3 Minutes

Global smartphone production recovers in Q2 2025

Industry researcher TrendForce reports that global smartphone production climbed to roughly 300 million units in Q2 2025, marking a 4% increase versus Q1 and a 4.8% year‑over‑year rise. After months of inventory pressure that constrained manufacturing, targeted subsidy programs and refreshed demand helped factories ramp back up across multiple regions.

How subsidies and inventory clearance changed the landscape

China’s government-backed subsidies for mid-range and entry-level phones played a pivotal role in clearing excess stock and stimulating orders. That policy, combined with aggressive regional promotions and price adjustments, accelerated shipments for several domestic brands and supported component suppliers along the value chain.

Top manufacturers: winners and laggards

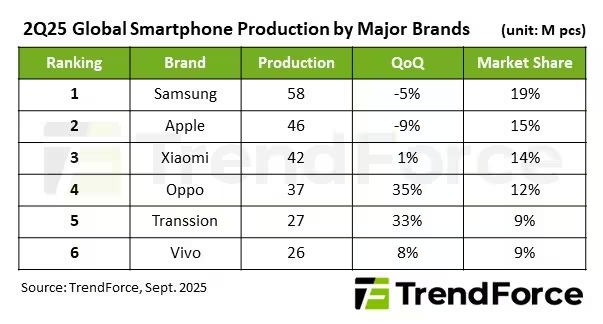

The market remains concentrated: the leading six vendors accounted for about 80% of global production in Q2 2025. Samsung retained the No. 1 position with approximately 58 million units, down roughly 5% quarter‑on‑quarter — a predictable cooldown after a spike tied to new flagship launches. Apple produced about 46 million iPhones in the quarter, a 9% decline from Q1 but a 4% increase year‑over‑year, helped by strong uptake of the iPhone 16e and strategic price reductions in China in May.

Xiaomi and regional expansion

Xiaomi, including Redmi and Poco labels, delivered about 42 million units. The maker benefited from China’s subsidy program and continued market expansion in South America and Africa, where value and distribution reach remain decisive.

Oppo, Transsion and vivo stage notable rebounds

Oppo — measured together with OnePlus and Realme — produced around 37 million units, staging a roughly 35% rebound after a softer Q1. Transsion brands (Tecno, Infinix, itel) climbed about 33% quarter‑on‑quarter to 27 million units, reflecting their strength in emerging markets. Vivo, including iQOO, increased output by about 8% to roughly 26 million units.

Product features, comparisons and advantages

Across the lineup, vendors continue to differentiate with features important to consumers and enterprise buyers: improved multi-camera systems, on‑device AI, longer battery life, faster charging, and enhanced 5G/AIoT integration. Flagship models emphasize premium displays and advanced compute for photography, gaming and multitasking, while mid‑range models focus on battery endurance, value pricing and robust offline/online distribution — a combination that resonates in emerging markets.

Use cases and market relevance

For consumers, the mix of affordable mid-range devices and competitively priced flagships expands options for content creation, cloud gaming and mobile productivity. For carriers and retailers, a shift toward mid-tier volume means supply chains, aftersales service and software update commitments are more important than ever. From an industry standpoint, the concentration of production among the top six players underscores ongoing consolidation and the growing importance of scale, regional channel partnerships and localized pricing strategies.

Outlook

As inventories normalize and subsidy programs influence demand, expect more quarter‑to‑quarter volatility tied to product launches and seasonal promotions. Manufacturers that balance innovation with competitive pricing and strong distribution will likely extend their momentum into the second half of 2025.

Source: gsmarena

Leave a Comment