5 Minutes

Bitcoin’s bounce back above $71,000 meets derivatives skepticism

Bitcoin (BTC) climbed above $71,000 after a sharp sell-off, recovering a portion of recent losses. While spot BTC has gained momentum — rising roughly 17% from the $60,150 Friday low — derivatives markets show professional traders remain guarded. Options skew, futures basis rates and recent large-scale liquidations all point to caution around whether this rebound can hold.

Price action vs. leverage dynamics

Despite the rebound to $71.5K, Bitcoin has not drawn the same leveraged appetite seen in prior rallies in gold or major tech stocks. The market’s response to the correction has been uneven: bulls have added exposure between $70,000 and $90,000, but that accumulation occurred alongside forceful futures contract liquidations.

Futures liquidations and open interest

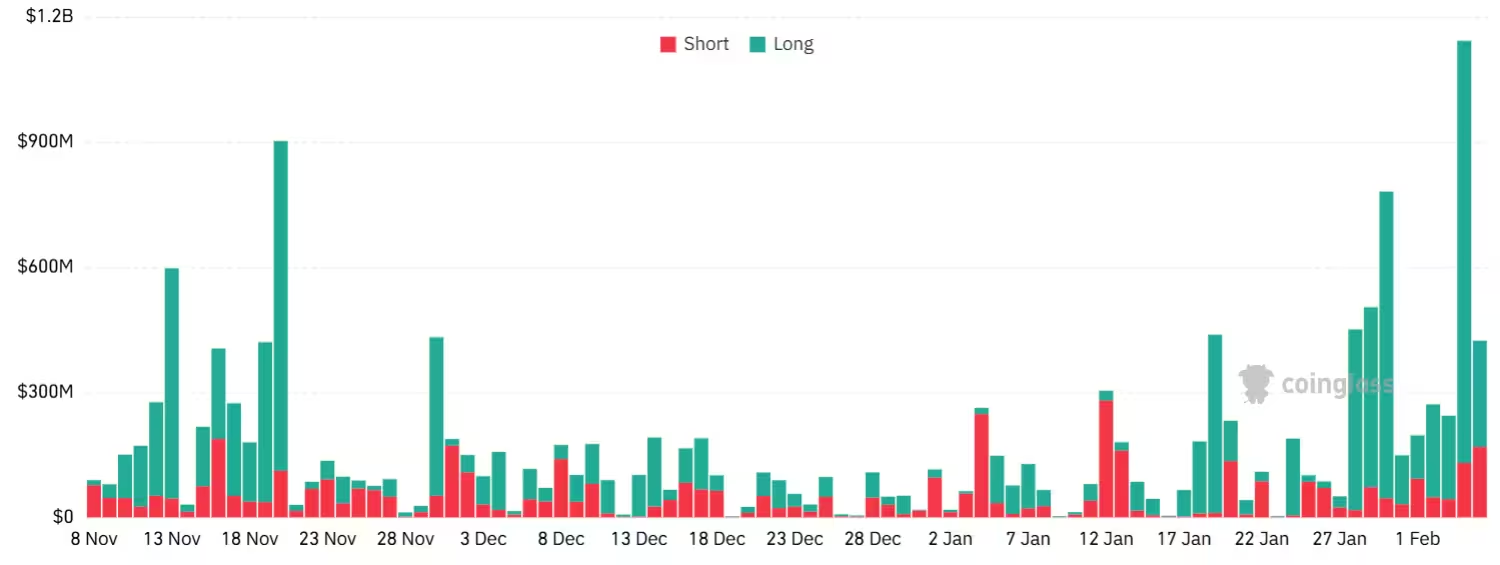

Aggregate liquidations in Bitcoin futures contracts, USD.

Over five days, roughly $1.8 billion of bullish leveraged futures were wiped out — a sign that overly aggressive long positions were over-levered. Aggregate futures open interest on major venues remained near 527,850 BTC on Friday, effectively unchanged week-on-week even as notional value declined from $44.3 billion to $35.8 billion. That ~20% fall in notional aligns with the approximate 21% price drop the prior seven days, indicating traders cut contract size while some bulls continued to rebuild positions.

.avif)

Bitcoin futures aggregate open interest, BTC.

The recent liquidation events have left participants wondering whether a large hedge fund, market maker, or exchange desk was force-closed, which can amplify uncertainty and suppress risk-taking among pro traders.

Futures basis rate: low demand for bullish leverage

.avif)

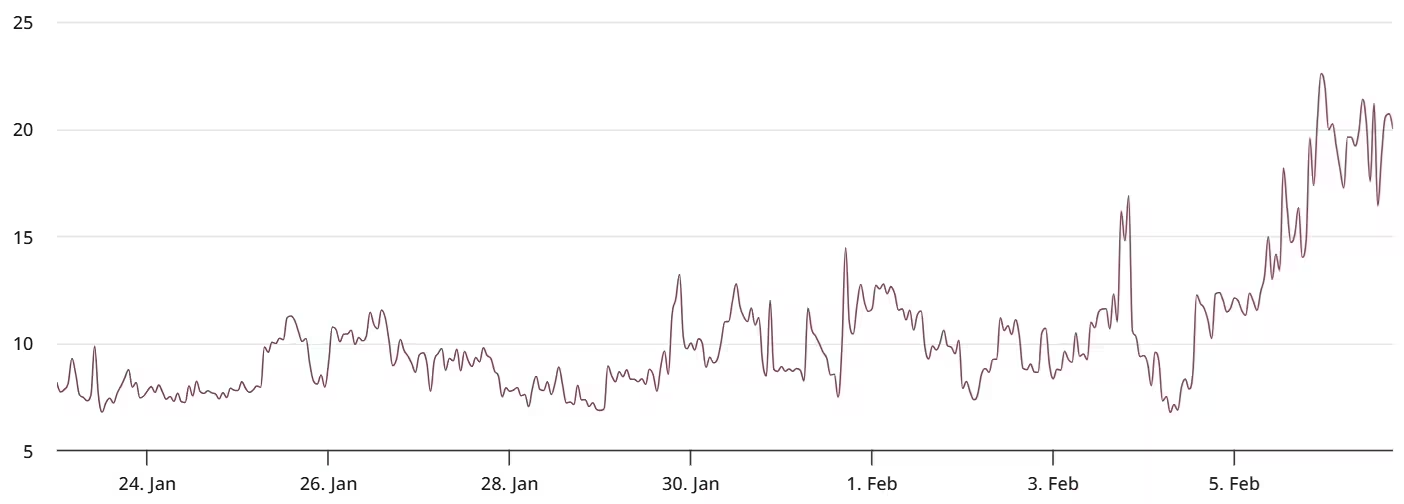

Bitcoin two-month futures annualized premium.

The two-month futures annualized premium — the basis rate — is a useful gauge of leverage appetite. Under neutral conditions it is typically 5%–10% annualized to compensate for settlement lag. On Friday, the BTC futures basis tumbled to around 2%, the weakest in over a year. This compressed premium signals limited demand for leveraged long exposure, meaning professional buyers are reluctant to commit capital to sustained upside despite the spot bounce.

Options skew and market sentiment

Options markets are sending a clear message: traders are paying extra for downside protection. The put-call skew — a measure of how much more traders demand puts versus calls — spiked sharply.

BTC two-month options skew (put-call) at Deribit.

On Friday the two-month put-call skew hit roughly 20%, a level that typically denotes panic or deep concern among sophisticated options traders. For context, the skew was near 11% on Nov. 21, 2025, after a 28% correction to $80,620. With no single public catalyst explaining the present drop, the elevated skew suggests an abundance of fear and a consensus that further downside remains a real possibility.

What traders should watch next

Key on-chain and derivatives signals to monitor:

- Options skew: Persistent elevated skew (>10–15%) typically precedes continued volatility and indicates strong demand for downside protection.

- Futures basis and funding: Sub-5% annualized basis and negative or muted funding imply weak bullish leverage interest.

- Liquidation clusters: Large, concentrated liquidations can signal forced deleveraging by a market participant, increasing tail-risk.

- Price vs. macro and risk assets: BTC’s move so far has not yet matched gains in gold or leading tech stocks, suggesting spot-level demand is still selective.

Bitcoin remains about 44% below its all-time high, and the market’s cautious derivatives profile means sustained bullish momentum will require improving on-chain metrics and a normalization of skew and basis rates.

Bottom line

The rebound to $71.5K shows Bitcoin’s resilience, but derivatives metrics — low futures basis, heavy liquidations and an extreme options skew — signal that pro traders remain skeptical about durability. Until leverage demand and skew moderate, the risk of renewed downside stays elevated despite the spot recovery.

This article is for informational purposes and does not constitute investment advice. Cryptocurrency trading involves significant risk; readers should perform their own research and consider their risk tolerance before making trading decisions. While every effort is made to present accurate information, the author and publisher do not guarantee completeness or accuracy and are not liable for investment outcomes.

Source: cointelegraph

Comments

Armin

wow, pumps like this always look fragile to me... dont trust the headline rally, wait for skew to cool off

chainflux

OK bounce, but the skew and tiny basis scream trapped longs. Who got liquidated? big fund? exchange desk? feels risky, not a breakout imo

Leave a Comment