3 Minutes

Whales Dump 147K BTC, Putting Price Pressure on Bitcoin

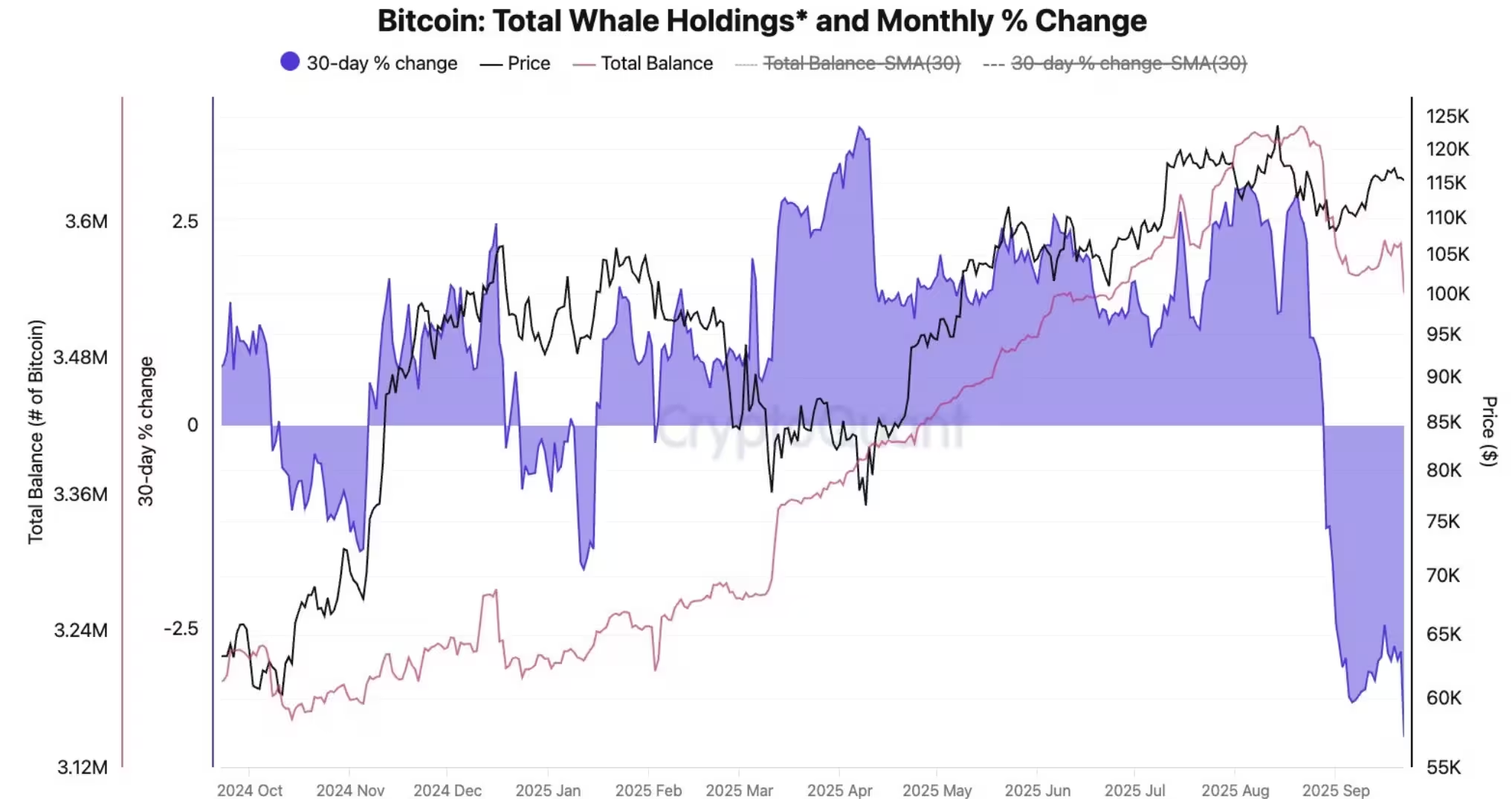

Large Bitcoin holders have reduced their inventories by roughly 147,000 BTC in the past 30 days, equivalent to about $16.5 billion at current market prices. CryptoQuant research indicates this represents a more than 2.7% decline in total whale balances and the fastest monthly drop of the current cycle. Analysts warn continued selling by these whales could intensify downward pressure on BTC in the coming weeks.

Bitcoin: Total whale holdings and 30-day percentage change

Who is selling and where are coins going?

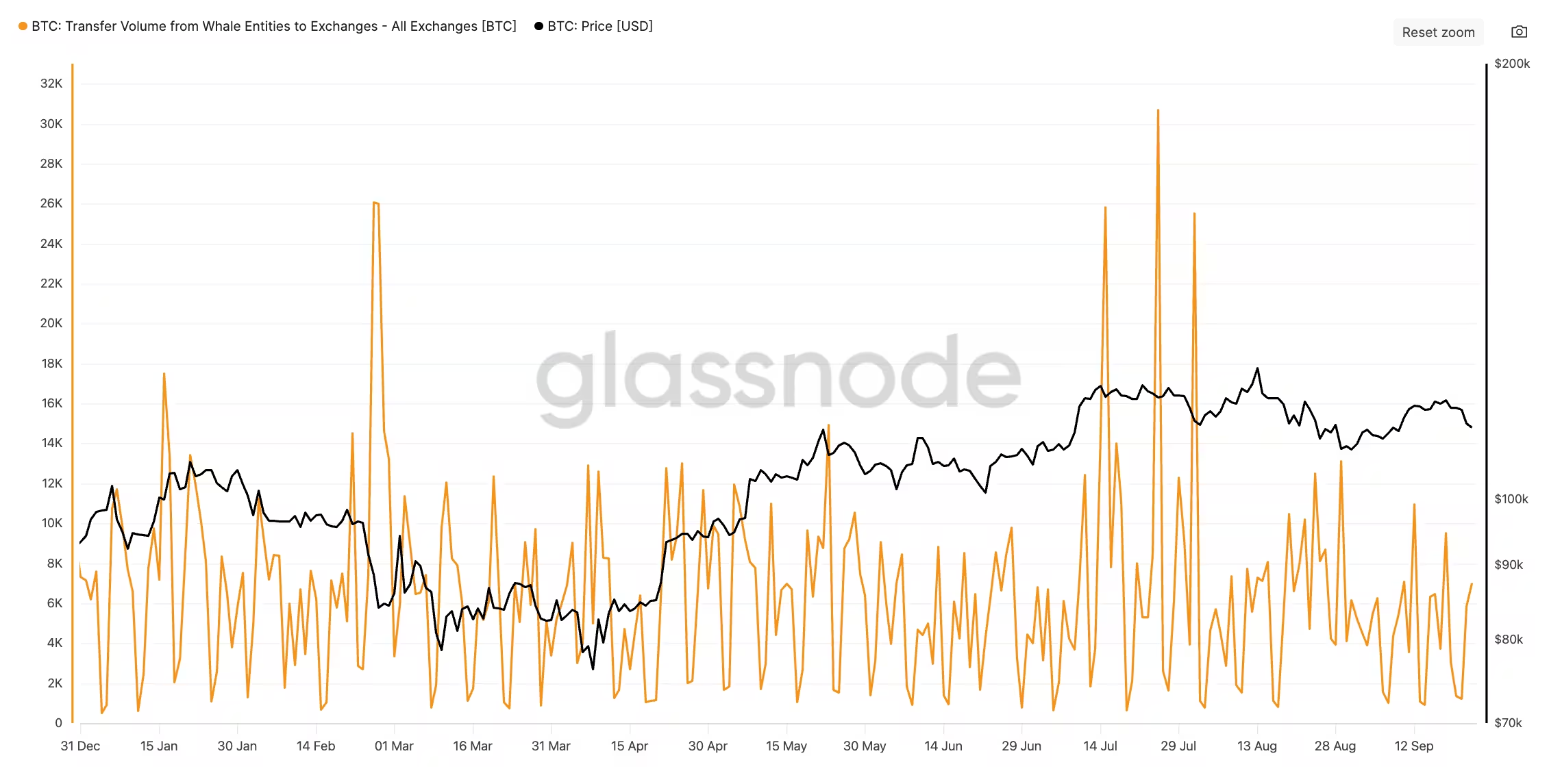

CryptoQuant team members have noted that much of the movement has come from long-term holder (LTH) whales, including transfers from cohorts aged six to 12 months. Some moves averaged about 8,500 BTC each, which translates into roughly $10 billion of potential selling pressure when valued near $115,000.

Bitcoin: Transfer volume from whales to exchanges

Corporate treasuries and ETFs are buying

At the same time, corporate buyers and treasury entities continue aggressive accumulation. Public firms like Japan’s Metaplanet and strategies linked to Michael Saylor have added sizable amounts — Metaplanet recently added 5,419 BTC, while Saylor’s vehicle increased holdings to more than 639,000 BTC. Crypto investment firms note that corporations now hold more bitcoin than ETFs, and both classes of buyers are accelerating purchases, helping absorb some of the whales' profit-taking.

Technical outlook: Bear flag points to $100,000

On the technical side, BTC fell below $116,000 and lost both the 50-day SMA (~$114,300) and 100-day SMA (~$113,400), validating a bear flag on the daily chart. Traders say the immediate support zone sits between $112,000 and $110,000 — a daily close beneath that range could trigger a deeper sell-off toward the bear-flag target near $100,000, representing about an 11% drop from current levels.

BTCUSD daily chart

Momentum indicators

The RSI has slid from 61 to 44 over the past week, signaling building downside momentum. If buyers step in, bulls could find a foothold closer to $106,000, but the path depends on whether ETF inflows and corporate treasury buys continue to absorb whale supply.

Overall, the market balance now hinges on whether institutional and corporate accumulation can offset sustained whale selling — key dynamics for BTC price action and the $100K scenario.

Source: cointelegraph

Leave a Comment