3 Minutes

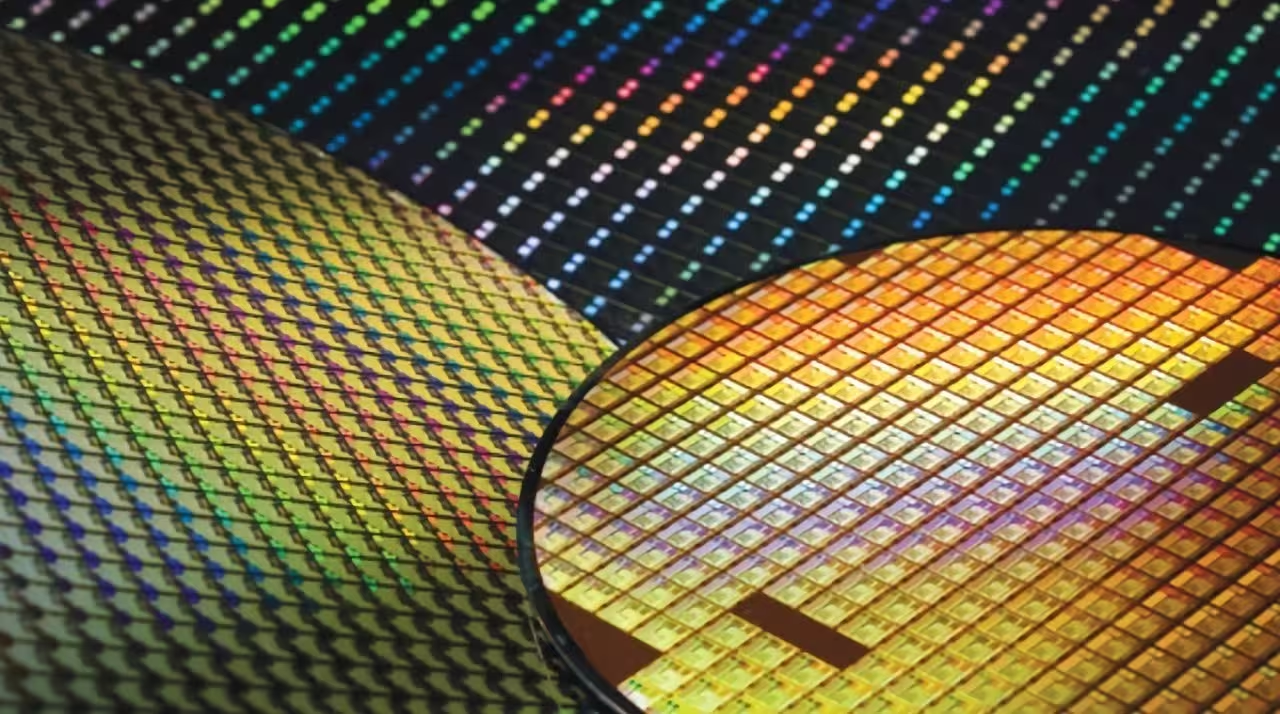

TSMC is reportedly preparing to raise prices on its most advanced semiconductor process nodes by roughly 5%–10% as it seeks to protect profit margins amid higher costs linked to US tariffs, currency shifts and supply-chain pressures. The move would primarily affect cutting-edge nodes including 5nm/4nm, 3nm and 2nm — the technologies driving AI accelerators, flagship smartphones and high-performance datacenter chips.

What changes are expected?

Price adjustments by node

Industry sources indicate the proposed increase targets TSMC's latest logic processes (5/4nm, 3nm and 2nm). At the same time, the foundry may offer more competitive pricing for mature, older nodes to balance customer relationships and capacity utilization.

Who will feel the impact?

Major customers that rely on TSMC for advanced SoCs and accelerators — such as cloud providers, GPU makers and leading smartphone OEMs — are likely to see higher wafer costs. Firms with large, recurrent orders (for AI training chips, mobile SoCs and custom silicon) will be most affected.

Product features and technical relevance

TSMC's advanced nodes deliver higher transistor density, lower power consumption and improved performance-per-watt — features essential for AI inference/ training accelerators, high-end mobile processors and specialized network ASICs. The 3nm and upcoming 2nm processes are focused on scaling logic density and energy efficiency, directly supporting next-generation chip designs and packaging innovations.

Comparisons and market position

TSMC remains the dominant pure-play foundry with the largest market share and the most mature high-volume production for advanced nodes. While competitors are closing gaps in process innovation, TSMC's combination of manufacturing yield, ecosystem support and advanced packaging capabilities gives it pricing leverage that few rivals can match today.

Advantages, use cases and market relevance

- Advantages: superior yields, established advanced packaging, and extensive customer ecosystem.

- Use cases: AI accelerators, datacenter GPUs, flagship smartphone SoCs, and high-performance networking chips.

- Market relevance: The hike reflects geopolitically driven costs (tariffs and reshoring investments), FX movements and significant capital deployed for U.S. fabs and packaging lines — notably the Arizona facilities intended to secure supply chains and localize advanced manufacturing.

Implications for industry and customers

A modest price rise could nudge system makers to reassess BOM costs, pass some expense to end-users, or shift more volume to older nodes and alternative suppliers where feasible. Nonetheless, for cutting-edge performance and energy efficiency, many customers will likely continue to rely on TSMC despite higher unit costs.

Conclusion

TSMC's potential 5%–10% increase on leading nodes underscores the balance between technological leadership and the rising costs of global supply-chain realignment. For tech companies racing to deploy AI silicon, the trade-off will be between securing the most advanced process technology and managing higher wafer spend.

Source: wccftech

Leave a Comment