4 Minutes

Tether’s USDt Surges to New Market Cap High

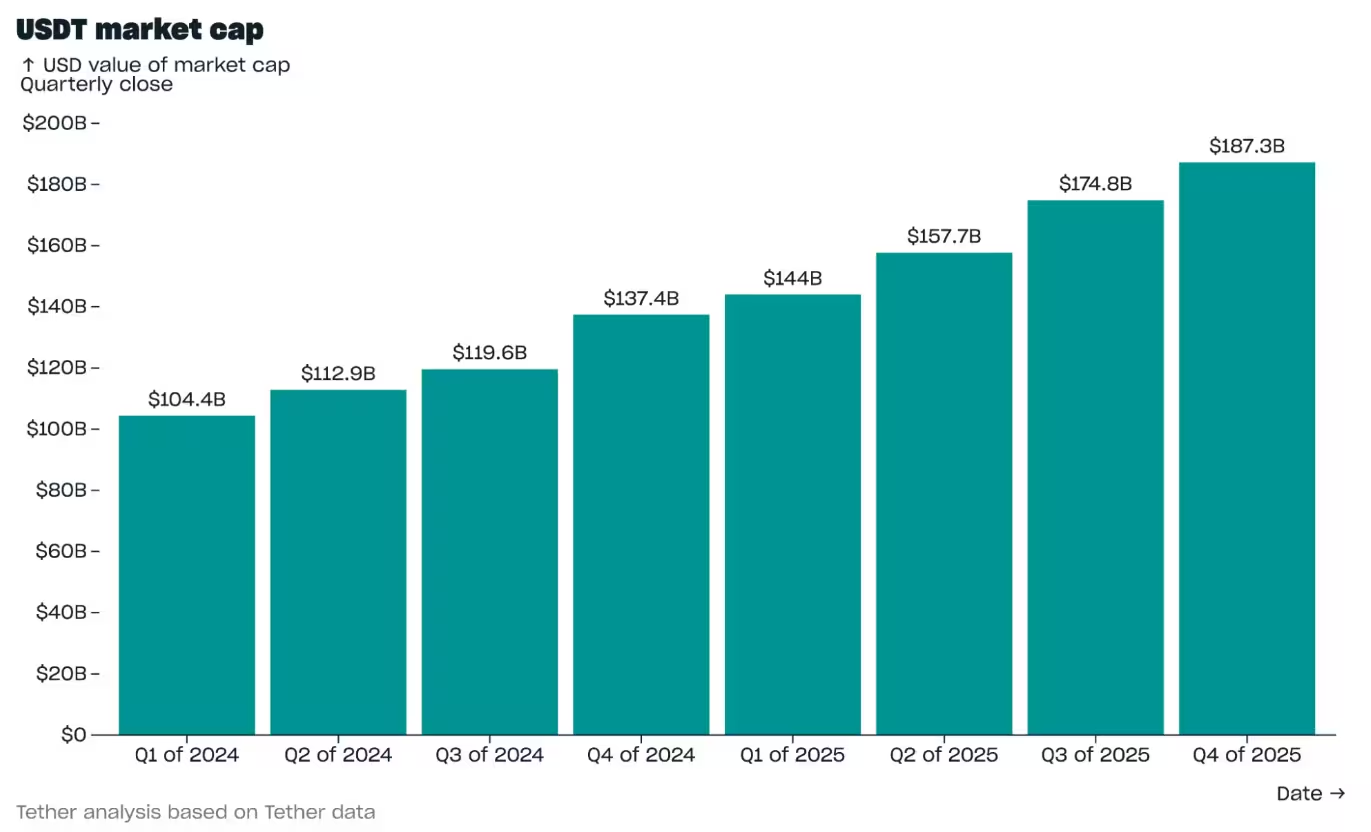

Tether’s USDt stablecoin expanded to a record $187.3 billion market capitalization in Q4, adding $12.4 billion during the quarter even as the wider cryptocurrency market softened after October’s liquidation cascade. The milestone underscores USDt’s growing dominance among stablecoins and rising onchain adoption across trading, remittances and DeFi.

Market dynamics and competitor movements

Data from Tether’s quarterly report shows that USDt widened its lead while several rivals saw declining supply following the Oct. 10 liquidation event. Circle’s USDC fluctuated for the remainder of Q4 and finished the period largely flat, while other peers experienced sharper contractions — notably Ethena’s USDe, which slid about 57% in market cap ranking.

USDt market cap.

Onchain activity reaches record levels

Onchain metrics were equally robust. Average monthly active USDt wallets climbed to roughly 24.8 million — nearly 70% of all wallets that hold stablecoins. Quarterly transfer volume accelerated to about $4.4 trillion, while the total number of onchain USDt transfers rose to 2.2 billion. These indicators point to extensive use in high-frequency transfers, payments rails, and liquidity flows in decentralized finance.

Where supply is concentrated

Tether reported that about two-thirds of USDt supply is held in savings wallets and centralized exchanges, with the remaining one-third supporting payments, remittances and DeFi activity. This distribution underlines USDt’s central role in trading liquidity and cross-border payments across multiple blockchains, including Tron.

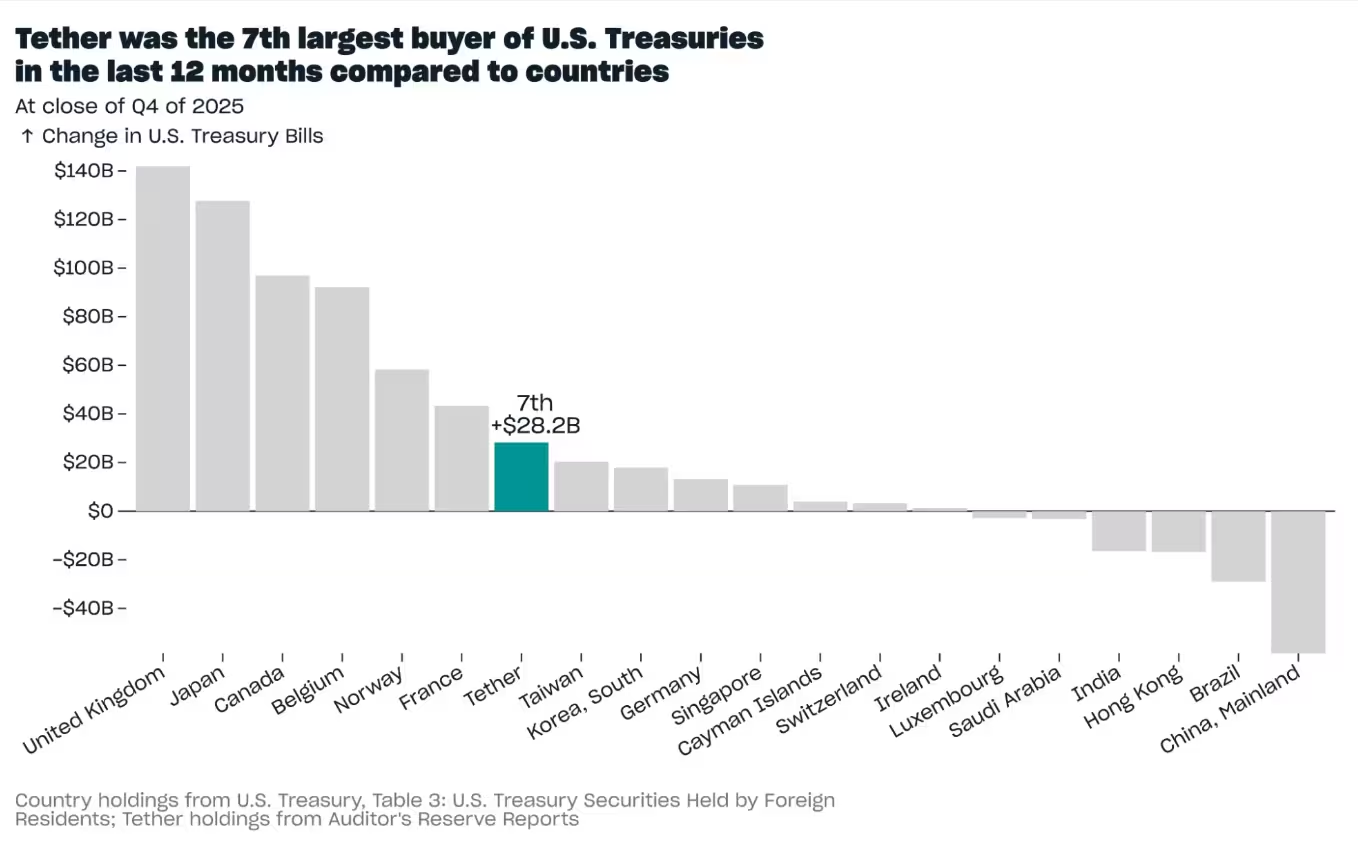

Reserves, US Treasuries and balance sheet

At quarter-end, Tether disclosed total reserves of $192.9 billion — an $11.7 billion increase from the prior quarter — leaving net equity reported at $6.3 billion. The company’s exposure to US Treasuries rose to $141.6 billion, positioning Tether among the largest holders of Treasuries globally and ahead of many sovereign entities.

Tether buys more US Treasuries.

Illicit transfers, compliance and risk mitigation

Independent analytics show USDt accounted for a significant share of high-risk stablecoin flows in 2024. Bitrace estimated $649 billion in stablecoin volume (~5.14% of total stablecoin transactions) moved through high-risk addresses, with Tron-based USDt representing over 70% of that activity. In response, Tether has tightened controls, partnering with compliance firms such as TRM Labs and working with Tron to monitor and freeze suspected illicit funds — steps that signal increased AML focus amid regulatory scrutiny.

Product launches and partnerships

In January, Tether introduced USAt, a GENIUS Act–compliant dollar stablecoin aimed at the U.S. market and issued by Anchorage Digital Bank. USAt launched with an initial $10 million supply on Ethereum. Additionally, Tether expanded access to digital payments through a partnership with Opera: USDt and Tether Gold (XAUT) were integrated into Opera’s MiniPay wallet to reach users in emerging markets.

Implications for traders and DeFi users

The record market cap and heavy onchain usage reinforce USDt’s role as a primary liquidity vehicle across exchanges and decentralized protocols. For traders, custodians, and DeFi builders, the growth signals both opportunity and responsibility: increased liquidity and settlement efficiency, alongside heightened compliance expectations and the need for robust onchain risk monitoring.

As the stablecoin sector evolves, market participants will watch how reserve composition, regulatory compliance, and cross-chain integrations shape the competitive landscape between USDt, USDC, and emerging dollar-pegged tokens.

Source: cointelegraph

Leave a Comment