3 Minutes

Retail investors scan social signals to time crypto buys

Retail crypto investors are intensifying their search for evidence that the market has bottomed, analyzing social chatter and on-chain metrics to decide when to increase exposure to Bitcoin and other crypto assets. According to sentiment analytics firm Santiment, many retail traders are attempting to "meta-analyze" the crash by watching for mass selling or signs that other participants are exiting positions.

Santiment flags "capitulation" as a trending signal

Santiment's report highlighted the surge in the use of the term "capitulation" across social channels — a signal often associated with panic selling when holders give up and markets reach a local trough. The firm warns that the widespread expectation of a single clear capitulation event can be misleading: investors may miss a bottom while waiting for a definitive sign.

In its analysis, Santiment noted that when traders fixate on others' behavior to time entries, they may inadvertently cluster around the same signals, which historically occur near market lows. The key implication is that apparent capitulation may already have happened while many were still looking for confirmation.

Search interest and market reaction

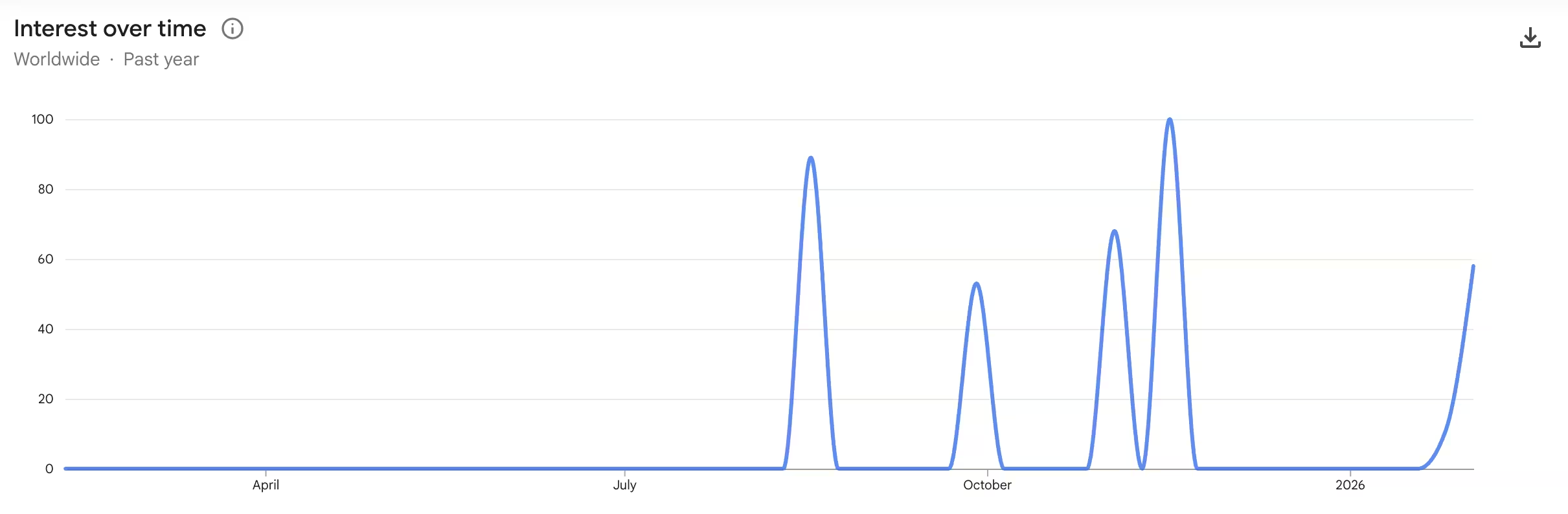

Google Trends data supports the narrative: searches for "crypto capitulation" climbed sharply from a score of 11 to 58 between the weeks ending Feb. 1 and Feb. 8, indicating growing public interest in whether the downturn has reached its nadir.

The search volume for “crypto capitulation” surged over the past week.

But caution remains. Experienced market analysts remind investors that bear markets often display multiple capitulation pulses rather than a single, definitive event. Market commentator Caleb Franzen pointed out that many traders misunderstand this, treating the latest dump as the ultimate bottom when historical cycles can include repeated washouts.

Bitcoin drop, sentiment gauges and analyst views

Bitcoin's price slid to as low as $60,000 on Thursday, a level not seen since October 2024, contributing to heightened anxiety among retail participants. Over the past 30 days, Bitcoin declined more than 24%, trading around $68,970 at the time of reporting (CoinMarketCap).

Some analysts remain skeptical that a true cycle bottom has arrived. Crypto analyst Ted observed that recent selling looked like capitulation but cautioned it was not necessarily the cycle bottom. Similarly, CryptoGoos argued that "true Bitcoin capitulation" has not yet occurred.

Meanwhile, the Crypto Fear & Greed Index plunged deeper into "Extreme Fear," registering a score of 7, underscoring the cautious stance among investors and the potential for further volatility as traders weigh macro factors like interest rate expectations and liquidity.

Takeaway for traders

For retail investors, the takeaway is to combine sentiment indicators, on-chain data and risk management rather than chase a single narrative. Understanding capitulation as a potential multi-stage process, rather than a single headline event, can help traders set more resilient entry strategies during volatile crypto market cycles.

Source: cointelegraph

Leave a Comment