5 Minutes

DePIN’s quiet comeback: $10 billion and growing

Decentralized physical infrastructure networks (DePINs) have endured a wave of skepticism, but a new “State of DePIN 2025” report from research firm Messari and Escape Velocity reframes the narrative. Rather than a dead sector, DePIN is now an overlooked, cash-flowing segment of crypto infrastructure valued at roughly $10 billion and generating about $72 million in onchain revenue last year.

From token hype to verifiable revenue

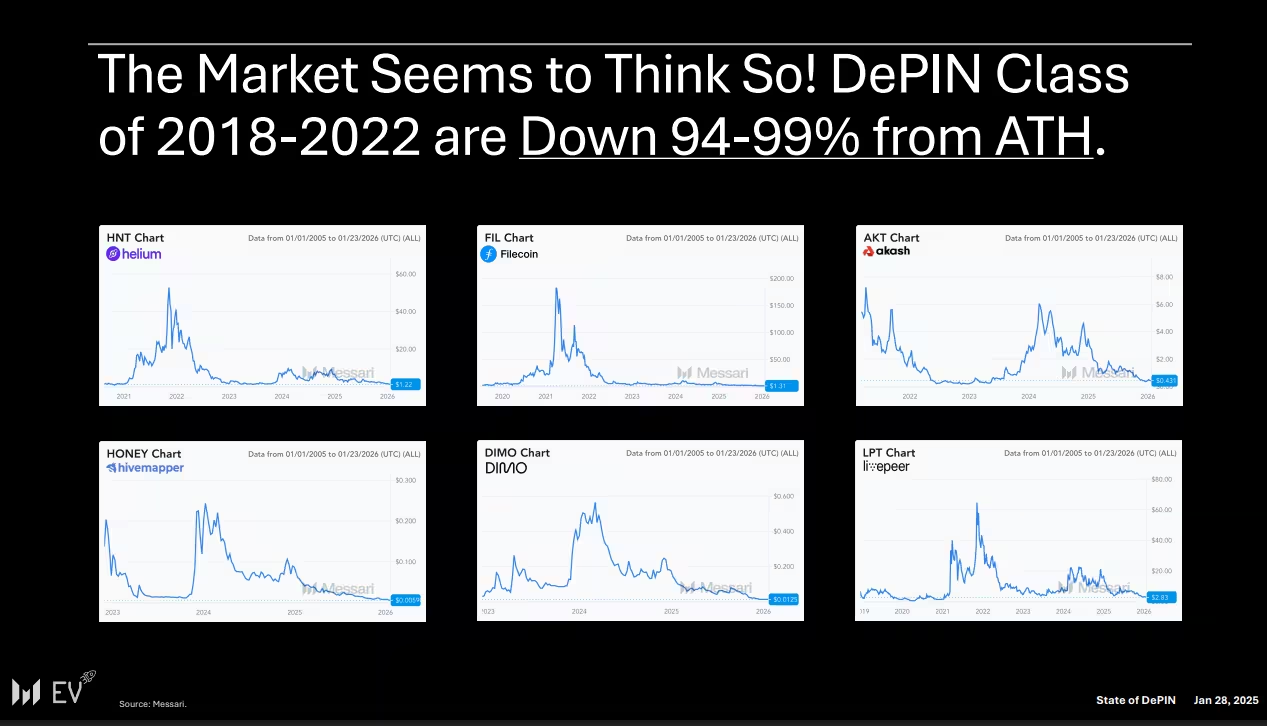

Early DePIN projects that emerged between 2018 and 2022 saw dramatic token price declines—many tokens are down 94–99% from their all-time highs—yet the underlying networks are starting to show sustainable economic activity. Messari’s analysis finds that leading DePIN projects report recurring, verifiable revenues and trade at revenue multiples (roughly 10–25x) that Messari considers conservative relative to their growth trajectories.

Crucially, this shift represents a move away from subsidy-driven token models toward real-world utility. DePIN applications that monetize bandwidth, compute, energy, and sensor data are gaining traction as they deliver measurable value to end users and enterprises, not just speculative demand.

DePIN class of 2018-2022. Source: Messari

Why revenue matters more than token price

Markus Levin, co-founder of XYO, a data-focused DePIN established in 2018, emphasized that network valuations are beginning to reflect tangible economic activity. In his view, successful DePINs demonstrate utility first through usage and cash flow, which provides a foundation that can hold up even when token markets are flat. That makes revenue metrics essential when evaluating DePIN tokenomics and long-term viability.

DePIN: From hype cycles to durable utility

Messari contrasts “DePIN 2021” with “DePIN 2025.” The earlier cycle was dominated by pre-revenue networks with high token inflation, heavy retail-driven speculation, and valuations tied to hype. Today’s leading projects, by contrast, are posting onchain revenues, limiting supply inflation, and growing via cost or utility advantages rather than continuous incentives.

Real-world usage and resilient growth

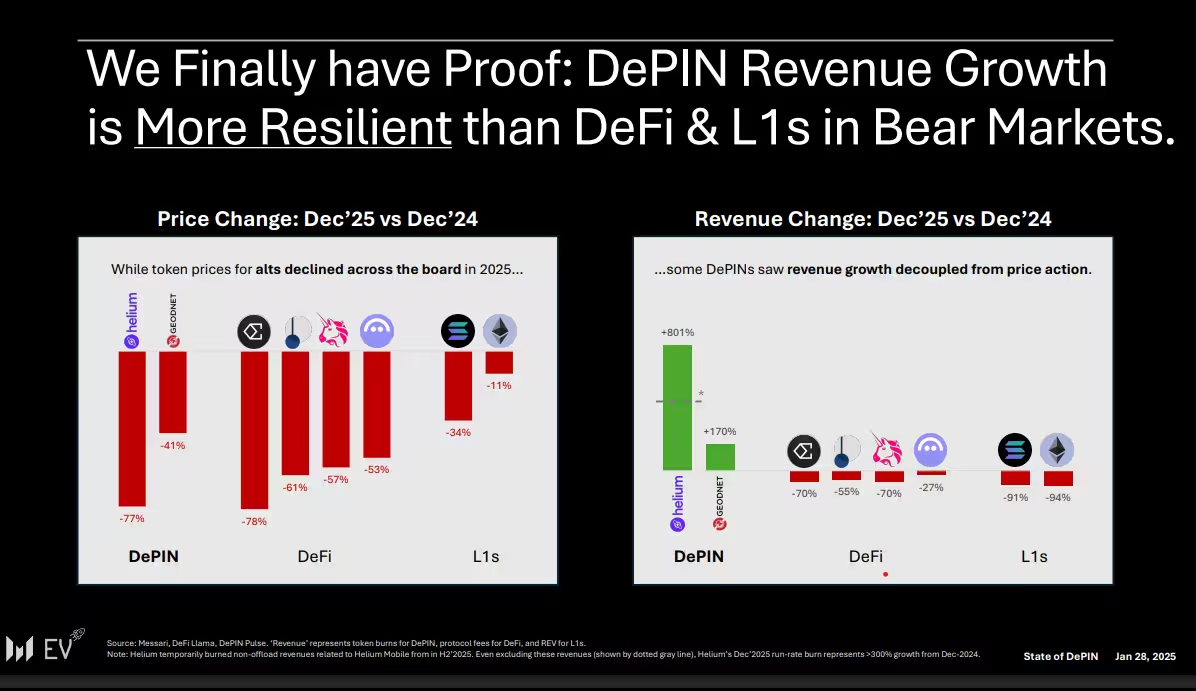

One notable finding is that DePIN revenue growth has held up better than revenues in decentralized finance (DeFi) and many layer-1 blockchains during the recent bear market. Messari highlights projects like Helium (HNT) and GEODNET (GEOD), which saw token price declines between late 2024 and late 2025, yet their onchain revenues rose substantially—roughly 8x and 1.7x respectively—over that period. That contrasts with steep revenue drops across leading DeFi protocols and smart-contract chains.

DePIN growth more resilient than DeFi and L1s. Source: Messari

Vertical winners and the revenue test

Levin explains the “big divider” within DePIN verticals is whether a network can consistently earn revenue from real customers without constant incentive programs. Some verticals—positioning, mapping, robotics—are finding repeatable enterprise use cases and stable demand. Others, particularly those constrained by regulation or intense competition, still face headwinds.

InfraFi: hybrid models funding real infrastructure

Funding for DePIN surged last year, with about $1 billion raised across the sector—up from $698 million in 2024. Messari calls attention to “InfraFi,” an emerging hybrid model that blends DeFi mechanisms with real-world infrastructure financing. In InfraFi setups, stablecoin holders can deposit funds to finance GPU fleets, energy assets, or bandwidth networks and earn yield backed by infrastructure cash flows. Examples cited in the report include USDai, Daylight, and Dawn, with USDai growing to roughly $685 million in deposits to underwrite compute capacity.

Valuation gap and future demand signals

Messari argues the top DePIN tokens resemble next-generation infrastructure companies in bandwidth, storage, compute, and sensing, yet many trade at prices that imply low survival odds. That, the report says, is a potential mispricing: networks that deliver consistent enterprise-grade service and capture AI-driven demand stand to benefit most as demand for decentralized compute, data, and telemetry scales.

What investors and builders should watch

For investors, the key signals are verified recurring revenue, low token inflation, and growing real-world customer adoption—particularly from enterprise and AI workloads. For builders, focusing on service reliability, cost advantage, and regulatory resilience will drive adoption beyond speculative cycles. As DePIN matures, its integration with Web3 infrastructure and hybrid DeFi models like InfraFi may reshape how real-world assets are funded and tokenized onchain.

In short, the DePIN narrative is shifting: from a story about token volatility to one about infrastructure economics, onchain revenue, and durable utility. That evolution could make DePIN one of the more resilient and strategically important sectors in the broader blockchain ecosystem.

Source: cointelegraph

Comments

astroset

Promising numbers, but feels like selective metrics. revenue doesnt equal profitability long term, supply inflation still lurking. we'll see

coinforge

If Helium revenue grew 8x but the token dumped, are markets just broken? curious about offchain deals, or am I missing something

Leave a Comment