3 Minutes

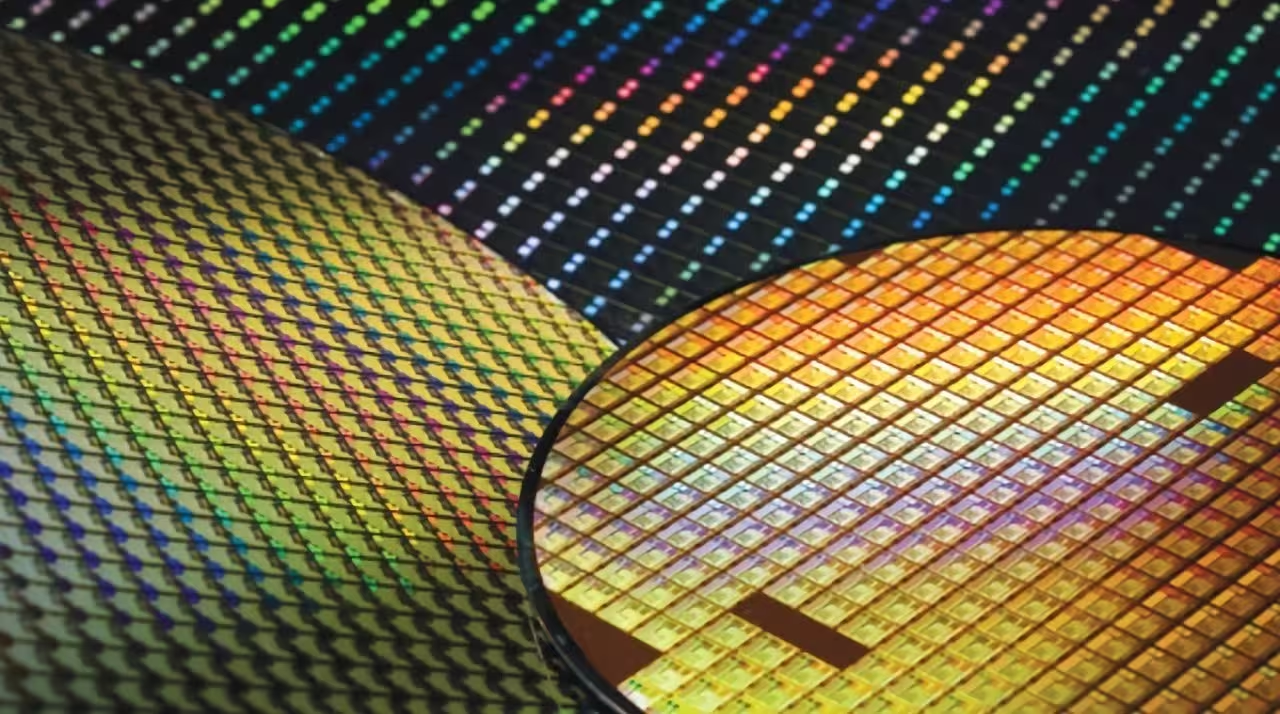

TSMC is preparing to adjust pricing on its most advanced semiconductor processes as global demand from mobile and high-performance computing (HPC) customers surges. Industry reports suggest negotiations are underway and that chip prices for leading nodes could rise by as much as 10% next year.

Why the price talk is heating up

According to the Taiwan Economic Daily, TSMC has begun discussing supply contracts with major clients, and the company’s most advanced lines — including 3nm and 5nm processes — are reportedly running at full capacity. That 100% utilization leaves little room to absorb cost pressures, so customers may see higher bills as TSMC factors increased demand and higher operating expenses into contract terms.

AI, HPC and mobile upgrades: the perfect storm

What’s driving the squeeze? Two things: the AI-driven boom in compute demand and an ongoing upgrade cycle in the mobile market. HPC customers now account for a growing share of TSMC’s order book, a shift from the company’s traditional mobile-dominated mix. Those HPC orders typically require advanced nodes and larger wafers, intensifying pressure on capacity.

Short supply, big buyers

- Advanced nodes are scarce: 3nm and 5nm lines are fully booked.

- HPC workloads consume more wafer real estate than typical mobile chips.

- With limited competitors at these cutting-edge nodes, TSMC has negotiation leverage.

Rising costs from global expansion

TSMC’s investments in overseas fabs — notably in the U.S. and Japan — are part of a long-term strategy to decentralize production, but they also mean higher short-term capital and operating costs. Those expenses, combined with tight capacity, are key reasons suppliers and analysts expect price increases. Still, the semiconductor leader is cautious: historically, it has preserved long-term partnerships by avoiding aggressive, sudden hikes.

Will customers walk away?

Even with price increases on the table, analysts and insiders expect demand to stay strong. The consensus view is that an increase of up to 10% would be modest given the current market dynamics — customers needing advanced chips for AI and HPC may accept higher unit prices rather than risk losing supply or delaying product roadmaps.

In short: TSMC appears poised to nudge prices higher as it balances full utilization, hefty capital spend on new fabs, and continued surging demand from both mobile and high-performance computing customers.

Source: wccftech

Leave a Comment