4 Minutes

Bitcoin’s $60K Drop: A Potential Bear Market Midpoint

Bitcoin’s dramatic correction to roughly $60,000 earlier this month has stirred debate among traders and analysts about whether the move marks a temporary pause or the halfway mark of a deeper bear market. Research firm Kaiko argues the sell-off — a roughly 32% pullback from recent highs — could represent the middle of the current cycle downturn, with implications for BTC, ETH and broader crypto market dynamics.

Kaiko’s view: cycle dynamics and on-chain indicators

Kaiko’s research highlights evidence that the market has transitioned from post-halving euphoria into a more typical multi-month bear phase. The firm points to a set of on-chain and market metrics that usually surface as a cycle moves toward its nadir, including falling spot trading volumes and reduced futures open interest across major exchanges — signs consistent with widespread deleveraging and risk-off behavior.

Bitcoin halving cycles, all-time chart

Trading volume and futures open interest

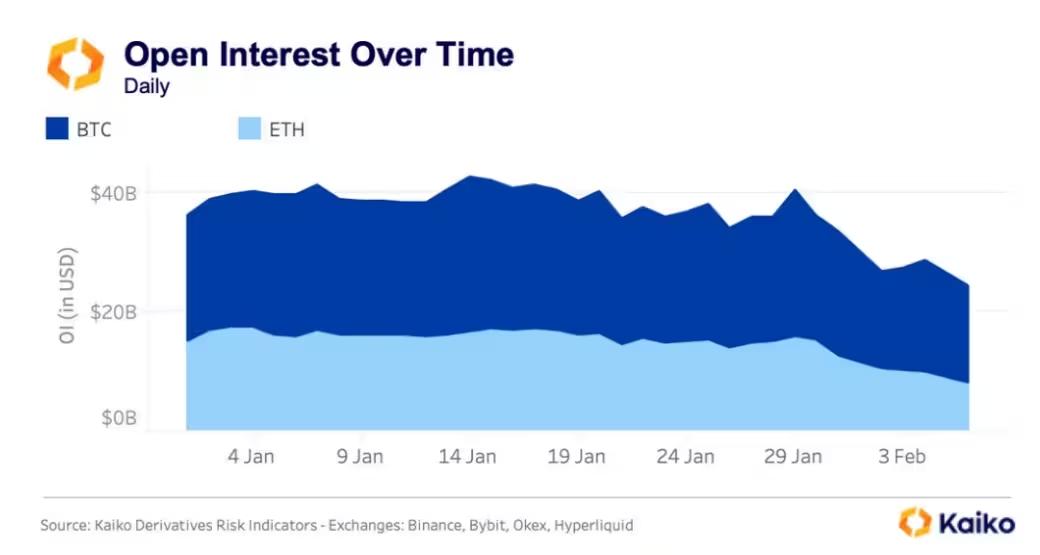

The report documented a roughly 30% contraction in aggregate spot crypto trading volumes across the ten largest centralized exchanges, sliding from around $1 trillion in October 2025 to about $700 billion in November. At the same time, combined BTC and ETH futures open interest fell from approximately $29 billion to $25 billion in the span of a week, signaling lower leverage and fewer speculative positions.

Open interest for BTC and ETH futures, top 10 exchanges.

How close is $60K to a historical bottom?

One focal point for investors is whether the $60,000 area aligns with long-term support. That level is roughly in line with Bitcoin’s 200-week moving average, which historically has acted as a durable support band during prior drawdowns. Kaiko, however, notes that the current retracement—about 52% from the previous all-time high—is shallower than many prior cycle bottoms, which often saw 60%–68% declines.

Implications for price targets and accumulation

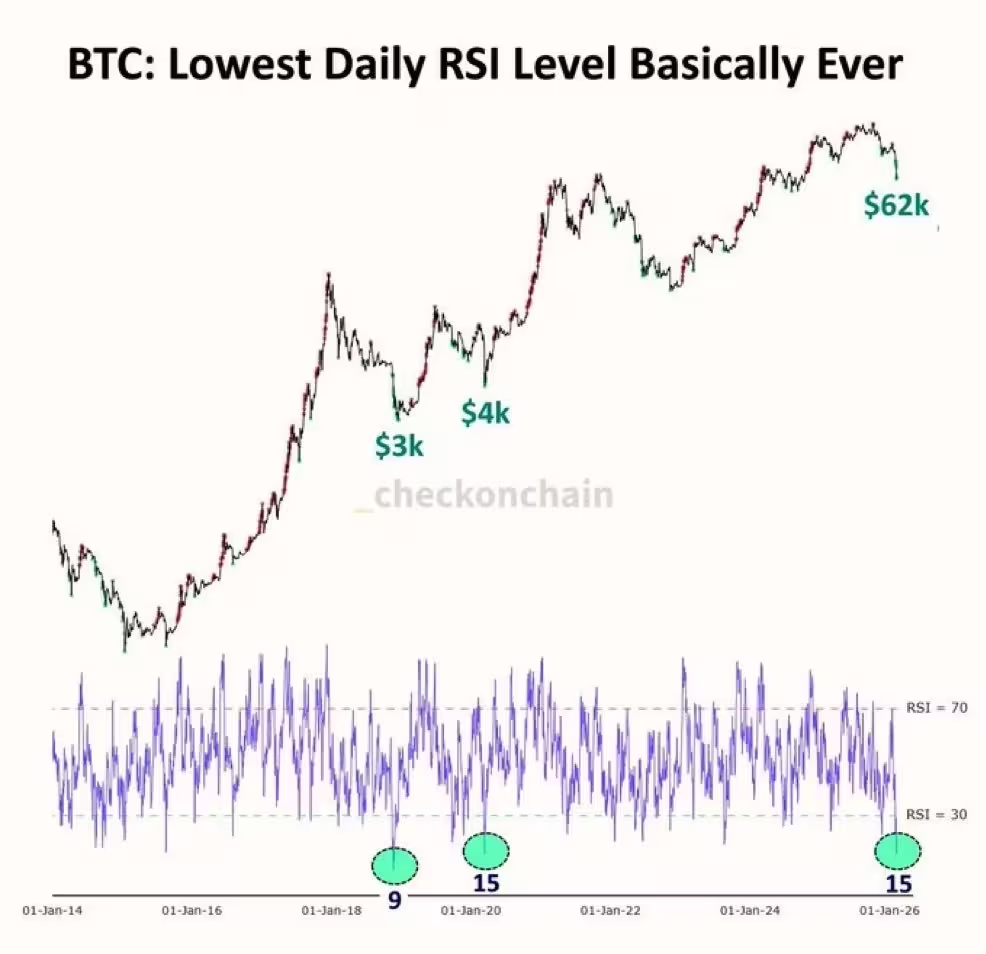

If Bitcoin follows an average historical bear cycle, Kaiko suggests a deeper low between $40,000 and $50,000 could still be possible. That said, some analysts, including Michael van de Poppe, argue the $60,000 print already represents a local bottom, citing historically depressed investor sentiment and oversold readings in metrics like the relative strength index (RSI).

Why the market outlook remains mixed

Market participants remain divided because several bullish structural catalysts that helped propel BTC toward six-figure targets earlier remain intact. These include institutional demand, macro liquidity conditions, and continued development activity across layer-1 and layer-2 ecosystems. Shawn Young of MEXC Research emphasized that oversold indicators across multiple timeframes make a rebound increasingly likely — but the timing and amplitude of any recovery are uncertain.

What traders should watch next

Traders and investors should monitor a handful of leading indicators: the 200-week moving average for long-term support, spot trading volume for liquidity trends, futures open interest for leverage dynamics, and on-chain flows such as exchange inflows/outflows and long-term holder behavior. Additionally, macro events and crypto-specific catalysts (regulatory news, large liquidations, or significant on-chain upgrades) can quickly change the risk-reward equation.

Ultimately, whether $60,000 was the bottom or merely the midpoint of a protracted bear market will likely be clarified over the coming months as on-chain metrics, sentiment indicators and price action around key moving averages evolve. For now, market participants should prepare for continued volatility and consider risk management strategies suited to a potential multi-month market cycle.

Source: cointelegraph

Leave a Comment