3 Minutes

Crypto ETPs log largest weekly outflows since February

Crypto exchange-traded products (ETPs) registered their biggest weekly withdrawals since February, shedding roughly $2 billion as investors pulled back amid rising uncertainty. CoinShares’ latest flows report shows outflows accelerated by nearly 71% from the prior week’s $1.17 billion, extending a multi-week retreat that has dented industry confidence.

Why assets under management are shrinking

CoinShares reported that total assets under management (AUM) across crypto ETPs fell to $191 billion, a 27% drop from the $264 billion peak in October. James Butterfill, CoinShares’ head of research, pointed to monetary policy uncertainty and selling pressure from crypto-native whales as primary drivers of the dislocation. The retreat underscores how macroeconomic risk and concentrated seller activity can quickly reverse inflows into crypto investment products.

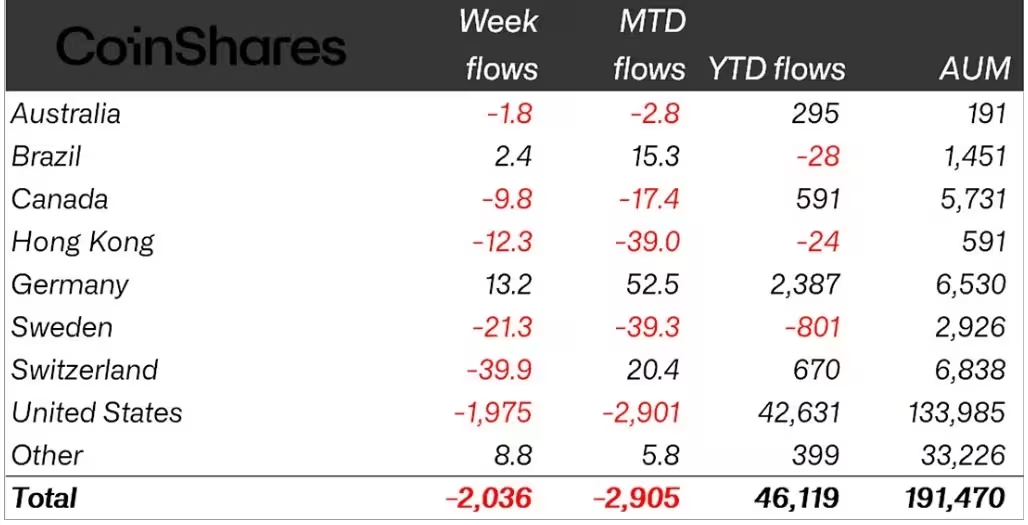

Geographic breakdown: US leads withdrawals

The United States drove the lion’s share of redemptions, accounting for 97% of last week’s outflows — about $1.97 billion. Germany was a notable exception, attracting $13.2 million in inflows even as major markets reversed. Other countries registering net outflows included Switzerland ($39.9 million) and Sweden ($21.3 million), while Hong Kong, Canada and Australia combined for $23.9 million in withdrawals.

Crypto ETP flows by country (in millions of US dollars)

Which crypto ETPs were hit hardest

Bitcoin-based ETPs suffered the largest absolute withdrawals, with nearly $1.4 billion exiting in a single week — roughly 2% of Bitcoin ETPs’ total AUM. Ether ETPs also felt significant pressure, losing nearly $700 million, equivalent to roughly 4% of their assets. Smaller single-asset products were not immune: Solana ETPs saw $8.3 million in outflows, while XRP ETPs recorded $15.5 million.

These redemptions mirror weakness in spot and derivative markets and reflect a rotation away from concentrated, single-asset exposure as traders reassess risk amidst macro uncertainty.

Investors rotate to diversified and hedged strategies

Not all crypto products experienced outflows. Multi-asset ETPs — funds that spread exposure across several tokens — attracted $69 million over the past three weeks, indicating a shift toward reduced volatility and broader exposure. Short-Bitcoin funds, which profit if Bitcoin price falls, saw $18.1 million in inflows over the same period, signaling rising hedging activity among institutions and retail investors.

Outlook for crypto investment products

The recent wave of outflows highlights how quickly investor sentiment can swing in crypto markets. For portfolio managers and crypto investors, the data reinforce the importance of diversification, liquidity management, and hedging strategies like short-bitcoin ETPs or multi-asset products during periods of policy uncertainty. With AUM down substantially since October, market participants will be watching macro signals and whale activity closely for signs of stabilization or further withdrawals.

Source: cointelegraph

Leave a Comment