3 Minutes

Market turnaround: from outflows to strong inflows

Crypto investment products shifted back into positive territory last week as investor risk appetite recovered following weaker-than-expected US inflation data. According to CoinShares, crypto exchange-traded products recorded roughly $921 million of net inflows, reversing the prior week's $513 million of outflows.

Why the bullish swing mattered

Lower-than-expected Consumer Price Index figures helped revive expectations of additional Federal Reserve rate cuts, which in turn supported demand for crypto ETPs and ETFs. CoinShares head of research James Butterfill cited renewed confidence in the prospect of easing monetary policy after the September CPI rose 0.3 percent month over month and 3 percent year over year, both below consensus.

Macro context

The ongoing US government shutdown and gaps in macro releases had left many investors uncertain about the Fed's path. The fresh CPI print provided a clearer signal and encouraged flows back into cryptocurrency investment products, particularly those tracking Bitcoin.

Asset flows: Bitcoin leads, Ether posts outflows

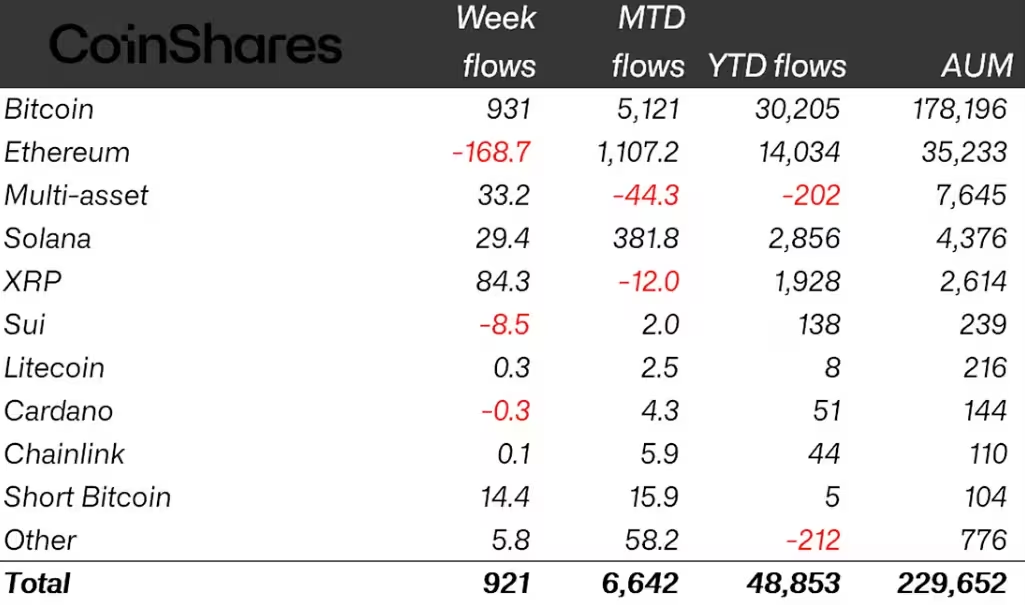

Bitcoin BTC $115,397, which had driven most of the prior week's outflows, almost fully recovered those losses with $931 million in inflows last week.

Ether ETH $4,158 saw its first outflows in five weeks, totaling $169 million as investors pulled funds across several days. CoinShares noted that 2x leveraged ETPs still remain in demand despite net outflows from ETH products.

Crypto ETP flows by asset as of Friday (in millions of US dollars)

Other altcoin products saw slower inflows ahead of expected ETF launches on US exchanges. Solana SOL $200.24 and XRP XRP $2.63 recorded $29.4 million and $84.3 million in inflows respectively, with Solana ETP inflows falling more than 81 percent week on week.

Broader fund metrics

Bitcoin's $931 million weekly inflow lifted cumulative inflows since the Federal Reserve began easing in September to about $9.4 billion. Despite recent momentum, year-to-date Bitcoin fund inflows remained lower than last year's pace, at $30.2 billion versus $41.6 billion a year earlier, down roughly 38 percent.

Overall assets under management across crypto funds reached about $229 billion, with total inflows of $48.9 billion so far this year. The data highlights that while investor interest in cryptocurrency ETPs and ETFs can shift quickly, macro signals like CPI and Fed guidance remain major drivers of flows.

Outlook for crypto ETPs and ETFs

Expect flow volatility to continue as markets digest inflation updates, Fed commentary, and ETF product launches. Bitcoin ETPs are likely to remain the primary beneficiary of renewed risk-on sentiment, while altcoin ETP flows may fluctuate ahead of major ETF approvals and macro releases.

Source: cointelegraph

Leave a Comment