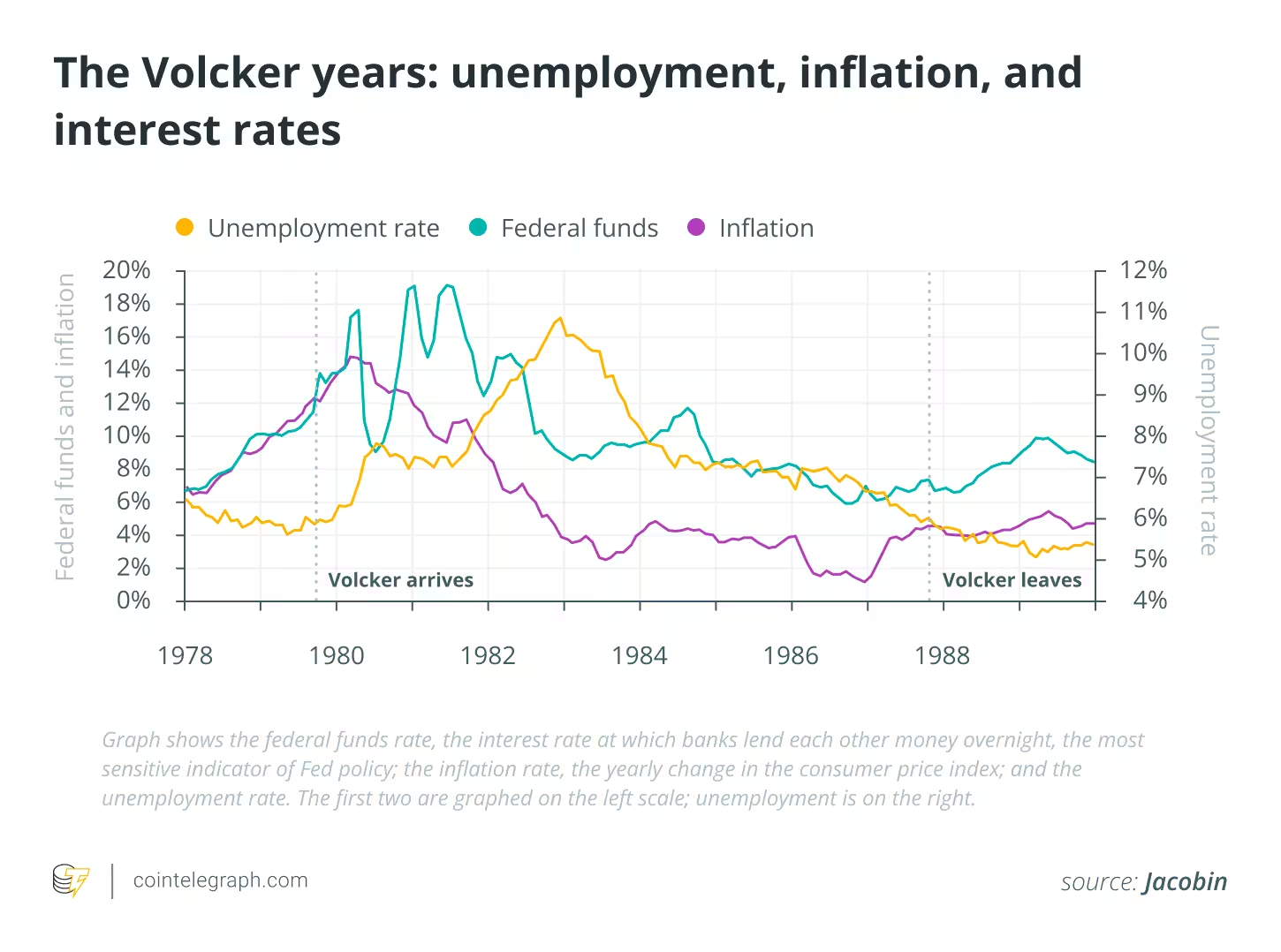

Historical Precedents: The Risks of Political Control

Richard Nixon’s pressure campaign on then-Fed Chair Arthur Burns in the early 1970s led to expansionary policies that won Nixon the election—at the cost of unleashing a decade-long wave of crippling inflation. Similar scenarios abroad—from Weimar Germany to modern Venezuela—demonstrate the perils of allowing politicians to undermine central bank independence, often resulting in economic chaos and runaway inflation.

Implications for the Cryptocurrency Ecosystem

The Ultimate Test for Decentralized Finance

Bitcoin and other cryptocurrencies were created as an answer to the flaws of traditional finance systems. If the Federal Reserve’s independence falls, this original mission will face its greatest test yet. A systemic crisis could see investors flock to Bitcoin en masse, potentially triggering unprecedented price appreciation and a fundamental shift in the global financial order.

Stablecoins Under Threat

Leading stablecoins like USDT and USDC derive much of their security from backing by U.S. Treasuries. In a scenario where the value or liquidity of these government securities drops, the very foundations of stablecoins could be shaken. Any collapse in the stablecoin sector would have cascading effects on smart contracts and decentralized applications built on platforms such as Ethereum and Solana.

Potential Erosion of the U.S. Dollar’s Privileged Status

The U.S. dollar has long served as the global reserve currency, but political instability and a weakened support structure could shift international commerce toward the euro, Chinese yuan, or even digital assets. Such a transition would upend the status quo, giving China and Europe more regulatory control over global finance, including tighter restrictions on cryptocurrency exchanges and digital asset flows.

A Surge in Demand for Non-Collateralized Cryptocurrencies

A collapse in trust toward fiat-backed stablecoins could trigger a rush into cryptocurrencies that operate without reliance on any centralized reserve. Despite limited adoption of algorithmic or decentralized stablecoins in real-world transactions to date, heightened turmoil might accelerate their growth and usage.

Portfolio Diversification Gains New Importance

In these volatile times, diversifying across major cryptocurrencies becomes a crucial risk management strategy. Leading assets like Bitcoin and Ethereum serve as both hedges against fiat instability and enablers of decentralized financial infrastructure. Savvy investors are advised to build balanced crypto portfolios, combining blue-chip digital currencies with emerging blockchain projects.

Education and Security: Pillars of Crypto Investment

With traditional financial systems under strain, knowledge of digital wallet management—including distinctions between hot and cold wallets—becomes more important than ever. Investors need to educate themselves about securing their private keys and understanding the nuances of blockchain technology to effectively manage risks associated with cryptocurrency holdings.

Blockchain Technology: Looking Beyond Currencies

The Rise of Decentralized Finance (DeFi)

Blockchain’s applications extend far beyond just digital currencies. The emergence of DeFi platforms threatens to disrupt classic banking by enabling peer-to-peer financial services and automated smart contracts that eliminate the need for intermediaries. In times of crisis, these decentralized solutions can offer unique stability and resilience.

Scalability Remains a Hurdle

Despite their promise, Bitcoin and other blockchain networks still face significant scalability challenges. To handle mass adoption and millions of transactions per day, infrastructural improvements are necessary. Layer 2 solutions like the Lightning Network seek to address these deficiencies, and their success will be critical for the future mass adoption of cryptocurrencies.

Market Outlook: Trends and Projections

Technical and Fundamental Analysis of Bitcoin

Recent charts indicate new price trends for Bitcoin, with its decoupling from U.S. equities hinting at a potential regime change in asset correlation. If influencers like Trump indeed alter the central banking landscape, analysts predict crypto valuations could reach record heights—though these forecasts must be approached with pragmatism given inherent market volatility.

Influence of International Central Banks and Regulation

The policies of the European Central Bank and the People’s Bank of China continue to shape global crypto market sentiment. Varied national regulations on digital assets play a key role in determining the market's future, as greater legal clarity attracts institutional participation and fosters investor confidence.

Conclusion and Future Prospects

Trump’s potential decision to remove the Federal Reserve Chair would represent a turning point for both the U.S. and global economies. For the cryptocurrency sector, such a move presents both significant opportunities and substantial risks. On one hand, digital assets may become the ultimate safe haven in times of fiat uncertainty; on the other, destabilization of stablecoins could pose existential threats to decentralized markets.

Ultimately, the destiny of cryptocurrencies hinges on a confluence of factors—political, economic, and technological. Investors and industry participants must brace for a new era of disruption and be prepared to adapt as the digital finance revolution accelerates.

Comments