3 Minutes

Fundstrat's Tom Lee: Ether near a V-shaped bottom

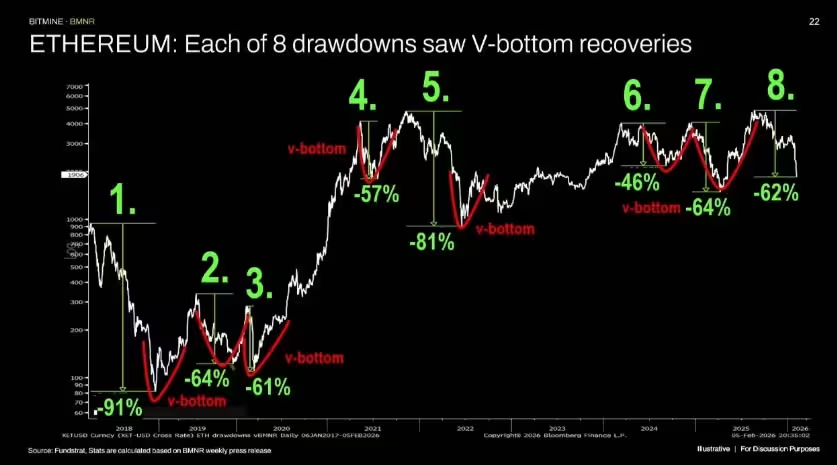

Fundstrat research head Tom Lee told attendees at a Hong Kong conference that Ether (ETH) appears poised for another rapid rebound after the recent sell-off. Lee highlighted a historical pattern: since 2018 Ethereum has endured multiple deep drawdowns of more than 50% and, in every instance, posted a swift, V-shaped recovery. For investors tracking Ethereum price action, that history suggests current weakness may be an opportunity rather than a signal to exit.

The previous eight drawdowns saw V-shaped recoveries for ETH.

Why Lee expects a repeat performance

Lee pointed to prior market cycles, noting that ETH fell sharply in several periods — including a 64% fall early last year — and recovered at roughly the same speed. He argued nothing fundamental has changed in Ethereum’s network that would prevent another V-shaped bottom, and advised market participants to begin looking for buying opportunities during the downturn. His view aligns with a narrative among some analysts that repeated historical recoveries increase the probability of similar rebounds in the future.

Technical levels and market context

Market technician Tom DeMark of BitMine flagged a potential bottom around $1,890, describing a likely short undercut before stabilization. Price data from TradingView showed Ether tumbling to $1,760 on Feb. 6 on Coinbase — a level approaching the 2025 low near $1,400. At the time of writing, ETH had failed to hold $2,000, trading near $1,970 after a roughly 37% slide over the prior 30 days. These levels matter to traders monitoring support, resistance, and possible capitulation points for Ethereum.

Staking demand remains resilient despite price drop

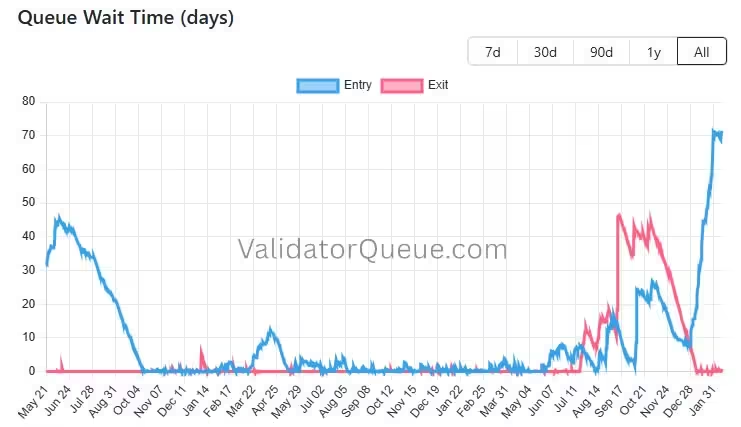

While price momentum has been weak, on-chain data shows strong, sustained demand for Ethereum staking. ValidatorQueue metrics reveal the validator entry wait time has climbed to an all-time high of 71 days, with about 4 million ETH waiting to enter the validator set. Roughly 30.3% of the circulating supply — approximately 36.7 million ETH — is currently staked. That mass of locked ETH effectively restricts available supply, a factor that can amplify price moves when demand shifts.

Ethereum staking entry queue at peak wait times.

Supply effects, yields and investor behavior

Analysts note that a substantial portion of ETH has become illiquid due to staking, earning a modest ~2.83% APR by crypto standards. The headline figure — roughly $74 billion locked — suggests many participants are not speculating on short-term swings but positioning for longer-term exposure to Ethereum’s ecosystem. For market watchers, staking reduces circulating supply and creates a structural dynamic that can support recoveries when buying returns.

What investors should consider now

Investors should balance technical price signals with on-chain fundamentals like staking demand, validator queues, and historical recovery patterns. Tom Lee’s call for a V-shaped recovery is rooted in historical precedent, but crypto markets remain volatile and subject to macro and micro factors. Position sizing, risk management, and a view of Ethereum’s long-term fundamentals — including staking economics and network development — should guide decisions rather than emotion-driven selling during a drawdown.

Source: cointelegraph

Leave a Comment