3 Minutes

Bitcoin ETFs rebound with $88M inflows as BTC stabilizes

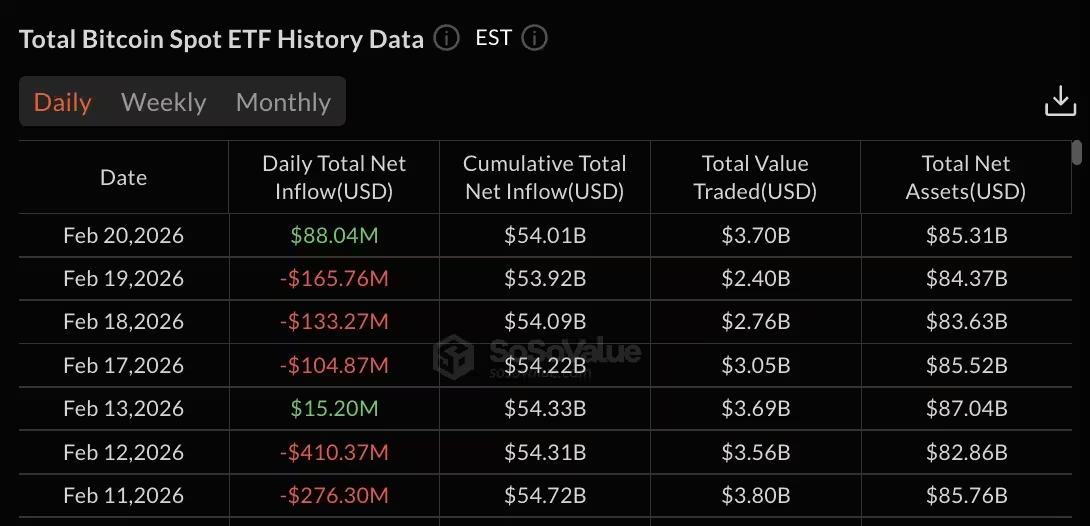

Bitcoin exchange-traded funds (ETFs) recorded a net inflow of $88.04 million on February 20, reversing a three-day withdrawal streak that had removed $403.90 million from the market. The uptick was concentrated in just two ETFs — BlackRock’s IBIT and Fidelity’s FBTC — while most other products remained inactive during the session.

Market snapshot and BTC price action

On the reporting day, Bitcoin (BTC) traded near $67,800 after dipping to an intraday low of $66,452. Total ETF net assets slipped to $85.31 billion, with cumulative total net inflows since ETF launches at about $54.01 billion. Despite the one-day recovery, weekly redemptions persisted and trading volume for the week ending February 20 declined to $11.91 billion from $18.91 billion the prior week.

Which funds drove inflows?

BlackRock’s IBIT led the day’s inflows with $64.46 million, reinforcing its dominant position; IBIT now accounts for $61.30 billion in cumulative net inflows. Fidelity’s FBTC added $23.59 million and holds roughly $10.96 billion in total inflows. The majority of U.S.-listed Bitcoin ETFs — including Grayscale’s GBTC and mini BTC trust, Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI — showed zero net movement on the day.

Short-term trends: three-day and weekly outflows

Before February 20’s inflows, ETFs suffered three consecutive days of net redemptions. February 19 recorded the largest single-day outflow of $165.76 million, followed by $133.27 million on February 18 and $104.87 million on February 17. A brief inflow of $15.20 million on February 13 had interrupted the downtrend but could not prevent the subsequent withdrawals. For the week ending February 20, net outflows totaled $315.86 million, marking the fourth straight week of redemptions. The four-week run from January 23 through February 20 saw roughly $2.48 billion exit Bitcoin ETF products, with the heaviest weekly losses in late January.

Implications for investors and traders

The concentrated nature of February 20’s inflows — limited to IBIT and FBTC — suggests selective investor confidence rather than a broad revival in ETF demand. Continued weekly redemptions and falling trading volumes point to ongoing caution among institutional and retail buyers. Traders monitoring BTC price and ETF flows should watch whether inflows broaden to more funds or if redemption pressure persists, potentially pressuring the BTC price in the short term.

Key metrics to follow in the coming sessions include daily ETF flows, total assets under management for leading issuers, and weekly trading volume, which collectively offer a clear read on institutional appetite for bitcoin exposure via ETFs.

Source: crypto

Leave a Comment