3 Minutes

NVIDIA CEO Jensen Huang made headlines at TSMC's Sports Day, delivering an emotional Mandarin speech and saying bluntly that 'without TSMC, there would be no NVIDIA today.' His visit underscores the tight link between the AI leader and Taiwan's chipmaking powerhouse as NVIDIA scrambles to secure more wafer capacity for its Blackwell chips and next-generation packaging.

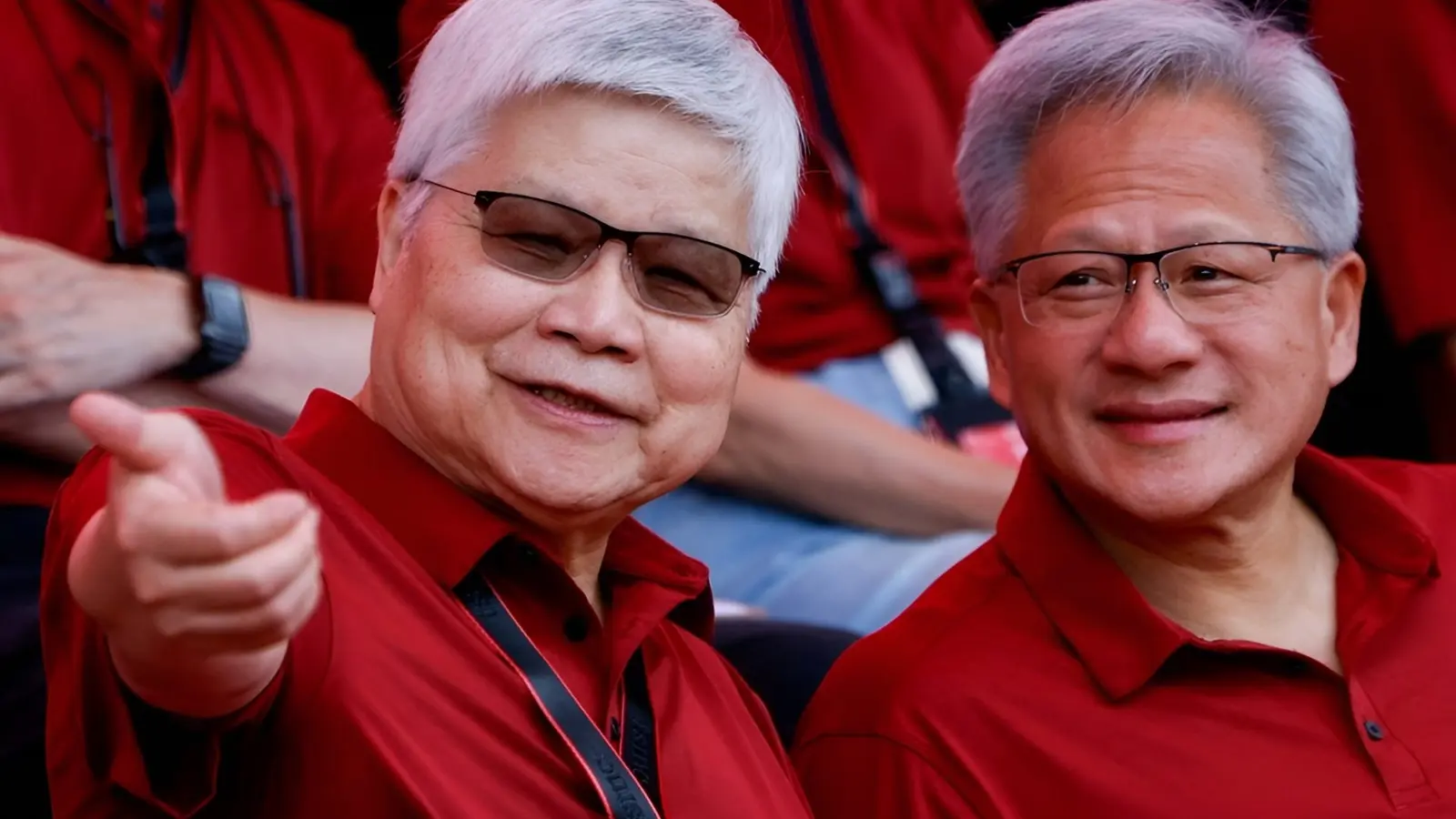

Huang's unexpected praise on TSMC's home turf

Appearing at TSMC's employee event, Huang thanked executives, engineers and factory workers alike, framing the chipmaker as not just a supplier but a strategic partner. That wasn't empty flattery: Huang has visited Taiwan multiple times this year, and each trip seems aimed at deepening collaboration as NVIDIA expands its AI hardware footprint.

Why TSMC is central to NVIDIA's AI strategy

Look at the supply chain and the statement reads less like hyperbole and more like fact. NVIDIA's latest Blackwell-series accelerators and rack-scale systems rely on advanced nodes and packaging that only a handful of foundries, led by TSMC, can deliver at scale. From 3nm production to high-density packaging technologies such as CoWoS, TSMC supplies both the wafers and the expertise that make these chips commercially viable.

- Blackwell demand: NVIDIA is pushing for additional wafers to meet huge customer orders.

- 3nm allocation: NVIDIA is expected to take a significant share of early 3nm output—reports suggest roughly 30%—highlighting the competition for leading-edge capacity.

- Advanced packaging: Services like CoWoS help turn chips into usable AI systems, a capability central to NVIDIA's advantage.

Can NVIDIA diversify away from TSMC?

Short answer: not easily. While the industry is exploring alternatives and software-level competition is heating up (see efforts to reduce CUDA dependency), shifting manufacturing at scale takes years and enormous capital. For now, TSMC's capacity, process maturity and packaging know-how make it the anchor of NVIDIA's production strategy.

Imagine trying to move a major cloud or AI GPU program to a new foundry overnight—it's not just wafer prints, it's validated designs, packaging, thermal profiles and a global logistics chain. That complexity explains why Huang is on the road in Taiwan, personally courting capacity and reinforcing the partnership.

What's next: capacity battles and closer ties

NVIDIA's push for more wafers—and its likely priority on early 3nm runs—signals an industry-wide capacity crunch. As demand for AI accelerators grows, so will the stakes: foundry allocations, long-term contracts and collaborative R&D will decide who gets chips first. Expect NVIDIA and TSMC to deepen coordination on scheduling, packaging and yield optimization as the AI hardware race accelerates.

Whether the phrase 'No TSMC, no NVIDIA' will age as bravado or prophecy depends on how quickly competitors, foundries and new packaging approaches can reshape the supply chain. For now, the message is clear: TSMC sits at the heart of NVIDIA's AI ambitions, and keeping that relationship close is a strategic priority.

Source: wccftech

Leave a Comment