3 Minutes

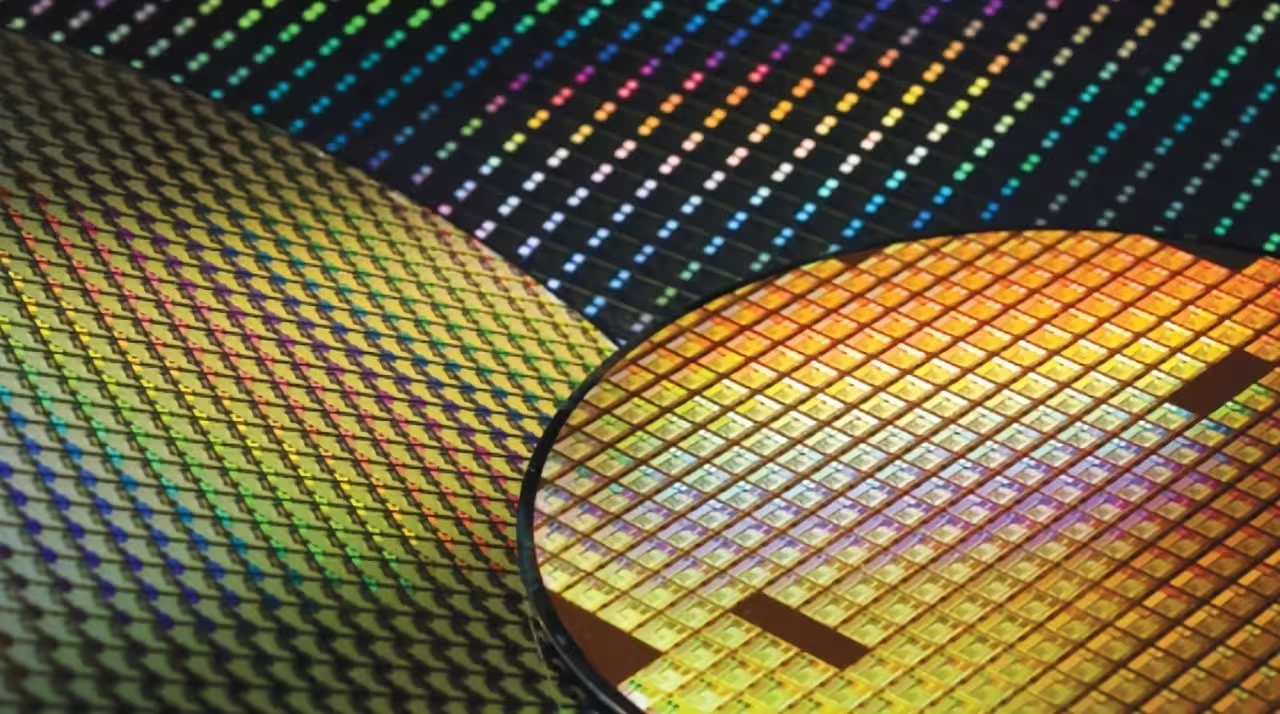

TSMC's massive push into the United States stirred more than headlines — it rewired the competitive map for advanced chipmaking. According to Taiwanese reporting and comments from a former envoy, the move to build fabs in Arizona was as much about reassuring US customers as it was about keeping rivals like Intel from becoming the default domestic supplier.

Investment as strategy: securing clients and supply

TSMC serves a who’s who of American tech: NVIDIA, AMD, Apple and others depend on its cutting-edge nodes. That customer base made US policy and market conditions critical to Taiwan's foundry leader. Reports cite Roy Chun Lee, Taiwan’s former EU envoy, who told local media that TSMC’s investments — part of a roughly $165 billion long-term plan — were intended to protect client trust and stabilize supply chains in the US.

Was the goal to block Intel?

Here’s the provocative claim: if TSMC had declined to expand in the US, Washington might have shifted its full political and financial support to Intel, elevating Team Blue from an alternative to the primary domestic option. That prospect alarmed TSMC and, according to Lee, made US-based investment a near necessity, not just a commercial choice.

What that means in practice

- For TSMC, US fabs reduce tariff exposure and reassure American customers of a local supply option.

- For Intel, TSMC’s presence complicates an easy path to becoming the dominant US foundry partner.

- For chip buyers, competition between foundries can mean better access, innovation, and resilience for the supply chain.

Scaling to advanced nodes and future facilities

So far, TSMC’s US bets have paid off. The company plans to push toward more advanced process nodes on American soil, with roadmaps that include next-generation technologies referenced in industry chatter (for example, the A16 1.6nm class of nodes). New facilities and expansions are on the table as the firm seeks to meet rising demand from its largest clients.

Whether you read this as geopolitical chess or straightforward commercial defense, the Arizona fabs underline a simple reality: in today’s semiconductor landscape, where customers, politics and technology intersect, physical presence matters. TSMC’s US investments are both a signal to its clients and a competitive move that reshapes Intel’s ambitions on home turf.

Source: wccftech

Leave a Comment