3 Minutes

Bitcoin Retreats While Traditional Assets Advance

Bitcoin (BTC) slid to weekly lows near $101,300 as U.S. equities and precious metals rallied ahead of a pivotal House vote to end the U.S. government shutdown. The move highlights a short-term rotation from higher-risk crypto exposures into assets that are more directly sensitive to federal policy and economic data flows.

Market snapshot

U.S. stock markets climbed on optimism that lawmakers would pass a bill to reopen the government. The Dow Jones Industrial Average led gains, rising more than 0.9% and adding roughly 423 points, supported by strong returns from large financials including Goldman Sachs and JPMorgan Chase. The S&P 500 posted a small advance while the Nasdaq Composite showed modest weakness.

Bitcoin, by contrast, fell from an intraday peak of about $105,300 to a low near $101,200 — a roughly 3.4% decline that reflects renewed flows into equities and safe-haven metals.

Bitcoin four-hour chart

Gold and silver benefitted from both safe-haven demand and expectations that clearer economic data will resume once the shutdown ends; gold traded higher and silver rose above $53 per ounce.

Why Bitcoin weakened

Several factors likely contributed to BTC's pullback:

- Profit-taking after a short-lived rally earlier in the session.

- A rotation toward traditional, policy-sensitive assets such as bank stocks and precious metals as shutdown risk receded.

- Potentially reduced institutional inflows into crypto relative to conventional markets during periods of heightened political clarity.

As sentiment shifted toward assets with more direct exposure to interest-rate guidance and credit conditions, Bitcoin sat aside the primary rotation tied to governance and policy signals.

ETF Flows and Volatility Outlook

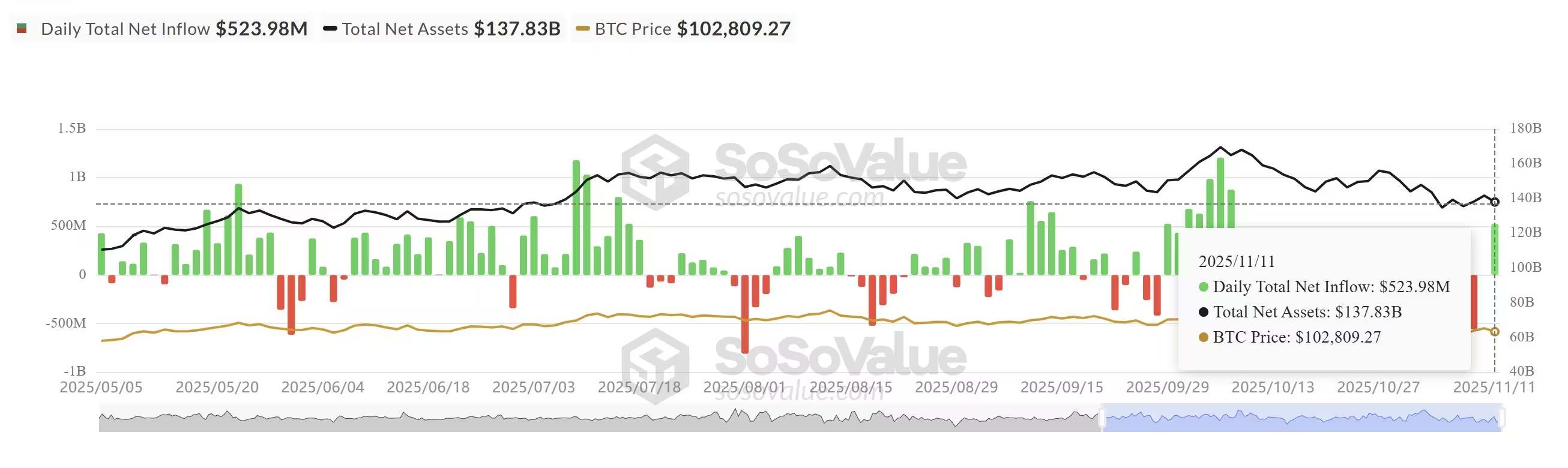

Despite the near-term weakness, indicators show that volatility could swing back in Bitcoin's favor. Spot Bitcoin exchange-traded funds recorded a combined net inflow of $524 million on Tuesday — the largest single-day total since early October — suggesting renewed institutional demand for BTC exposure via regulated ETF products.

Daily total netflows for spot BTC ETF

Looking ahead, the Federal Reserve’s policy decisions later this month will be a key catalyst. Any dovish tilt from the Fed could broaden risk appetite and send investors back into cryptocurrencies seeking diversification and higher returns. Conversely, if equities stabilize and rate expectations remain elevated, BTC may struggle to regain momentum until institutional flows ramp up further.

What traders should watch

- Congressional action on the government shutdown bill and ensuing market reaction.

- Spot Bitcoin ETF inflows and outflows as a gauge of institutional demand.

- Fed comments and U.S. economic releases that shape risk-on/risk-off dynamics.

In sum, Bitcoin's drop to around $101K illustrates a temporary market rotation into equities and precious metals as political uncertainty eases. However, improving ETF inflows and the prospect of Fed-driven policy moves mean BTC could see renewed volatility and upside if risk appetite returns.

Source: cointelegraph

Leave a Comment