3 Minutes

Prominent Leverage Trader James Wynn Exits X Following Massive Crypto Losses

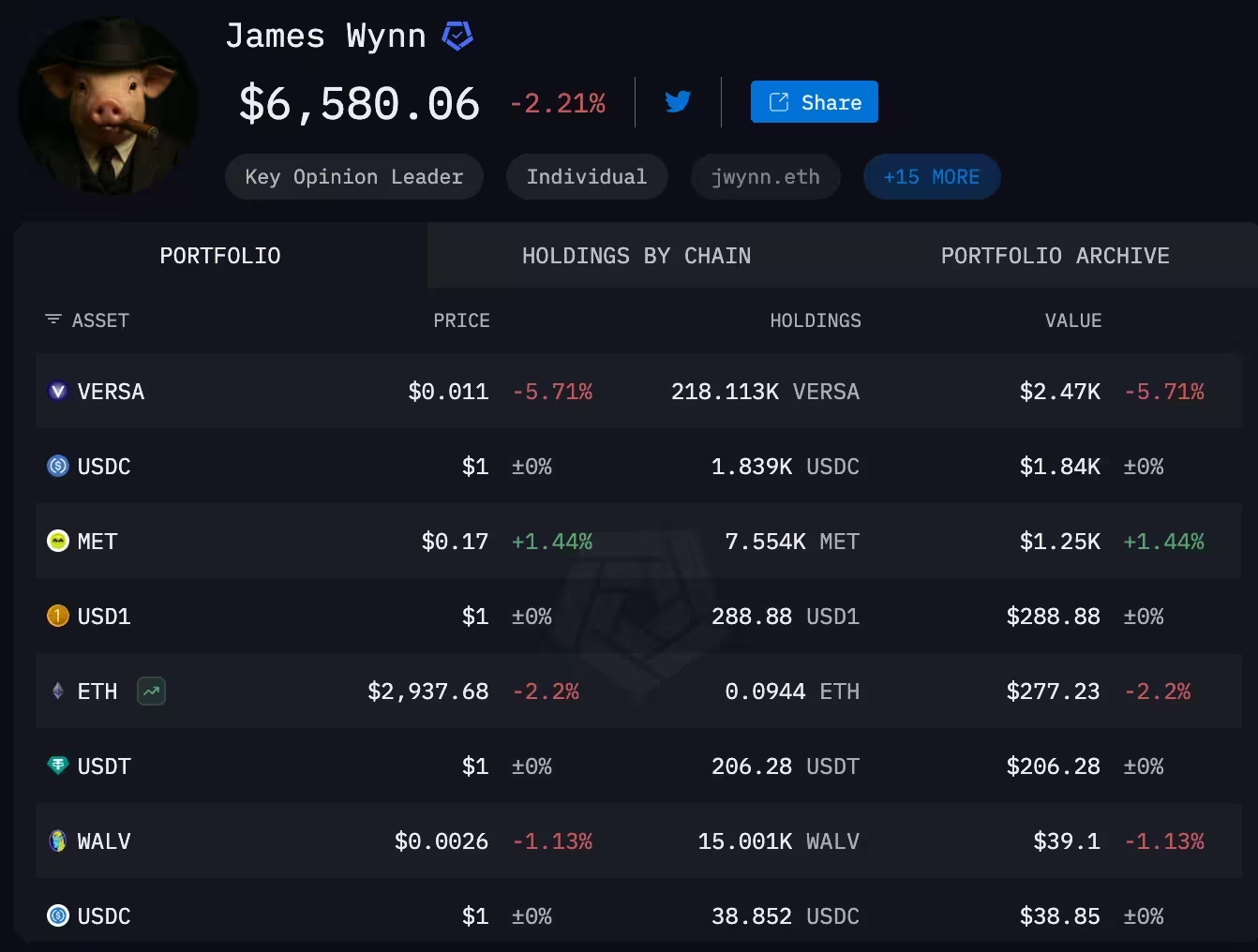

Renowned for his high-risk, highly-leveraged positions, cryptocurrency trader James Wynn has deleted his X (formerly Twitter) account after enduring staggering losses amounting to several hundred million dollars. As shared by Mihan Blockchain, Wynn’s crypto wallets now reportedly hold only around $10,000, a massive drop from his previous fortune.

Wynn’s Crypto Holdings Plummet Following Liquidations

According to data from Arkham Intelligence and Hypurrscan, Wynn’s remaining wallet balances total just $10,176. This stark figure reflects the fallout from a series of risky leveraged bets that went against Wynn in the notoriously volatile crypto markets. Before deactivating his X account, which was formerly under the handle "JamesWynnReal," Wynn updated his bio to read “bankrupt,” signaling the severity of his financial troubles.

Wynn built a significant following in the cryptocurrency trading community by regularly executing outsized leveraged trades, particularly on the Hyperliquid exchange platform. Many of these trades ran counter to prevailing market sentiment, but Wynn’s daring approach won him both admirers and critics—and ultimately, contributed to his downfall.

Major Bitcoin Long Positions Lead to Massive Losses

The turning point came in May 2025, when Bitcoin’s price fell below $105,000. At that time, Wynn’s open long positions on Bitcoin—worth around $100 million—were forcibly liquidated, wiping out 949 BTC from his account. Just prior to this collapse, Wynn admitted in a now-deleted post, “I don’t have proper risk management and don’t claim to be a pro; if anything, I just get lucky. I’m basically gambling and could lose it all. I advise others not to do what I do.”

Despite this warning, Wynn reopened another $100 million long Bitcoin trade only a few days after the initial liquidation, showing he was undeterred by his previous losses.

Market Makers Allegedly Targeted Wynn’s Positions

Wynn asserted that his leveraged trades were deliberately targeted by market makers intent on liquidating his positions—a phenomenon that is sometimes discussed within cryptocurrency trading communities where whale accounts can become targets for professional trading firms. Wynn even reached out to the crypto community for help, and at least 24 separate addresses sent him funds in an effort to shore up his depleted account.

Shortly after receiving community support, Wynn revealed he had liquidated another 240 BTC, worth roughly $25 million at the time, as a strategic move to lower the liquidation price of his remaining Bitcoin positions. However, this and other defensive maneuvers were not enough to save his portfolio.

In total, Wynn lost more than 99% of the $100 million he once managed. His dramatic wipeout has sparked renewed debate within the crypto ecosystem over the dangers of leveraged trading. Many long-term investors have pointed to Wynn’s story as a cautionary tale, emphasizing the benefits of holding assets over engaging in high-risk, short-term trades.

The saga of James Wynn underscores the importance of risk management in cryptocurrency trading, serving as a stark lesson for both amateur and professional traders as digital asset markets remain as unpredictable as ever.

Source: itresan

Leave a Comment