6 Minutes

Buick Electra L7 Tops Independent China AD Test — Tesla Trails

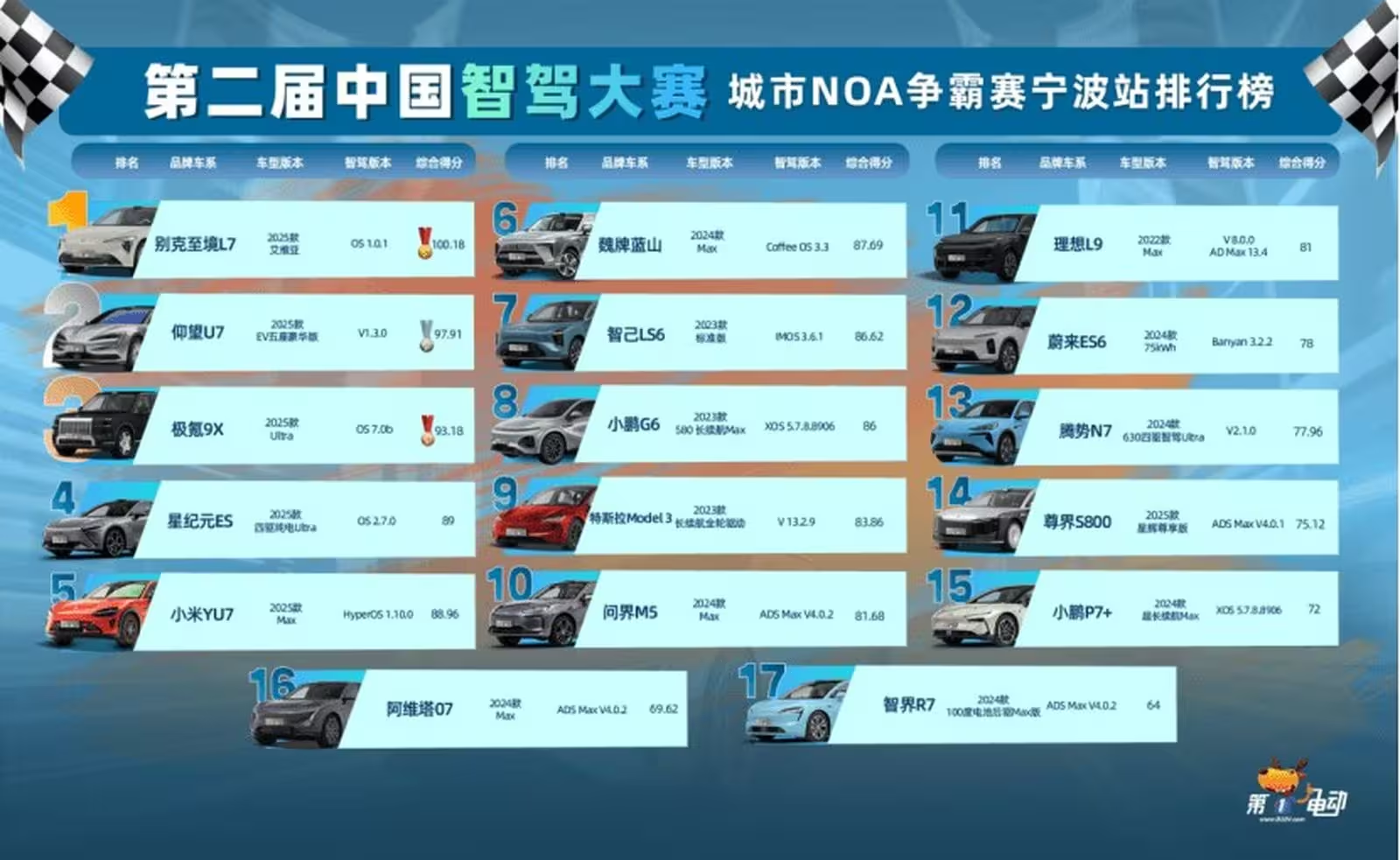

Just days after Tesla told investors full autonomy was within reach, an independent autonomous driving competition in China delivered a very different message. Organized by D1EV in Ningbo, Zhejiang, the Second China Intelligent Assisted Driving Competition placed the SAIC-GM Buick Electra L7 at the top of a 17-car field, while the Tesla Model 3 finished a disappointing ninth.

The 29-kilometer urban and rural course — featuring 28 traffic lights, five waypoints and eight demanding test sites — was kept secret to prevent teams from tailoring their systems to specific scenarios. That secrecy revealed real-world strengths and weaknesses across a wide range of advanced driver-assistance systems (ADAS) and autonomous driving stacks.

Key results

- 1st: Buick Electra L7 (SAIC-GM) — 100.18 points

- 2nd: BYD YangWang U7 — 97.91 points

- 3rd: Geely Zeekr 9X — 93.18 points

- 5th: Xiaomi YU7 — 88.96 points

- 9th: Tesla Model 3 — 83.86 points

These results underscore a larger trend: in China, many automakers and tech firms have rapidly advanced ADAS and autonomous features, often using LiDAR and multi-sensor fusion alongside high-performance mapping and AI models.

Why the Electra L7 won

The Electra L7 is an SAIC-GM extended-range electric vehicle (EREV) that combines an efficient powertrain with a robust autonomous stack. Crucially, it is the first vehicle in the competition equipped with Momenta's R6 Flywheel Big Model AD platform for its Navigate on Autopilot (NOA) system. Momenta's large-scale perception and planning model emphasizes multi-sensor fusion — especially LiDAR — and appears to have been decisive on the course.

Several test segments highlighted that advantage. A man-made transparent plastic screen designed to simulate low-visibility obstacles was detected by only six cars: Li Auto L9, YangWang U7, Nio ES6, Buick Electra L7, Zeekr 9X and Xiaomi YU7 — all of which carry LiDAR. Vision-only systems, including Tesla's FSD/Intelligent Assisted Driving, missed that obstacle entirely.

Course challenges and system behaviors

The course mixed tight residential lanes, roundabouts, blind-turn U-turns, rural lanes and contrived obstacles to evaluate navigation, lane selection, obstacle detection and decision-making. Highlights:

- Narrow roads: Designed to test precision and avoidance; three cars requested driver takeover (Wey 07, Xiaomi YU7, Xpeng G6).

- Roundabouts: Successfully completed by all entrants, showing improved lane-selection logic across the market.

- Blind-spot U-turns: Tripped up several cars; Nio ES6 and Xpeng G6 requested driver takeovers while Denza N7 deviated from navigation.

- Man-made transparent obstacle: Only LiDAR-equipped cars reliably detected it.

- Confusing U-turn route: Several models took wrong roads or required interventions, revealing weaknesses in route reasoning under ambiguous signage.

Two additional scenarios — a right-turn intersection with a U-turn and a lightly trafficked rural road — further separated contenders. The Tesla Model 3 did complete the right-turn test successfully but still lacked consistency across the entire route, which contributed to its mid-pack placement.

What this means for Tesla and the broader AD market

Tesla has been vocal about a push toward artificial intelligence, robotaxis and full autonomy, with Elon Musk promising unsupervised driving capability by the end of 2025. In North America the narrative often centers on Tesla versus Waymo, the latter running driverless operations in limited areas. But the Chinese market presents a crowded, fast-moving landscape: local automakers and tech firms are integrating LiDAR, high-precision mapping and large-model AI approaches to make AD features more robust in complex urban and rural mixes.

This competition suggests two important takeaways:

- Sensor choice matters. LiDAR-equipped systems showed clear advantages in obstacle detection and scenario awareness, particularly for transparent or low-contrast hazards.

- End-to-end promises do not substitute for consistent, scenario-proven performance. A single successful demo or investor claim won’t outweigh repeated, varied field testing in public roads and competition settings.

Market and product context

The Electra L7’s victory boosts SAIC-GM’s credentials in a market where consumers and regulators are increasingly focused on ADAS safety and real-world validation. For Tesla, the result is a reminder that vision-only approaches still face limits in certain use cases — especially when large-model perception and LiDAR-enhanced fusion are in play.

Quote: "The Electra L7 showed consistent decision-making across diverse scenarios," said a competition observer. "This is what will matter to customers and fleet operators when choosing AD-enabled cars."

Looking ahead

Expect further rounds of testing and public demonstrations as automakers refine their NOA and ADAS features. Momentum in China will likely push more partnerships between OEMs and AI firms (like Momenta), and may accelerate LiDAR adoption in mid- to high-tier models.

For drivers and fleet buyers, the lesson is simple: focus on validated system performance in real-world conditions rather than promises. Competitions like the D1EV event are valuable because they expose systems to hidden, diverse scenarios — a stronger gauge of readiness than scripted demos.

Highlights

- Event: Second China Intelligent Assisted Driving Competition, Ningbo

- Course: 29 km, 28 traffic lights, 5 waypoints, 8 test sites

- Winning tech: Momenta R6 Flywheel Big Model AD on Buick Electra L7

- Implication: LiDAR + large-model AI fusion currently outperforms vision-only solutions in complex scenarios

As the race for autonomous driving heats up, the winners will be the teams that prove safe, repeatable performance across unpredictable, real-world roads. This test shows Tesla still has homework to do — at least in the Chinese context — while legacy and local players press their advantage with new sensor stacks and AI partnerships.

Source: autoevolution

Comments

Reza

wow ok, Buick toppling Tesla lol. LiDAR + big models winning, but does that mean pricier cars? kinda excited and nervous 🤔

roadx

Is this even true? Tesla's vision only approach failing on a plastic screen... feels like a setup or, legit gap in tech. curious how apples-to-apples it was

Leave a Comment