3 Minutes

Ethereum price prediction: On-chain signals point to deep undervaluation

Ethereum (ETH) has shown extended weakness in recent weeks, driving key on-chain valuation metrics into ranges historically associated with major market lows. As ETH hovers around $2,000 after failing to maintain levels above $2,100 amid market volatility, analysts are divided over whether the token is close to a long-term inflection point or if further downside is still possible.

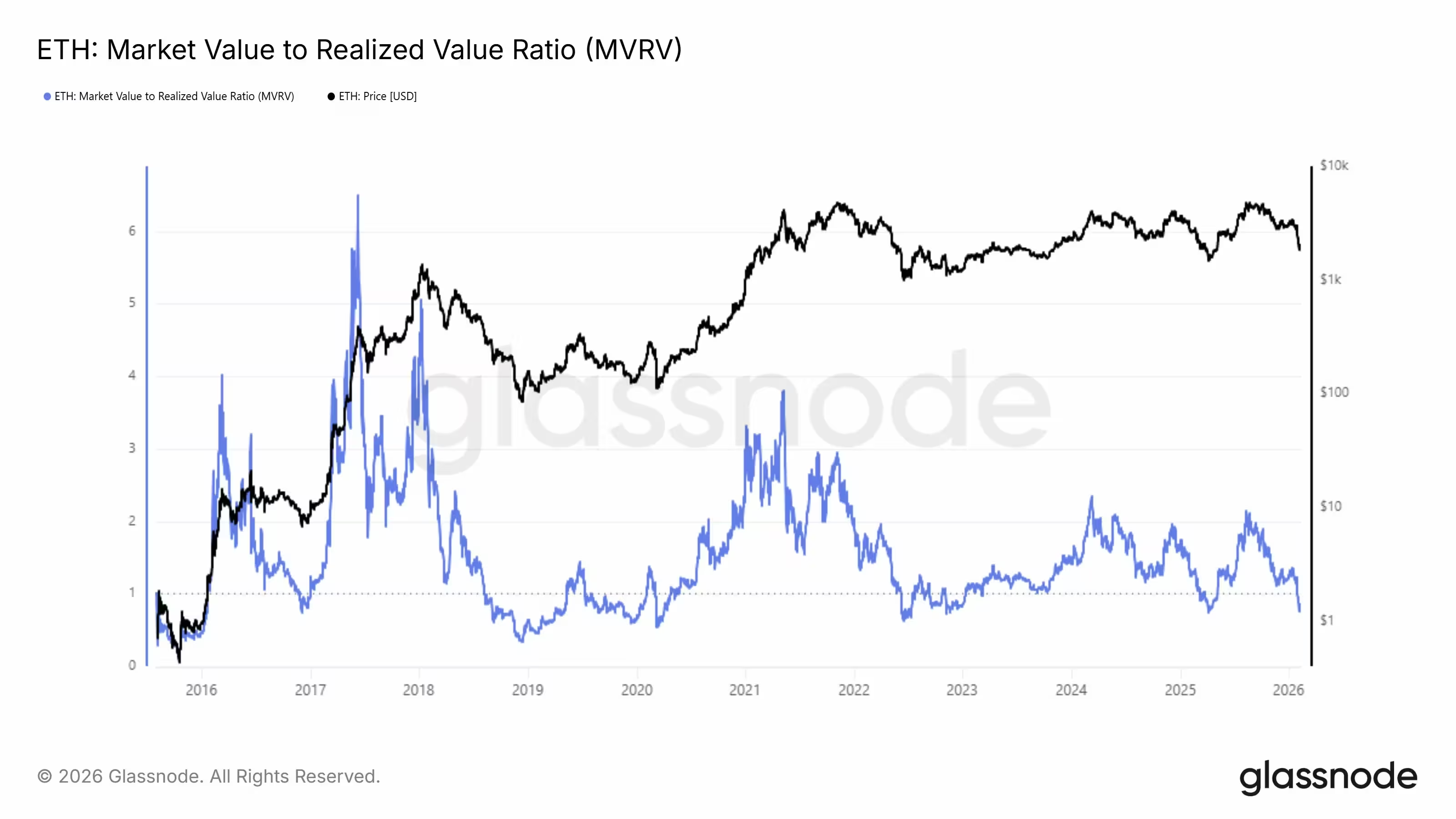

MVRV highlights historical buying windows

Leading crypto analyst Michaël van de Poppe argues that Ethereum is trading at a significant discount to its 'fair value' based on Market Value to Realized Value (MVRV) readings. Van de Poppe highlights four prior episodes when Ethereum displayed comparable MVRV conditions: the March 2020 COVID crash, the December 2018 bear-market bottom, the June 2022 capitulation following the Terra-Luna collapse, and the April 2025 market crash.

ETH MVRV Ratio

In each of those episodes, the deep undervaluation preceded extended recoveries and strong long-term returns. From the valuation perspective, these historical parallels suggest ETH could be trading near levels that have previously marked the latter stages of bear cycles — a potentially attractive risk-reward setup for long-term crypto investors.

Capitulation indicators urge caution

Not all on-chain signals are unanimously bullish. On-chain analyst Jao Wedson warns that while capitulation is clearly underway, the MVRV Z-Score remains above the extreme lows tied to definitive market bottoms. Wedson notes the recent MVRV Z-Score low of -0.42, which is stressed but not as deep as the -0.76 recorded in December 2018 when the market reached a clearer structural low.

Capitulation tends to be a drawn-out process rather than a single event; past bottoms often included failed recoveries and extended volatility before settling. Wedson’s analysis implies that investors should prepare for the possibility of additional downside or prolonged consolidation before a conclusive bottom forms.

What the mixed signals mean for ETH price prediction

Taken together, the evidence presents a balanced but nuanced picture for any Ethereum price prediction. Valuation-based metrics like MVRV indicate historically cheap conditions relative to past cycles, which supports the narrative that ETH could be approaching a long-term buying opportunity. At the same time, capitulation metrics and MVRV Z-Score readings suggest that extreme exhaustion associated with cycle lows may not yet have been reached.

For traders and investors focused on blockchain fundamentals and on-chain analytics, this means two practical scenarios: one in which patient, long-term buyers use current MVRV-based signals to accumulate ETH progressively; and another where short-term traders remain cautious, watching for deeper capitulation or confirmation of a structural bottom before committing significant capital.

Bottom line

Ethereum remains at a crossroads: on-chain valuation signals point to deep undervaluation and historical parallels with major recovery periods, but capitulation indicators caution that further turbulence is possible before a definitive bottom emerges. As always with crypto markets, risk management, diversification, and an understanding of on-chain metrics like MVRV and MVRV Z-Score should guide trading and investment decisions.

Source: crypto

Leave a Comment