3 Minutes

Market snapshot: BTC falls below a key threshold

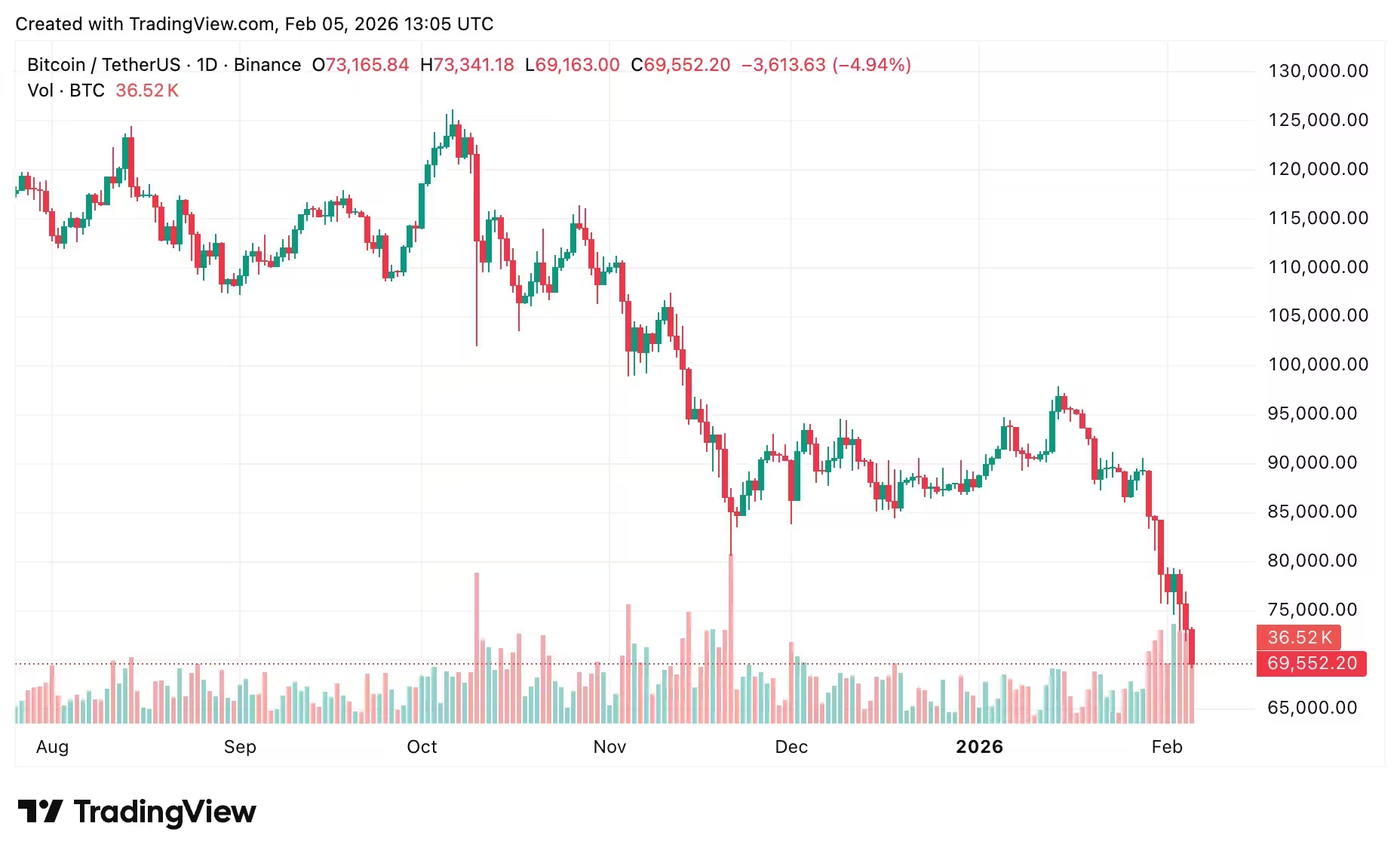

Bitcoin slid toward $69,000 on Feb. 5, 2026, marking the lowest trade level since October 2024 and sparking a fresh wave of volatility across crypto markets. The selloff has wiped out leveraged long positions and amplified outflows from spot Bitcoin ETFs, contributing to a broader risk-off environment that correlated with weakness in U.S. tech stocks.

BTC has traded inside a wide intraday range of $69,060–$76,075 and is currently hovering near $69,550. On the day, Bitcoin posted a roughly 8.7% loss, while weekly declines approach 21%. From its all-time high of $126,198 set about four months ago, BTC is down nearly 45%.

BTC 1-day chart, February 2026

What drove the recent decline?

The rapid drop was triggered initially by concentrated long liquidations on derivatives platforms. As leveraged traders were forced out, selling pressure intensified. Simultaneously, outflows from spot Bitcoin ETFs and a risk-off move in technology equities compounded the downward momentum. These factors together created heightened volatility and left many market participants re-evaluating exposure to BTC and other digital assets.

Key market drivers

- Long liquidations that accelerated deleveraging

- Spot Bitcoin ETF outflows reducing buying support

- Weakness in U.S. tech stocks increasing overall risk aversion

- Elevated volatility and quick swings in leverage-sensitive positions

Bitcoin price prediction: where could BTC head next?

Technically, $70,000 had been an important psychological and technical support. With BTC now trading below that level, the next downside target to watch is about $67,500 — a zone where buyers previously stepped back in. If that support fails, traders should monitor lower support bands for potential stabilization.

Upside and resistance levels

On the upside, $76,100 has emerged as a firm resistance. A clean breakout above $76,100 could open the path toward $78,500–$80,000, areas that have capped rallies in prior moves. Until BTC convincingly reclaims resistance levels, volatility and the risk of further downside remain elevated.

Final thoughts for traders and investors

The market outlook remains choppy. Breaking below $70,000 has increased the likelihood of additional selling as stop orders cascade and risk-sensitive capital reduces exposure. Traders should consider liquidity, position sizing, and the potential for quick rebounds when managing risk. Longer-term investors tracking fundamentals and ETF flows may find entry points if established support zones hold and macro conditions improve.

Source: crypto

Leave a Comment