3 Minutes

Kiyosaki: global cash crunch is fueling the market crash

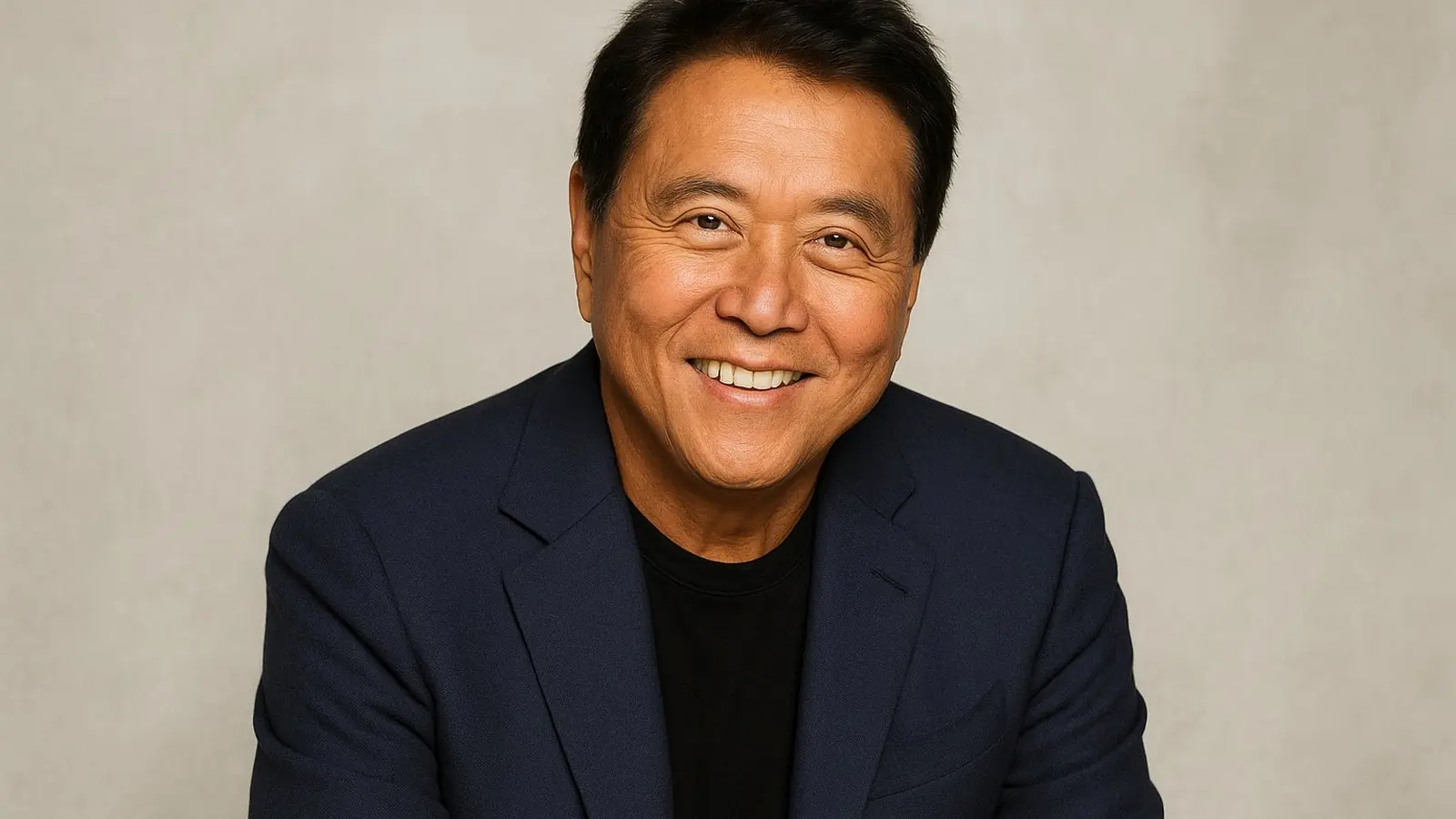

Robert Kiyosaki, author of Rich Dad Poor Dad, told his 2.8 million followers on X that he is holding onto Bitcoin and gold despite the recent market selloff. He argues that an acute global cash shortage, rather than pure market sentiment, is the primary driver of the declines across stocks, commodities, and crypto.

Why liquidity matters

Kiyosaki says the market turmoil is rooted in liquidity stress as businesses, institutions, and consumers scramble for cash. This kind of squeeze can force indiscriminate selling and amplify volatility in assets such as Bitcoin, BTC, gold, silver, and Ethereum. He recommends that anyone who truly needs cash consider selling assets, but cautions that many panic sales are driven by short-term liquidity needs rather than a loss of conviction in long-term value.

The Big Print thesis and crypto as a hedge

Echoing a concept he calls The Big Print, Kiyosaki points to the likelihood that governments will resort to expansive money printing to cover mounting debt burdens. He believes massive monetary expansion would devalue fiat currencies and bolster hard assets. In his view, gold, silver, Bitcoin, and Ethereum stand to gain real purchasing power as what he terms fake money weakens.

Buying strategy and BTC supply cap

Kiyosaki reiterated that he plans to buy more Bitcoin after the crash subsides, emphasizing Bitcoin's 21 million supply cap as a key attribute for long-term scarcity. For traders and investors focused on crypto, this aligns with the buy the dip mindset, although timing a bottom remains difficult.

Market indicators and cautionary notes from analysts

Crypto sentiment indicators have turned sharply negative. The Bitcoin Fear and Greed Index recently plunged into extreme fear territory, which some analysts interpret as a contrarian buying opportunity. However, analytics firm Santiment warns traders to be cautious about premature bottom calls. Santiment notes that widespread confidence that a bottom is in place can sometimes precede further declines, and that real market bottoms tend to form when most participants expect prices to fall further.

What traders should consider now

For crypto investors, the current environment emphasizes risk management and liquidity planning. Keep allocations diversified across core hedges such as BTC and gold, monitor macro indicators and sentiment metrics, and avoid forcing entries during periods of extreme volatility. Those with a long-term horizon who accept the risks may view these lower prices as an accumulation window, while others should prioritize liquidity and capital preservation until clearer signals emerge.

Source: cointelegraph

Leave a Comment