3 Minutes

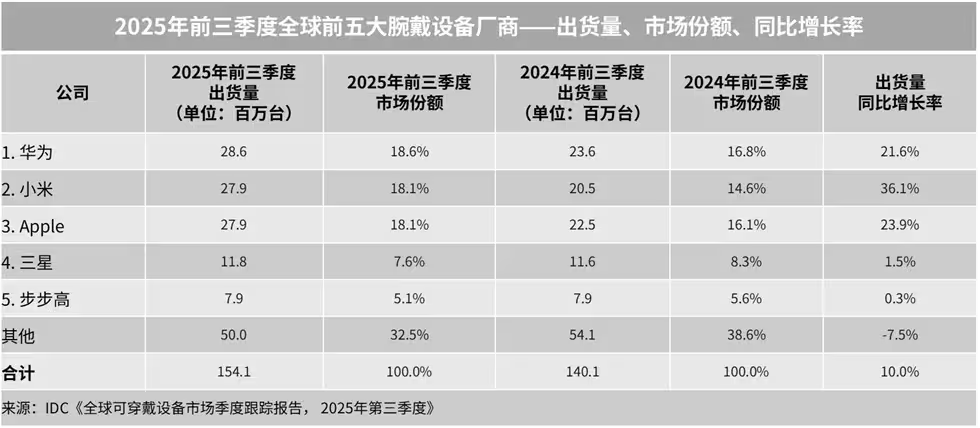

The global market for wrist-worn smart devices—covering both full-featured smartwatches and simpler fitness bands—surged in the first three quarters of the year, with IDC reporting robust shipment gains and shifting competitive dynamics.

Market snapshot: shipments climb to 150+ million

According to IDC, more than 150 million wrist-worn devices shipped worldwide during Q1–Q3, a roughly 10% increase versus the same period last year. Nearly 120 million of those were smartwatches, which grew 7.3% year-on-year. Meanwhile the more affordable fitness trackers posted an even bigger jump—32.86 million units, up 21.3%—as demand for budget wearables remains strong.

Huawei holds the lead while Xiaomi steals the growth spotlight

Huawei claimed the top spot over the nine-month period, moving an impressive 28.6 million units. The Huawei Watch GT 6 and Watch GT 6 Pro played important roles in that performance. IDC notes that the bulk of Huawei’s shipments—about 20.8 million—were concentrated in China, although the company is reportedly pushing to expand overseas.

Xiaomi finished a close second with 27.9 million units and was the fastest-growing brand among the top five. Affordable models such as the Xiaomi Smart Band 10 and the Redmi Watch lineup helped Xiaomi gain traction not only in China but also across Southeast Asia and South America.

Apple, Samsung and what’s next for wearables

Apple sits third globally but drops to fourth place in China, continuing to focus on mid- and high-end devices. This year Apple emphasized advanced connectivity—think 5G and satellite messaging—alongside richer health features. Samsung, meanwhile, rebounded after a sluggish first half: the Galaxy Watch8 and Galaxy Watch8 Classic, launched in Q3, boosted its year-to-date numbers.

So what’s driving the next phase of growth? IDC points to a mix of better connectivity, deeper AI integrations and more sophisticated health tracking as the main tailwinds for wearables in the coming year.

Key trends to watch

- Connectivity upgrades: 5G and satellite messaging are becoming standard selling points.

- AI on-device: smarter activity and health insights will differentiate products.

- Health tracking depth: continuous monitoring and clinically oriented features will appeal to premium buyers.

- Regional expansion: Chinese brands are increasingly targeting Southeast Asia, South America and beyond.

With demand for both premium smartwatches and budget-friendly fitness bands rising, manufacturers that combine strong hardware with advanced connectivity and useful AI-driven health features are best positioned to capture the next wave of growth.

Source: gsmarena

Leave a Comment