3 Minutes

Tesla’s struggles in Europe are intensifying, as recent sales data reveals a sharp downturn for the renowned electric car brand. In May 2025, Tesla’s vehicle registrations across the European Union, United Kingdom, and EFTA countries plunged by 27.9%, marking a fifth consecutive month of declining figures for the American EV pioneer. This downturn contrasts starkly with the broader European electric vehicle (EV) market, which saw an impressive 27.2% surge during the same period.

Current Market Conditions and Tesla’s Decline

Over the first five months of 2025, Tesla’s European year-to-date sales have fallen by a concerning 37.1% compared to last year, according to ACEA data. Tesla’s slide began with a 45% drop in January, continued through February with a 40% decrease, and hit a trough in April when deliveries nearly halved. Although the spring update of the Model Y provided a brief respite, it hasn’t been enough to reverse the ongoing negative trend.

Broader Electric and Hybrid Vehicle Market Growth

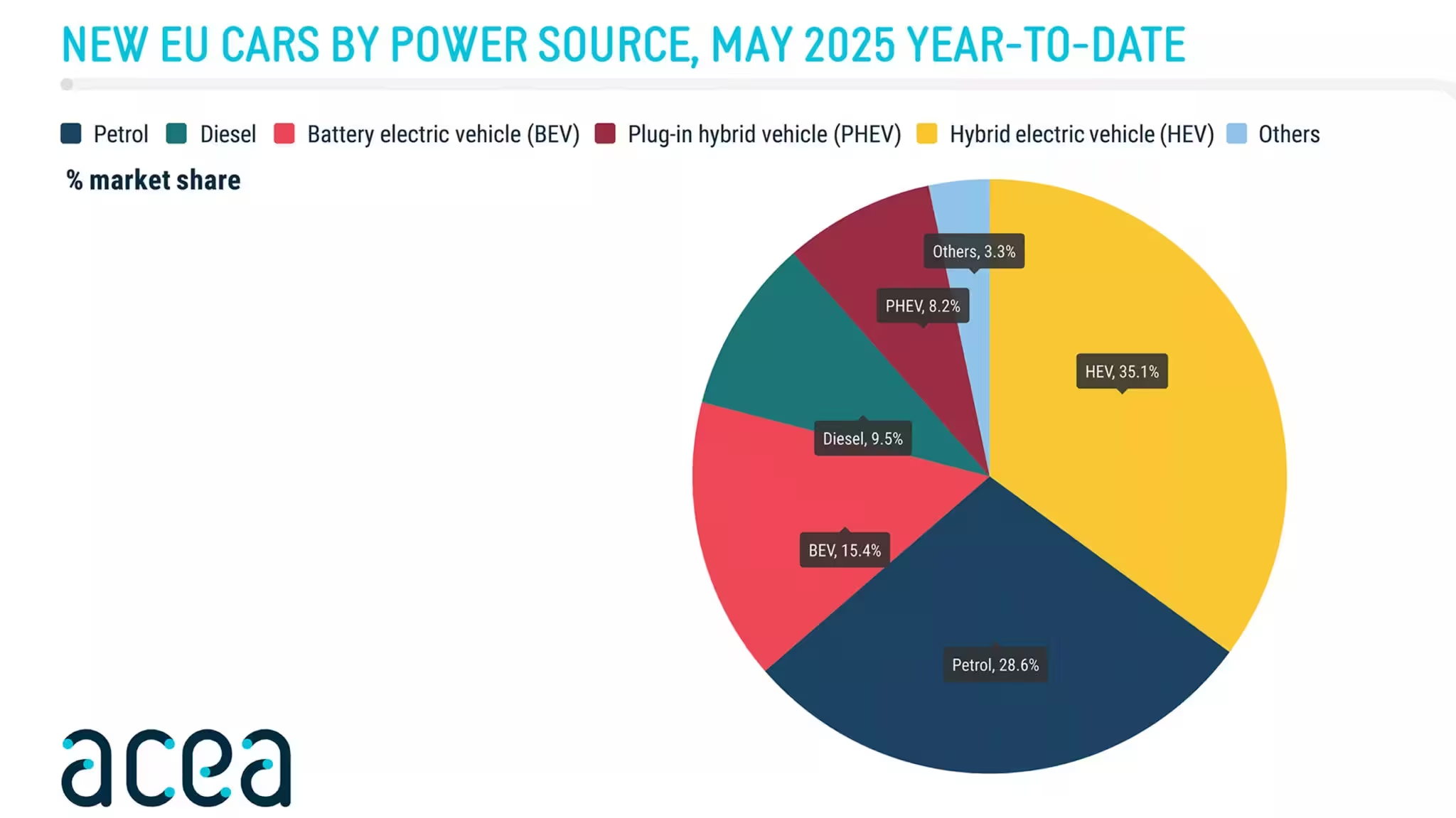

While Tesla sees red, the overall European EV market has flourished. Electric vehicles claimed 15.4% of the market share in May 2025, up from 12.5% a year earlier. Hybrid vehicles also continue to gain traction, growing by 14.2% year-on-year and capturing 34.1% of all car sales, putting them ahead of traditional petrol-powered cars. Notably, plug-in hybrids posted a remarkable 46.1% gain, now representing 9.4% of the market.

Competitors Outperform Tesla

Tesla’s lagging performance stands in contrast to several other automakers. Mini, BMW’s iconic marque, saw sales soar by 29.1%. Alfa Romeo achieved a robust 21.5% rise, while Cupra, SEAT’s sporty sub-brand, surged by 32.4%. China’s SAIC Motor, owner of the MG brand, recorded an impressive 22.5% increase. In sharp contrast, SEAT suffered a significant 25.4% drop, highlighting the fluctuating fortunes throughout the matrix of European automotive brands.

Vehicle Lineup, Specifications, and European Appeal

Tesla’s Model Y—once the continent’s top-selling car—is facing stiff competition. European buyers are now gravitating toward fresh offerings blending cutting-edge design, strong performance, and innovative EV technology. Brands like Cupra, Alpine, and Lexus are capitalizing on this momentum, launching new EV and hybrid models that combine style, efficiency, and advanced safety features tailored for the European market.

Market Positioning and Future Prospects

Tesla’s current position highlights a pressing need to re-evaluate its European strategy. The surge in rival EVs and hybrids—offering competitive prices, improved specifications, and localized features—is shaping fierce competition. As the European EV landscape evolves, Tesla must innovate in both product and customer experience to regain its appeal among European car enthusiasts.

Comparative Sales: Winners and Losers in May 2025

Looking at the broader landscape, Volkswagen Group remains the top-selling automaker in Europe with 309,930 units in May, followed by Stellantis and Renault Group. Meanwhile, Jaguar endured a steep 93.6% year-over-year drop, and Mazda, Suzuki, and Land Rover also saw declines. The varied fortunes underscore rapidly shifting dynamics in the electric and hybrid vehicle arenas.

In summary, while Tesla grapples with persistent sales declines in Europe, competitors are rapidly gaining ground, propelled by robust new models and evolving consumer preferences. For automotive enthusiasts and industry experts alike, Europe’s EV market is more dynamic and competitive than ever before.

Source: carscoops

Comments