4 Minutes

Pepe Coin price rally accelerates as massive exchange outflows reduce circulating supply

Pepe Coin (PEPE) extended a multi-day upswing on Sep. 13, climbing to a one-month high as traders and investors moved a substantial chunk of the token supply off centralized exchanges. The sudden withdrawal of roughly 1.1 trillion PEPE from exchange wallets coincided with sharply higher trading volume and a notable uptick in derivatives activity.

Key market moves: supply shift and record volume

On Sep. 13, PEPE traded as high as $0.00001200, while 24-hour trading volume topped $1.34 billion — outpacing comparable meme tokens such as Shiba Inu ($406 million) and Pudgy Penguins ($592 million). Exchange reserves of Pepe fell to approximately 255.9 trillion tokens from about 257 trillion on Sept. 11, a decline that points to increased self-custody and reduced selling pressure on exchanges.

A large-scale transfer of tokens from exchange addresses into private wallets typically signals stronger holder conviction and can tighten the available tradable supply. That dynamic likely helped underpin the recent price appreciation for this memecoin.

Derivatives tell a bullish story

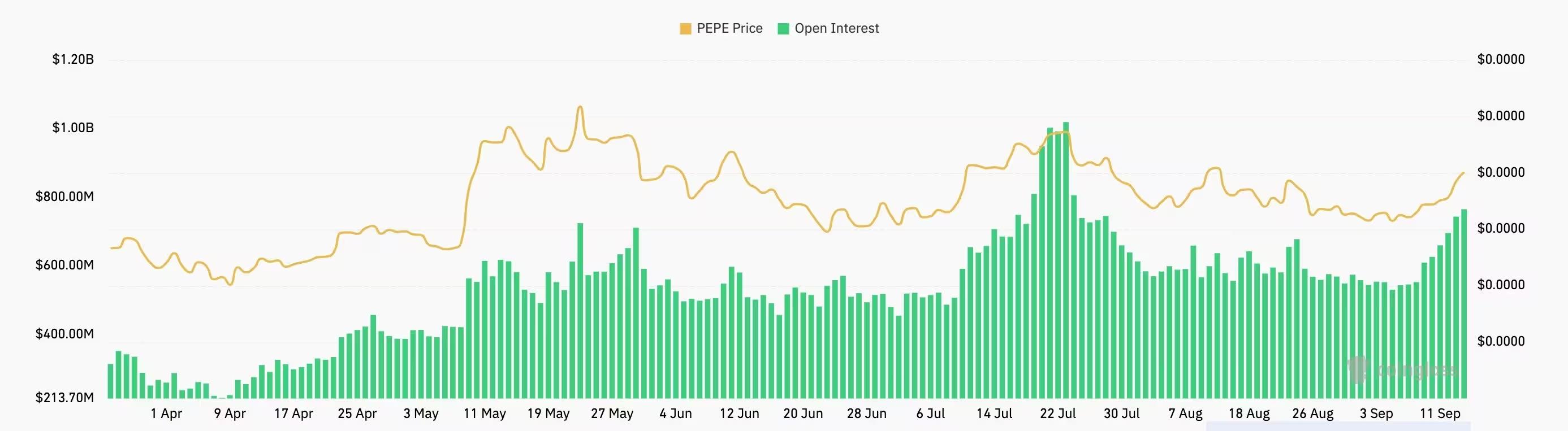

Per on-chain derivatives trackers, Pepe’s futures open interest has surged to levels not seen since July. Open interest rose above $765 million after bottoming near $500 million on Sept. 5, an on-chain indicator that institutional and retail traders are deploying more leverage and capital into PEPE derivatives markets.

Futures open interest | Source: CoinGlass

Higher open interest alongside growing spot volume often reflects fresh demand and increased market attention, which can amplify volatility — both to the upside and downside — as positions are built or unwound.

Technical outlook: falling wedge breakout and bullish momentum

Pepe’s daily chart shows a rebound from earlier lows near $0.0000091 to the recent high of $0.00001200. The breakout followed a falling wedge formation — a bullish reversal pattern marked by two descending, converging trendlines. Momentum indicators support the bullish case: the Relative Strength Index (RSI) climbed to about 65, its strongest reading since late July, and the Percentage Price Oscillator (PPO) registered a bullish crossover.

Given these signals, a near-term upside target sits around $0.00001475 — roughly 22% above the current level and near July’s high. Traders should, however, monitor the ascending trendline that connects March’s lows; a decisive break below that line would invalidate the current bullish outlook and could invite deeper retracement.

Pepe price chart | Source: crypto.news

Why this matters for crypto investors

- Exchange outflows: Large withdrawals into private wallets are often interpreted as confidence in long-term holdings and reduce immediate sell-side liquidity.

- Futures open interest: Rising OI indicates growing leveraged exposure; it can fuel momentum but also raise the risk of sharp liquidations if sentiment flips.

- Technical setup: A falling wedge breakout backed by rising RSI and PPO crossovers offers a constructive technical case, though stop management and risk controls remain essential.

Social context and meme token dynamics

Pepe’s mascot — the Pepe the Frog meme — briefly re-entered headlines due to unrelated political reporting involving groups that have at times adopted meme imagery. While cultural and political associations can affect social sentiment around a memecoin, price action ultimately responds to on-chain flows, liquidity, and derivatives positioning.

Outlook and risk considerations

The current Pepe forecast leans bullish while exchange supply continues to shrink and futures open interest rises. Still, memecoins are inherently volatile, and rapid inflows or news-driven events can reverse trends quickly. Traders should weigh leverage exposure carefully, use position sizing and stop-loss strategies, and keep an eye on on-chain metrics such as exchange reserves and open interest for early signals of trend change.

Source: crypto

Leave a Comment