4 Minutes

Crypto ETPs suffer second weekly outflow as investor sentiment weakens

Crypto exchange-traded products (ETPs) recorded another heavy week of withdrawals as investors continued to pull capital from crypto funds. European asset manager CoinShares reported $1.7 billion in outflows for the most recent week, bringing total outflows across two consecutive weeks to $3.43 billion and pushing year-to-date flows into negative territory by about $1 billion.

What drove the withdrawals

CoinShares head of research James Butterfill attributed the selling to a combination of macro and market-specific factors: the emergence of a more hawkish stance at the US Federal Reserve, continued large-scale selling tied to the four-year Bitcoin cycle, and elevated geopolitical volatility. The result has been renewed risk-off behavior across crypto investment products and a measurable reduction in assets under management.

Assets under management decline significantly

Total assets under management in crypto funds have declined to $165.8 billion, a drop of about $73 billion since October of last year, according to CoinShares. That decline underscores how sensitive crypto ETF and ETP inflows are to macro headlines and large whale trading activity.

Bitcoin and Ether lead outflows; short products attract capital

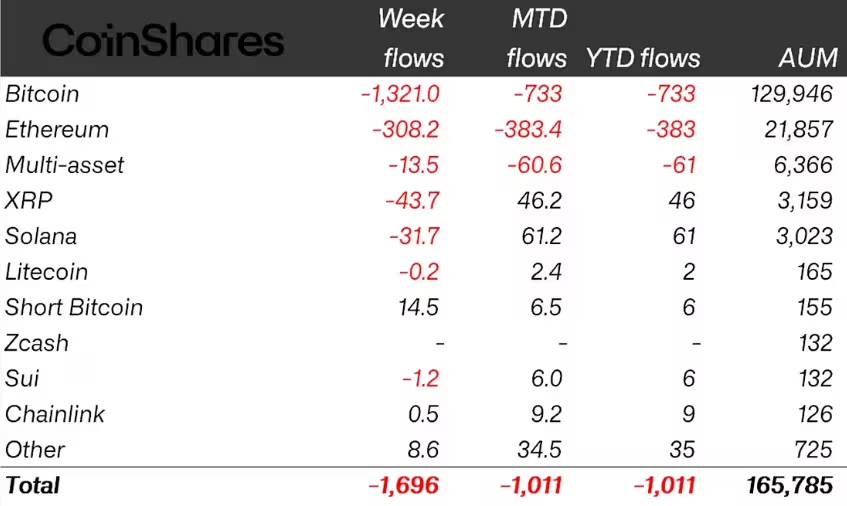

Bitcoin investment products led the sell-off, with $1.32 billion leaving BTC funds last week. That sizable outflow left year-to-date redemptions for Bitcoin products at approximately $733 million. Ether funds also saw meaningful withdrawals, posting $308 million in weekly outflows and $383 million withdrawn year-to-date.

Weekly crypto ETP flows by asset as of Friday (in millions of US dollars)

Other tokens were not spared. Solana experienced $31.7 million in outflows while XRP saw $43.7 million withdrawn. Reflecting the bearish tone, short Bitcoin products registered inflows of $14.5 million as investors positioned for further downside.

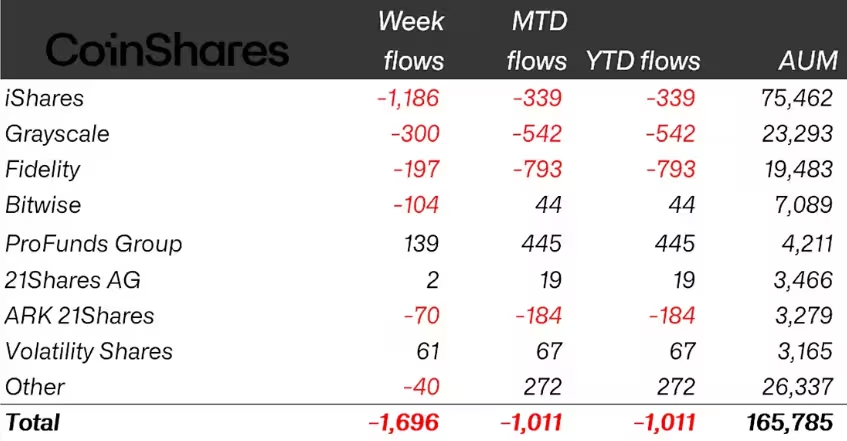

Issuer-level moves: BlackRock leads outflows

Outflows were broad-based across issuers. BlackRock iShares suffered the largest outflows at roughly $1.2 billion. Grayscale Investments and Fidelity reported approximately $300 million and $197 million in redemptions, respectively. A few providers bucked the trend: ProFunds Group and Volatility Shares attracted $139 million and $61 million of inflows.

Weekly crypto ETP flows by issuer as of Friday (in millions of US dollars)

CoinShares also flagged tokenised precious metals activity as a bright spot, noting that Hyperliquid was a notable exception among tokens benefiting from demand in that niche.

Market context and sentiment indicators

Last week’s outflows preceded a sharp weekend sell-off that saw Bitcoin dip below $75,000 on Sunday. The Crypto Fear & Greed Index currently sits in the Extreme Fear zone at around 14, indicating prevailing negative sentiment that could keep pressure on crypto funds unless markets stage a significant rebound.

At the time of the report, CoinGecko listed Bitcoin trading near $77,610, down roughly 1.7% over the previous 24 hours. For portfolio managers, traders, and retail investors, the CoinShares data highlights the need to monitor ETF and ETP flows as a barometer of market conviction and liquidity.

What this means for investors

Sustained outflows can exacerbate downward price momentum and reduce liquidity in crypto markets. Investors focused on institutional flows, ETF and ETP inflows, and assets under management should treat these weekly reports as part of a broader assessment that includes macro policy, on-chain metrics, and market structure. While some niche products and providers may still attract capital, the near-term outlook for broad crypto investment products remains cautious until sentiment improves.

Source: cointelegraph

Leave a Comment