4 Minutes

Apple Holds Top Spot as iPhone 16 Series Leads Global Sales

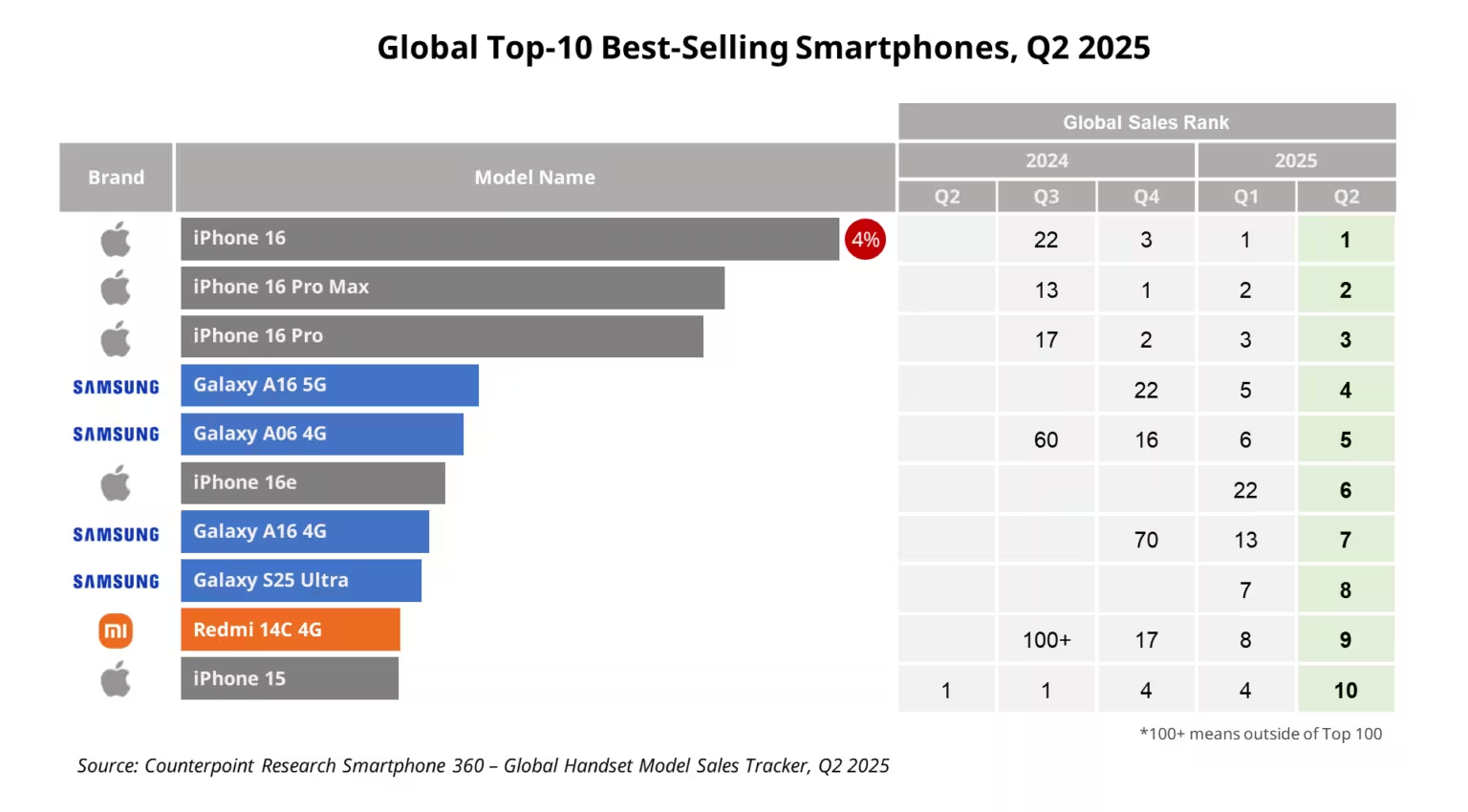

New market data for Q2 2025 shows the smartphone landscape remaining sharply divided by price tier. Counterpoint Research reports that Apple once again dominated unit sales between April and June, with the iPhone 16 emerging as the world’s best-selling handset. The iPhone 16 Pro Max and iPhone 16 Pro followed closely, reinforcing Apple’s grip on the premium segment and high-margin market share.

Galaxy A16 5G: The Best-Selling Android Phone of the Quarter

Samsung scored a notable win in the mid-range and budget categories. The Galaxy A16 5G finished fourth overall and was the highest-selling Android device in the quarter. Its success stems from a combination of pragmatic hardware, competitive pricing, and extended software support—an increasingly important factor for value-conscious buyers.

Key features of the Galaxy A16 5G

- Processor options: Exynos 1330 or MediaTek Dimensity 6300 depending on region

- Commitment to up to six years of Android updates

- Balanced battery life and essential cameras optimized for everyday use

- Price-performance positioning for emerging markets and budget shoppers

Other Notable Models and Market Movements

Samsung's Galaxy A06 4G also posted strong sales, landing in fifth place. Apple’s more affordable iPhone 16e made the top ten at number six by trimming premium extras like the ultra-wide camera and MagSafe while retaining the A18 chip—an example of Apple optimizing hardware and price to boost adoption in cost-sensitive regions.

High-end Android flagships had limited visibility in the rankings: the Galaxy S25 Ultra was the only flagship to break into the top ten. Xiaomi’s Redmi 14C 4G claimed a spot as well, driven by robust demand in Latin America, the Middle East, and Africa. Beyond Apple and Samsung, Xiaomi was the only other brand to make the list, highlighting how concentrated global smartphone sales remain.

Comparisons: Premium vs Mid-Range vs Budget

Apple continues to dominate the premium tier with strong brand loyalty, seamless hardware-software integration, and lucrative services revenue. In contrast, Samsung’s strength is playing out in two dimensions: flagship innovation at the high end and aggressive value propositions in the mid-range and entry-level segments. Xiaomi and other Android makers focus heavily on price-to-spec ratios, particularly in developing regions where cost, battery life, and network compatibility drive purchase decisions.

Advantages and use cases

- iPhone 16 series: Best for users seeking premium cameras, ecosystem integration, and high resale value—suitable for professionals and power users.

- Galaxy A16 5G: Ideal for buyers who prioritize long-term software updates, dependable daily performance, and affordability—great for students and first-time smartphone buyers.

- Redmi 14C 4G and A06 4G: Practical choices in regions where 4G remains dominant and price sensitivity is high.

Market Relevance and What It Means for Consumers

The Q2 2025 figures underline a persistent market split: Apple leads premium device sales while Samsung and Xiaomi battle for control of mid-range and budget categories. For consumers, this means clearer choices: invest in premium hardware and ecosystem features with Apple, or opt for flexible, cost-effective Android options that deliver long-term value through extended Android updates and region-specific optimizations. For industry watchers, the data highlights the ongoing importance of software support, regional strategy, and competitive pricing in shaping global smartphone market share.

Source: gizmochina

.webp)

Leave a Comment