5 Minutes

Dogecoin’s Recent Price Action Raises Concerns

Dogecoin (DOGE), one of the most popular meme coins in the cryptocurrency market, has recently failed to defend its critical $0.25 support level. This breach signals renewed pressure from sellers, leading many analysts to warn of a potential price decline toward the lower end of its trading range. As technical indicators flash bearish signs, liquidation heatmaps suggest a possible price rebound in coming days. The key question for crypto enthusiasts now is whether this is a buying window—or a sign of deeper risks ahead for DOGE holders.

Key Highlights from the Latest Dogecoin Analysis

According to the latest analysis from AMB Crypto, Dogecoin faced a sharp rejection from the $0.285 resistance—an area that also acted as a formidable ceiling back in February. While Bitcoin (BTC) has not experienced significant downward pressure and has been fluctuating between $116,700 and $122,000, Dogecoin hasn’t shown strength even during BTC’s consolidation. Selling pressure in the last 24 hours pushed DOGE below its previous support band, indicating a shift in sentiment.

The Breakdown of Dogecoin’s Support

The $0.25 threshold was widely viewed as a strong support where buyers hoped to defend DOGE’s price. However, this level was easily breached. At the time of writing, Dogecoin trades near $0.196, positioning this median range as the likely next target. The meme coin's price action suggests that further downside could be on the horizon unless buyers step in decisively.

Technical Analysis: A Bearish Outlook for DOGE

Dogecoin’s trading range now spans from $0.142 to $0.25. The 50-day moving average (MA50) sits just below the mid-range mark at $0.196, making both these levels potential support zones. Still, the failure to hold $0.25 last week was a pivotal moment, revealing the strength of the bears. The On-Balance Volume (OBV) indicator is showing a new low compared to last week, and the Relative Strength Index (RSI) has dropped below the neutral 50 mark. Both suggest sellers have taken control of the DOGE market for now.

Key DOGE Price Levels to Watch

- Major support: $0.195

- Downside target: $0.142 (bottom of the range)

- Resistance levels: $0.227 and $0.25

If the price firmly falls below $0.195 and stabilizes under that line, it could trigger a larger drop toward $0.142. Some crypto analysts recommend that traders wait for confirmation before initiating short positions, as volatility around these levels can lead to unexpected reversals.

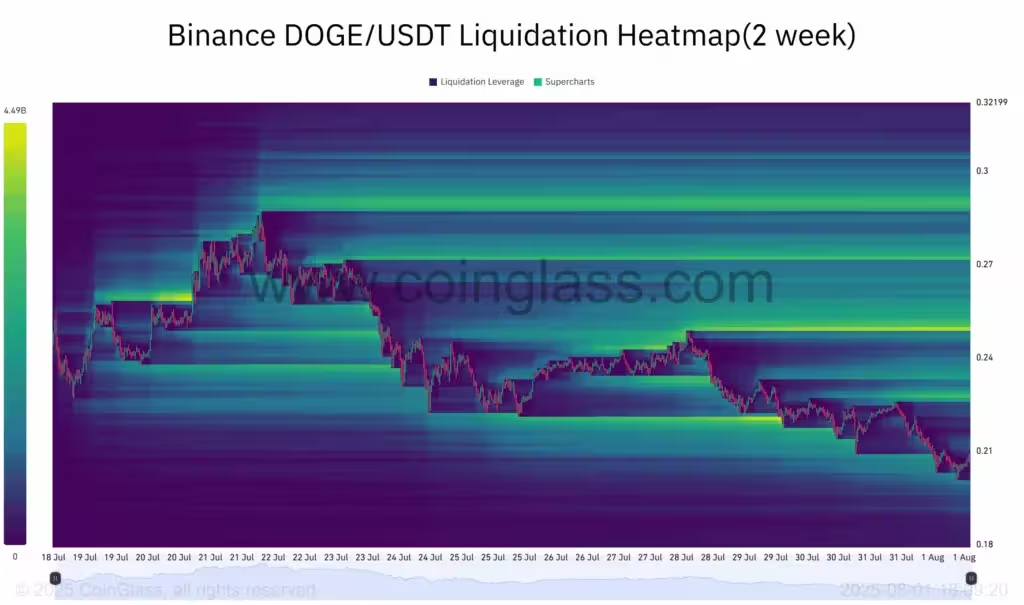

Liquidation Heatmap Hints at a Short-Term Rebound

Looking at the two-week liquidation heatmap, a significant cluster of liquidations lies just under the $0.20 mark. Above the current price, the $0.227 and $0.25 regions stand out as areas with high liquidity potential. When liquidation levels stack up above price, risk increases for short squeezes, where rapid upward movements can liquidate overleveraged positions. Despite the prevailing bearish trend, these liquidation clusters indicate that DOGE could see swift rallies if conditions align—especially should Bitcoin regain its pivotal $116,700 support.

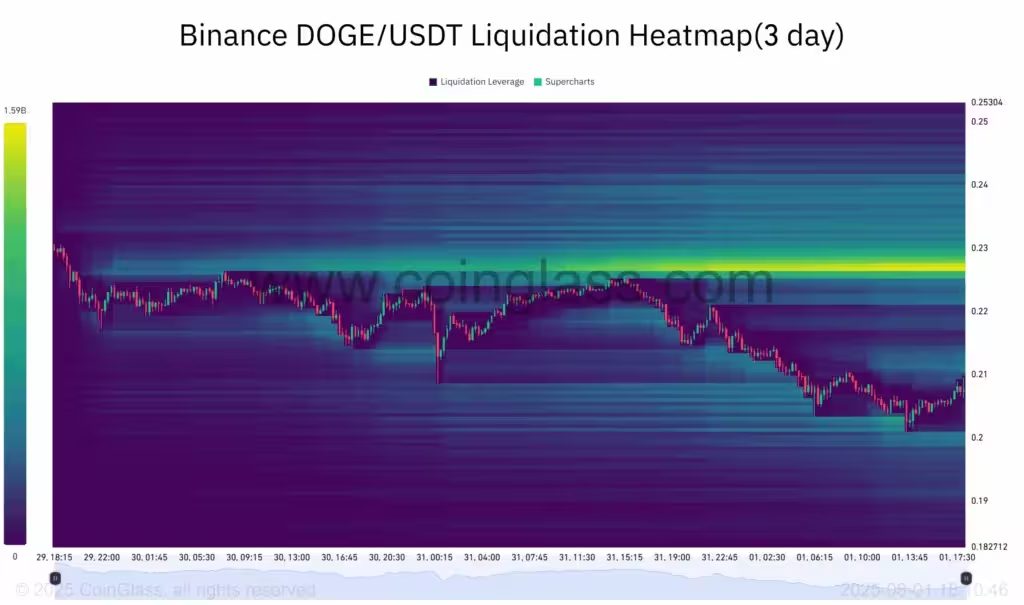

In fact, the three-day Dogecoin liquidation heatmap points to the possibility of a short-term bounce up to $0.23. Traders should be aware that in the near term, DOGE’s price direction is likely to be closely tied to Bitcoin’s performance.

Opportunities for Long-Term Investors

Long-term DOGE supporters might find the recent breakdown disappointing, but the price approaching the lower end of its range could present a new buying opportunity. Some market experts suggest that patient buyers could consider accumulating below current price levels if they believe in Dogecoin’s longer-term prospects. However, any new positions should take DOGE’s dependence on Bitcoin price action into account—sustained weakness in BTC could keep selling pressure high on Dogecoin.

Factors Affecting Dogecoin’s Future Trajectory

Dogecoin’s price largely mirrors Bitcoin’s market moves. As long as BTC remains unstable, DOGE is likely to face challenges as well. Therefore, traders and investors should keep a close eye on Bitcoin’s support and resistance levels when planning their Dogecoin strategies.

Conclusion: Cautious Optimism with an Eye on Bitcoin

In summary, Dogecoin is currently navigating a bearish trend with $0.196 as the main short-term level in focus. Should DOGE fail to hold this support, the path to $0.142 becomes increasingly likely. However, the notable liquidity above current prices means a short-lived price rebound is possible in the near term, especially if Bitcoin manages a recovery. Traders are advised to monitor Bitcoin’s moves, as a positive turn for BTC could drive a corresponding jump in Dogecoin’s price. Ultimately, $0.195 remains the critical level—if breached, it could open the door to further downside for DOGE in the crypto market.

Leave a Comment