3 Minutes

A proposed U.S. policy to levy tariffs based on the chip content inside imported electronics could raise the cost of consumer PCs and graphics cards. The draft plan aims to encourage domestic chip manufacturing, but it also introduces uncertainty and potential price shocks for buyers.

How the proposed chip-content tariffs would work

The administration is reportedly considering a tariff calculated as a percentage of an item's estimated chip value rather than a flat duty on the finished product. In practical terms, that means devices containing semiconductors made overseas—by companies such as TSMC—could be hit with additional import fees if the chips are traced to foreign fabs.

Details remain sketchy. Officials would need a system to assess the chip content for each device, determine origin and destination, and assign tariff rates by chip type. That process would add significant operational overhead for customs authorities and manufacturers alike.

Which products are likely to be affected and why it matters

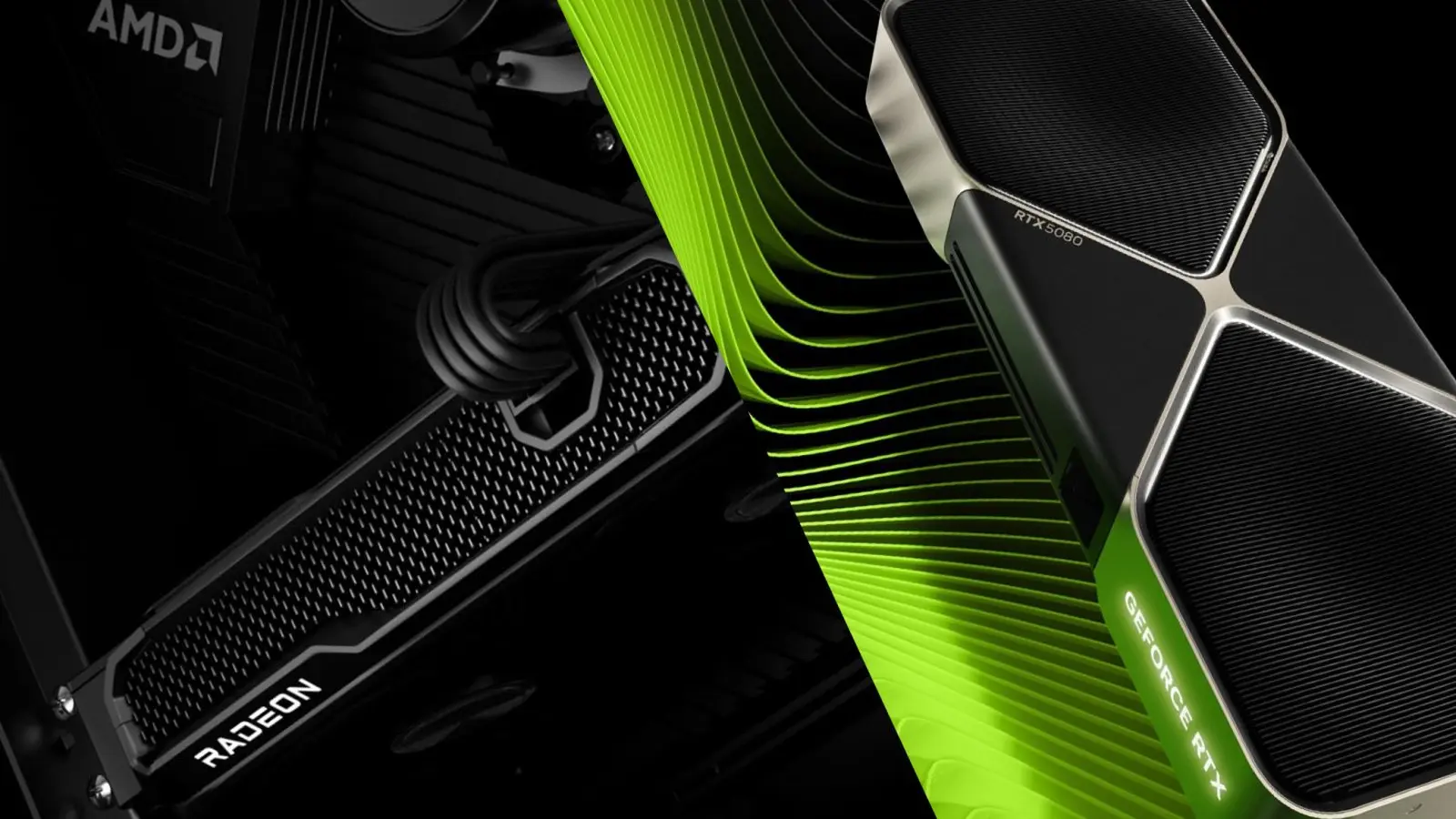

Consumer GPUs and CPUs are particularly exposed because many are produced using offshore foundries. Popular designs like NVIDIA's GeForce RTX series and AMD's Ryzen lines often rely on TSMC fabs in Taiwan, Thailand, or Indonesia. If the tariff is applied to the chip portion of those products, retail prices for laptops, discrete graphics cards, and desktop processors could climb sharply.

.avif)

Manufacturers are already taking steps to localize production—AMD has announced moves to TSMC’s Arizona facility for some Ryzen chips, and NVIDIA has signaled similar efforts. Still, until such shifts are widespread and verifiable, the threat of tariffs remains.

What price changes could look like

Observers have modeled worst-case scenarios where tariffs reach very high levels. For example, a hypothetical 100% tariff on chip content could roughly double the end price of certain components. Estimated examples (illustrative only):

| AMD Ryzen 7 9800X3D (MSRP) | $479 → ≈ $958 |

| NVIDIA GeForce RTX 5080 (MSRP) | $999 → ≈ $1,998 |

| NVIDIA GeForce RTX 5090 (MSRP) | $1,999 → ≈ $3,998 |

| AMD Radeon RX 9070 XT (MSRP) | $599 → ≈ $1,198 |

These figures are speculative and depend on how tariffs are measured and enforced. They illustrate the potential consumer impact if the policy is implemented in a strict form.

Practical implications for industry and buyers

For chipmakers and OEMs, the policy would incentivize faster relocation or duplication of production in the U.S. But dual-sourcing strategies—splitting workloads across domestic and foreign fabs—may not be enough if the tariff targets the percentage of foreign chip content. Consumers could see higher prices, supply-chain disruptions, or limited product availability during any transition period.

Conclusion

The proposed chip-content tariffs aim to accelerate reshoring of semiconductor manufacturing, but they come with trade-offs. Without clear rules and predictable timelines, the plan could trigger price increases for CPUs, GPUs, and other electronics. Buyers and industry watchers should track both policy details and manufacturers’ localization progress to understand the true impact.

Source: wccftech

Leave a Comment