3 Minutes

Retail Bitcoin optimism is cooling, Santiment says

Calls forecasting Bitcoin (BTC) to reach $150,000–$200,000 — and even shorter-term $50K–$100K targets — have noticeably tapered off, according to crypto market analytics firm Santiment. Rather than a sign of weakness, Santiment frames the decline in price-target chatter and meme-driven FOMO as a constructive development: retail exuberance is fading and sentiment is normalizing toward neutral.

Context: bold price predictions versus market reality

Throughout 2024 some high-profile commentators pushed eye-catching forecasts — with figures like Arthur Hayes and Tom Lee publicly suggesting BTC could climb to $250,000 in 2025. Instead, Bitcoin peaked near $126,100 in October and then trended downward, leaving the market below expectations at year-end. Short-term volatility continued into early 2025 as BTC dipped toward $60,000 on Feb. 6 before recovering modestly to the mid $60,000s.

Sentiment metrics shifting back to neutral

Santiment reports the ratio of bullish to bearish social media comments has moved from extreme bearishness back to a neutral band. For analysts and traders that shift can complicate short-term decision-making: sentiment-based signals lose some of their predictive power once the market is no longer polarized.

“Better to avoid trading in these scenarios or at least discount the significance of sentiment metrics in your analysis,” Santiment advised, highlighting the limits of relying solely on social sentiment for trading Bitcoin or other cryptocurrencies.

Bitcoin is down 24.39% over the past 30 days.

Other indicators still point to caution

While social sentiment moderates, several on-chain utility metrics are blinking yellow. Santiment notes that transaction volume, active addresses, and overall network growth have been steadily declining — a sign the Bitcoin network is being used less frequently. Reduced transaction activity and fewer active addresses can indicate traders are sitting idle rather than deploying capital or onboarding new users.

These usage metrics are important for long-term crypto market health: expanding network activity usually accompanies price discovery, while dormancy can suggest consolidation or distribution phases.

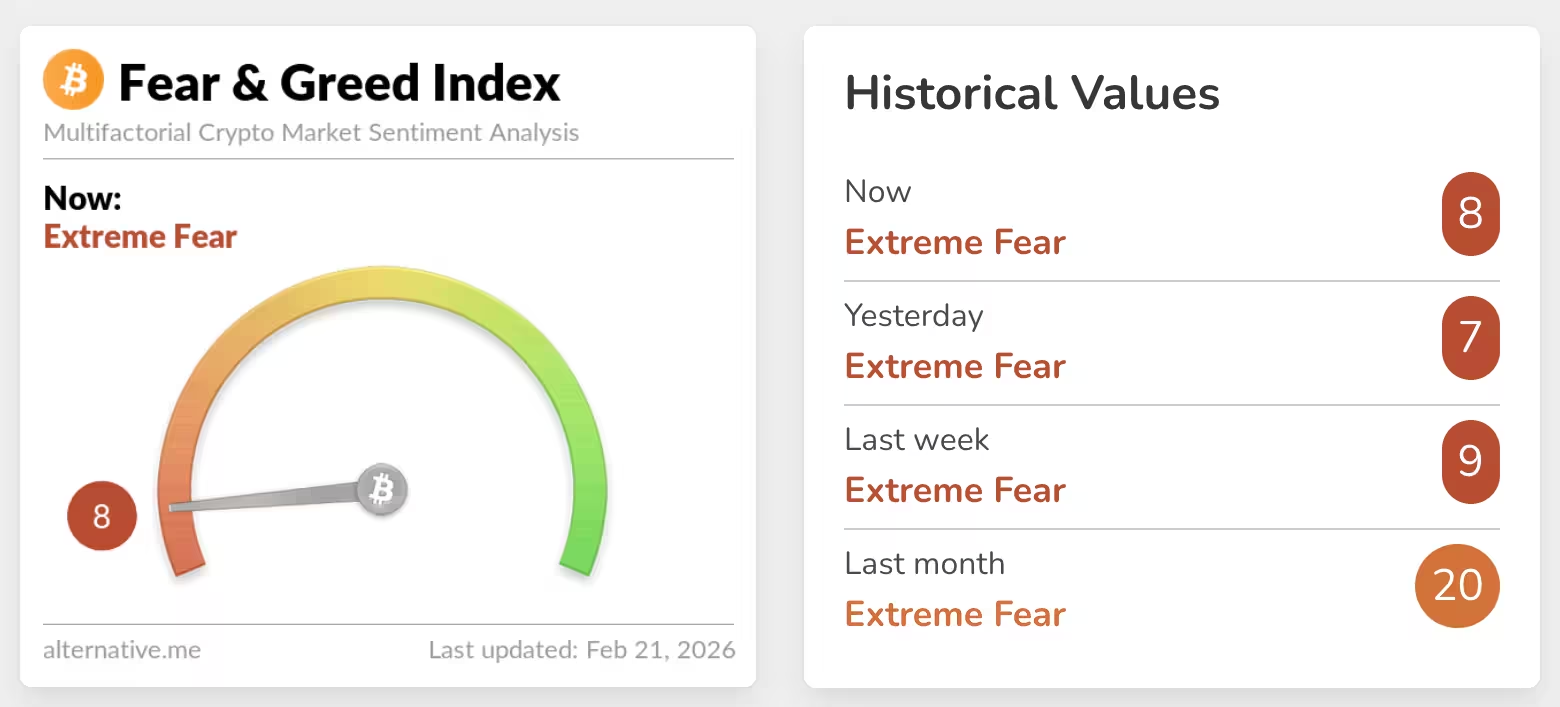

The Crypto Fear & Greed Index has been in “Extreme Fear” since Feb. 9.

What this means for traders and investors

For investors focused on risk management and fundamentals, a decline in speculative $150K-plus chatter is arguably positive. It reduces the intensity of retail-driven leverage and FOMO, which can amplify drawdowns during corrections. At the same time, persistent low network activity and an 'Extreme Fear' reading on the Fear & Greed Index indicate caution remains warranted.

In short: normalized sentiment without robust growth in transaction volume suggests the market is rebalancing. Traders should weigh sentiment signals alongside on-chain metrics, exchange flows, and macro factors before placing new directional bets on Bitcoin or broader crypto markets.

Source: cointelegraph

Leave a Comment